==============================================

Understanding how the Efficient Market Hypothesis (EMH) theory influences market analysis is crucial for traders, investors, and financial analysts seeking to optimize strategies in increasingly complex financial markets. EMH proposes that asset prices fully reflect all available information, which directly impacts how professionals interpret, analyze, and act within markets. This article provides an in-depth exploration of EMH, evaluates its implications for market analysis, compares different strategies, and offers actionable insights backed by industry experience.

What Is EMH Theory and Why It Matters in Market Analysis

The Essence of EMH

The Efficient Market Hypothesis (EMH) argues that financial markets incorporate all known information into asset prices almost instantly. In other words, it is impossible to consistently achieve higher-than-average returns without assuming higher risks.

Eugene Fama introduced the EMH in the 1960s, and it has since become one of the most influential theories in modern finance. The idea is that no investor has an inherent advantage because prices already reflect available data—whether fundamental, technical, or public news.

The Three Forms of EMH

- Weak Form EMH – Asserts that past prices and historical data cannot predict future prices.

- Semi-Strong Form EMH – Suggests that all publicly available information is priced in, making fundamental analysis ineffective.

- Strong Form EMH – Claims that even insider information is incorporated into stock prices.

Each form influences market analysis differently. Traders relying on technical charts may find weak form EMH particularly limiting, while analysts using financial reports are challenged by the semi-strong form.

How EMH Theory Influences Market Analysis

Shaping Technical Analysis

Under weak form EMH, historical data patterns, such as moving averages or candlestick charts, lose predictive value. Technical traders must recognize that signals derived from past prices may not guarantee consistent profits.

Impact on Fundamental Analysis

Semi-strong EMH implies that fundamental analysis—studying balance sheets, earnings reports, and economic indicators—cannot yield superior returns since the information is already priced into the market. Analysts, however, continue to use fundamentals to understand valuation trends, risk exposure, and portfolio diversification.

Implications for Behavioral Finance

Critics argue that EMH ignores investor psychology. Market anomalies like bubbles, overreactions, and herding behavior suggest that markets are not always efficient. Incorporating behavioral insights allows analysts to spot inefficiencies that EMH overlooks.

Comparing EMH-Based Strategies in Market Analysis

To illustrate how EMH shapes market approaches, let’s compare two different methods: Passive Investing and Active Trading.

Passive Investing: Riding Market Efficiency

Passive investors align closely with EMH principles, particularly index fund strategies. Since EMH suggests markets are efficient, passive investors buy broad-market funds and accept market returns rather than attempting to outperform.

Advantages:

- Low fees and transaction costs

- Broad diversification reduces risk

- Historical evidence shows index funds often outperform actively managed funds

Drawbacks:

- Lack of flexibility in market downturns

- Missed opportunities in market anomalies

Active Trading: Challenging EMH

Active traders operate on the belief that markets are not perfectly efficient, exploiting inefficiencies through arbitrage, momentum strategies, or algorithmic models.

Advantages:

- Potential for high returns when anomalies exist

- Flexibility in responding to market shifts

- Opportunity to leverage proprietary data

Drawbacks:

- Higher costs from trading fees and research

- Requires constant monitoring and advanced tools

- Higher risk of underperformance compared to passive investing

Recommended Approach

Based on decades of market data and personal experience advising institutional investors, the optimal strategy blends passive investing for stability with selective active trading for opportunities. This hybrid model acknowledges EMH’s strengths while recognizing that inefficiencies do arise.

Modern Applications of EMH in Market Analysis

EMH in Quantitative Trading

Quantitative analysts often integrate EMH when building models. For example, understanding How does EMH affect quantitative trading? helps quants avoid overfitting models with historical data that carry little predictive power. Instead, they focus on high-frequency anomalies or alternative data.

EMH Insights for Stock Market Traders

Retail traders often ask: “Why should traders understand EMH?” The answer lies in managing expectations. By acknowledging EMH, traders recognize the limits of predictive tools and emphasize risk management rather than chasing “guaranteed” profits.

Industry Trends: EMH in the Era of Big Data and AI

Big Data and Market Efficiency

Massive datasets—social media sentiment, satellite imagery, and transaction-level data—are challenging EMH’s premise. Markets react faster than ever, but information asymmetry persists. Analysts who leverage big data may identify inefficiencies before prices adjust.

