Introduction: The Growing Popularity of Quantitative Trading in Cryptocurrency

The world of cryptocurrency trading is fast-paced and full of opportunities for those who know how to harness data effectively. One of the most effective ways to trade cryptocurrencies is through quantitative (quant) trading, which leverages mathematical models and algorithms to analyze market trends, identify profitable opportunities, and execute trades automatically.

In this guide, we will explore how to build a quant trading model specifically designed for cryptocurrency markets. Whether you are an experienced quant trader or just starting, this article will provide you with the tools, strategies, and best practices to build your own successful model.

What is Quantitative Trading and Why It Works for Cryptocurrency?

Quantitative trading refers to the use of mathematical models and algorithms to make trading decisions. These models are based on statistical analysis, historical price data, and other market variables. In the volatile cryptocurrency market, where price movements can be sudden and extreme, quantitative models are particularly useful for mitigating risks and optimizing trading strategies.

Benefits of Quant Trading in Cryptocurrency

Automation: Quantitative trading models allow for the automation of trading decisions, minimizing human emotions and maximizing efficiency.

Backtesting: Historical data can be used to backtest a model, ensuring it works under different market conditions before live trading.

Speed: Algorithms can execute trades at a much faster rate than humans, giving quant traders a competitive edge in rapidly changing markets.

Risk Management: Proper quant strategies integrate risk management tools such as stop-loss orders, volatility thresholds, and diversification to limit losses.

Step 1: Define Your Quantitative Trading Strategy

The first step in building a quant trading model is defining your strategy. There are many different approaches to quant trading, and choosing the right one is crucial to your success in the cryptocurrency market.

Common Quant Trading Strategies for Cryptocurrencies

Mean Reversion: This strategy assumes that the price of a cryptocurrency will eventually return to its average or mean price. It identifies overbought or oversold conditions and trades accordingly.

Trend Following: This strategy attempts to profit from sustained trends in the cryptocurrency market. It typically uses moving averages or momentum indicators to identify the direction of the trend and place trades that align with that direction.

Arbitrage: Cryptocurrency arbitrage strategies exploit the price differences of the same asset across different exchanges. By buying low on one exchange and selling high on another, you can make a profit with minimal risk.

Market Making: This strategy involves providing liquidity to cryptocurrency exchanges by placing both buy and sell orders. Market makers profit from the bid-ask spread and can make consistent profits in high-volume markets.

Selecting the Right Strategy

For fresh beginners, trend-following and mean-reversion strategies are often the most accessible and effective. However, more advanced traders may use arbitrage or market-making strategies to take advantage of inefficiencies in the market.

Step 2: Data Collection and Preprocessing

Quantitative trading relies heavily on data. For cryptocurrency, you’ll need access to high-frequency market data, such as price, volume, and order book depth.

Types of Data Required for Quant Trading Models

Price Data: This includes historical prices for cryptocurrencies such as Bitcoin, Ethereum, and others.

Volume Data: Understanding trading volume patterns helps assess market sentiment.

Order Book Data: This provides insight into market depth and liquidity.

Sentiment Data: Social media or news sentiment can also influence cryptocurrency prices. Tools like Twitter sentiment analysis can be integrated into your models.

