=================================================

Understanding performance metrics is critical for investors, traders, and portfolio managers. Among the most widely used measures, the Sharpe ratio and the Sortino ratio stand out for evaluating risk-adjusted returns. At first glance, they may look similar, but their differences can significantly impact decision-making. In this article, we will explore how the Sortino ratio is different from the Sharpe ratio, compare their applications, and provide strategies for choosing the right one in various investment contexts.

What Are Risk-Adjusted Return Ratios?

Risk-adjusted return ratios help investors determine whether the returns of an asset are sufficient to compensate for the risk taken. Instead of focusing solely on raw returns, these ratios incorporate volatility and risk measures to assess performance.

Two of the most recognized metrics are:

- Sharpe ratio: Measures excess returns per unit of total risk (volatility).

- Sortino ratio: Measures excess returns per unit of downside risk (bad volatility only).

This difference in how risk is defined sets the stage for their comparison.

Sharpe Ratio Explained

Definition

The Sharpe ratio is calculated as:

SharpeRatio=Rp−RfσpSharpe Ratio = \frac{R_p - R_f}{\sigma_p}SharpeRatio=σpRp−Rf

Where:

- RpR_pRp = portfolio return

- RfR_fRf = risk-free rate

- σp\sigma_pσp = standard deviation of portfolio returns

Key Insights

- Accounts for all volatility, both upside and downside.

- Useful when returns are normally distributed.

- Widely adopted in academia, hedge funds, and investment research.

Limitations

- Penalizes upside volatility as much as downside volatility.

- Less accurate in markets with skewed or non-normal return distributions.

