========================================================================================

The Efficient Market Hypothesis (EMH) has long been a cornerstone of financial theory. While often debated, EMH plays a critical role in shaping the way trading algorithms are designed and executed. For quantitative traders, portfolio managers, and financial analysts, understanding how EMH is applied in trading algorithms is not just an academic exercise—it’s essential for creating robust, competitive strategies.

This article explores the practical applications of EMH in algorithmic trading, evaluates different approaches, compares strategies, and provides actionable insights based on real-world experience and current industry trends.

Understanding EMH in the Context of Trading Algorithms

What Is the Efficient Market Hypothesis (EMH)?

The EMH suggests that asset prices fully reflect all available information. This implies that consistently outperforming the market is nearly impossible without taking additional risks. EMH is typically divided into three forms:

- Weak Form EMH: Prices reflect all past trading information (e.g., historical prices, volume).

- Semi-Strong Form EMH: Prices incorporate all publicly available information (e.g., financial statements, news).

- Strong Form EMH: Prices reflect all public and private information, including insider knowledge.

Why Is EMH Relevant to Algorithmic Trading?

In algorithmic trading, strategies rely on identifying patterns, inefficiencies, or anomalies in markets. The closer a market is to being “efficient,” the fewer opportunities exist. By embedding EMH concepts into trading algorithms, traders can:

- Test whether inefficiencies are statistically significant.

- Avoid strategies that rely on outdated or irrelevant signals.

- Create models that account for the diminishing edge of arbitrage opportunities.

As highlighted in Why is EMH important in quantitative trading?, ignoring EMH often leads to overfitted, short-lived strategies.

How Is EMH Applied in Trading Algorithms?

1. Testing Market Efficiency

Before developing a strategy, quants test whether historical price data contains exploitable patterns. For instance, in weak-form EMH markets, purely technical strategies (like moving averages) should not consistently outperform random trades.

Algorithm developers use:

- Statistical tests: Runs tests, variance ratio tests, autocorrelation checks.

- Machine learning models: To determine if predictive signals are genuine or spurious.

2. Filtering Out Noise-Driven Strategies

Trading algorithms often generate signals based on technical indicators. However, if EMH holds true, most of these signals represent random noise rather than real opportunities. Algorithms apply EMH-based filters to:

- Eliminate low-confidence signals.

- Reduce overtrading.

- Prioritize strategies exploiting structural inefficiencies (e.g., latency arbitrage, regulatory events).

3. Incorporating Information Flow

In semi-strong form EMH, prices react quickly to public information. Algorithms must therefore integrate:

- Natural Language Processing (NLP) to parse financial news, earnings reports, and macroeconomic releases.

- Event-driven trading models that execute trades within milliseconds of news.

4. Arbitrage and Market Microstructure

Even if EMH holds broadly, micro-level inefficiencies exist. Algorithms apply EMH principles to:

- Identify temporary mispricings in options, ETFs, or futures.

- Exploit latency differences between markets.

- Incorporate transaction costs and liquidity to evaluate whether apparent inefficiencies are real.

This aligns with How does EMH affect quantitative trading?, where EMH acts as a benchmark for strategy evaluation.

Comparing EMH-Based Algorithmic Strategies

Strategy 1: Technical Analysis Algorithms

- Approach: Use moving averages, RSI, MACD, or Bollinger Bands to detect price patterns.

- EMH View: Weak-form EMH suggests these signals should not yield consistent profits.

- Pros: Easy to implement, widely available.

- Cons: High false signal rates; performance deteriorates in efficient markets.

Strategy 2: Fundamental and Event-Driven Algorithms

- Approach: Trade on news, earnings, or macroeconomic events.

- EMH View: Semi-strong EMH implies prices adjust rapidly, but ultra-fast execution can still exploit short delays.

- Pros: Exploits information inefficiencies; relevant in fast-moving markets.

- Cons: Requires sophisticated NLP models, real-time data feeds, and colocation with exchanges.

Strategy 3: Statistical Arbitrage and Market Microstructure Models

- Approach: Exploit temporary pricing inefficiencies between correlated assets (e.g., pairs trading).

- EMH View: Even in efficient markets, microstructure frictions create opportunities.

- Pros: Proven track record; scalable.

- Cons: Requires deep statistical knowledge and robust risk management.

