=======================================================

Time series analysis is an essential tool in quantitative trading, helping traders forecast market trends, understand market behaviors, and make informed trading decisions. In this comprehensive guide, we will explore the methods and strategies used in time series analysis, its importance in quantitative trading, and how it can be implemented effectively. Whether you’re a beginner or an experienced quantitative trader, understanding time series analysis will provide you with a deeper insight into the dynamics of financial markets.

What is Time Series Analysis?

Time series analysis refers to the statistical method used to analyze data points collected or recorded at specific time intervals. In trading, time series data typically includes historical market prices, trading volumes, and other financial indicators. The objective is to identify patterns, trends, and relationships that help in forecasting future market movements.

Key elements of time series analysis include:

- Trend: The long-term movement in data, such as the general rise or fall of asset prices.

- Seasonality: Regular fluctuations in data over a specified period (e.g., monthly, quarterly).

- Noise: Random variations in the data that cannot be explained by trends or seasonality.

Why Time Series Analysis is Important in Quantitative Trading

Time series analysis is crucial in quantitative trading for several reasons:

- Market Forecasting: Time series models help traders predict future price movements based on historical data, assisting in decision-making processes.

- Risk Management: By analyzing historical volatility and identifying price patterns, traders can assess and manage risks effectively.

- Strategy Development: Quantitative traders use time series models to develop algorithmic trading strategies, especially in high-frequency trading and statistical arbitrage.

Time series analysis enables traders to detect patterns in price movements, volatility, and other market metrics that can be used to develop strategies for maximizing returns while minimizing risk.

How to Use Time Series Analysis in Quantitative Trading

1. Data Collection and Preprocessing

Before you can use time series analysis, it’s essential to collect relevant data. The quality of data directly impacts the performance of your model. Common data types used in time series analysis include:

- Price data: Open, close, high, and low prices of assets.

- Volume data: Number of shares traded or contracts exchanged.

- Economic indicators: GDP, interest rates, inflation, etc.

Data Preprocessing Steps:

- Handling missing data: Missing or incomplete data must be addressed to ensure accurate analysis.

- Data normalization: Standardizing data to ensure consistency across different time periods.

- Smoothing: Reducing noise in the data by applying smoothing techniques (e.g., moving averages).

2. Time Series Decomposition

Time series decomposition breaks down the data into its underlying components: trend, seasonality, and residuals (noise). This step allows traders to isolate meaningful patterns and better understand market dynamics.

Steps in Time Series Decomposition:

- Trend detection: Identifying long-term directional movements in the price series.

- Seasonality extraction: Recognizing periodic fluctuations in the data that occur at regular intervals.

- Noise filtering: Separating random fluctuations that don’t contribute to predictive patterns.

Decomposition is helpful when working with time series that exhibit strong seasonality or cyclical behavior.

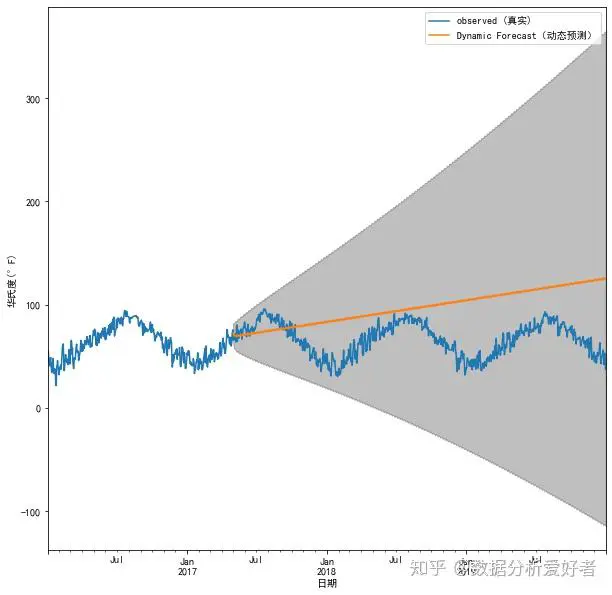

3. Time Series Forecasting Models

Once the data is preprocessed and decomposed, the next step is applying forecasting models. Several time series models are widely used in quantitative trading:

ARIMA (AutoRegressive Integrated Moving Average)

ARIMA is one of the most popular time series models in trading. It combines autoregressive (AR) and moving average (MA) processes to forecast future values based on past data. The model is particularly effective when the data exhibits both trend and seasonality.

