Cryptocurrency trading has evolved beyond the traditional buy-and-hold strategy into a more sophisticated approach known as quantitative trading. If you’re looking to delve into this space, this guide will walk you through everything you need to know about quant trading in the cryptocurrency market, providing actionable insights, methods, and strategies to help you succeed.

TL;DR

Quantitative trading in cryptocurrency involves using mathematical models and algorithms to make trading decisions.

The article covers key strategies, such as statistical arbitrage and market-making.

We explore two major ways to implement these strategies: through manual programming and quant trading bots.

We’ll also provide you with essential resources on where to learn and start your journey in quant trading.

If you’re looking to optimize your strategies, we’ll show you tools, platforms, and metrics for continuous improvement.

What Will You Learn?

By reading this article, you will gain:

A clear understanding of quantitative trading in cryptocurrency.

An introduction to different quant strategies that work in crypto markets.

A step-by-step guide to building and optimizing a quant trading model for cryptocurrency.

Insights into tools, bots, and platforms for effective quant trading.

Practical tips for integrating machine learning and backtesting in your strategy.

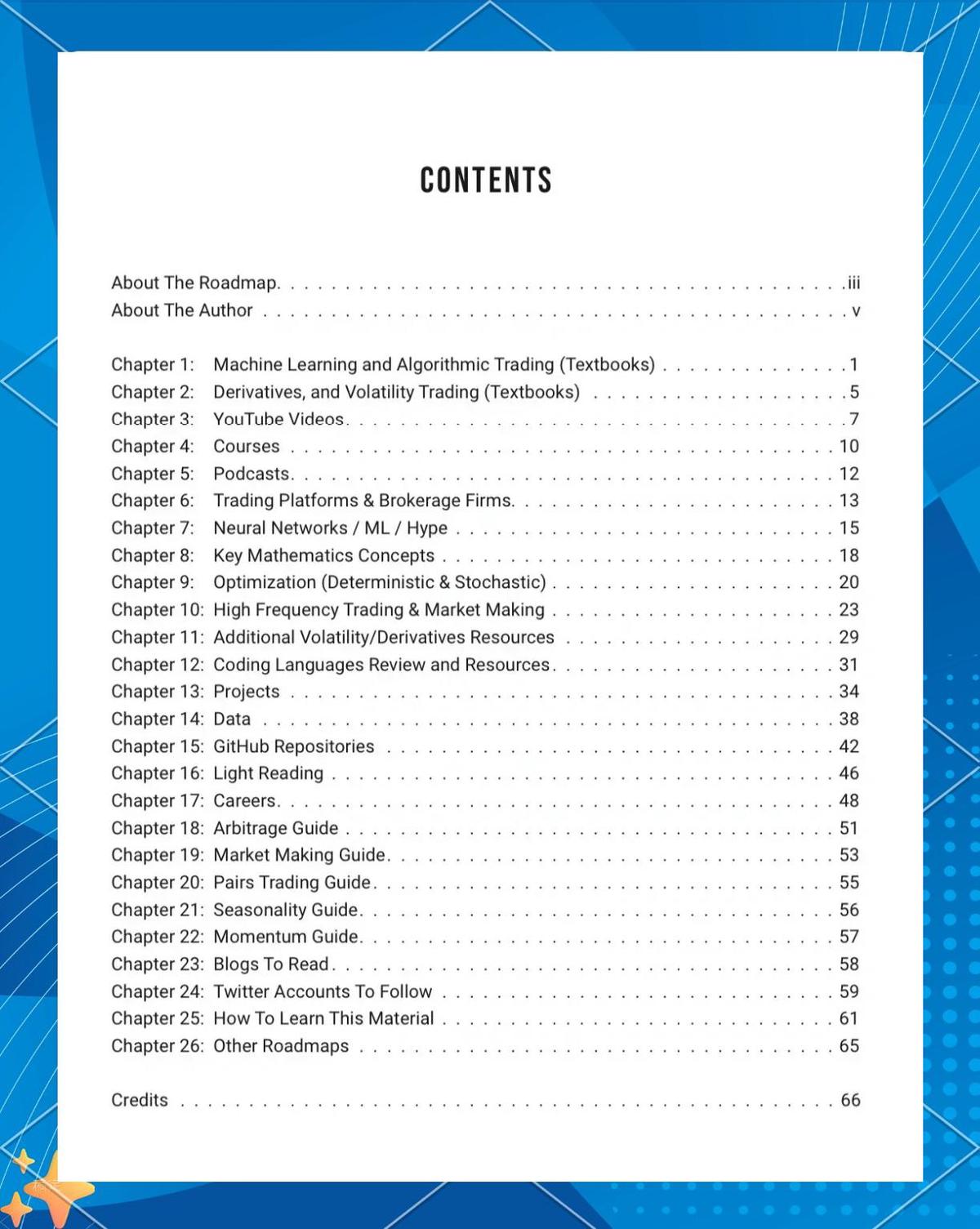

Table of Contents

What is Quantitative Trading in Cryptocurrency?

Popular Quant Strategies in Cryptocurrency Trading

Statistical Arbitrage

Market-Making

How Quant Trading Works with Cryptocurrency

How to Build a Quant Trading Model for Cryptocurrency

Tools and Platforms for Quant Trading Cryptocurrency

Optimizing Your Quant Trading Strategy for Cryptocurrency

Frequently Asked Questions (FAQs)

Conclusion

What is Quantitative Trading in Cryptocurrency?

Quantitative trading in cryptocurrency refers to the use of mathematical models, algorithms, and data analysis techniques to make trading decisions in the crypto market. Unlike traditional trading, where decisions may be influenced by human emotions or news, quant trading leverages statistical analysis, algorithms, and machine learning to identify trends and make data-driven decisions.

This method is highly suitable for the volatile and 24⁄7 nature of the cryptocurrency market, as it allows traders to automate decisions, reduce human error, and execute high-frequency trades that would be impossible manually.

