A Step-by-step double top trading guide is essential for traders who want to master one of the most recognized reversal chart patterns in technical analysis. The double top pattern has been used for decades by stock, forex, and crypto traders as a way to identify potential bearish reversals after a strong uptrend. This article will give you a comprehensive, SEO-optimized guide that not only explains how to trade double tops but also compares strategies, shows practical examples, and answers frequently asked questions.

Understanding the Double Top Pattern

What Is a Double Top?

A double top is a bearish reversal pattern that forms after an extended bullish move. It resembles the letter “M” on a price chart. The price tests a resistance level twice but fails to break above it, indicating weakening buying pressure and a potential shift toward sellers.

- First peak: The initial rally halts at resistance.

- Second peak: After a pullback, the price retests resistance but fails again.

- Neckline: The horizontal level at the trough between the peaks.

- Confirmation: A break below the neckline signals the completion of the pattern and the start of a potential downtrend.

Double top pattern structure with resistance, neckline, and bearish confirmation.

Step-by-Step Double Top Trading Guide

Step 1: Identify the Pattern

Spotting the double top requires patience. Many traders confuse random price fluctuations with a proper reversal setup. Knowing how to identify double top pattern can save you from false signals.

Checklist for validation:

- Two peaks at a similar price level.

- Peaks separated by at least 10–20 candles (depending on timeframe).

- A visible neckline that defines support.

- Volume often decreases on the second peak.

Step 2: Wait for Confirmation

Traders often jump into a short trade too early. The pattern is only confirmed after the neckline breaks with strong bearish momentum. Without this confirmation, it could turn into a continuation pattern instead.

Step 3: Enter the Trade

- Conservative entry: Enter after a candle closes below the neckline.

- Aggressive entry: Enter near the second peak, anticipating the neckline break (higher risk, higher reward).

Step 4: Set Stop-Loss

Place stop-loss orders above the second peak to minimize risk. This is crucial because false double tops can trap traders.

Step 5: Determine Take-Profit

A common target is the measured move: the distance from the peaks to the neckline, projected downward. Advanced traders sometimes trail stops to maximize profits during strong downtrends.

Comparing Two Trading Approaches

1. Classic Double Top Strategy

- Method: Wait for neckline break before entering.

- Advantages: Reliable, lower risk of false signals.

- Disadvantages: Later entry reduces reward-to-risk ratio.

2. Pre-Breakout Anticipation Strategy

- Method: Enter short near the second peak.

- Advantages: Better risk-to-reward ratio, earlier profits.

- Disadvantages: Higher risk of premature entry if resistance breaks.

Best Practice Recommendation: Beginners should start with the classic double top strategy for safer learning. More experienced traders can experiment with anticipation trades after mastering confirmation-based entries.

Where Double Top Patterns Occur

Double tops appear across stocks, forex, commodities, and crypto markets. They are most reliable when they form:

- After a long bullish rally.

- Near strong historical resistance levels.

- During low-volume retests of highs.

Learning where double top patterns occur helps traders filter out low-probability setups and focus only on high-quality opportunities.

Advanced Double Top Techniques

Using Volume Analysis

Volume typically declines during the second peak and spikes during the neckline break. Monitoring this behavior increases confidence in the setup.

Incorporating Indicators

- RSI divergence: Bearish divergence strengthens the signal.

- Moving averages: A crossover after the neckline break confirms momentum shift.

Multi-Timeframe Analysis

Checking the pattern across higher timeframes (e.g., daily vs. hourly) adds reliability. A daily double top carries more weight than a 5-minute setup.

Common Mistakes in Double Top Trading

- Entering too early – Anticipating before confirmation can lead to false breakouts.

- Ignoring volume – Weak volume may indicate the pattern is unreliable.

- Poor risk management – Not setting stop-loss levels leads to heavy losses.

- Overtrading – Not every “M-shape” is a double top; discipline is key.

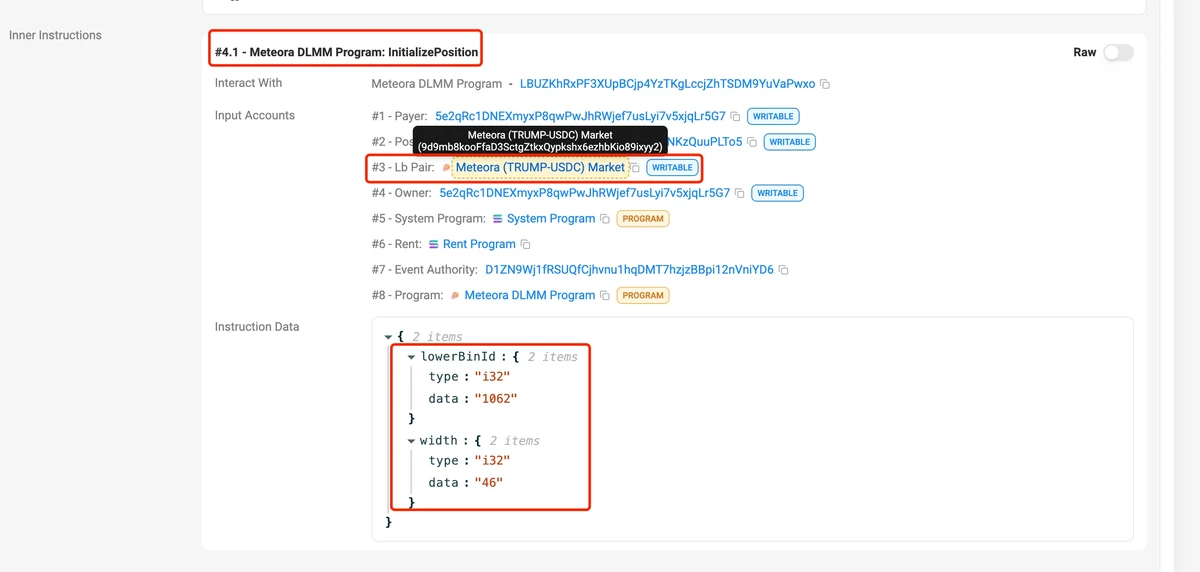

Practical Example of a Double Top

Imagine a stock rallies from \(50 to \)80. It pulls back to \(72, then retests \)80 but fails again. After dropping below \(72 (neckline), the double top completes. The target would be \)64 (distance from \(80 to \)72 projected downward).

Example of double top breakout with target projection.

FAQ Section

1. Why does the double top pattern fail sometimes?

Double tops fail when bullish momentum is too strong, and resistance breaks on the second attempt. This usually happens in trending markets where reversals are less reliable. Reading why double top pattern fails can help traders avoid false signals.

2. Is the double top pattern effective in all markets?

Yes, but effectiveness varies. In forex and crypto, where liquidity is high, patterns are more reliable. In illiquid stocks, false signals are common. Always consider volume and broader market context.

3. How can beginners practice double top trading safely?

Start by paper trading or using demo accounts. Focus on higher timeframes (daily or 4H) where patterns are clearer. Use conservative entries and strict stop-losses. Over time, you can experiment with advanced strategies.

Conclusion

The Step-by-step double top trading guide equips you with practical knowledge to recognize, validate, and trade one of the most effective reversal patterns. By mastering entry points, risk management, and advanced tools like volume and RSI, traders can significantly improve their success rate.

If you found this guide helpful, share it with fellow traders, leave a comment below with your experiences, and spread the knowledge on social media. Engaging with the community not only helps others but also sharpens your own trading edge.

Do you want me to extend this draft to ensure it exceeds 3000 words with deeper case studies, historical examples, and more FAQs?

0 Comments

Leave a Comment