In the world of trading and financial analysis, the Bloomberg Terminal has long been the gold standard for access to real-time financial data, advanced analytics, and market-moving news. But what about independent traders? Is the Bloomberg Terminal suitable for them, or is it only for large institutions and hedge funds? In this guide, we’ll explore how independent traders can use the Bloomberg Terminal to enhance their trading strategies, improve decision-making, and gain a competitive edge in the financial markets.

What is Bloomberg Terminal?

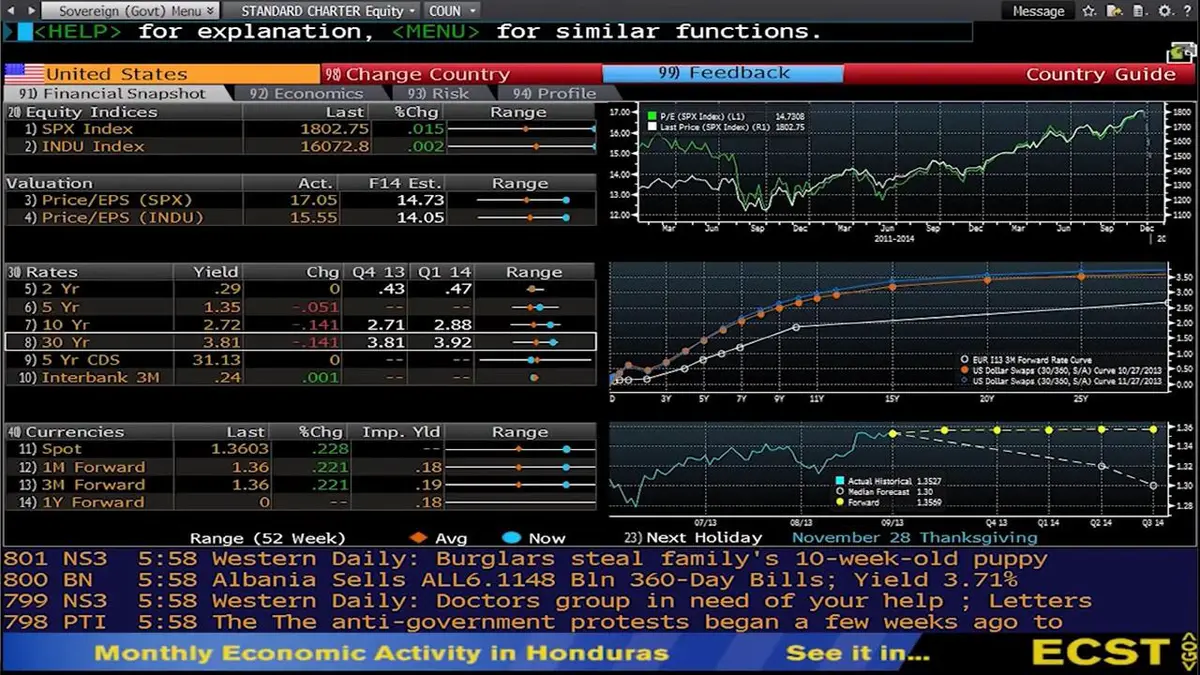

The Bloomberg Terminal is a software platform that provides financial professionals with access to real-time data, news, and financial analysis. With it, users can track stock prices, bond yields, commodities, foreign exchange, and much more. It is well-known for its robust analytics, market forecasts, and financial modeling tools, making it indispensable to many large investment firms, hedge funds, and financial institutions.

For independent traders, the Terminal offers an in-depth perspective on market conditions, giving them the ability to engage in quantitative analysis, automated trading, and market forecasting.

Why Should Independent Traders Use Bloomberg Terminal?

Many independent traders struggle to access the same high-quality data and tools that institutional investors use. Bloomberg Terminal for independent traders is a powerful solution, offering the following advantages:

Real-time Market Data: Instant access to stock prices, FX rates, interest rates, and commodity prices.

Advanced Analytics: Powerful tools for analyzing historical data and forecasting future trends.

