In the world of trading, automation has become an essential tool for enhancing decision-making and boosting profitability. One powerful technique that has gained significant traction is regression analysis. By leveraging this statistical method, traders can make more informed, data-driven decisions, leading to more accurate market predictions and improved trading strategies. In this guide, we will explore how automating trading decisions with regression analysis works, discuss two distinct approaches to applying regression in trading, and provide practical insights based on real-world experience.

Introduction to Regression Analysis in Trading

Regression analysis is a statistical tool used to model the relationship between variables. In the context of trading, it is typically used to understand how different market factors (e.g., stock prices, economic indicators) are related and how one variable can predict another. This makes it an invaluable method for traders aiming to automate decisions based on historical data.

By automating trading decisions with regression analysis, traders can analyze vast amounts of market data and identify patterns that would be too complex or time-consuming for manual analysis. Whether you’re a day trader or a quantitative analyst, regression can help you build predictive models that automate trading strategies, minimizing human error and maximizing efficiency.

Key Concepts of Regression Analysis in Trading

What is Regression Analysis?

Regression analysis seeks to establish relationships between a dependent variable (such as a stock price) and one or more independent variables (like trading volume or moving averages). This relationship allows traders to predict future market movements based on historical data.

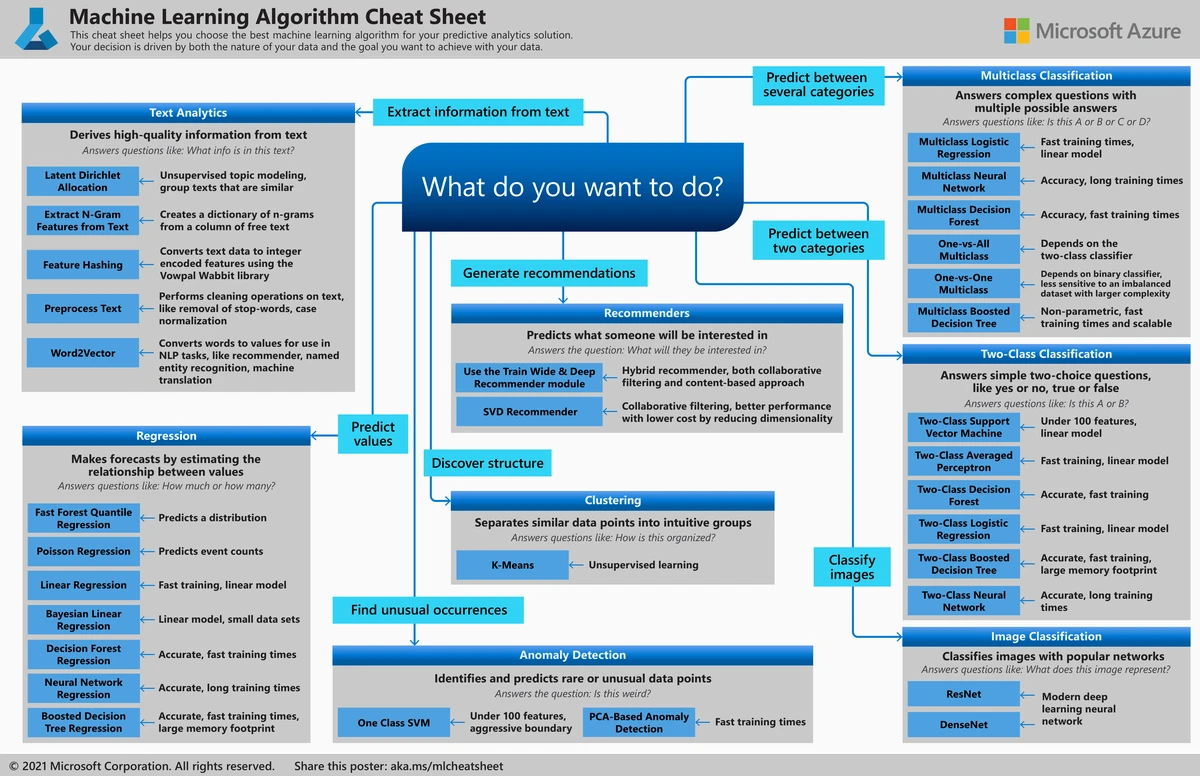

There are various types of regression models used in trading, including:

Linear regression: Assumes a straight-line relationship between the dependent and independent variables.

Multiple regression: Uses more than one independent variable to predict the dependent variable.

Logistic regression: Often used for binary outcomes (e.g., whether a stock will go up or down).

Regression analysis is essential because it enables traders to predict price trends and market behavior, making it easier to automate decisions based on these predictions.

