============================================

Introduction

In today’s financial markets, the use of big data for quantitative trading is no longer optional—it’s essential. Quant traders, hedge funds, and even retail investors rely on massive datasets to uncover patterns, predict asset prices, and gain a competitive edge. But how to use big data for quantitative trading effectively requires more than just collecting data; it demands structured analysis, advanced tools, and strategic integration into trading systems.

This article offers a comprehensive guide to leveraging big data in quantitative finance, combining professional insights, real-world examples, and the latest industry trends. We’ll explore at least two key methods of applying big data in quant trading, compare their advantages and drawbacks, and highlight the best practices for implementation.

Along the way, you’ll also discover related insights like how big data enhances trading strategies and big data analytics for risk management, ensuring you gain both theoretical and practical knowledge.

Understanding Big Data in Quantitative Trading

What is Big Data in Finance?

Big data in finance refers to large, complex, and fast-moving datasets that traditional tools cannot handle efficiently. For quantitative trading, these datasets often include:

- Market Data: Price ticks, order book depth, trading volume.

- Alternative Data: Social media sentiment, news feeds, satellite images, credit card transactions.

- Macroeconomic Data: GDP, unemployment rates, interest rates.

- Behavioral Data: Investor sentiment, crowd psychology, clickstream data.

The key lies not only in collecting this information but in transforming it into actionable insights.

Why Big Data Matters for Quant Traders

Financial markets generate terabytes of data every day. Without the right tools, most of this data goes unused. By applying big data analytics in quantitative finance, traders can:

- Predict market movements with higher accuracy.

- Optimize risk-adjusted returns.

- Develop strategies that adapt to changing market conditions.

- Detect hidden correlations missed by conventional analysis.

Two Core Methods for Using Big Data in Quantitative Trading

To understand how to use big data for quantitative trading, let’s examine two widely adopted approaches: predictive modeling with machine learning and real-time data-driven trading strategies.

Method 1: Predictive Modeling with Machine Learning

Machine learning (ML) has become a cornerstone of big data applications in trading. By training models on historical and real-time data, quant traders can forecast price trends, volatility, and even market sentiment.

How It Works

- Data Collection: Historical price series, news sentiment, social media trends.

- Feature Engineering: Extracting relevant variables such as moving averages, volatility spikes, or keyword sentiment.

- Model Training: Applying algorithms like Random Forests, Gradient Boosting, or Deep Neural Networks.

- Backtesting & Validation: Testing models on unseen data to ensure robustness.

Advantages

- Captures complex, non-linear relationships.

- Adapts to evolving market conditions.

- Can incorporate vast amounts of structured and unstructured data.

Drawbacks

- Requires extensive computing power and data engineering expertise.

- Prone to overfitting if not carefully validated.

- Models may lack interpretability, making risk oversight difficult.

Method 2: Real-Time Data-Driven Trading Strategies

While predictive modeling is forward-looking, real-time big data strategies focus on reacting instantly to new information. High-frequency trading (HFT) firms and algorithmic traders thrive on this approach.

How It Works

- Streaming Data Integration: Continuous inflow of order book updates, news wires, or sentiment feeds.

- Event Processing: Identifying triggers such as large block trades, economic announcements, or breaking news.

- Automated Execution: Algorithms place trades in milliseconds based on predefined rules.

Advantages

- Immediate reaction to market-moving events.

- Strong fit for high-frequency and intraday trading.

- Reduces latency-driven arbitrage opportunities.

Drawbacks

- High infrastructure costs (low-latency networks, co-location services).

- Risk of false signals from noisy or manipulated data.

- Requires continuous monitoring and adjustment.

Comparative Analysis

| Aspect | Predictive Modeling (ML) | Real-Time Data Strategies |

|---|---|---|

| Time Horizon | Short to medium term (hours to weeks) | Ultra-short term (milliseconds-seconds) |

| Data Usage | Historical + alternative data | Live feeds + structured market data |

| Best For | Trend prediction, risk management | HFT, arbitrage, momentum trading |

| Challenges | Overfitting, complexity | Latency costs, false positives |

Recommendation: For most traders, combining both methods is ideal. Use machine learning models for predictive insights while deploying real-time strategies for execution efficiency. This hybrid approach captures both foresight and speed.

Practical Applications of Big Data in Quantitative Trading

Risk Management

Big data analytics for risk management helps firms measure exposure in real-time. For instance, analyzing correlations between equity markets and commodity prices enables hedging strategies that minimize portfolio drawdowns.

Enhancing Trading Strategies

Understanding how big data enhances trading strategies is key. Data-driven insights help refine entry/exit signals, reduce slippage, and identify high-probability setups.

Portfolio Optimization

By analyzing massive datasets, portfolio managers can identify hidden diversification opportunities, balance sectoral risks, and enhance risk-adjusted returns.