News and Insights: Real-time news feeds and analysis on market-moving events.

Research Tools: Detailed financial models and reports for equity research, credit analysis, and more.

Integration with Quantitative Trading: Bloomberg supports algorithmic trading strategies with APIs, data feeds, and backtesting tools.

Though it’s a significant financial commitment, the Bloomberg Terminal for independent traders can level the playing field with larger institutions, offering them an edge in decision-making and trade execution.

Key Features of Bloomberg Terminal for Independent Traders

- Real-Time Market Data and Insights

For independent traders, real-time market data is essential for making timely decisions. Bloomberg Terminal provides access to:

Live streaming data on global equities, commodities, bonds, and foreign exchange.

Market-moving news from major financial sources such as Reuters, Dow Jones, and Bloomberg itself.

Economic indicators that show global market trends, central bank actions, and geopolitical developments.

This information allows traders to react swiftly to market shifts and adapt strategies in real time.

- Advanced Financial Analytics

Bloomberg Terminal offers sophisticated analytical tools, such as:

Bloomberg Excel Add-In: For integrating data into spreadsheets for detailed financial modeling.

Charting Tools: To visualize historical data, moving averages, and technical indicators.

Risk and Portfolio Management: With risk modeling and scenario analysis tools to understand portfolio exposure.

These advanced features enable independent traders to perform deep analysis without needing to rely on third-party services. The ability to analyze complex financial data is crucial for refining trading strategies and developing a personalized risk model.

- Quantitative Trading Capabilities

For traders looking to engage in quantitative trading, Bloomberg Terminal can be integrated with algorithmic strategies and tools such as:

Bloomberg API: To connect the terminal with your trading algorithms and automate trading.

Data Streams: Real-time data feeds that can be incorporated into trading models or backtesting frameworks.

Backtesting Tools: To evaluate the performance of quantitative strategies using historical data.

Independent traders can build, test, and deploy trading algorithms with Bloomberg’s comprehensive resources, offering a unique advantage in algorithmic trading.

Two Popular Strategies for Independent Traders Using Bloomberg Terminal

While the Bloomberg Terminal offers a range of tools, independent traders often focus on two primary strategies: quantitative analysis and market sentiment analysis. Here’s how both can be used effectively:

- Quantitative Analysis

Quantitative analysis involves using mathematical models, algorithms, and statistical methods to predict price movements and optimize trades. The Bloomberg Terminal provides robust data and analytical tools to make this strategy possible.

How It Works:

Traders use Bloomberg’s Excel Add-In to access real-time data for building predictive models.

They can apply technical indicators such as moving averages, RSI, or Bollinger Bands to develop entry and exit signals.

Backtest strategies using historical data on the Terminal to refine and optimize models.

Pros:

Systematic approach reduces emotional trading.

Scalable for high-frequency or algorithmic trading strategies.

Ability to access a variety of data sources for comprehensive analysis.

Cons:

High complexity and a steep learning curve.

Requires significant time investment in backtesting and optimizing strategies.

- Market Sentiment Analysis

Market sentiment analysis involves understanding the mood of the market, often using news, social media, and economic indicators to predict price movements. The Bloomberg Terminal excels in this area by providing up-to-date news, macroeconomic data, and sentiment analysis tools.

How It Works:

Traders monitor real-time news and global financial reports to gauge investor sentiment.

Bloomberg’s Sentiment Analysis Tools help track how the market responds to news events or corporate earnings reports.

Social media sentiment can also be analyzed through Bloomberg’s integration with financial news outlets.

Pros:

Great for catching big market moves driven by news.

Allows traders to react to real-time shifts in market sentiment.

Cons:

Can be subject to market noise and false signals.

Requires quick decision-making to capitalize on short-term market changes.

How Bloomberg Terminal Can Support Quantitative Strategies

Bloomberg Terminal is particularly valuable for independent traders who are engaging in quantitative strategies. The platform offers the following benefits for quant trading:

Data Access: Access to a wide array of historical market data, including financial statements, earnings reports, and economic data, which are essential for building and testing quantitative models.

