Quantitative trading, or “quant trading,” has gained significant attention in recent years, especially in the world of cryptocurrency. While traditional financial markets have long embraced algorithmic and data-driven trading strategies, the volatile and decentralized nature of the cryptocurrency market presents unique opportunities. So, why is quant trading in crypto particularly profitable? In this article, we’ll explore the core strategies that make quant trading successful in crypto, compare two different approaches, and help you understand why quant trading might be the right path for your crypto investment.

TL;DR

Quant trading in crypto leverages data, algorithms, and statistical models to make profitable trades by taking advantage of market inefficiencies.

The volatile nature of crypto markets amplifies the potential for profits, but it also increases risks, making a well-calculated quant strategy necessary.

Two common approaches—statistical arbitrage and market-making—both offer distinct advantages and trade-offs.

A successful crypto quant trader uses machine learning, high-frequency trading algorithms, and advanced data analytics to refine strategies.

The future of quant trading in crypto looks promising, as new tools and platforms continue to emerge, enabling even better strategies and higher profitability.

What Will You Gain from This Article?

By reading this article, you will:

Understand why quant trading in crypto is profitable.

Learn about different strategies like statistical arbitrage and market-making.

Discover the tools, risks, and benefits associated with quant trading in crypto.

Explore a side-by-side comparison of two distinct quant trading methods.

Gain actionable insights to help you get started or enhance your crypto trading skills.

Table of Contents

Introduction to Quantitative Trading in Crypto

Why Quant Trading is Profitable in Crypto

Two Popular Quant Trading Strategies

Statistical Arbitrage

Market-Making

How to Choose the Right Quant Trading Strategy

Tools and Resources for Crypto Quant Trading

FAQ: Common Questions About Quant Trading in Crypto

Conclusion

Introduction to Quantitative Trading in Crypto

Quantitative trading refers to using mathematical models, data analytics, and algorithms to make trading decisions. In the context of cryptocurrency, this can be incredibly profitable due to the volatile, 24⁄7 nature of the market. Unlike traditional asset classes, where liquidity and volatility are generally lower, crypto markets can exhibit extreme price swings, offering substantial opportunities for quant traders.

With the rise of cryptocurrency exchanges, decentralized finance (DeFi), and algorithmic trading platforms, quant traders can now leverage a range of tools to enhance their strategies and improve profitability.

Key Advantages of Quant Trading in Crypto

Market Volatility: Cryptocurrency markets are known for their high volatility, which provides traders with significant opportunities for profit, especially when using advanced algorithms that can react quickly to market movements.

24⁄7 Market: Unlike traditional markets, crypto markets never close, meaning quant traders can operate continuously without the need for manual intervention.

Market Efficiency: With crypto’s relatively new status and smaller market size compared to traditional financial markets, inefficiencies exist. These can be exploited through sophisticated trading algorithms.

