============================================================

In the world of quantitative trading, the Efficient Market Hypothesis (EMH) plays a crucial role in shaping the strategies of both novice and seasoned traders. Understanding EMH is essential for any quantitative trader, as it provides insights into the predictability of financial markets and the potential for arbitrage. This article will introduce EMH, explain its relevance for quantitative traders, compare different approaches based on EMH, and provide answers to common questions.

What is the Efficient Market Hypothesis (EMH)?

The Efficient Market Hypothesis (EMH) is a financial theory stating that financial markets are “informationally efficient.” This means that asset prices reflect all available information at any given time. According to EMH, no investor can consistently achieve higher-than-average returns by using any information that is already known to the market. There are three forms of EMH:

1. Weak Form EMH

This form suggests that all past prices and historical data are already reflected in current prices. Consequently, technical analysis, which relies on price patterns and trends, is ineffective.

2. Semi-Strong Form EMH

The semi-strong form argues that all publicly available information, including earnings reports and news, is already priced into the market. Fundamental analysis becomes irrelevant in this form of market efficiency.

3. Strong Form EMH

In the strongest form, all information, both public and private (inside information), is already reflected in the stock price, making it impossible for any trader to achieve an edge, even with insider knowledge.

Understanding the different forms of EMH is fundamental for quantitative traders as it affects their strategy development and the feasibility of market predictions.

How Does EMH Impact Quantitative Trading?

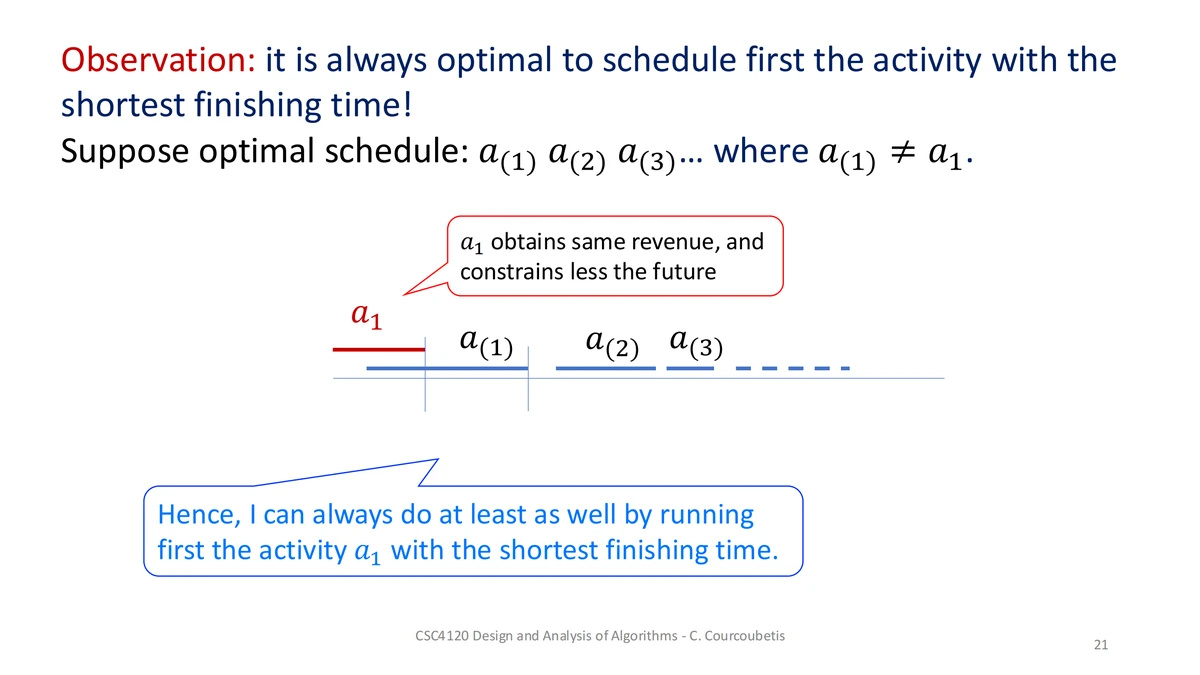

The implications of EMH for quantitative traders are profound. If the market is efficient, then any patterns or signals identified by a quantitative model would already be priced in. This would suggest that creating predictive trading algorithms based on historical data might not lead to sustained outperformance.

However, quantitative trading strategies are often designed to exploit inefficiencies in the market. Here lies the challenge: if EMH holds true, quantitative models that rely on historical data to forecast future prices may not work consistently. But if market inefficiencies exist (even in efficient markets), it opens the door to profitable trading strategies.