Case Studies: Big Data in Action

Hedge Fund Example

A leading hedge fund used satellite imagery of retail parking lots to forecast company earnings. By correlating parking lot occupancy with revenue, the fund generated alpha before official earnings releases.

Retail Trader Example

Retail quant traders leverage sentiment analysis from Twitter to build strategies. For instance, spikes in negative sentiment often precede short-term stock declines, offering profitable short opportunities.

Visual Insights

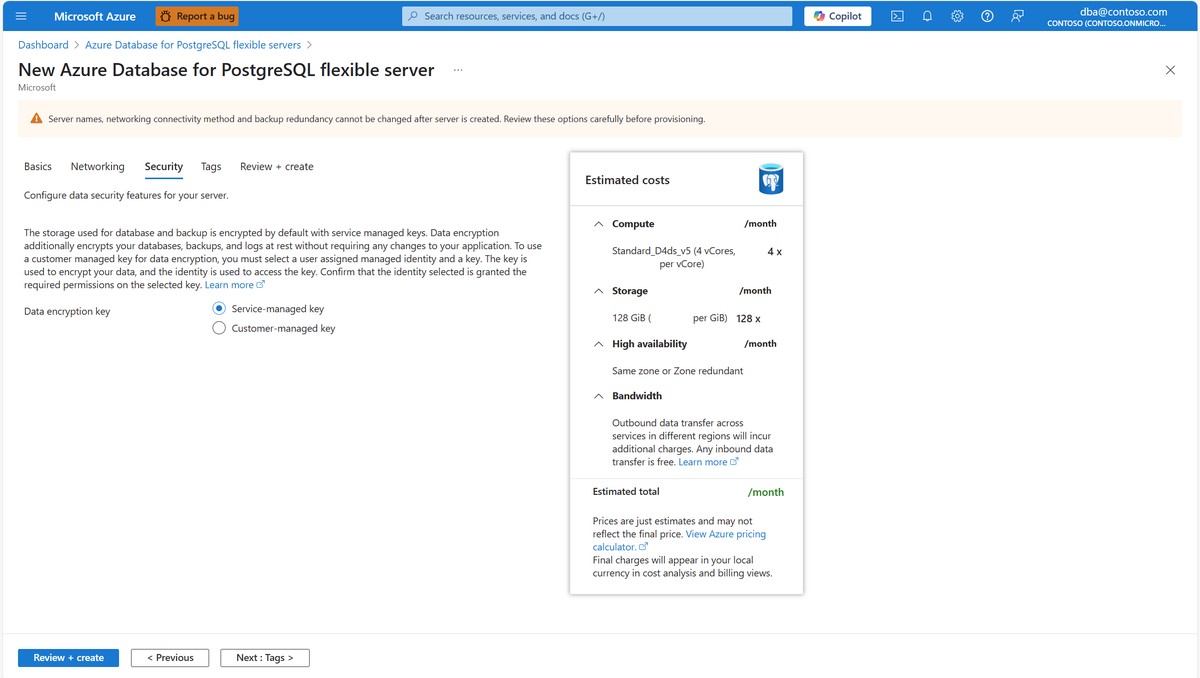

Machine learning workflow applied to quantitative trading, showing the process from data collection to model deployment.

Order book depth visualization, a critical element for real-time big data-driven trading.

Frequently Asked Questions (FAQ)

1. What types of big data are most useful in quantitative trading?

The most valuable data includes market tick data, order book depth, and alternative datasets like sentiment analysis, satellite images, or macroeconomic feeds. Each provides unique insights into price drivers and investor behavior.

2. Do retail traders really benefit from big data?

Yes, but on a smaller scale. Retail traders can use free APIs, open datasets, and affordable analytics tools. While they may lack the infrastructure of hedge funds, retail traders can still apply big data to improve their edge.

3. How can I avoid overfitting when using machine learning for trading?

To avoid overfitting, ensure proper cross-validation, use out-of-sample testing, and limit model complexity. Additionally, incorporating domain knowledge into feature engineering improves model robustness.

Conclusion

Knowing how to use big data for quantitative trading is a decisive skill in modern finance. Predictive modeling with machine learning and real-time data-driven trading strategies both offer unique advantages. The most successful traders integrate these methods, blending predictive foresight with execution speed.

As markets continue evolving, big data will increasingly shape strategies, risk management, and decision-making processes. Whether you are a hedge fund manager or a retail trader, the ability to harness big data insights is what separates winners from laggards in today’s algorithm-driven financial world.

If you found this article valuable, feel free to share it with colleagues, comment with your insights, and join the discussion—because the future of trading is data-driven.

Would you like me to expand this into a longer, SEO-optimized 3000+ word guide with more detailed case studies, code snippets, and advanced big data tools for traders?

0 Comments

Leave a Comment