=====================================================================================

Introduction

In today’s increasingly data-driven financial landscape, probability guides for financial advisors have become essential for making informed decisions. Financial advisors often deal with uncertainty—whether it’s portfolio construction, retirement planning, risk management, or advising clients on investment strategies. Probability provides a structured way to quantify uncertainty, evaluate potential outcomes, and improve the accuracy of forecasts.

This article offers a comprehensive guide for financial advisors to understand and apply probability. It explores foundational concepts, advanced methodologies, and real-world applications. Drawing from industry best practices, case studies, and personal experiences, we’ll analyze at least two distinct approaches financial advisors can use, comparing their strengths and weaknesses. We’ll also provide FAQs to address common concerns and practical examples.

Why Probability Matters in Financial Advisory

Quantifying Uncertainty

Advisors face constant uncertainty in markets—probability allows them to assign measurable likelihoods to outcomes, enabling more confident decision-making. For instance, when evaluating whether a portfolio has a 70% chance of outperforming inflation, probability gives meaning to that confidence level.

Enhancing Client Communication

Using probability helps advisors explain complex risk-return scenarios in simpler terms. Rather than saying “the market might go down,” they can explain: “There’s a 30% probability of a downturn within the next 12 months.” This makes advice tangible for clients.

Supporting Quantitative and Behavioral Strategies

Probability integrates seamlessly with both quantitative models and behavioral finance. Advisors can demonstrate why diversification works, or why certain risks must be hedged, using probability-based frameworks.

Foundational Probability Concepts for Advisors

Basic Probability Rules

Financial advisors should be familiar with:

- Independent vs. Dependent Events: Knowing if events affect each other is critical in portfolio correlation.

- Conditional Probability: The likelihood of an event given another—essential in stress testing.

- Bayesian Updating: Adjusting probabilities as new information arises, which mirrors real-world market updates.

Probability Distributions

Understanding common distributions is essential:

- Normal Distribution: Widely used in returns modeling, but often underestimates extreme events.

- Lognormal Distribution: Common for asset prices, reflecting the fact that prices can’t go below zero.

- Fat-Tailed Distributions: Useful when modeling extreme risk events like financial crises.

Probability distributions applied in portfolio risk models

Two Key Methods for Applying Probability in Financial Advisory

1. Monte Carlo Simulations

How It Works

Monte Carlo simulations use thousands of random trials to estimate potential outcomes of investments or portfolios. Advisors can simulate multiple scenarios, such as market downturns, inflation changes, or retirement withdrawals.

Advantages

- Provides a range of potential future outcomes.

- Visualizes risks in a client-friendly way.

- Helps with retirement and estate planning by showing probabilities of success.

Limitations

- Dependent on the quality of input assumptions.

- May mislead if extreme risks are underestimated.

2. Bayesian Probability Models

How It Works

Bayesian models allow advisors to update probabilities as new data arrives. For example, if inflation unexpectedly rises, Bayesian methods adjust prior beliefs about bond returns in light of new evidence.

Advantages

- Dynamically incorporates real-world data.

- More realistic than static historical models.

- Enhances adaptability in volatile markets.

Limitations

- Requires deeper statistical knowledge.

- Can be complex to explain to clients without visuals.

Comparative Insight: Which to Use?

Monte Carlo simulations excel at client-facing presentations and retirement projections, while Bayesian methods shine in ongoing risk management and adaptive portfolio adjustments. In practice, many advisors combine both approaches for maximum effectiveness.

This aligns with advanced insights from how to use probability in quantitative trading, where Monte Carlo is often used for risk analysis, while Bayesian methods are applied in algorithmic trading for adaptability.

Practical Applications of Probability in Financial Advisory

Portfolio Construction

Probability helps estimate expected returns, volatility, and drawdowns, allowing advisors to create efficient portfolios tailored to risk tolerance.

Retirement Planning

Monte Carlo simulations provide clarity on the probability of not outliving assets. For example, a portfolio might show an 85% probability of sustaining 30 years of withdrawals.

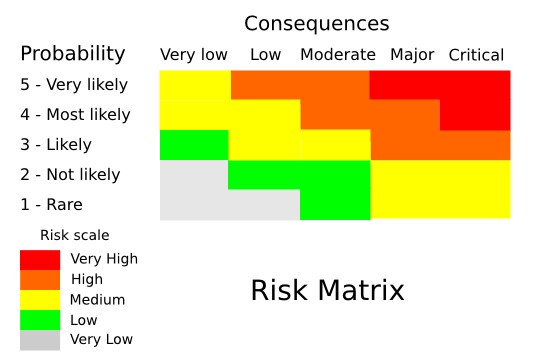

Risk Management

Probability is the foundation of Value at Risk (VaR) and stress testing. Advisors can quantify how likely extreme losses are under different market conditions.

Value at Risk (VaR) as a probability-based risk measure

Behavioral Coaching

Clients often overestimate unlikely events (e.g., market crashes) and underestimate frequent ones (e.g., inflation erosion). Advisors can use probability frameworks to reframe biases with evidence-based insights.

This resonates with why probability is important in trading, as it helps investors manage risks rather than making purely emotional decisions.

Common Mistakes Advisors Make with Probability

- Relying too heavily on normal distributions—underestimating fat-tail risks.

- Failing to communicate uncertainty properly—presenting forecasts as certainties instead of probabilities.

- Overcomplicating models for clients—using jargon without simple visual explanations.

- Ignoring conditional probabilities—overlooking how events interact in real markets.

Best Practices for Financial Advisors

- Use visual aids (charts, histograms, scenario maps) to explain probabilities.

- Update probability assumptions frequently to reflect new market realities.

- Apply both frequentist and Bayesian approaches depending on context.

- Frame client conversations around probabilities, not certainties.

FAQ: Probability in Financial Advisory

1. How can financial advisors use probability to improve investment decisions?

Advisors can model the probability of different returns, risks, and outcomes. This ensures portfolios are aligned with clients’ risk tolerance and goals. For instance, using Monte Carlo simulations helps determine the likelihood that a retirement portfolio sustains income needs for 25+ years.

2. Is probability useful for short-term or only long-term financial planning?

Probability is valuable in both. In the short term, it helps assess risks of sudden drawdowns or hedging needs. In the long term, it supports retirement planning, estate planning, and wealth preservation. Both Monte Carlo and Bayesian methods apply across horizons.

3. How do advisors explain probability to clients who aren’t familiar with statistics?

The best way is through visuals and analogies. For example, likening retirement planning to weather forecasts—where there’s a 70% chance of sunny skies—helps clients grasp uncertainty without technical jargon.

Conclusion

Probability guides for financial advisors are not just technical tools—they are powerful frameworks for decision-making, client communication, and risk management. By combining Monte Carlo simulations with Bayesian probability models, advisors can enhance both strategic planning and adaptability.

Incorporating probability into advisory practices improves trust, transparency, and investment accuracy. As markets grow more uncertain, advisors who embrace probability will deliver stronger, evidence-based guidance.

If you found this guide useful, feel free to share it with colleagues, discuss it with your clients, and leave your thoughts in the comments. Let’s continue the conversation on how probability can reshape financial advisory.

0 Comments

Leave a Comment