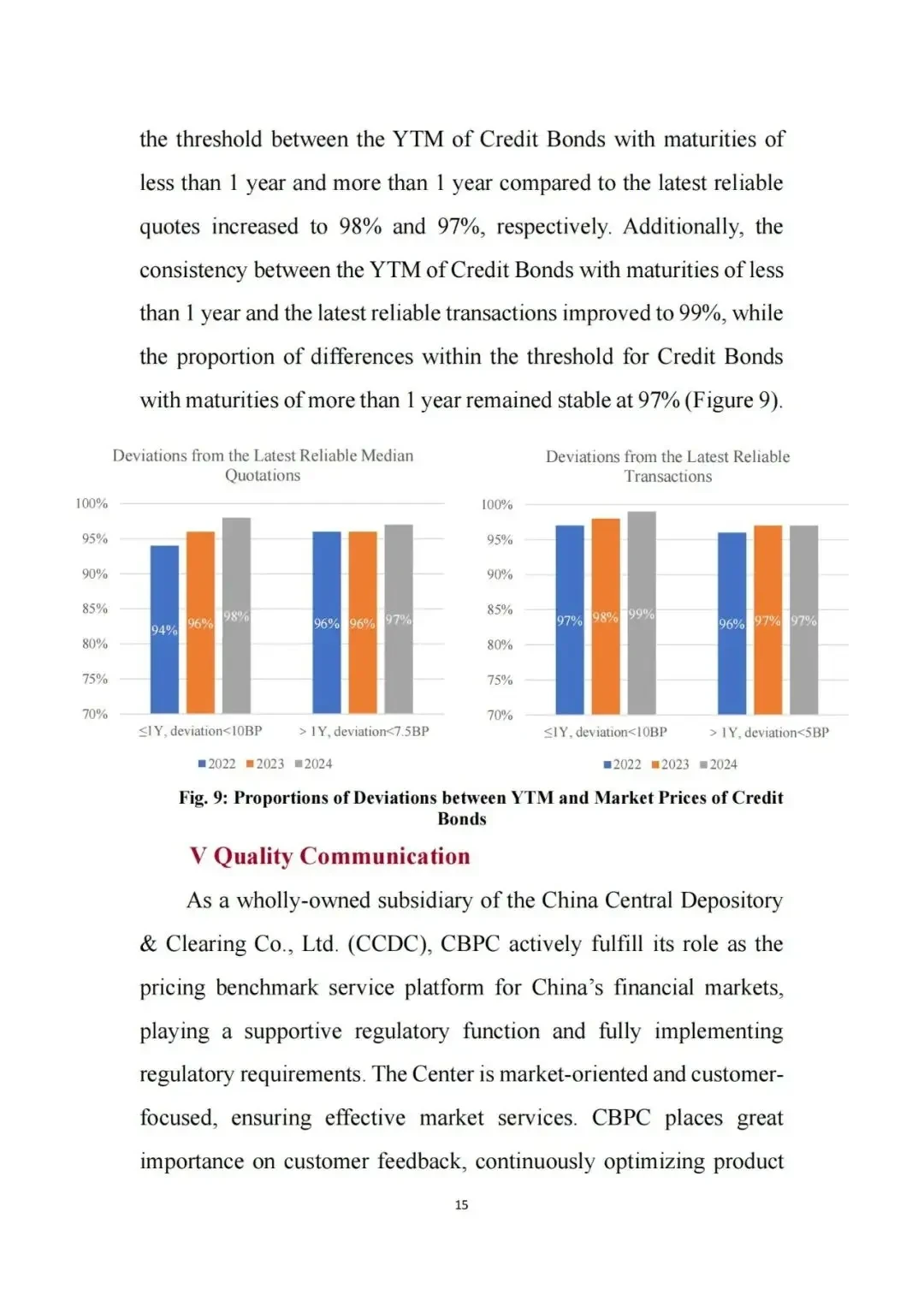

Trade execution quality is a cornerstone of institutional investing. It plays a critical role in determining whether trading strategies are successful and whether the investment goals of institutional investors are met. Understanding how to assess trade execution quality can help investors and asset managers minimize transaction costs, enhance portfolio performance, and ensure compliance with regulatory standards. This guide explores the most effective ways to assess trade execution quality for institutional investors and provides a comprehensive analysis of the key factors involved.

What is Trade Execution Quality?

Defining Trade Execution

In financial markets, trade execution refers to the process of completing a buy or sell order for a security. The execution quality is a measure of how efficiently and cost-effectively this order is completed. For institutional investors, achieving high-quality execution is essential to achieving the desired financial outcomes while minimizing the negative impacts of transaction costs, market slippage, and timing risks.

Why Trade Execution Quality Matters for Institutional Investors

Institutional investors—such as hedge funds, pension funds, mutual funds, and endowments—often execute large, high-value trades. The scale and impact of these trades mean that even minor inefficiencies can significantly affect the overall portfolio performance. Additionally, institutional investors are bound by fiduciary duties to ensure the best execution for their clients. Therefore, assessing trade execution quality becomes not just an operational requirement but a regulatory necessity as well.

Key Metrics for Assessing Trade Execution Quality

- Execution Cost (Transaction Cost Analysis)

One of the most critical factors in evaluating trade execution quality is transaction cost analysis (TCA). TCA involves analyzing the cost incurred in executing a trade, which includes:

Explicit costs such as brokerage commissions, exchange fees, and other direct charges.

Implicit costs like market impact (the price movement caused by the trade itself) and opportunity costs (the cost of missing better prices during execution).

