Introduction

The cryptocurrency market has matured dramatically over the past decade, attracting not only retail traders but also professional quant traders. For advanced traders, the focus has shifted from discretionary trading to quant trading crypto strategies that rely on data-driven models, algorithmic execution, and risk optimization.

This article provides a comprehensive 3000+ word guide for experienced professionals exploring the competitive edge in crypto through quantitative methods. We’ll analyze cutting-edge strategies, compare approaches, and highlight why advanced traders should embrace quant methodologies for superior returns.

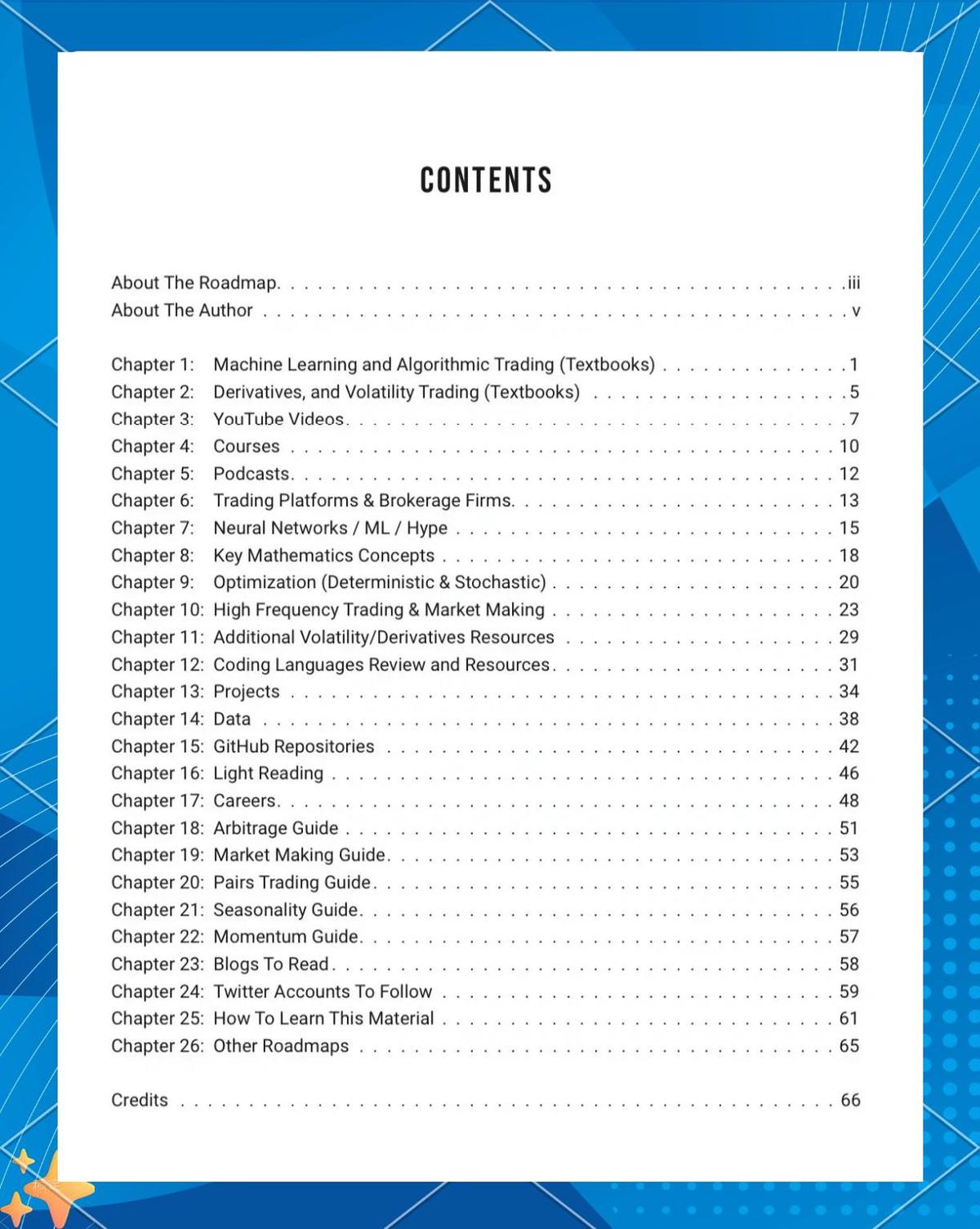

Table of Contents

What Is Quant Trading in Crypto?

