Introduction: Why Behavioral Finance Matters for Quant Researchers

In today’s highly automated and data-driven markets, quantitative research roles are often associated with mathematical rigor, algorithmic design, and statistical modeling. However, the integration of behavioral finance in quantitative research roles has become an essential dimension for generating more robust and adaptive strategies. While numbers and models provide the backbone, investor psychology, market sentiment, and behavioral biases frequently create inefficiencies that pure quantitative systems may overlook.

This article explores the importance of behavioral finance in quantitative research, methods of integration, real-world applications, and how risk managers, hedge funds, and algorithmic trading desks are increasingly blending these disciplines.

Behavioral finance concepts integrated into quantitative research frameworks

Understanding Behavioral Finance in Quantitative Contexts

Defining Behavioral Finance

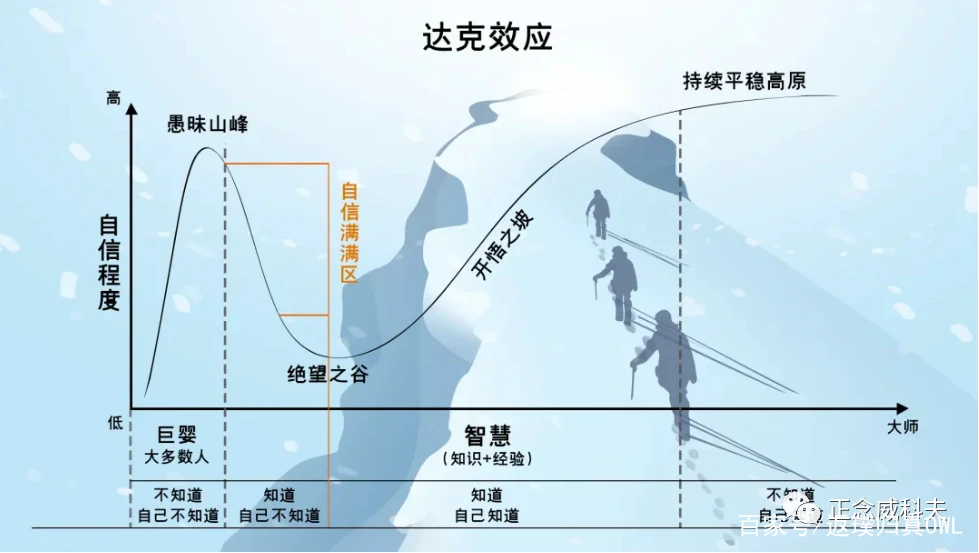

Behavioral finance is the study of psychological influences on investor decisions and market outcomes. Unlike traditional finance theories that assume rational actors, behavioral finance emphasizes cognitive biases such as loss aversion, overconfidence, herd behavior, and anchoring.

The Role in Quantitative Research

Quant researchers rely heavily on backtesting, historical data, and statistical models. Yet, purely rational models often fail during periods of market stress when behavioral biases dominate. Incorporating behavioral finance into quant workflows allows researchers to anticipate and model irrational market moves, improving the resilience of strategies.

Methods for Integrating Behavioral Finance with Quantitative Research

- Sentiment Analysis Models

By leveraging natural language processing (NLP) on news articles, earnings calls, and social media feeds, quant researchers can quantify investor mood. These sentiment scores are then integrated into trading models.

Pros:

Captures real-time behavioral dynamics

Enhances short-term predictive power

Cons:

Data can be noisy and manipulated

Requires advanced machine learning pipelines

- Bias-Aware Risk Modeling

Instead of assuming normal distribution of returns, researchers can incorporate behavioral biases like overconfidence-driven volatility spikes into their risk models.

Pros:

Improves drawdown estimation

Strengthens portfolio stress testing

Cons:

Complex calibration needed

Limited historical bias datasets

Recommended Approach

The most effective strategy is hybrid modeling: integrating sentiment indicators with bias-aware risk frameworks. This ensures that quant strategies are both forward-looking and structurally resilient, adapting to irrational investor behavior during crises.

Applications of Behavioral Finance in Quantitative Research Roles

Hedge Fund Strategy Design

Large funds are embedding behavioral finance insights to predict herding in crypto markets or retail-driven stock rallies.