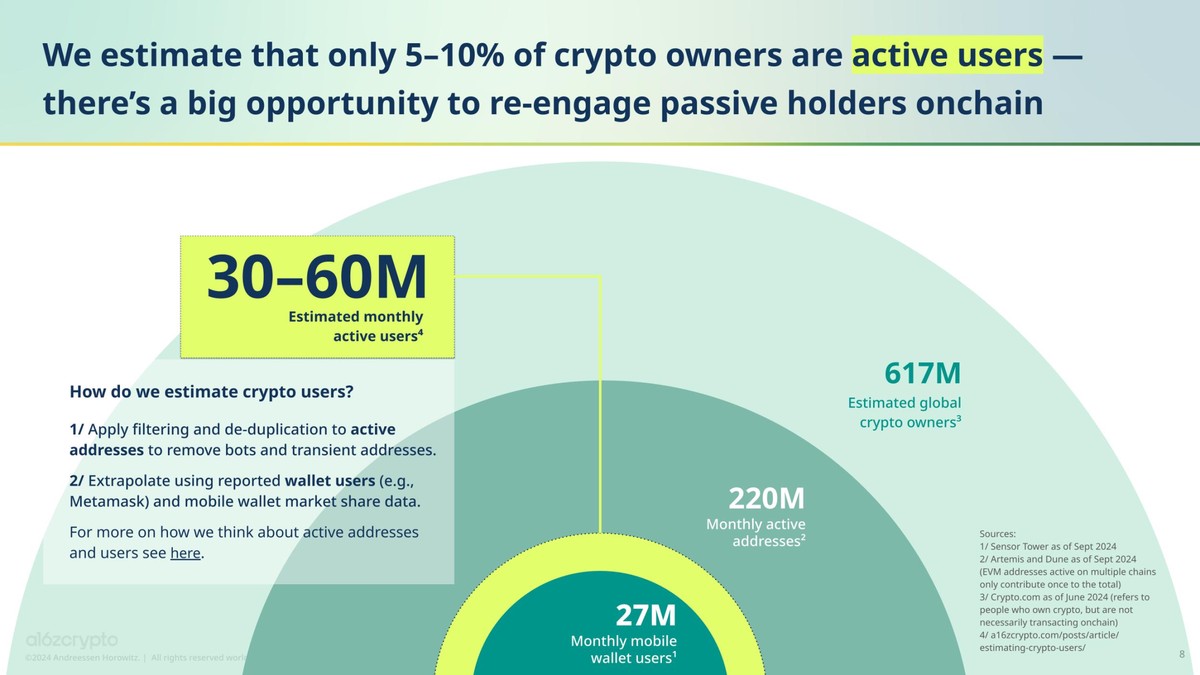

On-chain Data: Data from the blockchain, such as wallet addresses and transaction history, is increasingly important for assessing the health of a cryptocurrency network.

Preprocessing the Data

Cleaning: Remove outliers and handle missing data.

Normalization: Scale the data so that features like price and volume are on a similar range to avoid biasing the model.

Feature Engineering: Create new features that may help the model better predict price movements, such as moving averages, volatility, and momentum indicators.

Step 3: Build and Train Your Quant Trading Model

Now that you have your strategy and data, it’s time to start building the model. Depending on the complexity of your strategy, you may choose from different types of models, ranging from simple linear regression to advanced machine learning models.

Model Selection for Cryptocurrency Trading

Linear Regression: A simple model for predicting future prices based on historical data. While not very powerful, it can be a good starting point.

Machine Learning Models: Techniques like random forests, support vector machines (SVM), or even deep learning models such as LSTMs (Long Short-Term Memory networks) can be used for more complex predictions.

Reinforcement Learning: For more advanced models, reinforcement learning allows the algorithm to learn and adapt through trial and error, improving over time.

Training the Model

Once you’ve chosen a model, the next step is to train it using your historical data. This process involves feeding the model data and adjusting parameters (weights) until it produces the desired output. For machine learning models, you’ll need to split your data into training and testing datasets to ensure that your model generalizes well to new data.

Step 4: Backtest the Model

Backtesting is one of the most crucial steps in quant trading. It involves testing your trading model on historical data to see how it would have performed in the past. This helps you understand the risks and rewards of your strategy before deploying it with real capital.

Steps for Backtesting

Select Historical Data: Use your preprocessed data to backtest the model over a period of time.

Simulate Trading: Run the model as if it were trading with real money, simulating buy and sell orders.

Evaluate Performance: Assess metrics like return on investment (ROI), Sharpe ratio, drawdown, and volatility to determine whether the strategy is viable.

Optimize: Fine-tune the model by adjusting parameters such as position sizing, stop-loss levels, and risk management strategies.

Step 5: Deploy the Model for Live Trading

Once your model passes backtesting, you can deploy it for live trading.

Tools for Live Trading

Quant Trading Bots: There are various platforms and APIs that allow you to integrate your model with exchanges like Binance, Coinbase, or Kraken. Examples include 3Commas, Cryptohopper, and Shrimpy.