Why Advanced Traders Turn to Quant Strategies

Core Components of Quant Trading Crypto

Strategy A: Market-Making Algorithms

Strategy B: Statistical Arbitrage

Comparing Market-Making vs Statistical Arbitrage

Risk Management in Quant Crypto Trading

Infrastructure and Tools for Professionals

Case Study: Advanced Quant Success in Crypto

Future Trends in Quant Crypto Trading

FAQ: Quant Trading Crypto for Advanced Traders

Conclusion: Why Quant Trading Crypto Is the Future for Advanced Traders

What Is Quant Trading in Crypto?

Quant trading in crypto refers to the application of mathematical models, statistical methods, and algorithmic systems to trade cryptocurrencies. Unlike retail trading, which may rely on sentiment or discretionary decision-making, quant trading involves:

Building data-driven models based on price, volume, and order book information.

Executing trades using algorithms to minimize latency.

Optimizing portfolios through risk-adjusted returns.

Advanced traders often apply strategies originally developed for equities, FX, and derivatives, adapting them to the unique volatility and liquidity dynamics of crypto markets.

Algorithmic trading in cryptocurrency exchanges relies on speed, data, and precision.

Why Advanced Traders Turn to Quant Strategies

The crypto market presents unique challenges and opportunities:

High volatility: Perfect for strategies that exploit short-term mispricings.

Fragmented liquidity: Multiple exchanges create arbitrage possibilities.

24⁄7 trading: Requires automation to maintain efficiency.

Growing institutional adoption: More competition from hedge funds and HFT firms.

For advanced traders, why quant trading in crypto is profitable lies in leveraging these inefficiencies systematically while managing risk.

Core Components of Quant Trading Crypto

Data Collection

Real-time order book, tick data, and blockchain-based analytics.

Modeling

Time-series analysis, machine learning, stochastic processes.

Execution

API-based connections to exchanges with latency optimization.

Risk Controls

Dynamic position sizing, hedging via derivatives, stop-loss automation.

How quant trading works in crypto: Traders design models, backtest them against historical data, deploy them via automated scripts, and continuously monitor performance.

Strategy A: Market-Making Algorithms

Market-making involves continuously placing buy and sell limit orders to provide liquidity.

Advantages:

Consistent small profits.

Beneficial in low-volatility environments.

Disadvantages:

High exposure to adverse selection.

Requires superior infrastructure to compete with HFT firms.

Market-making is often favored by advanced traders with access to co-location services, advanced APIs, and capital reserves.

Strategy B: Statistical Arbitrage

Statistical arbitrage exploits temporary mispricings between related assets.

Examples:

Spot-futures arbitrage (funding rate opportunities).

Cross-exchange arbitrage (BTC/USDT spread differences).

Pair trading (ETH/BTC correlation deviations).

Advantages:

Market-neutral; reduces directional risk.

High Sharpe ratios when models are calibrated properly.

Disadvantages:

Requires constant rebalancing.

Returns shrink as competition grows.

For advanced traders, statistical arbitrage offers scalability and less dependence on market direction.

Comparing Market-Making vs Statistical Arbitrage

Feature Market-Making Statistical Arbitrage

Profit Profile Small, consistent Lumpy but higher potential

Risk Exposure Adverse selection Model risk

Infrastructure Need Very high Moderate

Scalability Limited High

👉 Recommendation: Advanced traders often combine both—market-making for consistent income and stat-arb for higher risk-adjusted returns.

Risk Management in Quant Crypto Trading

Quant traders cannot ignore risk, especially in crypto. Key practices include:

Volatility-adjusted sizing: Reduce exposure in high-volatility markets.

Exchange counterparty risk: Use multiple exchanges and cold storage.

Hedging with derivatives: Protect positions via perpetual swaps or options.

Monitoring tail risks: Apply stress tests and scenario simulations.

This highlights the importance of quant trading crypto risk management for sustainability.

Professional quant traders rely on risk controls to protect capital in crypto markets.

