========================

Introduction

In the world of financial markets, traders often look for strategies that provide consistent returns while reducing exposure to risk. One such method is spread trading, a market-neutral strategy that focuses on the price difference between two related instruments rather than betting on the absolute price direction of a single asset.

Understanding how spread trading works is essential for both beginners and professionals because it helps balance portfolios, enhance stability, and exploit relative mispricings in markets. In this comprehensive guide, we will break down the mechanics of spread trading, discuss different methods, compare their pros and cons, and share real-world insights to help traders optimize their strategies.

What Is Spread Trading?

Definition

Spread trading involves simultaneously buying one asset and selling another, creating a position based on the relative price difference (the “spread”) between them. Unlike outright trading, where the profit or loss depends entirely on market direction, spread trading profits from the narrowing or widening of the spread.

Core Principles

- Market Neutrality: Spread trading reduces exposure to broad market moves by hedging one position against another.

- Relative Value Focus: The key lies in evaluating whether one instrument is underpriced relative to another.

- Risk Control: Spreads often lower volatility compared to directional bets.

Types of Assets Used

- Futures (e.g., crude oil vs. heating oil)

- Options (e.g., bull call spread)

- Equities (e.g., pairs trading: Coke vs. Pepsi)

- Bonds and interest rate products

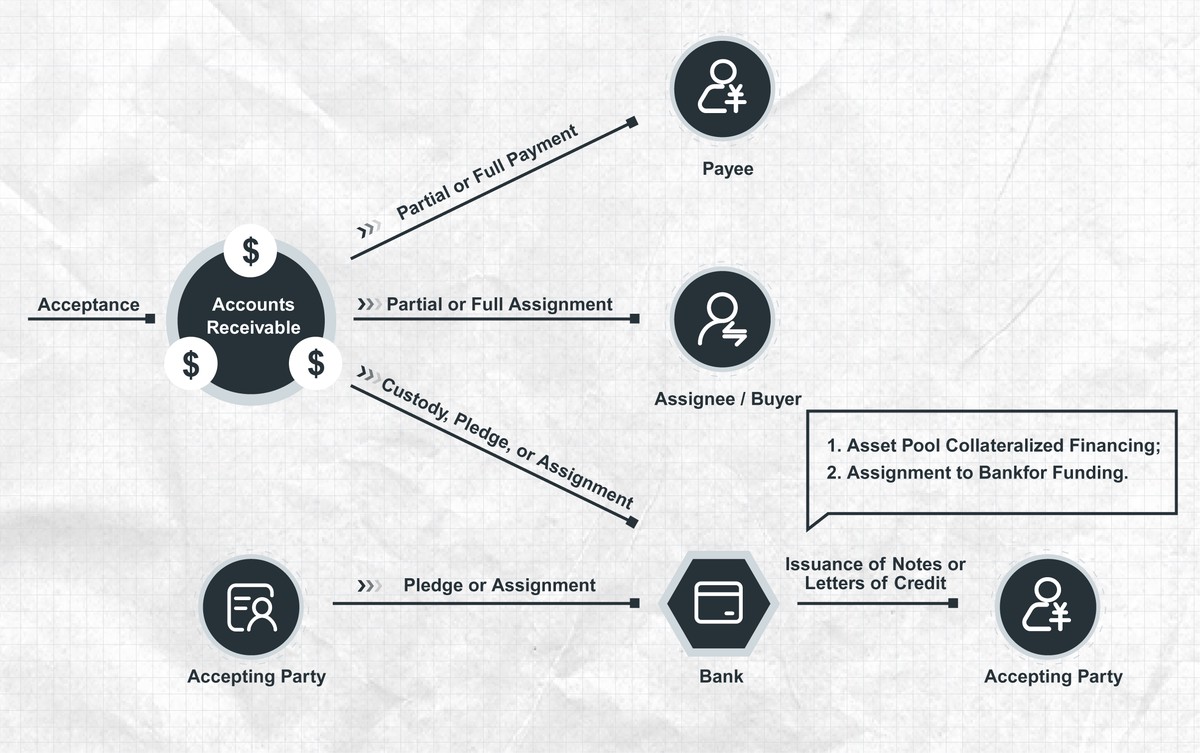

Illustration of how spread trading works by focusing on the price difference between two correlated instruments

How Spread Trading Works in Practice

Step 1: Identify Correlated Instruments

Traders first select two related instruments that historically move together. Example: Brent crude vs. WTI crude.

Step 2: Determine the Spread

The spread is calculated by subtracting the price of one asset from the other.

Step 3: Analyze Historical Behavior

Statistical tools like correlation analysis, cointegration tests, or moving averages help confirm the relationship.

Step 4: Place Simultaneous Trades

One leg is bought (long) and the other is sold (short) in equal or proportional amounts.

Step 5: Monitor the Spread

If the spread widens or narrows according to the trader’s hypothesis, the position becomes profitable.

Two Main Methods of Spread Trading

Method 1: Intra-Market Spreads

An intra-market spread involves trading two contracts of the same commodity but with different expiration dates. Example: buying December crude oil futures and selling March crude oil futures.

Advantages

- Lower margin requirements.

- Easier to manage due to high liquidity.

- Strong historical patterns in calendar spreads.

Disadvantages

- Limited profit potential compared to inter-market strategies.

- Sensitive to changes in seasonality and storage costs.

Method 2: Inter-Market Spreads

An inter-market spread uses two related but different assets. Example: trading corn vs. wheat futures or gold vs. silver.

Advantages

- Broader profit opportunities from relative mispricing.