TCA helps investors compare the executed trade prices against a benchmark, such as the arrival price (the price when the order is placed) or VWAP (volume-weighted average price), which can highlight inefficiencies in trade execution.

Benefits of TCA:

Identifies areas of improvement in execution strategies.

Quantifies transaction costs, providing actionable data.

Helps ensure compliance with the best execution standards.

- Slippage

Slippage occurs when the execution price of a trade is different from the expected price, usually due to price movements between the time the order is placed and the time it is filled. It’s essential to track slippage to understand how well trades are executed.

Types of Slippage:

Positive slippage occurs when the executed price is better than expected.

Negative slippage happens when the executed price is worse than expected.

For institutional investors, minimizing negative slippage is crucial for maintaining high-quality execution. Monitoring slippage across different asset classes can help identify areas where execution strategies need refinement.

- Fill Ratio

The fill ratio is the percentage of the total order that is successfully executed at the requested price or better. For large orders, particularly those in illiquid markets, achieving a high fill ratio is essential for maintaining execution quality. A low fill ratio might indicate that the strategy needs adjustment, such as breaking up larger orders into smaller, more manageable parts.

- Time to Execution

Time to execution measures how long it takes to complete a trade. Speed is especially crucial for institutional investors engaged in high-frequency trading (HFT) or those working with fast-moving assets like equities, options, or foreign exchange (forex). Delays in execution can result in higher costs and missed trading opportunities.

Factors Affecting Time to Execution:

Market liquidity: Less liquid markets tend to experience longer execution times.

Order type: Market orders typically execute faster than limit orders.

Technology: Advanced trading algorithms and platforms can reduce time to execution significantly.

- Market Impact

Market impact is the price change caused by executing a large trade, especially when liquidity is limited. Institutional investors, especially those executing block trades, need to minimize market impact to avoid moving the market price against their position.

How to Minimize Market Impact:

Use smart order routing to split large orders across different venues.

Employ algorithmic trading strategies that spread the trade out over time to minimize sudden price movements.

Time trades based on liquidity patterns in the market.

Methods for Assessing Trade Execution Quality

- Transaction Cost Analysis (TCA) Tools

For institutional investors, using TCA tools is one of the most effective ways to assess trade execution quality. These tools analyze the execution of trades against various benchmarks and provide detailed reports on explicit costs, slippage, and market impact. Popular TCA platforms include Aladdin by BlackRock and Portware.

Advantages of TCA:

Provides comprehensive data for assessing execution quality.

Highlights inefficiencies and areas for improvement.

Helps compare trade execution across different brokers and venues.

Limitations of TCA:

Can be expensive, especially for small institutions.

Requires access to accurate benchmark data, which can be difficult to obtain in some markets.

- Algorithmic Trading Strategies

Using algorithmic trading strategies is another key method for assessing trade execution quality. Algorithms are designed to optimize the execution of trades by minimizing costs, slippage, and market impact. Many institutional investors use proprietary algorithms or third-party solutions like SMART Order Routing (SOR) or VWAP strategies.

Advantages of Algorithmic Trading:

Reduces human error and improves execution speed.

Can adjust to market conditions in real-time.

Helps minimize market impact by executing orders over time or in smaller batches.

Challenges:

Requires sophisticated technology and infrastructure.

Complex algorithms can sometimes lead to unintended market disruptions if not carefully monitored.

Best Practices for Improving Trade Execution Quality

- Use Multi-Asset Execution Platforms

To assess and improve trade execution quality, institutional investors should leverage multi-asset execution platforms. These platforms provide access to a wide range of markets and liquidity pools, allowing for better price discovery and trade execution.

Examples of Multi-Asset Platforms:

TradeStation

Bloomberg EMSX

FlexTrade

These platforms allow institutional investors to monitor execution quality in real-time, ensuring that trades are completed at the best possible prices.

- Continuous Monitoring and Feedback Loops

Institutional investors should establish continuous monitoring of trade execution quality and create feedback loops to improve strategies. By continuously analyzing execution reports and adjusting execution algorithms, investors can achieve better results over time. This process should involve regular reviews of TCA reports and slippage analysis.

- Transparency and Data Analytics

Transparency in trade execution is vital. Institutional investors must ensure that they have access to accurate, real-time data and detailed reports on every trade executed. By leveraging advanced data analytics tools, investors can gain deeper insights into their execution strategies and identify areas that need improvement.

Frequently Asked Questions (FAQs)

- How do institutional investors measure trade execution quality?

Institutional investors assess trade execution quality using metrics like transaction cost analysis (TCA), slippage, fill ratio, time to execution, and market impact. These metrics help quantify how efficiently and cost-effectively trades are executed.

- What is the role of transaction cost analysis (TCA) in assessing trade execution?

TCA is essential for evaluating the efficiency of trade execution. It compares the actual cost of executing a trade against various benchmarks, such as arrival price or VWAP, to determine if the trade was executed at an optimal price and with minimal market impact.

- How can algorithms improve trade execution quality?

Algorithmic trading strategies help institutional investors improve execution quality by reducing human error, optimizing execution speed, and minimizing market impact. Algorithms can split large orders into smaller, manageable pieces and execute them over time to avoid price fluctuations.

Conclusion

Assessing trade execution quality is an essential skill for institutional investors. By leveraging advanced tools like transaction cost analysis (TCA), using smart algorithms, and monitoring execution across various markets and platforms, investors can optimize their trading strategies, reduce costs, and enhance performance. In today’s fast-paced financial markets, continuous improvement in trade execution quality is vital for maintaining a competitive edge.

0 Comments

Leave a Comment