Sell side research plays a vital role in modern financial markets, offering essential insights and data that hedge fund managers can leverage to enhance their strategies. Whether it’s tracking market trends, identifying undervalued assets, or predicting market movements, sell side research helps hedge fund managers make more informed and profitable decisions. In this article, we will explore the benefits of sell side research, how it supports quantitative models, and why hedge fund managers rely on it to stay competitive in the market.

What Is Sell Side Research?

Sell side research refers to the analysis and insights provided by financial institutions (typically investment banks or brokerages) that are involved in the buying and selling of securities. These reports usually focus on specific companies, industries, or market trends and offer recommendations, financial metrics, and forecasts.

Sell side analysts are tasked with producing these reports to help clients, including hedge funds, institutional investors, and retail traders, make informed investment decisions. The research often includes:

Company analysis

Industry outlooks

Earnings reports

Valuation assessments

Market sentiment and economic forecasts

These reports are typically aimed at assisting clients in making trading decisions rather than directly executing trades. Hedge fund managers find great value in these insights because they are backed by extensive research, expert opinions, and industry knowledge.

Why Hedge Fund Managers Should Leverage Sell Side Research

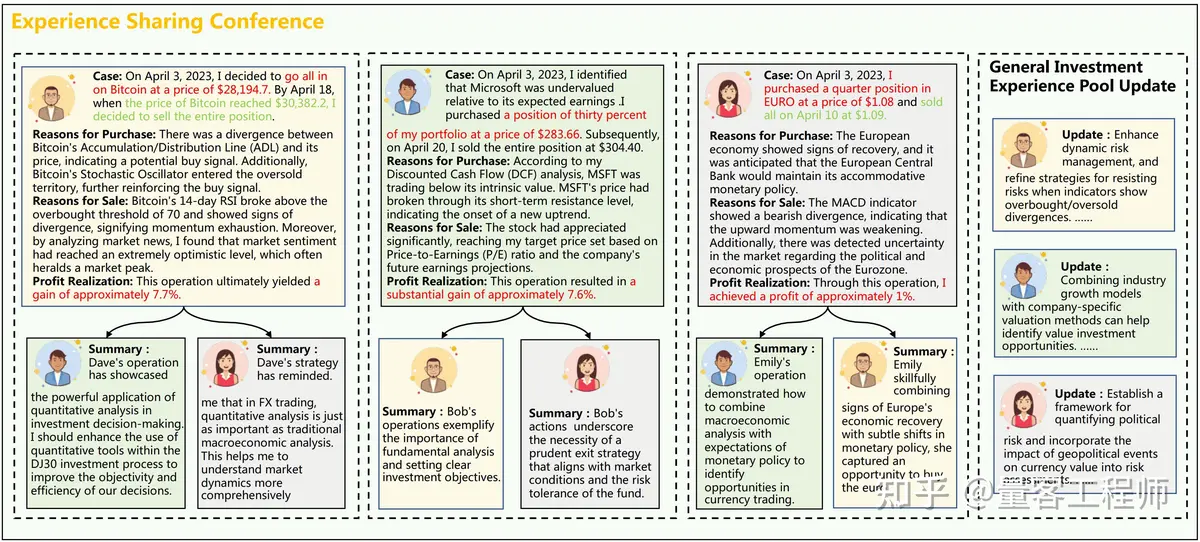

2.1 Enhancing Decision-Making

Hedge fund managers use sell side research as a critical component in the decision-making process. By having access to comprehensive market reports, they can analyze macroeconomic conditions, sector-specific trends, and individual company performances. This enables them to craft well-informed investment strategies and enhanced risk management practices.

Example: A hedge fund manager analyzing a technology company might rely on a sell side report that highlights expected earnings growth, competitive advantages, and industry dynamics. Such insights guide them in taking a long or short position, depending on the findings.

2.2 Identifying Market Opportunities

Sell side research provides hedge fund managers with insights into emerging market trends, investment opportunities, and potential risks. By incorporating this information into quantitative trading models, hedge fund managers can identify alpha generation opportunities and stay ahead of the market.

For instance, sell side reports might provide early warnings on stocks poised for a price surge, enabling hedge funds to enter positions early and exit before the broader market catches up.

Example: Sell side research on consumer behavior trends may uncover a rapidly growing segment that could benefit a specific stock, which is valuable information for any hedge fund’s alpha generation strategy.

2.3 Improving Quantitative Models

Hedge funds increasingly rely on quantitative trading strategies, and sell side research plays a pivotal role in enhancing these models. Sell side data can be integrated into quantitative models to provide accurate input variables, which can then be used to optimize predictions and improve model outcomes.

Quantitative analysts (quants) use sell side research data in multiple ways, such as:

Incorporating company performance data into models.

Evaluating market sentiment to assess potential price fluctuations.

Using economic forecasts to adjust risk parameters.

By integrating these insights into trading algorithms, hedge funds can optimize entry and exit strategies, portfolio construction, and risk management techniques.