Popular Quant Strategies in Cryptocurrency Trading

Statistical Arbitrage

Statistical arbitrage (stat arb) is one of the most popular quant strategies in both traditional and cryptocurrency markets. It involves taking advantage of price discrepancies between two or more assets that are expected to converge over time. In cryptocurrency, this strategy often focuses on:

Cointegration: Identifying pairs of cryptocurrencies that move together in the long term, and exploiting short-term price divergences.

Market-neutral approach: Stat arb strategies typically involve going long on one cryptocurrency while shorting another, ensuring limited exposure to market-wide movements.

Advantages:

Minimal exposure to market risks.

Ability to take advantage of price inefficiencies in crypto exchanges.

Disadvantages:

Requires sophisticated statistical knowledge and programming skills.

Can be expensive in terms of trading fees and computational power.

Market-Making

Market-making is another common strategy, particularly for liquidity providers. In this approach, traders provide liquidity by continuously placing buy and sell orders at different price levels. The goal is to profit from the bid-ask spread, the difference between the buying and selling price.

Market makers take advantage of high-frequency trading opportunities and market inefficiencies, earning profits from the spread while ensuring the market remains liquid.

Advantages:

Steady returns from the bid-ask spread.

Involves relatively low risk if done correctly.

Disadvantages:

Requires substantial capital to make meaningful profits.

Market-making in highly volatile crypto markets can be risky.

How Quant Trading Works with Cryptocurrency

Quantitative trading in cryptocurrency operates on the same principles as traditional quantitative finance. However, the unique characteristics of the crypto market—such as extreme volatility, a lack of liquidity on certain exchanges, and the 24⁄7 nature of trading—add specific challenges.

Key factors that affect quant trading in cryptocurrency include:

Volatility: Cryptocurrencies can experience sudden and large price movements. Quant models need to incorporate volatility adjustments to manage risk.

Liquidity: Some cryptocurrencies may have limited liquidity, which can affect the execution of trades and widen bid-ask spreads.