- Flexible application across multiple asset classes.

Disadvantages

- Requires deeper fundamental and statistical analysis.

- Higher risk if correlation breaks down.

Comparing the Two Approaches

| Factor | Intra-Market Spreads | Inter-Market Spreads |

|---|---|---|

| Complexity | Low | High |

| Profit Potential | Moderate | High |

| Risk | Lower | Higher if miscalculated |

| Best For | Beginners, conservative traders | Experienced traders, hedge funds |

Recommendation: For newcomers, starting with intra-market spreads is advisable. Professionals can explore inter-market spreads once they gain more experience.

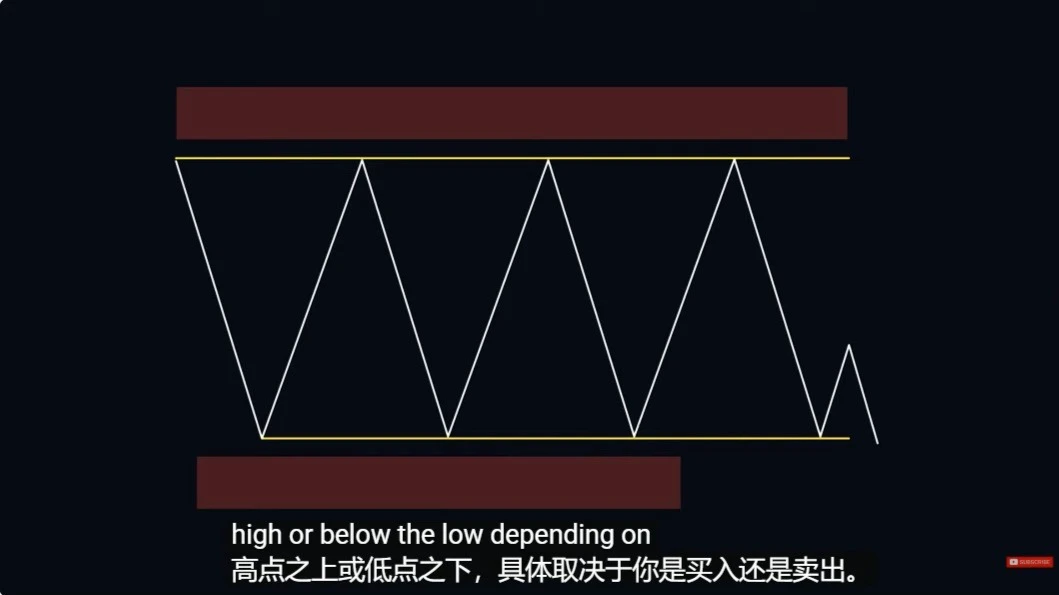

Common spread trading types: intra-market, inter-market, and options-based spreads

Advanced Spread Trading Strategies

Options Spreads

- Bull Call Spread: Buy a call at one strike price, sell a call at a higher strike price.

- Iron Condor: Combines multiple spreads to profit from low volatility.

Statistical Arbitrage (Pairs Trading)

Pairs trading involves identifying two historically correlated stocks and betting on their relative price convergence or divergence.

Algorithmic Spread Trading

Quantitative analysts use algorithms to detect and exploit small inefficiencies in spreads. This requires robust backtesting, data analysis, and execution speed.

Key Considerations for Spread Traders

Risk Management

Since spread trading is often perceived as “low-risk,” many traders underestimate potential losses. To avoid this:

- Use stop-loss levels.

- Diversify across asset classes.

- Regularly reassess correlations.

Choosing a Platform

Traders often ask where to find spread trading platforms. The best ones provide low latency execution, deep order book visibility, and customizable spread orders.

Profitability Potential

Understanding why spread trading is profitable requires looking at inefficiencies created by supply-demand imbalances, seasonal trends, or temporary mispricing between related assets.

Case Study: Spread Trading in Energy Markets

A trader monitors Brent vs. WTI crude oil futures. Historically, Brent trades at a premium due to higher global demand. When the spread unexpectedly narrows, the trader buys Brent and sells WTI. Over the next month, the spread returns to historical norms, producing significant profit.

This real-world case highlights the importance of:

- Historical analysis.

- Awareness of geopolitical events.

- Strong execution platforms.

FAQ

1. Is spread trading suitable for beginners?

Yes, especially intra-market spreads. They offer lower margin requirements and simpler analysis compared to inter-market spreads. Beginners should start small and gradually increase exposure.

2. How much capital is required for spread trading?

Capital requirements vary depending on the instruments and platforms. Futures spreads often require less margin than outright positions, making them accessible for smaller accounts.

3. Can spread trading strategies fail?

Yes. Correlations may break down due to unexpected news, structural market changes, or low liquidity. Continuous monitoring and adaptive strategies are essential.

Conclusion

Spread trading offers a balanced way to profit from relative value rather than outright market direction. By focusing on how spread trading works, traders can reduce volatility, diversify portfolios, and improve consistency in returns.

- Intra-market spreads are ideal for beginners seeking stability.

- Inter-market spreads suit advanced traders aiming for higher profits.

- Options and statistical arbitrage provide even more sophisticated opportunities.

Whether you are a beginner learning the basics or an advanced trader refining strategies, spread trading can be a powerful addition to your financial toolkit.

If this article helped you understand spread trading better, share it with your network, comment with your own experiences, and encourage discussions to grow collective market knowledge.

Do you want me to expand this into a spread trading strategy optimization checklist (step-by-step) that traders can directly apply to their daily routines?

0 Comments

Leave a Comment