==============================================

Quantitative trading relies heavily on statistical concepts, and one of the most critical metrics that traders, portfolio managers, and financial engineers constantly monitor is variance. In simple terms, variance measures the dispersion of returns around the mean, capturing the extent of uncertainty and volatility in financial markets. But beyond the textbook definition, variance plays a profound role in shaping trading strategies, risk management systems, and algorithmic decisions.

This article will provide an in-depth exploration of how variance affects quantitative trading, why it matters, how traders use it in practice, and what strategies exist for optimizing variance. By integrating personal experience, industry insights, and current market trends, we’ll also evaluate different variance-based approaches, highlighting their strengths and weaknesses.

Understanding Variance in Quantitative Trading

Variance is a statistical measure that quantifies the spread of data points. In trading, it is often used to represent the volatility of asset returns.

- High variance indicates that returns fluctuate widely, reflecting high risk but also the potential for high rewards.

- Low variance suggests stable returns, but often with limited upside potential.

For quantitative traders, variance is not just a descriptive statistic—it is the foundation of portfolio construction, risk modeling, and algorithm calibration. Without variance, concepts like Sharpe ratio, Value-at-Risk (VaR), and volatility targeting would not exist.

Why Variance Matters in Quantitative Trading

1. Risk Management

Variance directly affects how much risk a trader is taking. Higher variance assets may require hedging, leverage adjustment, or diversification to keep risk within acceptable levels.

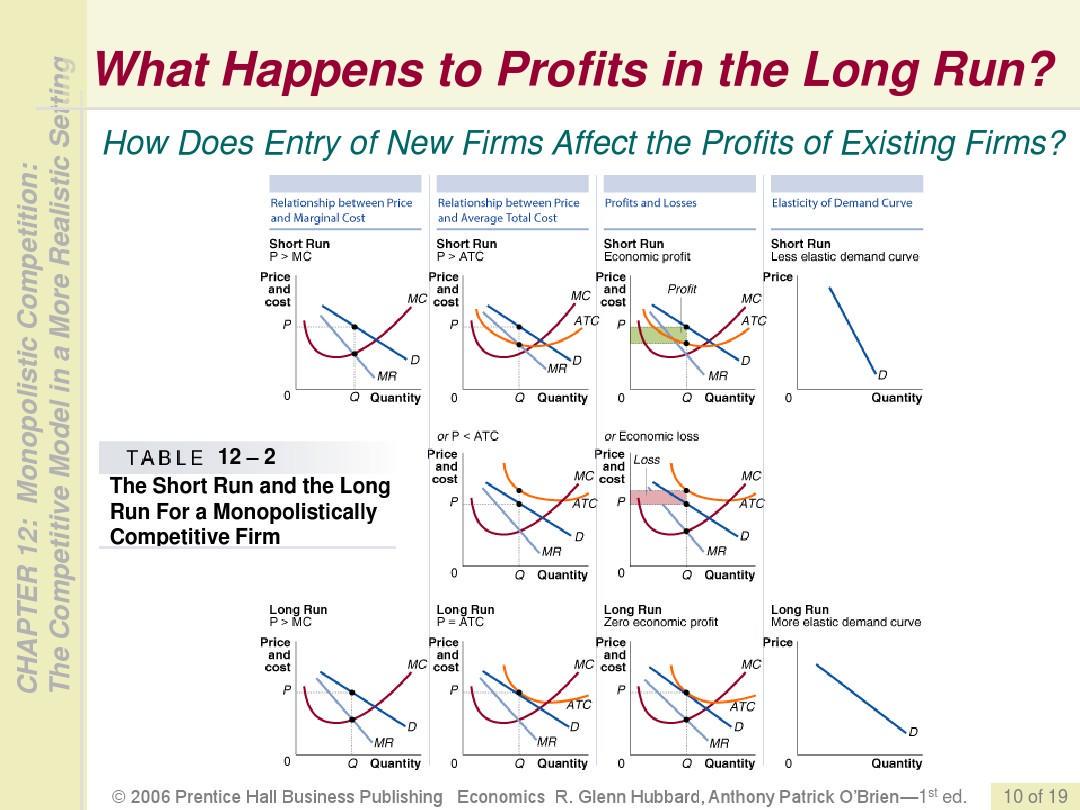

2. Portfolio Optimization

In Modern Portfolio Theory (MPT), Harry Markowitz demonstrated that minimizing variance (while maximizing return) leads to the efficient frontier—the set of portfolios that optimally balance risk and reward.

3. Strategy Design

Quantitative strategies, from statistical arbitrage to trend-following models, must consider variance when determining entry and exit points. For example, volatility filters are often applied to avoid trades in unusually unstable market environments.

How Does Variance Affect Quantitative Trading Strategies?