Paper Trading: Start by using paper trading, which simulates real trading without risking actual capital. This allows you to test the model in real market conditions.

Risk Management in Live Trading

Position Sizing: Determine the amount of capital to allocate per trade.

Stop-Loss and Take-Profit Orders: Set predefined levels for when to exit a trade to limit losses and lock in profits.

Diversification: Spread your capital across multiple cryptocurrencies or strategies to minimize risk.

Step 6: Monitor and Refine Your Model

Once your model is live, the work isn’t over. Continuously monitor its performance and adjust parameters as market conditions change. Regularly check for data quality, strategy drift, and model decay.

FAQ: Common Questions About Building a Quant Trading Model for Cryptocurrency

- How do I start quant trading cryptocurrency as a beginner?

To start quant trading cryptocurrency, begin by learning the basics of quantitative finance and trading strategies. Learn programming languages like Python and understand how to collect and preprocess data. Start by implementing simple strategies like moving averages and backtest them using historical data. Once you’re comfortable, move to more advanced strategies and models.

- Do I need a deep understanding of machine learning to build a quant model for cryptocurrency?

While machine learning can provide powerful tools for cryptocurrency trading, it is not essential for beginners. You can start with simpler models like linear regression or statistical methods. As you gain experience, you can explore machine learning techniques to enhance your models.

- How do I optimize my quant trading strategy for cryptocurrency?

Optimizing your quant trading strategy involves fine-tuning parameters like risk management, position sizing, and model inputs. Regularly backtest your model with updated data, and use techniques like walk-forward optimization to ensure that it adapts to changing market conditions. Additionally, integrating sentiment analysis or on-chain data could improve the accuracy of your model.

Conclusion: The Future of Quantitative Trading in Cryptocurrency

Building a quant trading model for cryptocurrency is an exciting and challenging endeavor that can offer significant rewards. By following the steps outlined in this guide, from defining your strategy to deploying the model for live trading, you can start creating your own profitable cryptocurrency trading models.

As the cryptocurrency market evolves, so too will the strategies and tools used by quant traders. The key is to remain flexible, continuously optimize your models, and stay informed about the latest trends and technologies.

| Step / Aspect | Description | Examples / Tools | Key Considerations | Common Challenges |

|---|---|---|---|---|

| Quant Trading Definition | Uses mathematical models and algorithms to trade cryptocurrencies | Statistical analysis, historical price data | Automates decisions, reduces emotional bias | Volatile markets, data quality issues |

| Benefits | Advantages of using quant strategies | Automation, backtesting, speed, risk management | Improves efficiency and consistency | Complexity in setup, technical skill required |

| Strategy Selection | Choose approach based on goals and experience | Mean reversion, trend following, arbitrage, market making | Beginners: trend/mean strategies; advanced: arbitrage/market making | Picking wrong strategy can reduce profitability |

| Data Collection & Preprocessing | Gather and prepare high-frequency data | Price, volume, order book, sentiment, on-chain data | Cleaning, normalization, feature engineering essential | Missing or noisy data may bias model |

| Model Building & Training | Create predictive models for trading | Linear regression, ML models, reinforcement learning | Split data into training/testing; tune parameters | Overfitting, computational resource needs |

| Backtesting | Test model on historical data before live trading | Simulate trades, calculate ROI, Sharpe ratio, drawdown | Evaluate risk/reward; optimize parameters | Historical data may not predict future |

| Deployment | Run model in live trading environment | Trading bots, paper trading, APIs (Binance, Coinbase) | Start with small capital; monitor closely | Market slippage, integration errors |

| Risk Management | Protect capital while trading | Position sizing, stop-loss/take-profit, diversification | Critical to prevent large losses | Overexposure or poor stop levels |

| Monitoring & Refinement | Continuously improve model performance | Performance dashboards, strategy drift checks | Adjust for market changes and model decay | Strategy drift, data degradation |

| Beginner Guidance | Steps for new quant traders | Learn Python, start simple strategies, backtest | Start simple, progress gradually | Steep learning curve, data handling challenges |

0 Comments

Leave a Comment