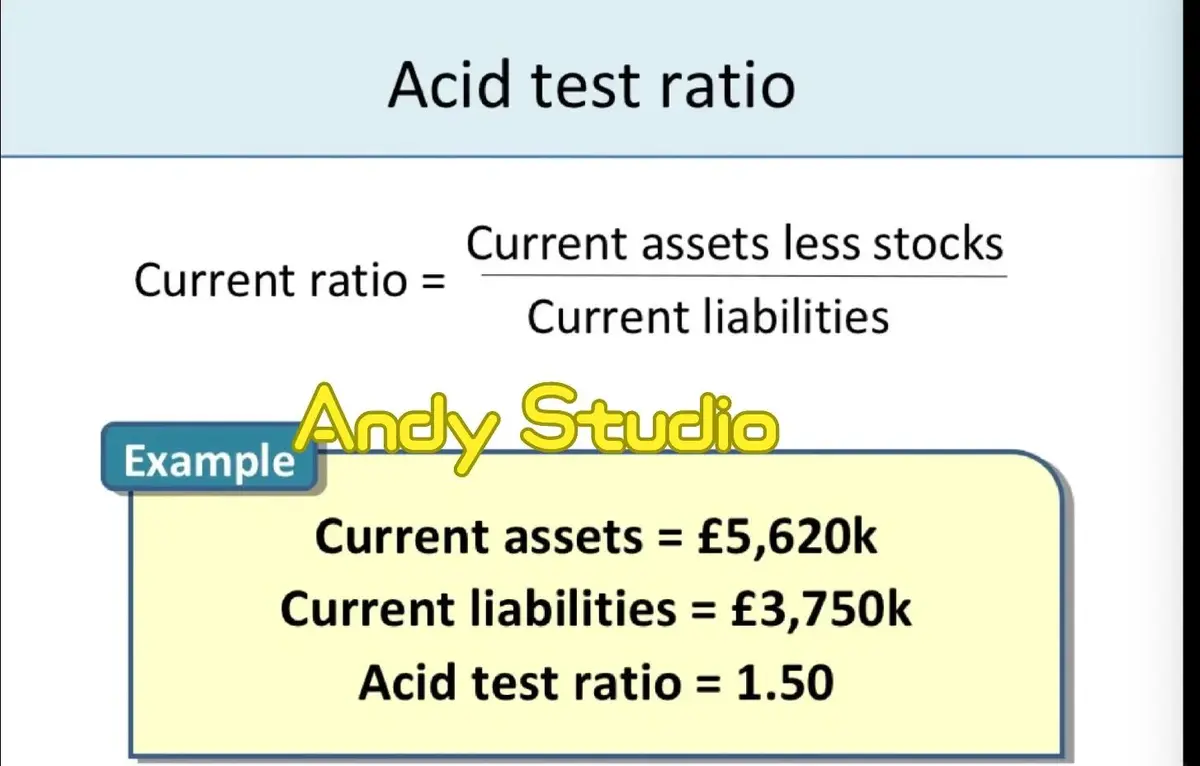

Sortino Ratio Explained

Definition

The Sortino ratio is calculated as:

SortinoRatio=Rp−RfσdSortino Ratio = \frac{R_p - R_f}{\sigma_d}SortinoRatio=σdRp−Rf

Where:

- RpR_pRp = portfolio return

- RfR_fRf = risk-free rate

- σd\sigma_dσd = downside deviation (measuring only harmful volatility)

Key Insights

- Focuses solely on downside risk, ignoring positive fluctuations.

- Provides a more realistic view for risk-averse investors.

- Popular among hedge funds, pension funds, and quant analysts who want a refined look at risk-adjusted returns.

Limitations

- Requires complex calculations (downside deviation is harder to compute).

- Sensitive to how the threshold for downside risk is defined.

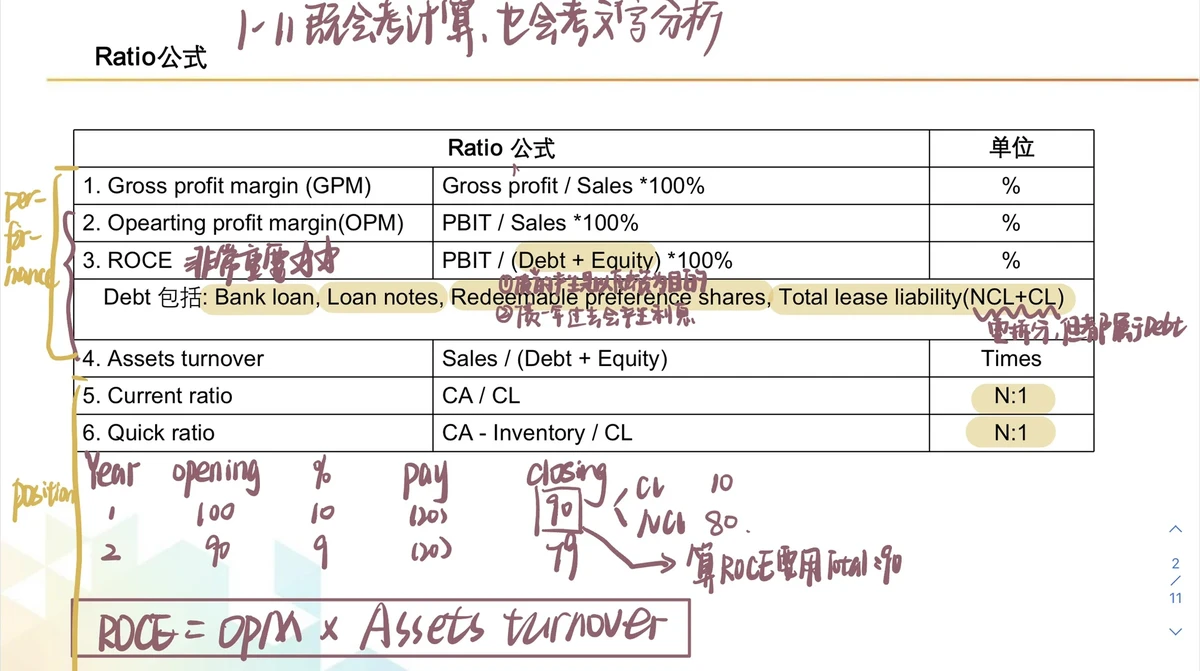

Key Differences Between Sharpe Ratio and Sortino Ratio

| Feature | Sharpe Ratio | Sortino Ratio |

|---|---|---|

| Risk Definition | Total volatility (standard deviation) | Downside deviation (bad volatility only) |

| Treatment of Upside Volatility | Penalizes it equally as downside | Ignores upside volatility |

| Suitability | Best for normally distributed returns | Best for skewed or asymmetric return profiles |

| Ease of Calculation | Simple and widely available | More complex, needs downside deviation |

| Preferred By | General investors, academics, performance benchmarks | Risk-averse investors, hedge funds, quants |

