The world of cryptocurrency is constantly evolving, and so are the methods used to trade digital assets. Quantitative trading has emerged as one of the most powerful techniques for maximizing profits in the volatile crypto markets. With platforms like Reddit offering thriving communities dedicated to trading strategies, it’s easier than ever to learn about and implement quantitative trading in the crypto space. In this comprehensive guide, we’ll explore how to get started with quantitative trading in crypto, using Reddit as a key resource.

What is Quantitative Trading in Crypto?

Quantitative trading is a data-driven approach to trading that involves using mathematical models, algorithms, and statistical methods to make buy and sell decisions. Instead of relying on gut feeling or subjective analysis, quantitative traders leverage market data to generate trading signals and execute trades automatically.

In the world of crypto, where price volatility is a daily reality, quantitative strategies can provide a systematic and repeatable approach to profiting from market movements.

Why Use Quantitative Trading for Crypto?

The unique features of the cryptocurrency market—its high volatility, 24⁄7 operations, and low market efficiency—make it an ideal environment for quantitative trading strategies. Here’s why:

Market Efficiency: Cryptocurrencies often have inefficiencies in pricing between exchanges or within the market itself. Quantitative strategies can help identify these inefficiencies.

High Volatility: The crypto market’s volatility can be exploited through strategies that identify price trends or reversals.

Data Availability: With vast amounts of data available from multiple exchanges, quantitative traders can use this to find patterns and make informed decisions.

Automation: Crypto markets never sleep, and automation allows for round-the-clock trading, maximizing opportunities and minimizing missed profits.