Exchange fees: High-frequency trading on crypto exchanges may incur significant fees that affect profitability.

How to Build a Quant Trading Model for Cryptocurrency

Building a successful quant trading model for cryptocurrency involves several key steps:

- Data Collection

Data is at the heart of any quant strategy. You’ll need historical price data, trading volumes, and other relevant market indicators. Popular sources for cryptocurrency data include:

CoinGecko: Offers detailed cryptocurrency price, volume, and market cap data.

Binance API: Provides access to historical price and trade data from the Binance exchange.

- Backtesting

Backtesting involves testing your trading strategy on historical data to see how it would have performed. This helps refine the strategy and assess its potential profitability.

Libraries: Python libraries like Backtrader or Zipline are commonly used for backtesting quant models.

Metrics: Key performance metrics to track include Sharpe ratio, maximum drawdown, and win rate.

- Algorithm Development

Develop the core algorithm that will execute trades based on your model’s signals. Common algorithms in cryptocurrency include:

Moving Average Crossover: Signals are generated when a short-term moving average crosses above or below a long-term moving average.

Machine Learning Algorithms: Models such as decision trees, support vector machines, or neural networks can be trained to predict price movements.

- Optimization

Once your algorithm is developed, the next step is to optimize it for better performance. This may involve:

Parameter tuning: Adjusting key model parameters like moving average window size or stop-loss levels.

Portfolio optimization: Balancing risk and return by adjusting asset allocation.

Tools and Platforms for Quant Trading Cryptocurrency

Several tools and platforms can assist in quant trading for cryptocurrency, offering everything from data analysis to algorithm execution.

Popular Tools:

QuantConnect: A cloud-based algorithmic trading platform that supports cryptocurrency trading and backtesting.

CryptoQuant: Provides on-chain analytics for cryptocurrencies, which can be integrated into your quant models.

3Commas: Offers a range of trading bots and automation features for crypto traders, including for quantitative strategies.

Platforms:

Binance: One of the largest cryptocurrency exchanges with robust API support for algorithmic trading.

KuCoin: Another major exchange with low fees and high liquidity, suitable for quant traders.

FTX: Known for its advanced trading features, including custom order types for quantitative trading.

Optimizing Your Quant Trading Strategy for Cryptocurrency

- Diversification

One of the most crucial aspects of risk management in quant trading is portfolio diversification. By spreading risk across different cryptocurrencies, traders can reduce exposure to the volatility of any single asset.

- Machine Learning Integration

Machine learning can improve your quant strategy by identifying patterns in price data that traditional methods might miss. Algorithms like reinforcement learning can be used to continuously improve your trading strategy based on performance.

- Real-Time Data and Monitoring

To be effective in cryptocurrency quant trading, your model needs access to real-time market data and monitoring tools. This allows for dynamic adjustments in response to changing market conditions.

Frequently Asked Questions (FAQs)

- What is the best strategy for quant trading cryptocurrency?

There is no one-size-fits-all answer, as it depends on your risk tolerance and goals. Statistical arbitrage and market-making are popular strategies, with the choice between them often based on whether you prefer more stable, low-risk returns or the opportunity for higher-frequency trading.

- How can I learn quantitative trading for cryptocurrency?

You can start by studying online courses on platforms like Coursera, Udemy, and QuantInsti. Additionally, reading books on quantitative finance and cryptocurrency trading can provide foundational knowledge.

- What tools should I use for crypto quant trading?

For data analysis, platforms like CoinGecko, CryptoCompare, and CryptoQuant provide useful resources. For building and testing strategies, QuantConnect, Backtrader, and Binance API are essential tools.

Conclusion

Quantitative trading offers a structured, data-driven approach to trading cryptocurrencies, helping traders optimize their strategies and manage risk. Whether you are a beginner or a seasoned professional, the techniques and tools outlined in this guide will give you a solid foundation to start or improve your quant trading career in cryptocurrency.

For further insights, share your experiences or ask questions in the comments below, and don’t forget to share this guide with

0 Comments

Leave a Comment