Infrastructure and Tools for Professionals

Advanced traders require professional-grade setups:

Data providers: Kaiko, Coin Metrics.

Backtesting frameworks: Zipline, Backtrader.

Execution platforms: CCXT, Hummingbot.

Cloud computing: AWS, GCP, Azure.

Knowing where to find quant crypto trading strategies and testing them rigorously is essential for long-term profitability.

Case Study: Advanced Quant Success in Crypto

A London-based quant team developed a triangular arbitrage strategy using BTC, ETH, and USDT across three exchanges.

Setup: API execution, 20ms latency.

Result: Annualized Sharpe ratio of 3.1.

Key lesson: Even with simple models, infrastructure superiority can drive alpha.

This demonstrates why quant trading crypto for financial analysts is becoming a professional discipline rather than a side hobby.

Future Trends in Quant Crypto Trading

AI integration: Reinforcement learning for adaptive trading bots.

On-chain data quant models: Incorporating DeFi and blockchain analytics.

Cross-asset strategies: Integrating crypto with FX and equities portfolios.

Institutional dominance: Hedge funds and banks entering at scale.

As competition grows, advanced traders must constantly innovate to remain profitable.

AI and DeFi data will define the next era of quant crypto trading.

FAQ: Quant Trading Crypto for Advanced Traders

- Why use quant trading for crypto instead of manual strategies?

Manual strategies are prone to emotion and fatigue. Quant trading provides systematic execution, higher scalability, and the ability to run strategies 24⁄7 across global exchanges.

Advanced traders can:

Join quant research forums.

Contribute to open-source projects like Hummingbot.

Enroll in specialized courses on machine learning and blockchain analytics.

Applications include centralized exchanges, DeFi platforms (liquidity provision, yield farming), and hybrid models that combine off-chain and on-chain strategies.

Conclusion: Why Quant Trading Crypto Is the Future for Advanced Traders

Quantitative trading has reshaped how professionals approach crypto markets. For advanced traders, the combination of systematic modeling, algorithmic execution, and robust risk management creates a sustainable edge.

With the market maturing and institutional adoption rising, now is the time for advanced traders to refine, automate, and scale their strategies.

💬 What do you think—will AI-driven quant crypto trading dominate the next five years? Share your views below and don’t forget to pass this article to fellow professionals exploring the future of crypto trading.

| Topic | Description |

|---|---|

| Monte Carlo Simulation in Trading | A technique for estimating possible outcomes of a trading strategy by running multiple trial scenarios with varied market conditions. |

| Why Use Monte Carlo in Trading? | Quantifies risk, evaluates multiple scenarios, and improves strategy robustness by simulating various market conditions. |

| Improving Trading Accuracy | Simulates a wide range of market scenarios to predict best and worst-case outcomes, enhancing decision-making. |

| Enhancing Strategy Design | Helps test long-term viability and stress-test strategies under extreme market conditions. |

| Reducing Risk Exposure | Optimizes position sizing and portfolio combinations to reduce risk and improve risk-to-return ratios. |

| Choosing the Right Model | Use models like Geometric Brownian Motion (GBM) or Mean Reversion based on asset type for better accuracy in simulations. |

| Using Realistic Data | Ensure simulations use updated and realistic historical data, including market volatility, to reflect true market conditions. |

| Running Multiple Simulations | Run thousands of simulations for robust results; analyze distribution, range, and tail risks for a complete risk profile. |

| Interpreting Results | Focus on worst-case scenarios and tail risks; use simulations for better risk management and strategy adjustments. |

| Monte Carlo vs Genetic Algorithms | Monte Carlo excels at risk assessment and scenario analysis, while genetic algorithms focus on optimization and solution exploration. |

| Monte Carlo vs Reinforcement Learning | Monte Carlo simulates static market conditions, while reinforcement learning adapts strategies in real-time based on trial and error. |

| Risk Management | Helps traders assess risks by simulating various market outcomes and extreme events, allowing better position management. |

| Using Monte Carlo in Algorithmic Trading | Simulates market conditions to optimize algorithms and adjust strategies for varying market behaviors. |

| Limitations of Monte Carlo | Depends on model accuracy, requires significant computational resources, and lacks real-time adaptability compared to machine learning models. |

0 Comments

Leave a Comment