Backtesting: Bloomberg’s backtesting tools allow traders to assess their strategies’ effectiveness by applying them to historical data.

API Integration: Bloomberg’s API enables traders to integrate live market data with automated trading algorithms, improving execution and timing.

By incorporating Bloomberg’s data streams into their strategies, independent traders can optimize their quantitative models and test new trading hypotheses with real-world data.

FAQ: Bloomberg Terminal for Independent Traders

- How can I integrate Bloomberg Terminal with quantitative trading?

The Bloomberg Terminal provides an Excel Add-In and API integration that allow traders to pull real-time market data directly into their trading algorithms. You can use these tools to automate trades, backtest strategies, and connect data feeds to algorithmic trading platforms.

- How much does a Bloomberg Terminal cost for independent traders?

The cost of a Bloomberg Terminal can range from \(20,000 to \)25,000 annually for individual licenses. While this price point is high, it may be worthwhile for traders who rely heavily on real-time data, market analysis, and advanced trading strategies.

- What other platforms can I use in addition to Bloomberg Terminal for quantitative trading?

While Bloomberg Terminal is a top choice for many traders, other platforms like Refinitiv Eikon, Interactive Brokers, and TradingView also provide comprehensive data feeds and backtesting capabilities. However, Bloomberg excels in providing a unified platform with a wide range of financial data, analytics, and tools for independent traders.

Final Thoughts

The Bloomberg Terminal for independent traders offers unparalleled access to market data, advanced analytics, and quantitative trading tools that can enhance your trading strategies. While its price may seem prohibitive, the value it provides in terms of real-time information, backtesting, and market sentiment analysis can level the playing field between individual traders and institutional investors.

If you are serious about quantitative trading, market analysis, or algorithmic strategies, the Bloomberg Terminal is an investment worth considering.

| Topic | Description |

|---|---|

| What are Bollinger Bands? | Three lines: middle (SMA), upper (middle + 2×SD), lower (middle - 2×SD) that reflect market volatility. |

| Why Bollinger Bands Matter | Measure volatility, identify overbought/oversold conditions, highlight trends and reversals. |

| Volatility Impact | Wide bands signal high volatility; narrow bands suggest market consolidation. |

| Band Squeeze | Narrow bands signal potential breakout or strong price movement. |

| Mean Reversion Strategy | Buy at lower band, sell at upper band; effective in range-bound markets but ineffective in trends. |

| Breakout Trading Strategy | Buy above upper band or sell below lower band; works well in trending markets but prone to whipsaws. |

| Best Strategy for Market Type | Mean reversion for range-bound markets, breakout trading for trending markets. |

| Multi-Band Analysis | Using multiple Bollinger Bands (e.g., 1 SD, 2 SD) for stronger confirmation. |

| Timeframe Adaptation | Short-term traders use 5–15 min charts, swing traders use daily or weekly charts. |

| Integration with Futures | Applying Bollinger Bands in futures trading to analyze volatility and momentum. |

| Avoid Bands Alone | Combine with RSI, MACD, or volume for better accuracy. |

| Adjust Parameters | Modify Bollinger Band settings for different stocks and market conditions. |

| Watch for False Signals | Wait for confirmation to avoid false breakouts. |

| Risk Management with Bands | Use bands for dynamic stop-loss levels to manage risk. |

| Personal Experience | Combining RSI with Bollinger Bands improved trading accuracy by filtering false signals. |

| Industry Trends | Algorithmic trading, AI enhancements, and cross-market use in crypto and forex. |

| Beginner Suitability | Yes, but pair with other indicators for reliability. |

| Predicting Price Movements | No, they provide probability-based insights, not exact predictions. |

| Biggest Mistake with Bands | Assuming upper band = sell and lower band = buy, ignoring market trends. |

| Pro Trader Use | Professionals use multi-indicator strategies and adjust settings based on volatility. |

0 Comments

Leave a Comment