Why Quant Trading is Profitable in Crypto

Volatility Amplifies Opportunities

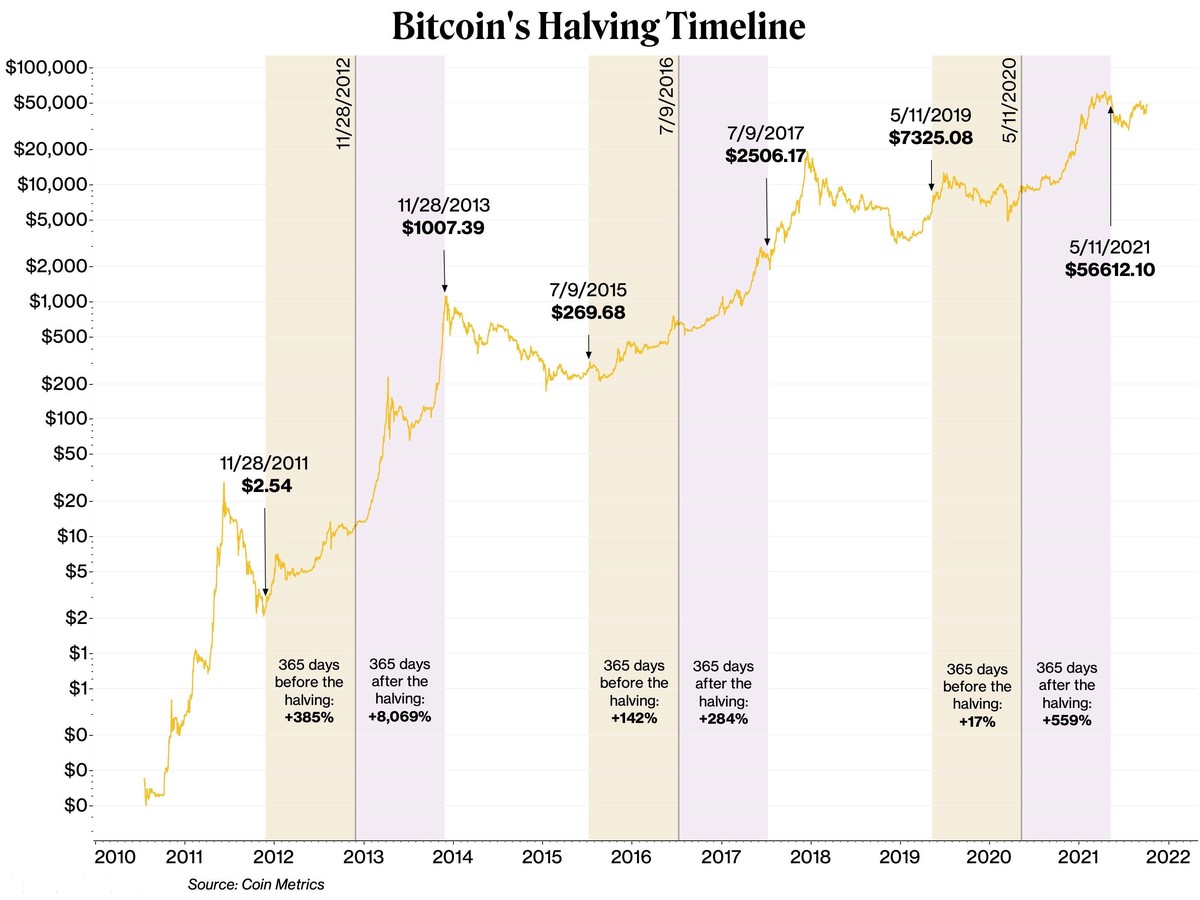

Crypto markets are highly volatile, with prices of digital assets like Bitcoin, Ethereum, and altcoins fluctuating significantly within short time frames. This volatility, while risky, provides a fertile ground for quant traders. By utilizing statistical models and machine learning, quant traders can exploit market inefficiencies and make profitable trades even during extreme price fluctuations.

Speed and Automation

One of the most significant advantages of quant trading in crypto is its ability to operate at lightning speed. Trading algorithms can place thousands of trades per second, far surpassing human traders. This enables quant traders to capitalize on short-lived market opportunities that human traders may miss.

Data-Driven Decisions

Quantitative traders use large amounts of historical data and real-time market feeds to guide their trading strategies. Crypto markets are full of data points such as price movements, order books, and social sentiment. Advanced algorithms analyze this data in real time to predict price movements and execute trades at optimal times, often ahead of other market participants.

Two Popular Quant Trading Strategies

Quantitative trading involves various strategies, and different approaches may be more or less suitable depending on your risk tolerance, experience level, and market conditions. Below, we’ll compare two common strategies: Statistical Arbitrage and Market-Making.

Statistical Arbitrage

Statistical Arbitrage (StatArb) is a strategy that involves identifying and exploiting price inefficiencies between correlated assets. In the crypto market, this might involve taking long and short positions on different digital assets that historically have moved together.

How It Works:

Traders use historical data to identify correlations between different cryptocurrencies.

When the price of one cryptocurrency deviates from the historical correlation with another, the trader executes a trade to capitalize on the price difference.

As the market corrects itself, the trader profits.

Pros:

Can be highly profitable when market inefficiencies are present.

Relatively low exposure to market risk since the strategy typically involves hedging.

Cons:

Requires large amounts of data and sophisticated algorithms.

Market inefficiencies are not always guaranteed to appear, so this strategy can be riskier during stable market conditions.

Market-Making

Market-making involves placing buy and sell orders for a cryptocurrency at different price levels to profit from the spread (the difference between the buy and sell prices). The strategy requires liquidity, and traders earn profit by providing liquidity to the market.

How It Works:

Traders place orders on both sides of the order book (buy and sell) at a price that is slightly better than the current market price.

As buyers and sellers execute their trades, the trader profits from the spread between the buy and sell price.

Pros:

Generates steady returns in highly liquid markets.

Less dependent on large price moves, making it a relatively safer option.

Cons:

Requires a significant amount of capital to maintain liquidity.

Can result in losses if the market moves rapidly in one direction.

How to Choose the Right Quant Trading Strategy

The best quant trading strategy for you depends on several factors:

Risk Appetite: If you prefer more stable returns with less exposure to market movements, market-making might be a better choice. If you’re comfortable with higher risk for potentially larger rewards, statistical arbitrage could be more suitable.

Capital: Market-making strategies typically require larger capital to provide liquidity, while statistical arbitrage may be more accessible to traders with smaller capital.

Experience: Statistical arbitrage is more data-driven and complex, while market-making may be easier to understand and implement.

Tools and Resources for Crypto Quant Trading

Key Tools

Trading Platforms: Binance, Coinbase Pro, Kraken, and others provide APIs for algorithmic trading.

Quant Trading Libraries: Python libraries like Zipline, Backtrader, and ccxt are popular for backtesting and executing strategies in crypto markets.

Data Providers: Websites like CoinMarketCap and CryptoCompare offer historical price data and market feeds necessary for quantitative analysis.

Learning Resources

How to Start Quant Trading in Crypto: Beginner’s Guide to Quantitative Crypto Trading

Where to Learn Quant Trading Crypto: Top Platforms and Courses

FAQ: Common Questions About Quant Trading in Crypto

- How much capital do I need to start quant trading in crypto?

While the amount of capital needed depends on the strategy, you can start quant trading with as little as $1,000. For strategies like market-making, more capital is required to provide liquidity.

- Is quant trading in crypto risk-free?

No, quant trading involves risks, especially due to the volatility of crypto markets. Proper risk management strategies and algorithms are crucial to mitigate losses.

- Can I build my own trading algorithm for crypto?

Yes, many crypto exchanges provide APIs that allow you to build and deploy custom trading algorithms. Popular programming languages for this are Python and C++.

Conclusion

Quantitative trading in crypto offers significant profit potential by exploiting market inefficiencies, utilizing speed and automation, and analyzing vast amounts of data. Whether you choose statistical arbitrage or market-making, the strategies offer distinct advantages and risks, depending on your experience and market conditions. With the right tools, resources, and risk management techniques, quant trading can be a lucrative avenue in the ever-evolving world of cryptocurrency.

Feel free to share your thoughts or comment below, and don’t forget to share this article with fellow traders!

0 Comments

Leave a Comment