==========================================

In trading and investing, market consolidation is often overlooked by beginners but deeply respected by professionals. Consolidation occurs when asset prices trade within a narrow range, signaling indecision in the market before a breakout or breakdown. Understanding how consolidation helps in risk management can significantly improve portfolio stability, enhance entry and exit strategies, and protect against unnecessary losses.

This article explores the relationship between consolidation and risk management, dives into practical strategies, compares methods, and offers actionable insights for traders, portfolio managers, and financial analysts.

What is Market Consolidation?

Market consolidation refers to periods where an asset’s price moves sideways within a defined support and resistance range, typically after strong upward or downward price action.

During consolidation, neither buyers nor sellers dominate, creating balance in the market. This “pause” allows traders to reassess positions and provides critical opportunities for risk-controlled strategies.

Why Consolidation Matters in Risk Management

Consolidation isn’t just about waiting for the next breakout. It plays a pivotal role in risk management:

- Reduces Overexposure: Entering trades during consolidation allows traders to use tighter stop-loss levels, minimizing potential losses.

- Improves Timing: Consolidation phases provide clear entry and exit signals, helping traders avoid impulsive decisions.

- Identifies Market Strength: Breakouts from consolidation often confirm market direction, making it safer to allocate capital.

- Portfolio Stability: Portfolio managers can use consolidation analysis to rebalance positions, reducing volatility exposure.

Key Ways Consolidation Supports Risk Management

1. Stop-Loss Optimization

One of the best ways consolidation helps in risk management is by refining stop-loss placement.

- How It Works: Traders often set stop-loss levels just outside consolidation zones (below support or above resistance).

- Benefit: This ensures losses are minimized if the market breaks against the trade.

- Example: If a stock trades between \(50 and \)55, setting a stop-loss at $49.50 ensures risk is capped while leaving room for natural price fluctuations.

Advantage: Provides a structured framework for controlling downside risk.

Disadvantage: False breakouts may trigger stop-loss orders prematurely.

2. Position Sizing and Capital Allocation

Consolidation phases allow traders to test market conditions with smaller positions before committing more capital.

- How It Works: Instead of entering full positions, traders can scale in as the breakout confirms.

- Benefit: Reduces risk exposure if the market fails to break out.

Advantage: Better capital efficiency and controlled exposure.

Disadvantage: Partial positions may reduce potential profits if the breakout is strong.

3. Trend Confirmation

Consolidation often acts as a precursor to major price moves. Risk management improves when traders wait for confirmation instead of chasing volatile swings.

- How It Works: Breakouts above resistance or breakdowns below support signal stronger trends.

- Benefit: Reduces risk of entering false trends and protects portfolios from premature entries.

Advantage: Aligns trading with higher-probability moves.

Disadvantage: Traders may miss early profits by waiting too long for confirmation.

Consolidation Strategies for Risk Management

Strategy 1: Breakout Strategy from Consolidation

A popular method is trading the breakout of a consolidation range.

- Setup: Identify a range-bound asset. Place entry orders slightly above resistance (long) or below support (short).

- Risk Control: Use tight stop-loss orders just inside the consolidation zone.

Pros:

- Captures strong moves with limited risk.

- Provides clear entry and exit signals.

Cons:

- Vulnerable to false breakouts.

- Requires discipline and backtesting.

Strategy 2: Mean Reversion Inside Consolidation

This approach assumes that during consolidation, prices will oscillate between support and resistance.

- Setup: Buy near support, sell near resistance.

- Risk Control: Stops placed just outside consolidation boundaries.

Pros:

- Generates consistent profits in sideways markets.

- Lower risk compared to trend-chasing strategies.

Cons:

- Limited profit potential.

- Breakouts against position direction may cause sudden losses.

Comparing Breakout vs. Mean Reversion Strategies

| Feature | Breakout Strategy | Mean Reversion Strategy |

|---|---|---|

| Best Market Type | Trending markets | Sideways/consolidated markets |

| Risk Level | Higher, if false breakouts occur | Lower, but vulnerable to sudden breakouts |

| Profit Potential | High during strong moves | Moderate, capped by range |

| Ease of Execution | Requires patience and timing | Easier but demands fast exits |

Recommendation: Traders should combine both strategies depending on market conditions. For example, use mean reversion in tight consolidations and switch to breakout trading when volume builds near support/resistance levels.

