In recent years, the application of neural networks in market analysis has become a crucial tool for advanced analysts seeking to gain a competitive edge. These sophisticated algorithms, capable of learning from vast amounts of data, are transforming how market trends are predicted, risks are managed, and trading strategies are optimized. In this article, we explore how neural networks for advanced market analysts can enhance trading accuracy, offer powerful insights, and improve decision-making processes.

1. Introduction to Neural Networks in Market Analysis

What Are Neural Networks?

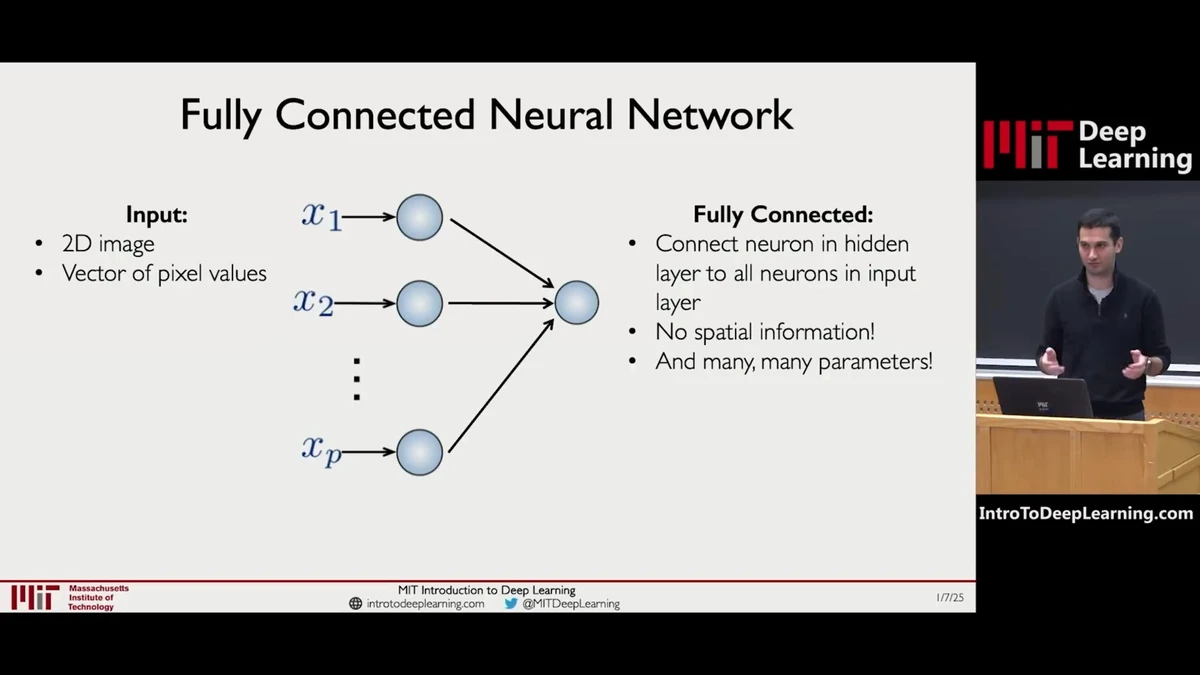

Neural networks are computational models inspired by the human brain. They consist of layers of interconnected nodes (also known as neurons) that process and analyze data. These networks are trained using vast datasets to recognize patterns, make predictions, and derive insights that might be difficult for traditional analytical methods to uncover.

Why Neural Networks Are Revolutionizing Market Analysis

For advanced market analysts, neural networks offer a powerful way to model complex market behaviors that involve non-linear relationships and vast, noisy datasets. Traditional statistical models often fall short in predicting future market trends because they lack the ability to account for the vast amounts of data and the non-linear, dynamic nature of financial markets. Neural networks, on the other hand, excel at identifying intricate patterns and providing accurate forecasts.

2. The Key Benefits of Using Neural Networks for Market Analysis

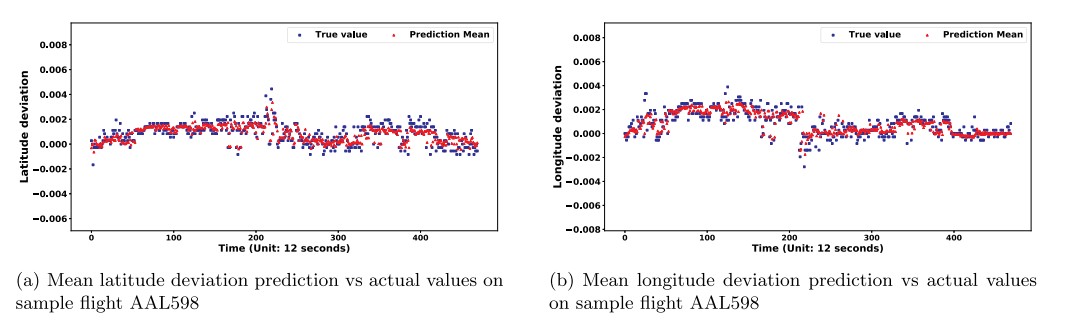

Improved Predictive Accuracy

Neural networks excel at predicting market trends, making them an invaluable tool for analysts and traders. By learning from past market data, these models can forecast price movements, volatility, and other key market factors with a level of accuracy that surpasses traditional methods. This enables analysts to make more informed trading decisions.