Why Traders Use Regression Analysis in Market Prediction

In the world of quantitative trading, regression analysis plays a key role in predicting price movements and establishing trading signals. This technique helps traders assess how various market factors, like interest rates or company earnings, affect stock prices. By integrating regression models into automated trading systems, traders can quickly act on market conditions and make informed decisions with minimal human intervention.

Two Approaches to Automating Trading Decisions with Regression Analysis

There are different strategies for incorporating regression analysis into automated trading. The two most common approaches are rule-based models and machine learning-based models. While both use regression techniques, their implementation and effectiveness can vary depending on the trader’s goals.

Rule-Based Regression Models

A rule-based regression model uses predefined rules to make trading decisions based on regression outputs. In this approach, traders set specific thresholds or conditions (e.g., when the predicted price reaches a certain level) that trigger an automatic trade.

Advantages of rule-based models:

Simplicity: These models are easy to implement and understand, making them suitable for traders with basic statistical knowledge.

Transparency: Traders can clearly define the rules and see how decisions are made.

Disadvantages:

Limited adaptability: Rule-based models may not perform well under changing market conditions since they are rigid and rely on predefined rules.

Overfitting: There’s a risk that these models might be over-optimized on historical data, leading to poor performance in real-time trading.

Machine Learning-Based Regression Models

In contrast to rule-based models, machine learning (ML)-based regression models use algorithms to continuously improve their predictive capabilities. These models can learn from past market data and adjust their strategies based on new information, making them more adaptable to changing market dynamics.

Advantages:

Dynamic learning: These models can adapt to new trends and patterns in the market, improving over time.

Higher accuracy: Machine learning models can potentially outperform rule-based systems due to their ability to process large amounts of data and learn complex relationships.

Disadvantages:

Complexity: Machine learning models require a deeper understanding of algorithms and may need more computational power and data to perform optimally.

Overfitting risk: If not properly tuned, machine learning models can become overfitted to historical data and perform poorly in live trading.

How to Build an Automated Trading System Using Regression Analysis

Creating an automated trading system with regression analysis involves several key steps. Below, we outline a general framework for building such a system:

- Collect and Clean Data

The first step is to gather historical market data that includes the variables you plan to analyze. This could include stock prices, volume, economic indicators, and other relevant market factors. Clean the data to remove any noise or errors, ensuring that your regression models are based on high-quality input.

- Choose a Regression Model

Based on the type of data and the trading goals, select an appropriate regression model. For simpler strategies, linear regression might be sufficient, while more complex strategies might require multiple or logistic regression models.

- Train the Model

Using your historical data, train the regression model to learn the relationships between the independent variables (e.g., market factors) and the dependent variable (e.g., price movement). If you are using a machine learning model, train the algorithm on past data and fine-tune the parameters to improve its predictive accuracy.

- Backtest the Strategy

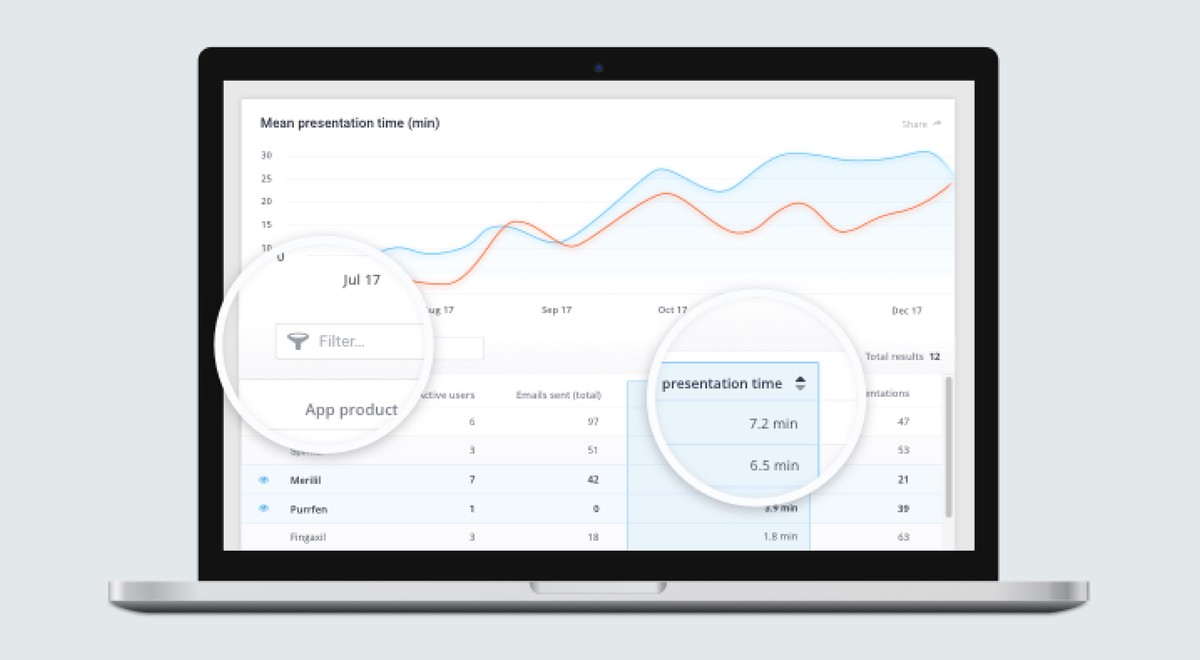

Before going live with your automated system, it’s crucial to backtest the strategy on historical data to evaluate its performance. This allows you to identify any potential weaknesses and optimize the model for better results.