Getting Started with Quantitative Crypto Trading on Reddit

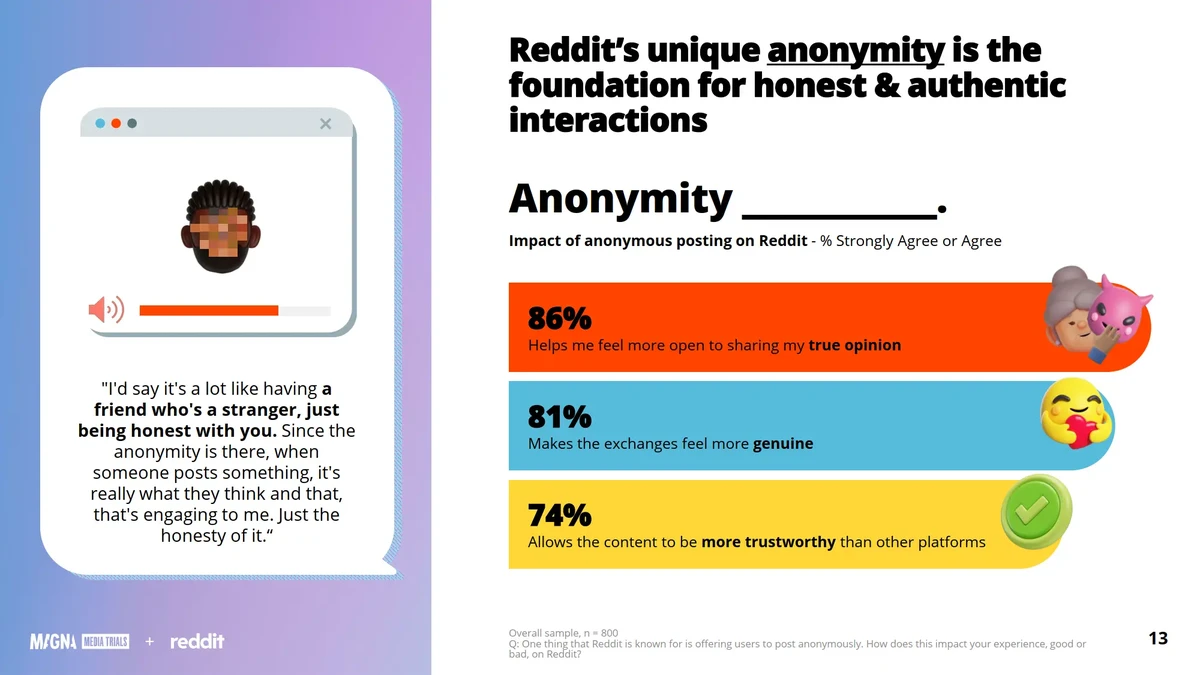

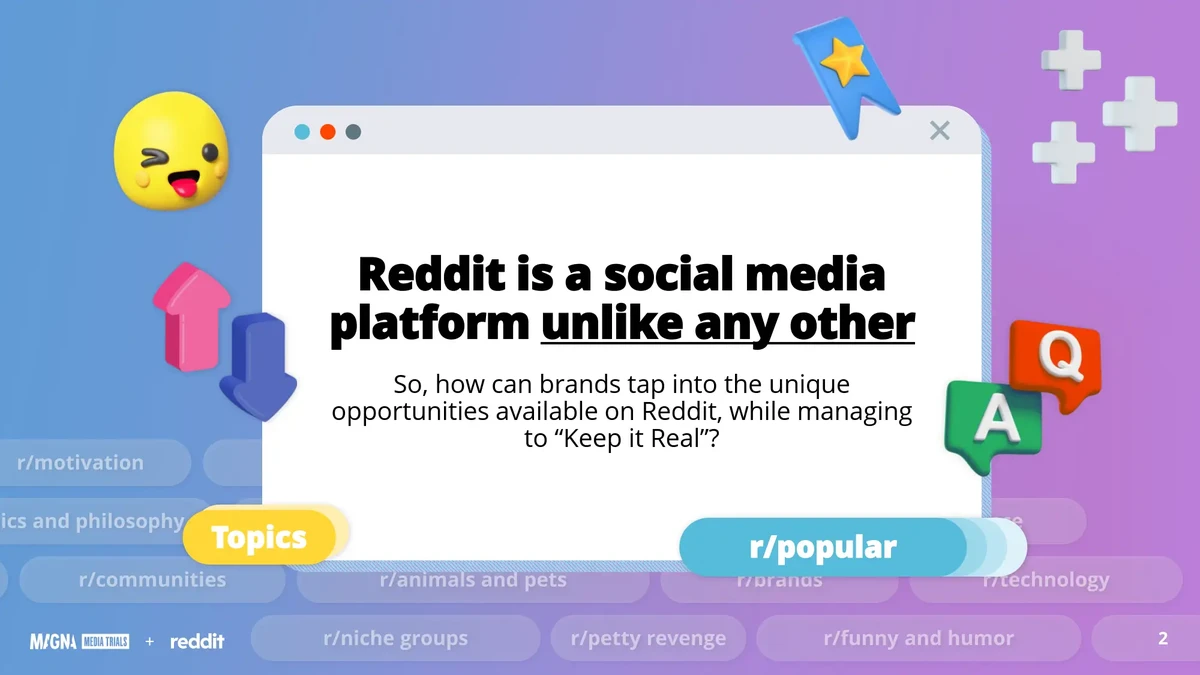

Reddit is a valuable resource for learning about quantitative trading in crypto. Numerous communities, such as r/CryptoQuant, r/algorithmictrading, and r/cryptotrading, are rich with resources, discussions, and tips from experienced traders and developers. Here’s how you can use Reddit to get started.

- Join Relevant Subreddits

The first step in starting quantitative trading in crypto is to join the right communities. Some of the most popular and helpful subreddits for quantitative trading include:

r/CryptoQuant: A subreddit dedicated to quantitative analysis and trading in the crypto space. This is the place to get tips on strategy development, risk management, and useful tools.

r/algorithmictrading: Although not focused exclusively on crypto, this subreddit offers insights into algorithmic trading techniques, which can be applied to crypto.

r/cryptotrading: While broader in scope, this community discusses various trading strategies, including quantitative approaches.

By participating in these subreddits, you can learn from others’ experiences, ask questions, and even find collaborators or mentors.

- Learn the Basics of Quantitative Trading

Before diving into crypto, it’s important to understand the basics of quantitative trading. On Reddit, you’ll find numerous threads and resources that can help you learn how to apply quantitative strategies to crypto markets. Some key concepts you should familiarize yourself with include:

Time Series Analysis: This method helps you understand how past price movements can be used to predict future price trends.

Statistical Arbitrage: A strategy that exploits price differences between related assets or markets.

Risk Management: Quantitative trading relies heavily on managing risk through position sizing, stop losses, and portfolio diversification.

- Pick the Right Quantitative Trading Strategy

Once you understand the basics, you need to decide which quantitative strategy to use. On Reddit, experienced traders frequently share their strategies and performance results, making it easier to learn about different approaches.

3.1 Trend Following Strategy

One of the most commonly used quantitative strategies is trend following, which involves identifying market trends and trading in the direction of that trend.

How it works: Traders use moving averages and momentum indicators to identify bullish or bearish trends. When a trend is identified, the algorithm buys or sells based on pre-set criteria.

Pros: Works well in markets with clear trends.

Cons: Not effective in choppy or sideways markets, which are common in crypto.

3.2 Arbitrage Trading

Arbitrage is another powerful strategy, especially in crypto markets where prices can vary between exchanges.

How it works: An arbitrage algorithm buys an asset on one exchange where the price is low and sells it on another where the price is higher, capitalizing on the price discrepancy.

