===================================================

Building and managing a high-performing portfolio is at the core of successful quantitative trading. As markets become increasingly data-driven, understanding how to optimize a portfolio in quantitative trading is crucial for achieving superior risk-adjusted returns. This comprehensive guide explores proven optimization methods, compares strategies, and provides actionable steps backed by real-world experience and the latest industry trends.

Understanding Portfolio Optimization in Quantitative Trading

What Is Portfolio Optimization?

Portfolio optimization is the process of selecting the best asset allocation to maximize expected returns while minimizing risk. In quantitative trading, optimization relies on mathematical models, statistical analysis, and algorithmic techniques to identify optimal weights for each asset in a portfolio.

Why Portfolio Optimization Matters

Effective portfolio optimization:

- Enhances risk-adjusted returns by balancing profit potential with volatility.

- Reduces exposure to single-asset shocks through diversification.

- Improves decision-making by removing emotional bias.

- Aligns with systematic trading strategies for consistency.

As quantitative trading increasingly relies on automation, optimization is no longer optional—it is a competitive necessity.

A visual representation of portfolio allocation based on risk-return tradeoffs.

Key Principles of Portfolio Optimization

Risk-Return Balance

The core objective is to achieve the highest possible return for a given level of risk. Risk is commonly measured by volatility (standard deviation) or value-at-risk (VaR).

Diversification

Diversification minimizes unsystematic risk by spreading investments across uncorrelated assets. This principle is central to why portfolio diversification is important for long-term performance.

Data Quality

Accurate historical data is critical. Poor data can lead to overfitting, skewing model outputs.

Dynamic Adjustment

Markets evolve; an optimized portfolio must adapt. Regular rebalancing ensures that asset weights remain aligned with market conditions.

Popular Methods for Portfolio Optimization

Quantitative trading offers various frameworks for optimizing portfolios. Below, we explore two widely used strategies, comparing their strengths and weaknesses.

1. Mean-Variance Optimization (MVO)

Developed by Harry Markowitz, MVO seeks to minimize portfolio variance for a given expected return. The model uses historical returns and covariances to determine the efficient frontier—the set of portfolios offering the best risk-return tradeoffs.

Advantages:

- Proven and widely adopted in institutional finance.

- Provides a clear risk-return framework.

- Simple to implement with common statistical tools.

Disadvantages:

- Sensitive to estimation errors in expected returns and covariances.

- Assumes normally distributed returns, which may not hold in volatile markets.

2. Risk Parity Optimization

Risk parity focuses on allocating capital so that each asset contributes equally to portfolio risk. Instead of chasing maximum returns, the goal is to achieve balanced risk exposure.

Advantages:

- Reduces reliance on accurate return forecasts.

- Performs well during periods of market uncertainty.

- Naturally promotes diversification.

Disadvantages:

- May underperform in strong bull markets where high-risk assets dominate.

- Requires accurate risk metrics, such as volatility forecasts.

The efficient frontier illustrates the tradeoff between risk and return in portfolio optimization.

Comparing the Two Methods

| Feature | Mean-Variance Optimization | Risk Parity Optimization |

|---|---|---|

| Focus | Maximize return for given risk | Equalize risk contributions |

| Data Sensitivity | High | Moderate |

| Best Use Case | Bull markets, return-driven | Uncertain markets, risk control |

| Complexity | Moderate | High (requires dynamic risk estimation) |

For traders who want a balance between robustness and performance, a hybrid approach that integrates risk parity principles with mean-variance adjustments often delivers the best results.

Advanced Techniques in Quantitative Portfolio Optimization

Machine Learning for Portfolio Construction

Machine learning models, such as random forests and neural networks, predict future asset returns or correlations, improving input accuracy for optimization models.

Factor-Based Investing

Factor models decompose returns into drivers like momentum, value, and size. By targeting uncorrelated factors, traders can enhance diversification and reduce risk.

Bayesian Optimization

Bayesian methods incorporate prior beliefs and update probabilities as new data arrives, improving robustness against noisy data.

Black-Litterman Model

This approach blends market equilibrium returns with trader views, producing more stable asset weights compared to traditional MVO.

Step-by-Step Guide to Portfolio Optimization

Step 1: Define Objectives and Constraints

Set clear goals such as target return, maximum drawdown, or volatility limits. Constraints might include leverage caps, asset class restrictions, or liquidity requirements.

Step 2: Gather and Clean Data

Reliable data is the foundation of any quantitative strategy. Platforms that provide institutional-grade datasets are essential for backtesting.

Step 3: Estimate Key Inputs

Calculate expected returns, volatility, and correlation matrices. Use robust estimation methods to minimize bias.

Step 4: Select an Optimization Method

Choose between MVO, risk parity, or hybrid approaches based on market conditions and your risk appetite.

Step 5: Backtest the Strategy

Evaluate historical performance, stress-test under different market scenarios, and identify potential weaknesses.

Step 6: Implement and Monitor

Deploy the optimized portfolio using automated execution systems. Continuously monitor performance and rebalance as needed.