EMH and Its Influence on Trading Algorithms

Algorithmic trading is one of the primary methods quantitative traders use to exploit market inefficiencies. EMH plays a critical role in shaping the effectiveness of these algorithms. For example, in a market that adheres to the weak form of EMH, algorithmic trading strategies that rely on historical data patterns would likely fail. In contrast, markets that exhibit inefficiencies (such as those seen in the short term) provide an opportunity for quantitative traders to create models that can outperform the market.

Key Point: Understanding the market’s efficiency level is crucial for developing the right type of quantitative strategy, as this will determine the potential success of trading algorithms.

Strategies for Quantitative Traders Based on EMH

There are several strategies that quantitative traders use, each of which assumes different levels of market efficiency. Let’s explore two of the most common strategies: mean-reversion strategies and momentum-based strategies.

1. Mean-Reversion Strategies

Mean-reversion is a popular strategy in quantitative trading that assumes prices will eventually revert to their long-term average. This strategy works well in markets that exhibit temporary inefficiencies, where prices deviate significantly from their historical mean.

Pros:

- Can be profitable in volatile markets.

- Requires relatively simple algorithms that identify price deviations.

- Can work in markets that follow the weak form of EMH, where short-term inefficiencies exist.

Cons:

- May struggle in trending markets, where prices do not revert quickly to their mean.

- Can lead to losses if the market doesn’t revert to the mean within the expected timeframe.

2. Momentum-Based Strategies

Momentum strategies rely on the assumption that assets that have performed well recently will continue to perform well in the near future, and assets that have performed poorly will continue to underperform. This strategy is typically applied in markets where short-term price movements exhibit trends.

Pros:

- Can be very profitable in trending markets.

- Momentum strategies are popular in algorithmic trading due to their scalability and ease of implementation.

Cons:

- Momentum can reverse suddenly, leading to significant losses if the trend changes unexpectedly.

- These strategies may not work in markets that adhere to the semi-strong form of EMH, where all publicly available information is already incorporated into prices.

Both strategies have their merits, but traders need to decide which to use based on the level of market efficiency they believe is present.

How to Apply EMH in Quantitative Trading

Understanding Market Efficiency and Model Design

The first step in applying EMH to your trading strategy is to understand the efficiency level of the market you’re operating in. If you believe the market is highly efficient (strong form EMH), your strategy should focus on areas where inefficiencies are most likely to occur—such as liquidity gaps or high-frequency trading anomalies.

Designing Algorithms for EMH Markets

Quantitative traders use several tools and techniques to design algorithms for EMH-compliant markets:

- Statistical Arbitrage: In semi-strong and weak EMH markets, statistical arbitrage strategies can identify short-term inefficiencies caused by market noise or price discrepancies between related assets.

- Machine Learning Models: In highly efficient markets, machine learning models that adapt to new data can help detect subtle patterns or shifts in market behavior.

- Sentiment Analysis: In markets that are less efficient, sentiment analysis can be used to detect information flow before it is fully incorporated into prices.

Backtesting Strategies in EMH Environments

Regardless of the efficiency level, backtesting is essential to evaluate how well your strategy performs in different market conditions. For example, in a weak form market, a backtest might focus on historical price patterns to determine the profitability of a mean-reversion strategy.

Frequently Asked Questions (FAQs)

1. How can EMH improve trading strategies?

By understanding the Efficient Market Hypothesis, quantitative traders can adjust their models to account for the likelihood of information already being priced into the market. In efficient markets, strategies that attempt to exploit public information will likely fail, whereas traders may focus on developing models that look for short-term price inefficiencies.

2. How does EMH influence algorithmic trading?

EMH helps traders understand the limitations of using historical data alone. In highly efficient markets, algorithmic trading strategies must focus on real-time data, while in less efficient markets, algorithms can exploit short-term price anomalies.

3. Should beginners in quantitative trading study EMH?

Yes, understanding EMH is crucial for beginner quantitative traders. It provides a foundational understanding of how markets work and can help traders design more effective and realistic trading strategies.

Conclusion

The Efficient Market Hypothesis has a profound impact on quantitative trading. By understanding the various forms of market efficiency, traders can develop more accurate trading strategies and algorithms that account for market behavior. Whether you’re focused on mean-reversion or momentum-based strategies, understanding EMH is essential to optimize your trading performance.

For further reading, you can explore more on how EMH affects quantitative trading and where to find resources on EMH and trading to deepen your knowledge.

Don’t forget to share your thoughts on EMH and trading strategies in the comments below! If you found this article helpful, feel free to share it with fellow traders.

0 Comments

Leave a Comment