========================================

Introduction

In the modern financial landscape, risk management is not just about avoiding losses—it’s about understanding the relationships between different assets. One of the most powerful tools in this process is covariance, a statistical measure that reveals how two assets move in relation to one another. Knowing how to use covariance in risk assessment helps investors, portfolio managers, and quantitative analysts make better decisions when diversifying investments and managing uncertainty.

This article will explore what covariance means, how it applies to financial risk assessment, compare multiple methods for using covariance, and provide practical, step-by-step examples. By the end, you’ll have a clear roadmap for applying covariance to real-world investment strategies.

What Is Covariance?

Definition

Covariance is a measure of the directional relationship between two variables. In finance, it evaluates whether two asset returns move together (positive covariance) or in opposite directions (negative covariance).

- Positive Covariance: Both assets tend to increase or decrease together.

- Negative Covariance: When one asset rises, the other tends to fall.

- Zero Covariance: No clear relationship between the two.

Importance in Risk Assessment

Risk assessment relies on understanding how assets interact. By analyzing covariance:

- Investors can identify hedging opportunities.

- Portfolio managers can reduce volatility through diversification.

- Quantitative traders can design predictive models with correlated or uncorrelated assets.

This connection is why many experts emphasize why covariance is important in portfolio management, particularly when balancing risky and safe assets.

Covariance highlights whether assets move together, apart, or independently.

How to Calculate Covariance

Covariance is calculated using the formula:

Cov(X,Y)=∑(Xi−Xˉ)(Yi−Yˉ)n−1Cov(X,Y) = \frac{\sum (X_i - \bar{X})(Y_i - \bar{Y})}{n-1}Cov(X,Y)=n−1∑(Xi−Xˉ)(Yi−Yˉ)

Where:

- Xi,YiX_i, Y_iXi,Yi = individual asset returns

- Xˉ,Yˉ\bar{X}, \bar{Y}Xˉ,Yˉ = mean of each return set

- nnn = number of data points

This calculation can be applied manually, through Excel, or using Python libraries such as NumPy and Pandas. For beginners, guides like how to calculate covariance in quantitative trading provide step-by-step examples with practical datasets.

Using Covariance in Risk Assessment

Application 1: Portfolio Diversification

Covariance helps investors determine whether combining two assets will reduce overall portfolio risk. For example:

- If Asset A and Asset B have high positive covariance, holding both offers little diversification.

- If Asset A and Asset B have negative covariance, combining them can significantly smooth returns.

Application 2: Identifying Risk Clusters

Covariance matrices (tables showing covariance between all assets in a portfolio) allow analysts to see which assets are too closely related. This prevents unintentional risk concentration.

Application 3: Stress Testing and Scenario Analysis

Risk managers use covariance in simulations to test how portfolios behave under market shocks. Covariance inputs make scenarios more realistic by including asset interdependence.

A covariance matrix helps detect hidden dependencies between portfolio assets.