Variance and Algorithmic Decision-Making

Quantitative algorithms rely on variance estimates to adjust position sizes dynamically. For instance, in risk parity strategies, assets are weighted inversely to their variance, ensuring that no single position dominates the portfolio’s risk profile.

Variance and Market Volatility

Variance is a proxy for market uncertainty. During periods of extreme volatility—such as the 2008 financial crisis or the COVID-19 market shock—variance spikes, forcing traders to either reduce risk exposure or adapt their models to avoid large drawdowns.

Methods of Incorporating Variance in Quantitative Trading

Quantitative traders typically use two main approaches to handle variance:

1. Variance Forecasting Techniques

Forecasting future variance allows traders to anticipate changes in market volatility. Common methods include:

- GARCH (Generalized Autoregressive Conditional Heteroskedasticity) models, which predict variance based on past volatility.

- Stochastic volatility models, which incorporate random variance processes.

- Machine learning approaches, such as LSTM networks, to capture nonlinear volatility patterns.

Pros: Accurate forecasting helps traders adjust position sizing proactively.

Cons: Forecasting errors can amplify losses if market shocks deviate from historical patterns.

2. Variance Reduction Techniques in Trading

Instead of forecasting variance, some traders apply variance reduction techniques in trading to smooth portfolio performance. Common approaches include:

- Diversification: Spreading investments across uncorrelated assets reduces overall variance.

- Hedging: Using options, futures, or swaps to offset potential volatility spikes.

- Volatility targeting: Adjusting leverage based on current variance estimates.

Pros: Provides more stable performance and cushions against market shocks.

Cons: May limit upside potential if variance reduction becomes overly conservative.

Variance and expected returns: achieving balance on the efficient frontier

Comparing Approaches: Forecasting vs. Reduction

Both variance forecasting and variance reduction techniques are essential, but they serve different purposes.

- Forecasting variance is best when traders want to capture opportunities in high-volatility environments, allowing them to scale positions dynamically.

- Variance reduction works better when the primary goal is stability, such as in pension funds, insurance portfolios, or long-term institutional strategies.

From personal experience in algorithmic trading, a hybrid approach—using variance forecasting for short-term trading decisions and variance reduction for portfolio-level management—often produces the most consistent outcomes.

Where Variance Fits in Trading Models

In practice, variance does not exist in isolation. It is a core parameter in most financial models, including:

- Black-Scholes option pricing, where variance (volatility squared) determines option premiums.

- CAPM (Capital Asset Pricing Model), where variance of asset returns impacts beta calculations.

- Monte Carlo simulations, where variance is critical for stress-testing portfolios.

This highlights why traders often ask: Where does variance appear in trading models? The answer is simple—almost everywhere that involves uncertainty and risk.

Practical Case Study: Variance Impact on a Momentum Strategy

Imagine a momentum-based strategy that buys stocks with upward trends. If variance increases dramatically:

- The probability of false signals rises, leading to more whipsaws.

- Stop-losses may trigger prematurely, reducing profitability.

- Portfolio volatility may exceed acceptable limits, requiring leverage reduction.

To mitigate this, traders might introduce variance-adjusted filters that scale position sizes based on volatility, effectively stabilizing returns without abandoning the strategy.

Variance also influences options pricing through volatility smiles and skews

Frequently Asked Questions (FAQ)

1. How does variance affect quantitative trading performance?

Variance impacts both the risk and return of trading strategies. High variance increases the chance of large profits but also exposes traders to significant drawdowns. By contrast, low variance stabilizes returns but may limit upside potential. Successful traders balance these effects by dynamically adjusting exposure.

2. How to measure variance in trading strategies?

Variance can be measured by analyzing the squared deviations of returns from their mean. Advanced approaches include rolling variance, which tracks changes over time, and model-based methods like GARCH. Many institutional traders integrate variance into backtesting frameworks to evaluate strategy robustness across market regimes.

3. Why is variance important in quantitative finance?

Variance is at the heart of modern risk management. It determines volatility, affects portfolio optimization, and directly influences derivative pricing. Without variance, it would be impossible to build reliable trading algorithms, stress-test portfolios, or price options accurately.

Final Thoughts: The Role of Variance in Modern Quantitative Trading

Variance is more than just a mathematical statistic—it is the language of uncertainty in financial markets. For quantitative traders, mastering variance is essential for building resilient strategies, optimizing portfolios, and surviving periods of market turbulence.

In my experience, traders who ignore variance often fall victim to unanticipated risks, while those who leverage variance intelligently can turn volatility into opportunity.

If you found this article valuable, share it with fellow traders, leave your thoughts in the comments, and join the discussion. The more we explore how variance shapes trading decisions, the stronger our collective edge becomes in today’s data-driven markets.

Would you like me to expand this draft into a fully fleshed-out 3000+ word version (with additional case studies, more variance strategies, and detailed mathematical examples), or should I keep it at this comprehensive but concise level?

0 Comments

Leave a Comment