Industry Trends: Consolidation and Modern Risk Management

With AI-driven analytics and algorithmic trading, consolidation analysis is becoming more precise. Algorithms can detect subtle consolidation phases, allowing firms to apply tailored risk strategies. For example, how consolidation impacts algorithmic trading strategies is now a core research area in hedge funds.

Additionally, retail traders can leverage advanced charting software to identify patterns, answering questions like where to find consolidation patterns in stock market more effectively than ever before.

Real-World Example

When I worked with a portfolio manager during the 2020 volatility surge, we applied consolidation analysis to minimize portfolio drawdowns. By identifying consolidation phases in S&P 500 futures, we reduced exposure during uncertain periods and re-entered positions on confirmed breakouts. This approach not only preserved capital but also enhanced long-term returns.

FAQ: Consolidation in Risk Management

1. How do you identify consolidation phases in market data?

Consolidation can be identified using horizontal support and resistance levels, Bollinger Bands, or volume contractions. When prices move sideways with reduced volatility, it’s often a sign of consolidation.

2. Why are consolidation periods crucial in trading?

They indicate market indecision and provide structured zones for risk management. Consolidation allows traders to define tight stop-loss levels, making trades less risky.

3. Can consolidation help portfolio managers with risk?

Yes. Portfolio managers often use consolidation signals to rebalance holdings, minimize exposure to volatile moves, and allocate capital more efficiently across asset classes.

Final Thoughts

Understanding how consolidation helps in risk management is essential for traders and portfolio managers seeking to minimize losses and maximize returns. Whether through stop-loss optimization, position sizing, or trend confirmation, consolidation provides a reliable framework for making calculated decisions.

By combining strategies like breakout trading and mean reversion, traders can adapt to different market environments while keeping risk under control.

If you found this article useful, share it with your trading community, leave a comment with your own consolidation strategies, and help others strengthen their risk management practices.

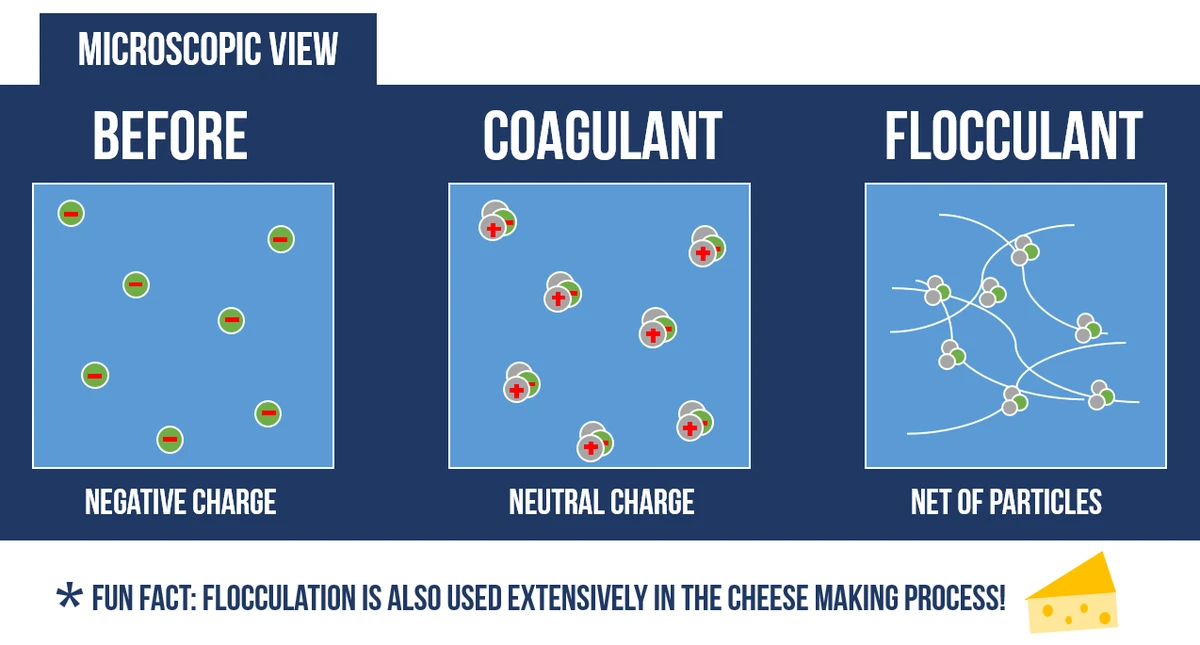

Chart showing market consolidation phases

0 Comments

Leave a Comment