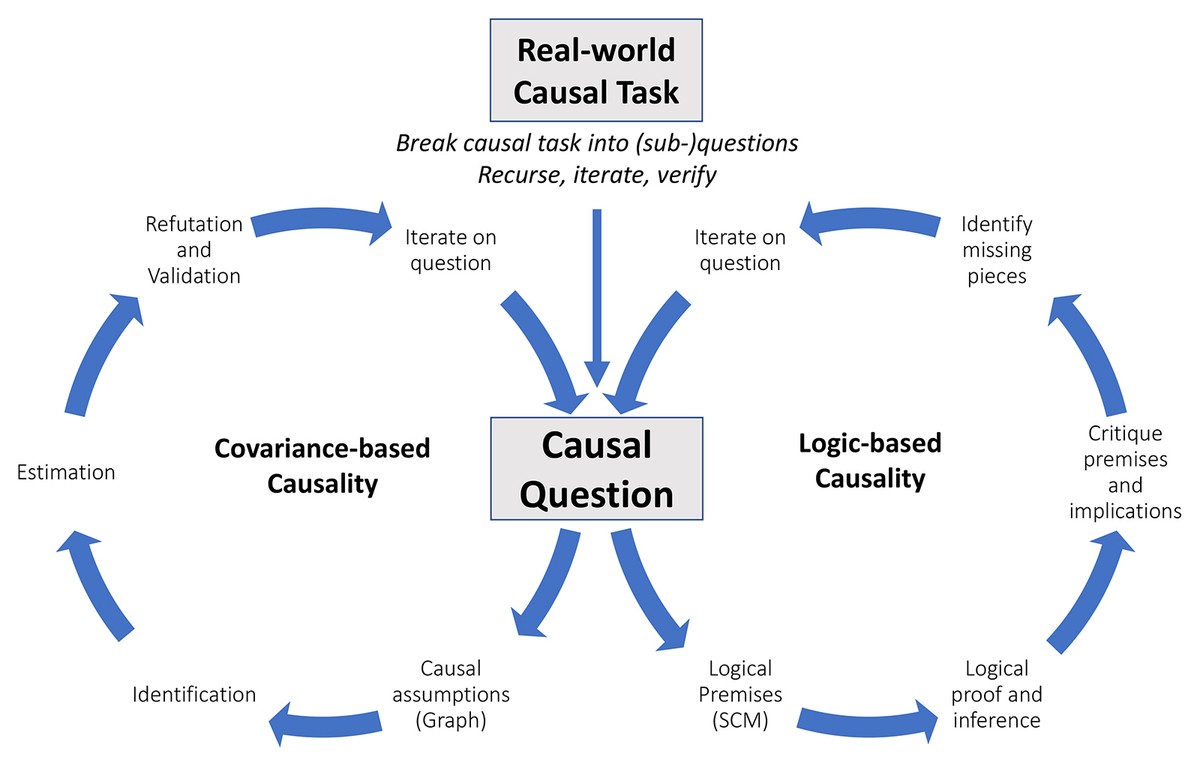

Two Approaches to Using Covariance in Risk Assessment

1. Traditional Portfolio Theory Approach

- How it works: Uses covariance in Modern Portfolio Theory (MPT) to minimize risk for a given return.

- Advantages: Well-established, mathematically proven, effective for long-term investors.

- Disadvantages: Relies on historical data, which may not predict future correlations.

2. Machine Learning–Based Risk Models

- How it works: Incorporates covariance into algorithms that adapt to real-time data.

- Advantages: More dynamic, adjusts quickly to market shifts, can detect nonlinear relationships.

- Disadvantages: Requires advanced technical skills, data-intensive, can overfit if poorly designed.

Recommendation: Beginners should start with traditional covariance-based portfolio analysis. Advanced analysts can incorporate machine learning models once they have experience with covariance fundamentals.

Common Mistakes When Using Covariance

- Relying only on historical data – markets evolve, so past relationships may not hold.

- Ignoring transaction costs and liquidity – diversification benefits can be lost if assets are hard to trade.

- Misinterpreting zero covariance – it does not mean independence, only lack of linear correlation.

For deeper insights, guides such as how covariance impacts quantitative analysis provide frameworks to avoid these pitfalls.

Real-World Example: Covariance in Risk Management

Imagine a portfolio of two assets:

- Tech Stock A – historically volatile with high growth.

- Government Bond B – stable with consistent returns.

Historical data shows a negative covariance between the two. By combining them, the investor lowers overall portfolio volatility while maintaining growth potential. This demonstrates how covariance drives effective portfolio diversification.

Negative covariance allows investors to balance high-risk and low-risk assets.

FAQ: How to Use Covariance in Risk Assessment

1. How does covariance differ from correlation in risk assessment?

Covariance measures the direction of movement between two assets, while correlation standardizes this measure between -1 and +1. Correlation is easier to interpret, but covariance provides raw values used in portfolio models.

2. Can covariance predict future risk?

Not directly. Covariance relies on historical data, which may change. However, when combined with forward-looking models and stress testing, it provides a powerful estimate of future portfolio behavior.

3. What is the role of covariance matrices in finance?

Covariance matrices show relationships across an entire portfolio, not just between two assets. They are essential for quantitative analysis, risk clustering, and optimization models in portfolio management.

4. Where can I find covariance data for trading strategies?

Covariance data can be derived from historical price series available on Bloomberg, Reuters, or free sources like Yahoo Finance. Quant analysts often calculate it directly using Python or R.

Conclusion

Understanding how to use covariance in risk assessment is a cornerstone of quantitative finance. From portfolio diversification to stress testing, covariance allows investors and analysts to evaluate interdependencies and reduce hidden risks.

For beginners, applying covariance in Modern Portfolio Theory is a reliable starting point. Advanced professionals can integrate covariance into machine learning models for dynamic, real-time risk management.

By mastering covariance, investors gain a strategic edge in managing uncertainty and building resilient portfolios.

👉 What’s your experience with covariance in trading or risk assessment? Share your thoughts in the comments and let’s discuss how different approaches to covariance can shape smarter investment strategies.

0 Comments

Leave a Comment