- Implement the Automation

Once your model is trained and tested, integrate it into a trading platform to automate the execution of trades. The system will monitor the market, analyze data, and execute trades based on the regression model’s predictions.

- Monitor and Optimize

Even after the system is live, continuous monitoring is essential to ensure that it performs as expected. Over time, optimize the model by feeding it new data and adjusting parameters to improve its accuracy.

FAQ: Common Questions About Automating Trading Decisions with Regression Analysis

- What is the role of regression analysis in improving trading outcomes?

Regression analysis allows traders to quantify relationships between various market variables and price movements. By automating decisions based on these relationships, traders can more effectively predict price trends and make timely, informed decisions. This can lead to higher profitability and reduced emotional bias in trading decisions.

- How do I choose the best regression analysis tool for trading?

When selecting a regression analysis tool, consider factors like ease of use, compatibility with your trading platform, and the tool’s ability to handle large datasets. Some tools are designed for beginners and offer simple interfaces, while others are more advanced and suited for professional traders. Popular options include R, Python libraries (such as Scikit-learn), and dedicated trading platforms like MetaTrader and QuantConnect.

- How do I ensure that my regression model is not overfitting?

To avoid overfitting, use techniques such as cross-validation to assess your model’s performance on unseen data. Additionally, ensure that your model is not too complex for the data at hand, and be cautious of creating too many variables that might lead to a model that performs well on historical data but poorly in live conditions.

Conclusion: Choosing the Right Regression Approach for Automated Trading

Both rule-based and machine learning-based regression models offer unique advantages and challenges. Rule-based models are easier to implement and understand but may not adapt well to market changes. On the other hand, machine learning models provide higher accuracy and adaptability but require more expertise and computational resources.

To get the most out of automating trading decisions with regression analysis, it’s crucial to understand your goals, resources, and level of expertise. Whether you choose a simple rule-based model or a sophisticated machine learning approach, the key is continuous optimization and data-driven decision-making.

By leveraging regression analysis, traders can improve their trading strategies, automate key decisions, and stay ahead of the curve in today’s fast-paced markets. Share this guide with your fellow traders to help them understand how regression can elevate their trading game!

Suggested Reading:

How to Perform Regression Analysis for Quantitative Trading

| Topic | Key Points | Advantages | Disadvantages | Example / Notes |

|---|---|---|---|---|

| Regression Analysis | Models relationships between variables to predict price movements | Data-driven decisions, minimizes human error | Requires quality data, risk of overfitting | Linear, multiple, logistic regression |

| Rule-Based Models | Use predefined rules to trigger trades from regression outputs | Simple, transparent, easy to implement | Limited adaptability, may overfit historical data | Threshold-based automatic trades |

| Machine Learning Models | Algorithms learn from past data and adjust strategies | Dynamic learning, higher accuracy | Complex, needs computational power, overfitting risk | Neural networks, decision trees, SVM |

| Building Automated System | Steps: collect data, choose model, train, backtest, implement, monitor | Automates trading, continuous optimization | Requires monitoring and parameter tuning | Use Python, R, MetaTrader, QuantConnect |

| Data Collection | Gather historical prices, volume, and indicators | Ensures model accuracy | Data cleaning needed | Remove noise and errors before analysis |

| Model Training | Train regression on historical data to predict prices | Learns relationships between variables | Needs sufficient historical data | Machine learning models fine-tune parameters |

| Backtesting | Test strategy on historical data before live trading | Identifies weaknesses, optimizes performance | Historical performance may differ from live markets | Evaluate slippage and real-world factors |

| Automation Implementation | Integrate model into platform for automatic trade execution | Reduces delay, executes trades efficiently | Requires robust platform integration | System monitors market and executes trades automatically |

| Monitoring & Optimization | Continuously track performance and adjust model | Maintains accuracy, adapts to new data | Requires ongoing effort | Feed new data, adjust parameters regularly |

| Tool Selection | Choose regression tools compatible with platform and data | Ease of use, handles large datasets | Tool complexity varies | Python libraries, R, MetaTrader, QuantConnect |

0 Comments

Leave a Comment