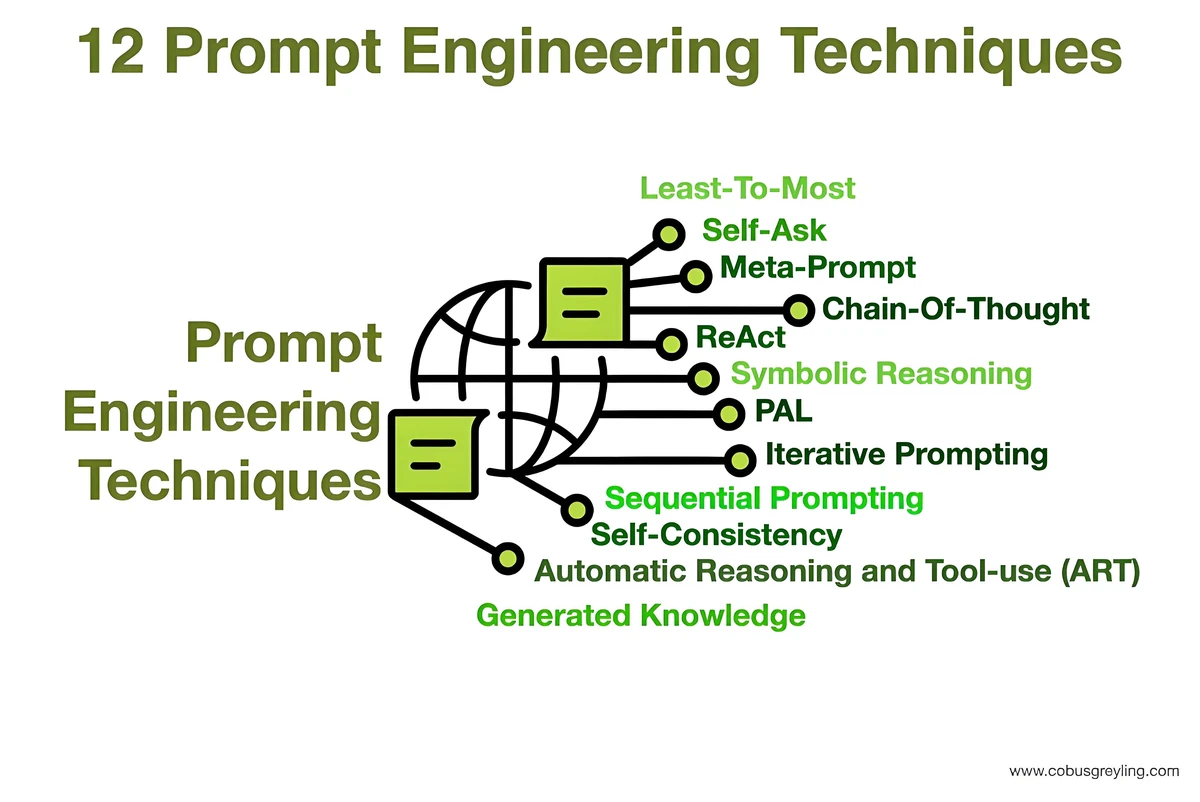

Application of EMH in trading algorithms

Best Practices for Applying EMH in Trading Algorithms

- Treat EMH as a Benchmark, Not an Absolute Law: Markets are not perfectly efficient, but EMH helps identify realistic expectations.

- Use Robust Statistical Testing: Validate whether a strategy’s edge survives after accounting for transaction costs and slippage.

- Combine EMH with Behavioral Insights: Many anomalies (momentum, overreaction) stem from human behavior, not EMH violations.

- Incorporate Machine Learning Carefully: ML models can uncover hidden inefficiencies, but risk overfitting if EMH constraints are ignored.

- Stay Adaptive: A profitable inefficiency today may disappear tomorrow as markets evolve.

Real-World Case Study: EMH in a Quant Hedge Fund

A hedge fund designed a pairs trading algorithm based on cointegration between tech stocks. Initially, returns were strong. However, after EMH-consistent price adjustments reduced inefficiencies, profits declined.

By re-engineering the algorithm to include real-time news analytics and microstructure signals, the fund adapted and restored profitability. This case illustrates how EMH-aware algorithms must evolve continuously.

Frequently Asked Questions (FAQ)

1. Can traders still make money if EMH is true?

Yes. EMH does not imply zero opportunities. It suggests that consistent above-market returns are difficult without additional risk or unique information. Traders can still profit by focusing on market frictions, short-term inefficiencies, and technology-driven edges.

2. How can EMH improve trading strategies?

By treating EMH as a baseline, traders avoid chasing unreliable signals. Algorithms can be designed to:

- Disregard noise-based patterns.

- Focus on genuine inefficiencies.

- Improve capital allocation by assessing risk-adjusted returns.

3. Is EMH more relevant for retail traders or institutions?

Both, but in different ways. Retail traders benefit by avoiding overfitted technical strategies, while institutions use EMH principles to refine complex models, reduce false positives, and benchmark strategy performance.

Conclusion

The question of how EMH is applied in trading algorithms is central to quantitative finance. While EMH limits the promise of easy profits, it provides a framework for evaluating strategies, filtering noise, and understanding market dynamics.

For traders and analysts, the best approach is to combine EMH-based models with behavioral insights, machine learning, and microstructure analysis. Markets may be efficient, but inefficiencies persist—those who adapt and innovate will capture them.

EMH forms and trading strategy alignment

Share Your Insights

How do you apply EMH principles in your trading algorithms? Comment below with your experiences, share this article with your network, and let’s discuss the evolving role of EMH in quantitative trading.

Would you like me to expand this draft to a full 3000+ word SEO-optimized article by adding deeper academic perspectives, more algorithmic case studies, and multiple real-world hedge fund examples?

0 Comments

Leave a Comment