Retail Investor Models

Platforms incorporate behavioral heuristics to guide risk management tools, offering real-time nudges that counteract loss aversion.

Academic Quant Research

Universities now combine behavioral finance with machine learning to test where behavioral finance meets quantitative analysis, identifying patterns in anomalies like the momentum effect or reversal trades.

Behavioral biases that impact trading decisions

Case Study: Behavioral Finance in Crypto Quant Strategies

In cryptocurrency markets, investor psychology often outweighs fundamental value. Overconfidence, panic selling, and meme-driven rallies are common. Quant researchers have applied behavioral finance by:

Using sentiment-driven trading bots that analyze Twitter and Reddit feeds.

Modeling anchoring effects in crypto volatility, where investors overreact to recent highs/lows.

These applications show why behavioral finance techniques in trading are vital for markets with high retail participation.

Comparing Two Strategies: Pure Quant Models vs. Behaviorally Enhanced Quant Models

Aspect Pure Quant Models Behaviorally Enhanced Quant Models

Assumptions Rational markets, efficient pricing Irrational behavior, bias-driven moves

Performance in Stable Markets Strong Strong

Performance in Stress Periods Weak Stronger resilience

Data Needs Historical prices Price + sentiment + psychology data

Best Use Normal periods, long-term stability High volatility, behavioral anomalies

Conclusion: For quant researchers, a behaviorally enhanced model offers better adaptability, particularly in volatile or retail-driven markets.

FAQs on Behavioral Finance in Quantitative Research Roles

- How does behavioral finance impact quantitative trading?

Behavioral finance provides quant researchers with a toolkit to model irrational investor actions. By accounting for biases such as herding or overreaction, quantitative strategies can anticipate sharp moves that purely rational models miss.

- Why is behavioral finance important in trading for quant researchers?

Markets are not always efficient. Behavioral finance adds a psychological layer, helping quants design algorithms that can withstand black swan events, meme-stock rallies, or panic-driven selloffs.

- How to integrate behavioral finance with quantitative strategies effectively?

The best approach is a multi-layered model: combine sentiment indicators with structural bias-adjusted risk models. Backtesting with behavioral variables, such as fear/greed indexes or Google search trends, enhances predictive accuracy.

Encouraging Social Sharing

If you found these insights valuable, share this article with your peers in finance, research, or academia. Join the conversation—how do you see behavioral finance in quantitative research roles evolving in the next decade? Comment below and spark a discussion!

| Section | Key Points |

|---|---|

| Introduction | Behavioral finance complements quant research by addressing investor psychology |

| Behavioral Finance Definition | Studies psychological influences, cognitive biases like overconfidence, loss aversion, herd behavior |

| Role in Quant Research | Models irrational moves, improves strategy resilience, enhances backtesting |

| Integration Methods | Sentiment analysis using NLP, bias-aware risk modeling, hybrid approaches |

| Sentiment Analysis Pros | Captures real-time behavior, improves short-term predictions |

| Sentiment Analysis Cons | Data noisy, potential manipulation, requires advanced ML |

| Bias-Aware Risk Pros | Better drawdown estimates, strengthens stress testing |

| Bias-Aware Risk Cons | Complex calibration, limited historical bias data |

| Recommended Approach | Combine sentiment indicators with bias-aware risk models |

| Applications | Hedge fund strategies, retail investor tools, academic quant research |

| Crypto Case Study | Sentiment-driven bots, anchoring effects, behavioral anomalies modeled |

| Pure vs Enhanced Quant Models | Pure: rational, stable markets; Enhanced: accounts for biases, stronger in stress |

| Data Needs | Pure: historical prices; Enhanced: price + sentiment + psychology data |

| Best Use | Pure: normal periods; Enhanced: high volatility, behavioral anomalies |

| FAQs Impact | Behavioral finance models irrational actions, anticipates sharp moves |

| Importance | Adds psychological layer, helps quants handle black swans and retail-driven rallies |

| Effective Integration | Multi-layered model: sentiment + bias-adjusted risk + backtesting |

| Conclusion | Behaviorally enhanced models improve adaptability in volatile markets |

0 Comments

Leave a Comment