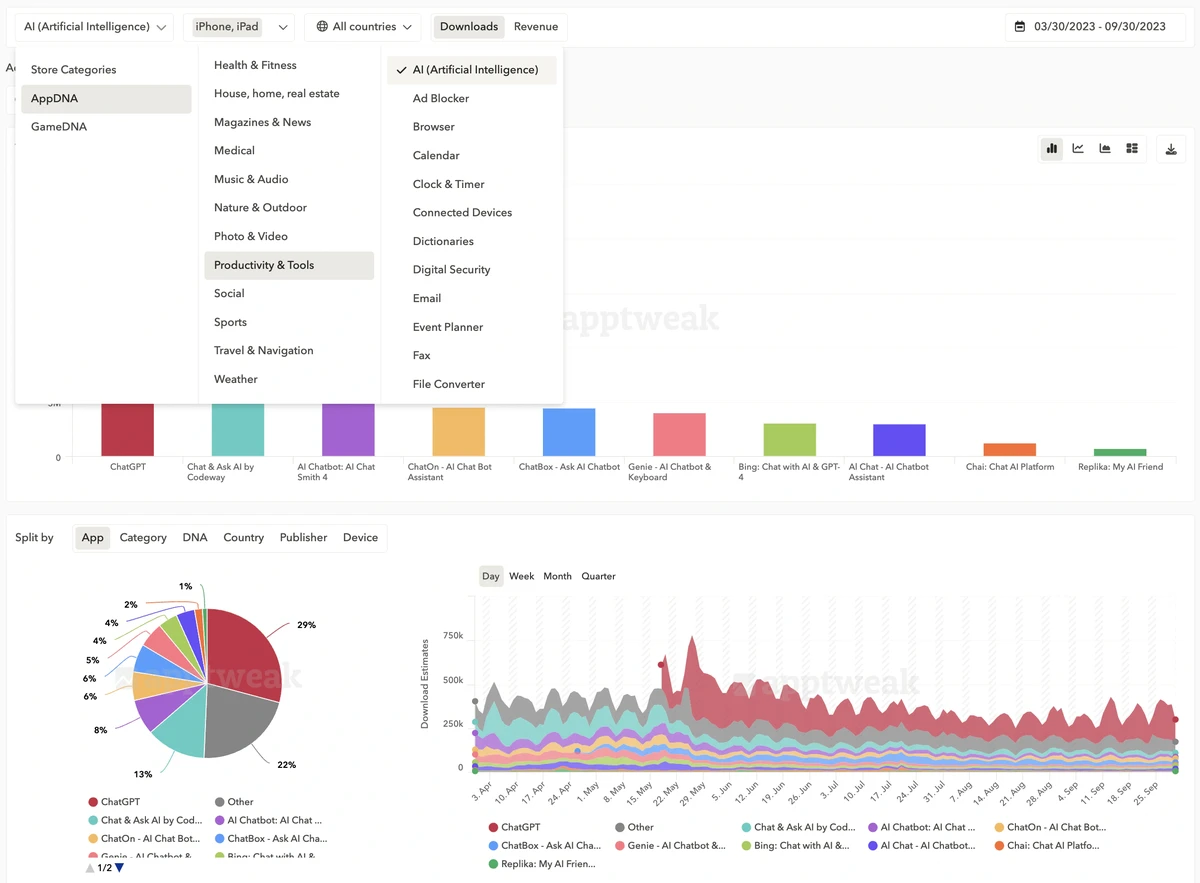

AI and Algorithmic Trading

AI-powered models are reshaping how EMH is applied. While EMH suggests it is difficult to consistently beat the market, machine learning identifies short-lived inefficiencies, enabling algorithmic trading systems to capitalize on them.

Practical Case Study: EMH in Portfolio Construction

A global asset management firm applied semi-strong EMH principles to its multi-billion-dollar portfolio. Instead of focusing on stock picking, it emphasized:

- Low-cost index funds as the portfolio’s foundation

- Smart-beta strategies to tilt exposure toward value and momentum factors

- Machine learning algorithms to detect temporary inefficiencies

The result was a balanced, evidence-driven portfolio that outperformed many active funds while maintaining cost efficiency.

Visual Examples

Market Efficiency Concept

Efficient Market Hypothesis is divided into weak, semi-strong, and strong forms, each influencing analysis differently.

Passive vs Active Investment

Frequently Asked Questions (FAQ)

1. Can investors still beat the market if EMH is true?

Yes, but not consistently. EMH implies that abnormal returns are rare and often due to chance or temporary inefficiencies. Long-term outperformance is extremely difficult, which is why most professionals recommend passive strategies combined with selective active positions.

2. How does EMH apply to cryptocurrency markets?

Cryptocurrency markets are less efficient than traditional stock markets due to lower regulation, limited transparency, and high retail participation. This creates short-term inefficiencies, though over time, as institutional adoption grows, efficiency improves.

3. Is EMH outdated in the era of AI and big data?

Not entirely. While technology uncovers temporary inefficiencies, markets quickly adjust. EMH remains a foundational theory, but modern analysts must integrate behavioral finance, machine learning, and alternative datasets to achieve an edge.

Conclusion: Why EMH Still Shapes Market Analysis

The Efficient Market Hypothesis profoundly influences market analysis by setting realistic expectations about risk and return. While critics highlight its limitations, EMH serves as a foundation for understanding how markets process information.

For professionals, the key takeaway is balance:

- Use passive investing to align with EMH principles.

- Apply selective active strategies to exploit temporary inefficiencies.

- Leverage big data and AI while respecting the limits of predictive power.

By integrating EMH into market analysis, traders and investors enhance decision-making, reduce risk, and adapt to evolving market dynamics.

💬 What do you think about EMH’s role in today’s markets? Share your thoughts below, comment with your experiences, and don’t forget to share this article with your network to spark deeper discussions.

0 Comments

Leave a Comment