=================================================

In modern financial markets, data is not just an asset—it is the backbone of every profitable trading strategy. Traders and quantitative analysts rely heavily on statistical methods to understand patterns, forecast price movements, and build robust systems that can survive volatile conditions. Among these methods, time series analysis stands out as one of the most powerful tools for enhancing trading systems. This article explores how time series analysis improves trading systems, dives into practical strategies, compares approaches, and offers actionable insights for professionals and beginners alike.

Understanding Time Series Analysis in Trading

Time series analysis refers to statistical methods used to analyze sequential data points, typically collected at regular time intervals. In finance, this usually involves asset prices, volume, volatility measures, or even macroeconomic indicators. By studying the structure of time series data, traders can detect trends, cycles, seasonality, and anomalies—key factors for predicting future price movements.

Unlike static datasets, financial data is dynamic, noisy, and often influenced by market psychology. This is where time series analysis provides an edge: it allows traders to uncover hidden structures in data and build models that adapt to changing market conditions.

Why Time Series Analysis Matters in Trading Systems

Time series analysis is not just a statistical exercise—it directly impacts the efficiency and profitability of trading systems:

- Improved Forecasting Accuracy: By capturing trends and cycles, time series models help traders anticipate short- and long-term price movements.

- Enhanced Risk Management: Identifying volatility clusters and regime shifts can prevent catastrophic drawdowns.

- Optimization of Algorithmic Strategies: Time series models provide input for trading algorithms, improving entry and exit signals.

- Scalability Across Assets: Whether it’s equities, forex, or crypto, time series methods are adaptable to different markets.

For instance, how to use time series analysis in quantitative trading often starts with simple moving averages or ARIMA models and scales up to advanced machine learning approaches such as LSTM networks or Bayesian time series.

Key Methods of Time Series Analysis in Trading

1. Statistical Models (ARIMA, GARCH, VAR)

- ARIMA (Auto-Regressive Integrated Moving Average): Captures linear dependencies and trends. Widely used for forecasting price levels.

- GARCH (Generalized Autoregressive Conditional Heteroskedasticity): Specializes in modeling volatility, crucial for options and leveraged products.

- VAR (Vector AutoRegression): Analyzes relationships between multiple financial instruments (e.g., stock and bond yields).

Pros:

- Well-established, mathematically rigorous.

- Easy to interpret and explain to investors.

Cons:

- Struggles with highly nonlinear financial data.

- Requires stationary time series, which financial data often violates.

2. Machine Learning and AI Models (LSTM, Random Forests, Reinforcement Learning)

- LSTM (Long Short-Term Memory): A type of recurrent neural network designed for sequential data, excellent at capturing long-term dependencies.

- Random Forests: Useful for feature extraction and combining time series with external variables (e.g., sentiment or macroeconomic indicators).

- Reinforcement Learning: Adaptive decision-making framework, where the model learns optimal trading actions through trial and error.

Pros:

- Handles nonlinearities and complex dependencies.

- Adaptable to large, high-frequency datasets.

Cons:

- Requires significant computing power and data.

- Can become black-box models, challenging interpretability.

Comparison of Strategies

| Method | Best For | Pros | Cons |

|---|---|---|---|

| Statistical Models | Short- to medium-term forecasting | Transparent, interpretable | Limited flexibility with nonlinear data |

| Machine Learning Models | Complex, high-frequency trading | Handles big data, nonlinearities | Resource-intensive, less explainable |

Recommendation: A hybrid approach often works best—using statistical models for baseline predictions and machine learning for pattern recognition and anomaly detection.

Real-World Applications of Time Series in Trading Systems

Forecasting Asset Prices

Traders use ARIMA and LSTM models to forecast short-term price movements. This is especially valuable in markets like crypto, where volatility is extreme.

Risk Management

GARCH models help traders understand volatility clustering, enabling them to size positions intelligently and avoid over-leverage.

Strategy Optimization

Advanced firms integrate time series analysis directly into algorithmic trading systems. For example, hedge funds employ time series forecasting for quantitative analysts to refine strategies across multi-asset portfolios.