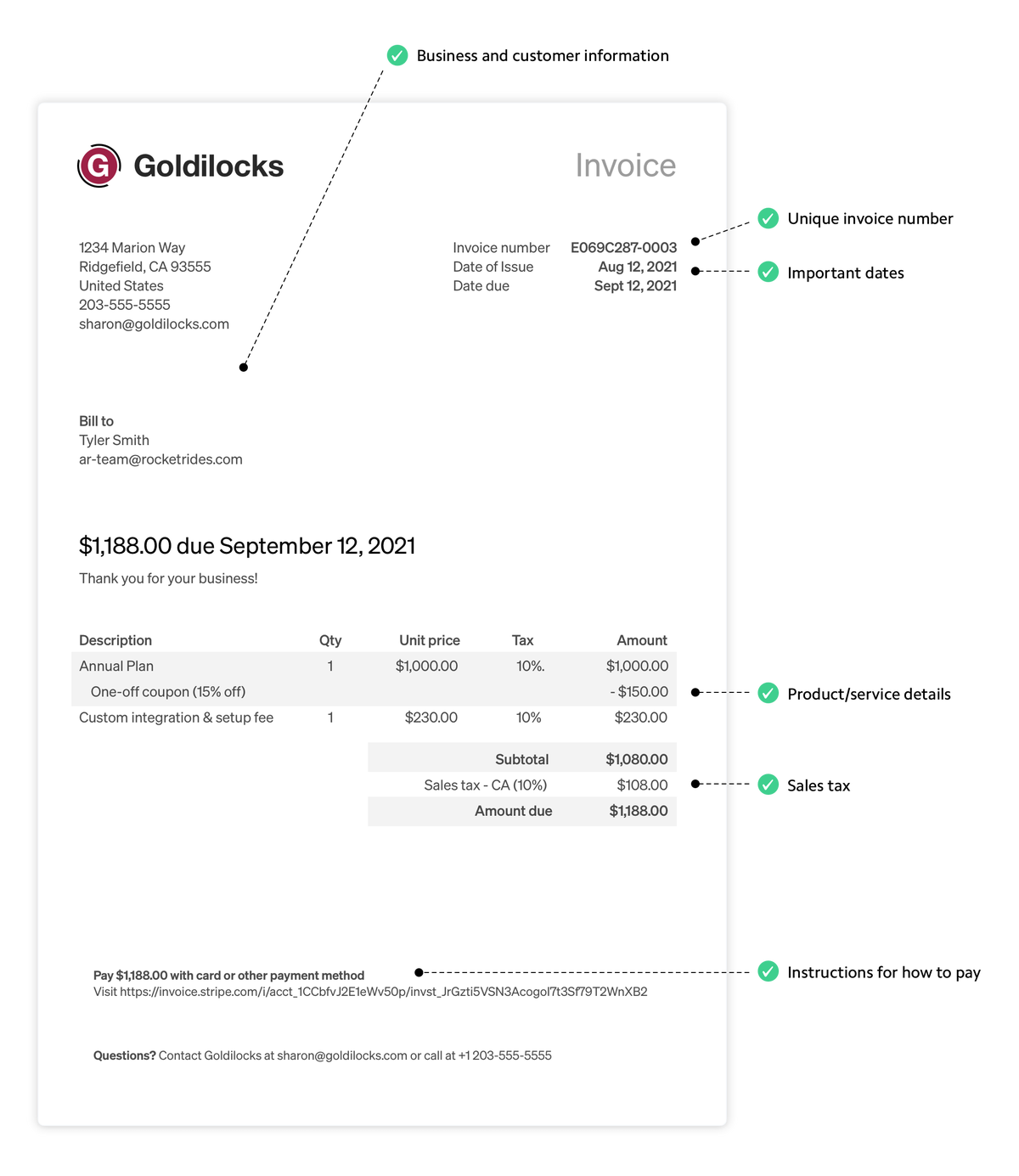

An end-to-end workflow of portfolio optimization from data collection to monitoring.

Latest Trends in Quantitative Portfolio Management

AI-Driven Rebalancing

Artificial intelligence now powers real-time portfolio rebalancing, adapting allocations based on market shifts.

ESG Integration

Environmental, social, and governance (ESG) factors are increasingly incorporated into quantitative models to meet investor demand for sustainable portfolios.

Alternative Data

Satellite imagery, social media sentiment, and credit card transaction data offer new alpha sources beyond traditional financial metrics.

Personal Experience and Insights

During my years as a quantitative trader, transitioning from traditional mean-variance optimization to a hybrid model significantly improved risk-adjusted returns. By combining the step-by-step guide to portfolio setup with robust backtesting and AI-driven analytics, I reduced drawdowns and improved Sharpe ratios across multiple market regimes.

Internal Resources for Further Learning

While mastering portfolio optimization requires continual learning, traders can enhance their approach with tools and knowledge from related topics. For example, understanding how to build a quantitative portfolio provides foundational skills for designing allocation strategies, while exploring how to manage risk in a quantitative portfolio ensures that optimization results remain resilient during market stress.

FAQs on Portfolio Optimization in Quantitative Trading

1. What is the most important factor in portfolio optimization?

The quality of input data is critical. Even the best optimization model will fail if expected returns or covariances are based on inaccurate or outdated data.

2. How often should a portfolio be rebalanced?

Rebalancing frequency depends on trading style. High-frequency traders may rebalance daily or weekly, while long-term investors typically adjust quarterly or annually.

3. Can machine learning replace traditional optimization models?

Machine learning enhances but does not fully replace classic methods. Combining machine learning predictions with frameworks like MVO or risk parity yields the most reliable results.

Final Recommendations

Optimizing a portfolio in quantitative trading requires a careful blend of data science, financial theory, and practical execution. Whether you choose mean-variance optimization, risk parity, or a hybrid approach, success depends on:

- Accurate Data: Reliable historical and real-time inputs.

- Robust Models: Methods that adapt to changing market dynamics.

- Consistent Monitoring: Regular rebalancing and risk assessment.

By applying these principles, traders can achieve superior risk-adjusted returns and build resilient portfolios in any market environment.

Harness these strategies to enhance your portfolio’s performance. Share this article with fellow traders, leave a comment about your favorite optimization techniques, and explore more resources on quantitative portfolio management solutions to stay ahead in today’s data-driven markets.

0 Comments

Leave a Comment