The Role of Sell Side Research in Trading Strategies

3.1 Sell Side Research for Market Timing

The timing of entry and exit is critical for hedge fund managers. Sell side research helps inform these decisions by providing insights into when a stock or asset might experience volatility or price movement. This allows hedge fund managers to time their trades with precision.

Example: A sell side analyst might forecast that a company’s stock price will increase after an earnings report, giving hedge fund managers an optimal window to enter a position before the broader market reacts.

3.2 Risk Management Insights

Sell side research offers crucial insights into potential risks, from macroeconomic factors to sector-specific issues. Hedge fund managers can incorporate these insights into their risk management frameworks, helping them identify when to hedge positions, reduce exposure, or increase leverage.

For example, sell side analysts might provide early warnings of upcoming regulatory changes or market disruptions, allowing hedge funds to adjust their positions ahead of time.

3.3 Supporting Hedge Fund Strategies

Sell side research supports various hedge fund strategies, including:

Event-driven strategies: Where hedge funds look for catalysts like earnings reports, mergers, or acquisitions.

Global macro strategies: Where economic forecasts and geopolitical insights help hedge funds position themselves in the global market.

Long/short equity: Where sell side reports help identify undervalued or overvalued stocks, forming the basis of long or short positions.

By leveraging sell side insights, hedge fund managers can develop more robust and effective strategies, driving better returns.

Sell Side Research vs. Buy Side Research

4.1 Differences Between Sell Side and Buy Side Research

The primary difference between sell side and buy side research is the target audience. While sell side research is created by brokerages and investment banks to inform their clients, buy side research is conducted by asset managers or hedge funds for their own investment decisions.

Sell Side Research: Primarily focuses on providing recommendations, financial metrics, and industry analysis for clients to use in making buy or sell decisions.

Buy Side Research: More in-depth, focusing on proprietary analysis and customized strategies based on the needs of the institution.

For hedge fund managers, sell side research is more valuable for gaining general market insight and identifying new opportunities, while buy side research is more tailored to specific strategies and individual portfolios.

4.2 Integrating Sell Side Research with Hedge Fund Strategies

While buy side research may have more influence on specific portfolio decisions, sell side research still plays a crucial role in informing a broader market outlook and identifying trading opportunities. Hedge fund managers should integrate both sell side and buy side research into their investment process to maximize the quality of their strategies.

FAQ

- How can hedge fund managers evaluate the quality of sell side research?

Hedge fund managers evaluate sell side research by assessing its accuracy, timeliness, and relevance. A quality report will be backed by solid data, include actionable insights, and be produced by experienced analysts. Hedge fund managers may also compare different sell side opinions to identify consensus and divergence.

- How does sell side research influence quantitative trading decisions?

Sell side research impacts quantitative trading by providing key data inputs for models. This can include earnings forecasts, macroeconomic indicators, or stock-specific information, which are all used to improve the predictive power of quantitative models. Incorporating sell side insights allows quantitative traders to make more informed decisions based on external, expert data.

- What are some common mistakes hedge funds make when using sell side research?

One common mistake hedge funds make is relying too heavily on sell side research without validating it through their own analysis or alternative sources. While sell side research is valuable, it should be considered one part of a broader decision-making process, especially when combined with proprietary research and quantitative models.

Conclusion

| Topic | Key Points | Applications for Hedge Funds | Advantages | Challenges / Considerations |

|---|---|---|---|---|

| Sell Side Research | Analysis by banks or brokerages on companies, industries, trends | Supports informed investment decisions | Provides expert insights and market forecasts | Should not be solely relied upon; validate with own research |

| Enhancing Decision-Making | Offers macro and sector insights, company performance data | Guides long/short positions and strategy design | Improves risk management and strategy quality | Complexity in interpreting broad data |

| Identifying Market Opportunities | Highlights emerging trends and undervalued assets | Integrates into quantitative models for alpha generation | Early access to market opportunities | May require additional verification of data |

| Improving Quantitative Models | Provides input variables like earnings and economic forecasts | Optimizes trading algorithms and predictions | Enhances model accuracy and portfolio performance | Over-reliance may reduce model diversity |

| Market Timing | Forecasts price movements and volatility | Helps determine optimal trade entry and exit | More precise timing and execution | Predictions may be inaccurate if market changes rapidly |

| Risk Management Insights | Reports potential macro and sector risks | Informs hedging, exposure adjustments, leverage | Reduces downside risk and volatility | Risk of outdated or incomplete information |

| Supporting Hedge Fund Strategies | Event-driven, global macro, long/short equity | Forms basis for strategy decisions | Enhances overall returns and strategy robustness | Must be integrated with other research types |

| Sell Side vs Buy Side | Sell side: client-focused analysis; Buy side: proprietary for internal use | Hedge funds use both for comprehensive insight | Broad market view plus tailored strategy | Differentiating relevance and quality of reports |

0 Comments

Leave a Comment