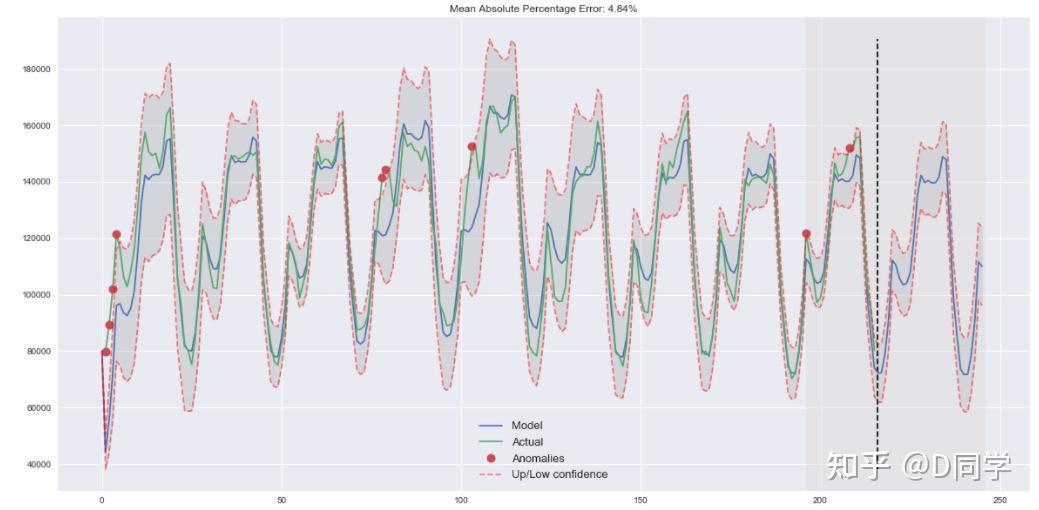

Visual Example: Time Series Forecasting

Below is a visualization of time series forecasting applied to financial market data:

Forecasting stock prices with ARIMA time series model

Industry Trends in Time Series Analysis

- Integration with Alternative Data: Social media sentiment, Google Trends, and ESG scores are being combined with price data.

- High-Frequency Trading Applications: Time series analysis is crucial for millisecond-level trading signals.

- Explainable AI (XAI): To address the black-box problem, firms are building interpretable machine learning models for compliance and trust.

- Cloud-Based Trading Systems: Time series models are increasingly deployed on cloud platforms for scalability and collaboration.

For retail traders, where to apply time series analysis in quantitative trading often starts with equities or forex before expanding to derivatives and crypto.

Best Practices for Using Time Series Analysis in Trading Systems

- Data Quality Matters: Garbage in, garbage out. Ensure datasets are clean, consistent, and free from survivorship bias.

- Backtesting and Validation: Always validate models on out-of-sample data to avoid overfitting.

- Combine Models: Use ensemble methods or hybrid strategies for robustness.

- Adaptability: Markets evolve—so should your models. Regular retraining and updating are essential.

FAQ: Time Series Analysis in Trading

1. How does time series analysis improve risk management in trading systems?

Time series analysis helps detect volatility clustering and market regime shifts, which are critical for setting position sizes, stop-loss levels, and margin requirements. By anticipating risk, traders can minimize losses and maximize returns.

2. Which time series method is best for short-term trading?

For short-term trading, ARIMA and GARCH are effective due to their ability to capture linear dependencies and volatility patterns. However, machine learning models like LSTM outperform when dealing with large, noisy, high-frequency datasets.

3. Can beginners effectively use time series analysis in trading?

Yes, beginners can start with simple moving averages or ARIMA models before moving to advanced techniques. Online resources and novice guide to time series analysis in trading tutorials make it accessible even without advanced math skills.

Conclusion: Why Time Series Analysis Is a Game-Changer

Time series analysis is more than a statistical tool—it is a strategic advantage for traders who seek consistent profits and robust systems. From forecasting to risk management, its applications are vast and growing with technological advances. By combining statistical rigor with AI-powered insights, traders can future-proof their strategies and outperform the competition.

If you found this article useful, share it with your fellow traders, comment with your experiences, and help expand the discussion on how time series analysis improves trading systems.

Would you like me to also prepare a downloadable PDF guide (with charts and case studies) so you can use it as a reference in your trading workflow?