- AR (AutoRegressive): Uses past values to predict future values.

- I (Integrated): Removes trends from data to make it stationary.

- MA (Moving Average): Smooths data by averaging past forecast errors.

ARIMA models are ideal for mean-reversion strategies, where prices tend to return to a historical average over time.

Exponential Smoothing (ETS)

ETS models apply smoothing techniques to emphasize more recent data while downplaying older observations. This method is especially useful when analyzing data with strong seasonal components or short-term trends.

- Simple Exponential Smoothing: Best for data without a trend or seasonality.

- Holt’s Linear Trend Model: Ideal for data with trends but no seasonality.

- Holt-Winters Seasonal Method: Effective for data exhibiting both trends and seasonality.

ETS models can be applied for trend-following strategies, where traders capitalize on the continuation of established trends.

Machine Learning Models

In recent years, machine learning techniques, such as random forests, support vector machines (SVM), and neural networks, have gained popularity for time series forecasting. These models can capture complex relationships in the data and adapt over time.

- Pros: Machine learning models are adaptive and can handle large datasets effectively.

- Cons: These models may require significant computational power and might be more difficult to interpret compared to traditional statistical models.

4. Backtesting the Time Series Model

Backtesting is a crucial step in validating the performance of a time series model. By applying the model to historical data, traders can assess its effectiveness before deploying it in live markets.

Steps in Backtesting:

- Divide the data: Split the dataset into training and testing periods to ensure that the model generalizes well.

- Evaluate performance: Use metrics such as Sharpe ratio, maximum drawdown, and accuracy to measure the model’s performance.

- Avoid overfitting: Ensure the model doesn’t memorize the training data, which could lead to poor performance in live markets.

Common Challenges in Time Series Analysis

While time series analysis is a powerful tool, there are several challenges traders face when applying it in quantitative trading:

1. Handling Non-Stationarity

Many financial time series are non-stationary, meaning their statistical properties change over time. Techniques like differencing and transformation can be used to make the data stationary before modeling.

2. Seasonality and Volatility

Identifying and adjusting for seasonality and volatility is crucial to creating an effective trading strategy. Failing to account for these factors can lead to misleading predictions.

3. Overfitting

Overfitting occurs when a model fits too closely to historical data and fails to generalize to new, unseen data. Regularization techniques like cross-validation can help mitigate this issue.

FAQ (Frequently Asked Questions)

1. How do I forecast with time series analysis in trading?

Forecasting with time series analysis in trading involves applying statistical models like ARIMA, ETS, or machine learning techniques to historical price and volume data to predict future price movements.

2. What is the best time series model for financial markets?

The best model depends on the characteristics of the data. ARIMA is ideal for stationary data with trends, while ETS is better suited for data with seasonality. Machine learning models may work well for complex datasets with non-linear relationships.

3. How do I handle seasonality in time series trading?

Seasonality can be handled by using models like Holt-Winters or incorporating seasonal components into ARIMA. These models explicitly account for periodic fluctuations in the data.

Conclusion

Time series analysis is a critical tool in quantitative trading, providing traders with the ability to predict market trends, identify patterns, and improve trading strategies. By leveraging statistical and machine learning models, traders can gain a competitive edge in the financial markets. Whether you’re working with ARIMA, exponential smoothing, or machine learning models, it’s essential to preprocess your data, validate your models, and continuously adapt your strategies to evolving market conditions.

0 Comments

Leave a Comment