Real-World Application of the Ratios

1. Using Sharpe Ratio for Balanced Portfolios

Investors managing a diversified stock and bond portfolio may prefer the Sharpe ratio because it captures total volatility. For instance, if markets are relatively stable, penalizing all volatility gives a fair reflection of performance.

2. Using Sortino Ratio for Hedge Funds and Risk-Averse Investors

A hedge fund pursuing aggressive returns with uneven volatility may use the Sortino ratio to filter out “good risk.” For example, a long/short equity strategy with occasional sharp gains would look unfavorable under the Sharpe ratio but favorable under the Sortino ratio.

Comparing Methods: Which One to Use?

Sharpe Ratio Advantages

- Simpler to calculate.

- Useful for broad comparisons across asset classes.

- Works well when returns follow a normal distribution.

Sortino Ratio Advantages

- More accurate for non-normal distributions, which are common in hedge funds, options trading, and crypto assets.

- Aligns better with investor psychology since only downside risk matters.

Recommended Approach

- Use the Sharpe ratio for general portfolio benchmarking.

- Use the Sortino ratio when analyzing risk-adjusted performance of alternative investments or asymmetric strategies.

- In practice, both should be calculated and compared for a comprehensive evaluation.

Industry Trends: Why Sortino Ratio Is Gaining Popularity

With markets becoming increasingly volatile and non-linear, traditional risk measures are being questioned. Quantitative investors and portfolio managers are shifting toward metrics like the Sortino ratio for greater precision. According to recent research, hedge funds often report Sortino ratios alongside Sharpe ratios in investor communications.

This aligns with the broader movement toward risk-adjusted metrics tailored to investor preferences, especially in complex environments like crypto trading, options strategies, and algorithmic portfolios.

Internal Linking for Further Learning

When learning how to calculate Sortino ratio, it’s essential to understand the role of downside deviation. Many trading platforms now offer built-in tools for these computations. Additionally, knowing why use Sortino ratio in trading can help investors align their strategies with their risk preferences.

Visual Guide

Sharpe vs Sortino: The key difference lies in the treatment of upside volatility.

FAQ: Sortino Ratio vs Sharpe Ratio

1. Why is the Sortino ratio considered better for risk-averse investors?

The Sortino ratio only penalizes downside volatility, which aligns with the mindset of risk-averse investors who care more about losses than gains. This makes it a more accurate measure of “true risk.”

2. Can the Sharpe ratio be misleading?

Yes. The Sharpe ratio can penalize strategies with frequent upside volatility, such as options or hedge fund strategies with asymmetric payoffs. This makes it less effective in capturing the real attractiveness of such portfolios.

3. Should traders use both ratios?

Absolutely. Using both provides a fuller picture. The Sharpe ratio helps compare across a wide range of portfolios, while the Sortino ratio highlights performance under downside risk. Together, they enable more informed investment decisions.

Conclusion

So, how is the Sortino ratio different from the Sharpe ratio? The difference lies in how each defines and treats risk. While the Sharpe ratio considers total volatility, the Sortino ratio focuses on downside deviation. For investors and traders, the choice depends on risk tolerance and investment style.

If you are benchmarking a traditional balanced portfolio, the Sharpe ratio is sufficient. But if you are analyzing hedge funds, crypto strategies, or asymmetric risk profiles, the Sortino ratio provides a more accurate picture.

Final Thoughts: Share Your Experience

Have you ever used the Sortino ratio or Sharpe ratio in your portfolio analysis? Which one gave you better insights? Share your thoughts in the comments below and don’t forget to share this article with colleagues and peers in finance—it may help them refine their performance evaluation strategies.

0 Comments

Leave a Comment