Pros: Lower risk since the positions are typically taken at the same time.

Cons: Requires high-frequency trading systems and low transaction fees to be effective.

3.3 Mean Reversion

The mean reversion strategy is based on the assumption that prices will revert to a long-term average after moving too far from it.

How it works: If a cryptocurrency price moves significantly away from its historical average, the algorithm buys when it’s underpriced or sells when it’s overpriced, expecting it to return to the mean.

Pros: Works well in stable markets where prices fluctuate around a central tendency.

Cons: Risk of further price deviations before the price reverts to the mean.

- Learn About Tools and Platforms

Once you’ve decided on a strategy, the next step is to choose the right tools and platforms. Reddit can be a great place to discover useful platforms for quantitative crypto trading.

Some popular platforms include:

Binance API: Binance provides an API that allows you to access real-time price data, execute trades, and more.

3Commas: An automation tool for crypto traders, 3Commas lets you set up trading bots with pre-configured strategies.

CCXT: A Python library that enables you to interact with a variety of cryptocurrency exchanges for data collection and trading.

- Backtest Your Strategies

Before trading with real capital, it’s crucial to backtest your strategies. Reddit offers multiple threads discussing the best backtesting methods and platforms for crypto, including TradingView and QuantConnect.

- Execute and Monitor

Once your strategy is ready and backtested, you can deploy it in the live market. Make sure to start with small amounts to limit risk, especially if you’re just beginning. Monitor your performance regularly and tweak your algorithm as needed based on real-time market conditions.

Frequently Asked Questions (FAQ)

- How can I learn quantitative trading in crypto if I don’t have a programming background?

You don’t need to be a programming expert to get started with quantitative trading in crypto. You can use platforms like 3Commas or Cryptohopper to automate your trades without any coding. Additionally, many Reddit communities offer step-by-step guides and resources for beginners, even those without technical backgrounds.

- How do I find reliable quantitative trading signals for crypto?

On Reddit, communities like r/CryptoQuant regularly share crypto trading signals based on quantitative models. However, it’s important to remember that signals should be taken with caution, as crypto markets can be highly unpredictable. It’s best to backtest any signals you plan to use and combine them with your own analysis.

- What are the best tools for quantitative crypto trading?

Some of the best tools for quantitative trading in crypto include:

CCXT: A Python library for connecting to multiple crypto exchanges.

3Commas: A platform for creating automated trading bots.

TradingView: For charting and backtesting strategies.

You’ll find detailed discussions and recommendations for these tools on Reddit, where experienced traders often share their insights.

Conclusion

Quantitative trading in crypto is an exciting field that offers a data-driven approach to navigating the volatile market. By leveraging Reddit’s wealth of resources, joining communities, and developing your own strategies, you can get started on the right foot. Whether you choose trend following, arbitrage, or mean reversion, it’s important to continuously learn and optimize your strategies to succeed in the ever-changing world of cryptocurrency trading.

| Topic | Details |

|---|---|

| What is Quantitative Trading? | A data-driven approach using algorithms and statistical methods to make buy/sell decisions in crypto. |

| Why Use Quantitative Trading? | Exploits market inefficiencies, volatility, automation, and data availability in the crypto market. |

| Getting Started on Reddit | Join communities like r/CryptoQuant, r/algorithmictrading, and r/cryptotrading for learning resources. |

| Learning Quantitative Basics | Learn time series analysis, statistical arbitrage, and risk management via Reddit threads and resources. |

| Popular Quantitative Strategies | Trend following, arbitrage trading, and mean reversion are common strategies in crypto trading. |

| Trend Following Strategy | Uses moving averages to identify and trade in the direction of trends. Effective in trending markets. |

| Arbitrage Trading Strategy | Capitalizes on price differences between exchanges. Requires high-frequency systems and low fees. |

| Mean Reversion Strategy | Assumes prices will revert to a mean; buys/sells when the price deviates significantly. |

| Tools & Platforms for Quant Trading | Binance API, 3Commas, CCXT, TradingView, and QuantConnect are popular tools for quantitative crypto trading. |

| Backtesting Strategies | Use platforms like TradingView or QuantConnect to test strategies before live trading. |

| Execute and Monitor | Deploy strategies with small amounts first, monitor performance, and adjust based on market conditions. |

| FAQ: No Programming Background | Platforms like 3Commas and Cryptohopper automate trades without coding. Reddit offers step-by-step guides. |

| FAQ: Reliable Quant Signals | r/CryptoQuant shares signals, but backtest them and combine with your own analysis for best results. |

| FAQ: Best Tools for Quant Trading | Best tools include CCXT, 3Commas, and TradingView for connecting to exchanges, automation, and backtesting. |

0 Comments

Leave a Comment