Handling Complex and High-Dimensional Data

Markets generate an overwhelming amount of data, from price movements to social media sentiment, economic indicators, and even geopolitical factors. Neural networks can process high-dimensional data—multiple variables simultaneously—allowing analysts to factor in a broader set of influences that impact market behavior.

Better Risk Management

Risk management is crucial in trading, and neural networks can help analysts identify potential risks before they become problematic. By analyzing historical patterns, neural networks can provide warnings about emerging risks, helping analysts adjust their strategies proactively.

3. Types of Neural Networks Used by Market Analysts

Feedforward Neural Networks (FNN)

Feedforward Neural Networks are one of the most common types used for stock prediction and trend analysis. These networks have layers of neurons that process data in one direction, from input to output. Analysts use FNNs to analyze historical market data and predict future trends.

Pros:

- Simple and easy to implement

- Effective for time series prediction

Cons:

- Limited in handling non-sequential data

Recurrent Neural Networks (RNN)

Recurrent Neural Networks are particularly effective in analyzing time-series data, such as stock prices. RNNs have loops that allow information to persist, making them ideal for sequential data where the current input is dependent on previous inputs.

Pros:

- Excellent for time-series data

- Can capture long-term dependencies

Cons:

- Difficult to train due to vanishing gradient problems

Convolutional Neural Networks (CNN)

Although typically used in image recognition, Convolutional Neural Networks (CNNs) have gained popularity in market analysis for feature extraction. CNNs can be used to analyze multiple data streams and extract meaningful patterns, especially when combined with other models like RNNs.

Pros:

- Excellent at feature extraction

- Can handle high-dimensional data

Cons:

- Computationally intensive

4. Neural Networks for Specific Market Analysis

Predicting Stock Prices with Neural Networks

Predicting stock prices is one of the primary applications of neural networks in market analysis. Advanced market analysts use neural networks to study price movements and forecast short-term and long-term price trends. By training the model on historical stock data, analysts can identify trends and patterns that might otherwise go unnoticed.

Analyzing Volatility Using Neural Networks

Market volatility plays a crucial role in risk management. Neural networks can be trained to analyze past volatility patterns and predict future price fluctuations, helping analysts prepare for potential market shocks.

Sentiment Analysis for Market Insights

Another innovative application of neural networks is sentiment analysis. By processing text data from news articles, social media posts, and financial reports, neural networks can gauge market sentiment and predict how this sentiment might affect stock prices or entire sectors.

5. Challenges of Using Neural Networks for Market Analysis

Data Quality and Availability

The performance of neural networks depends on the quality and quantity of data available for training. Inaccurate, incomplete, or biased data can lead to unreliable predictions, which is a significant challenge for analysts.

Overfitting

Neural networks, particularly deep learning models, are prone to overfitting, where the model becomes too specialized in the training data and performs poorly on unseen data. To mitigate overfitting, market analysts need to use techniques like cross-validation and regularization.

Computational Complexity

Training advanced neural networks requires significant computational power. This may involve using high-performance hardware, cloud services, or specialized software, which can be costly and time-consuming for analysts.

6. Best Practices for Advanced Market Analysts Using Neural Networks

Use of Hybrid Models

One way to overcome some of the limitations of individual neural networks is to combine them into hybrid models. By using a combination of models such as RNNs for time-series analysis and CNNs for feature extraction, analysts can achieve a more robust solution.

Regular Evaluation and Tuning

Given the complexity of neural networks, regular model evaluation and fine-tuning are crucial. Analysts should consistently monitor the performance of their models, adjusting hyperparameters or retraining the models with new data to improve predictive accuracy.

Transparency and Interpretability

While neural networks are powerful, they can also be seen as “black boxes.” Interpretability is essential for analysts to understand why the model is making specific predictions. Using techniques like LIME (Local Interpretable Model-agnostic Explanations) can help make the decision-making process more transparent.

7. FAQ on Neural Networks for Advanced Market Analysts

1. How do neural networks improve market predictions?

Neural networks improve market predictions by learning complex patterns from vast amounts of data. They can analyze multiple variables at once, which enables them to predict future price movements with greater accuracy than traditional methods.

2. What types of data can neural networks process for market analysis?

Neural networks can process various types of data, including time-series data (e.g., stock prices), economic indicators, social media sentiment, news articles, and even alternative data sources such as satellite imagery or weather patterns.

3. How can market analysts overcome overfitting in neural networks?

To avoid overfitting, analysts can use techniques like cross-validation, regularization, and dropout during model training. It’s also crucial to use diverse datasets to ensure the model generalizes well to new, unseen data.

8. Conclusion: The Future of Neural Networks in Market Analysis

The use of neural networks for advanced market analysts has already proven to be a game-changer, allowing for more accurate predictions, better risk management, and smarter decision-making. While there are challenges, particularly around data quality and computational resources, the potential of these tools cannot be overstated. As neural networks continue to evolve, they will undoubtedly play an even greater role in shaping the future of market analysis.

By embracing the power of neural networks, analysts can unlock new insights, predict trends more effectively, and gain a competitive edge in the fast-paced world of financial markets.

0 Comments

Leave a Comment