Evaluating stocks on the buy side is a rigorous process that blends fundamental research, quantitative models, and market intelligence to guide investment decisions. Unlike sell-side analysts who provide recommendations to clients, buy-side analysts work within asset managers, hedge funds, or institutional investors to directly influence portfolio allocations.

This article explores how buy side analysts evaluate stocks, highlighting both traditional and modern methods, comparing strategies, and offering practical insights. By the end, you’ll understand what frameworks professionals use, how they differ, and how aspiring analysts can apply these techniques.

The Role of Buy Side Analysts

Buy side analysts support portfolio managers and traders by producing in-depth research that drives investment selection, position sizing, and risk management. Their primary goal is alpha generation—finding opportunities that outperform benchmarks like the S&P 500 or MSCI indices.

Key responsibilities include:

Conducting fundamental and financial analysis.

Building and stress-testing valuation models.

Monitoring industry and macroeconomic developments.

Collaborating with portfolio managers to design entry and exit points.

Conducting risk analysis to balance potential returns with portfolio constraints.

Core Evaluation Methods

Fundamental Analysis

Definition: The study of a company’s financials, management, and industry position to estimate intrinsic value.

Key steps include:

Earnings Analysis: Reviewing revenue growth, margins, and EPS trends.

Balance Sheet Review: Evaluating debt levels, liquidity, and asset quality.

Cash Flow Analysis: Assessing sustainability of operations and capital allocation.

Industry Comparisons: Benchmarking against compe*****s.

Strengths: Offers deep insight into long-term value.

Weaknesses: Slow to react to market sentiment shifts.

Best Use: Long-term investment horizons, institutional portfolios.

Quantitative Models

Definition: Statistical and mathematical frameworks applied to market data to identify patterns, predict returns, or optimize portfolios.

Examples:

Factor Models: Value, momentum, quality, size, low volatility.

Machine Learning Models: Predictive analytics using large datasets.

Risk Models: Stress-testing portfolios under different market conditions.

Strengths: Handles large datasets; reduces human bias.

Weaknesses: Vulnerable to overfitting or regime changes.

Best Use: Hedge funds, high-frequency or systematic strategies.

Comparing Two Major Evaluation Strategies

Aspect Fundamental Approach Quantitative Approach

Cost Higher manpower (analysts, sector experts) Higher infrastructure (data, computing power)

Time to Insights Slower, manual research Faster, automated signals

Risk Bias from subjective judgment Overfitting, model drift

Scalability Limited to analyst coverage Easily scales across thousands of stocks

Best Fit Long-term institutional investors Hedge funds, systematic traders

Recommendation: A hybrid strategy is increasingly common—fundamental analysis validates signals from quantitative screens, ensuring both depth and breadth.

Key Tools and Techniques

DCF Models (Discounted Cash Flow) for intrinsic valuation.

Comparables (P/E, EV/EBITDA multiples) for relative valuation.

Scenario & Sensitivity Analysis for uncertainty handling.

Alternative Data (satellite imagery, web traffic, credit card spending).

Portfolio Optimizers to manage exposure and maximize Sharpe ratios.

Modern Trends in Buy Side Stock Evaluation

ESG Integration

Analysts now integrate Environmental, Social, and Governance (ESG) factors into valuations, as institutional investors increasingly demand sustainable strategies.

AI and Machine Learning

Natural Language Processing (NLP) tools analyze earnings call transcripts, news sentiment, and social media for real-time market insights.

Alternative Data Sets

Buy side analysts increasingly use satellite data, geolocation, and supply chain insights to anticipate earnings surprises.

Case Studies

Case 1: Value Strategy in a Growth Market

A buy side firm overweighted value stocks during a growth rally, underperforming peers. This highlights the risk of single-style dependence and the need for multi-factor diversification.

Case 2: Machine Learning Model Success

A hedge fund used NLP sentiment models on earnings calls to predict post-earnings drift, generating alpha over two quarters. However, accuracy decayed as compe*****s adopted similar methods.

Where to Learn Buy Side Strategies

For aspiring professionals, building expertise requires structured learning and practical exposure. Online platforms, CFA programs, and buy side research methods for analysts courses are key starting points.

A useful complement is understanding where to learn buy side quantitative strategies, which provide exposure to data-driven investment approaches. Combining both domains equips analysts to operate effectively in hybrid environments.

Best Practices for Analysts

Cross-Validate Models – never rely on a single approach.

Maintain Objectivity – separate research from trading execution pressures.

Stay Updated – regulatory changes, sector disruptions, and macro shifts all matter.

Communicate Clearly – portfolio managers value concise, actionable insights.

Continuous Learning – evolve skills across quant, fundamental, and ESG dimensions.

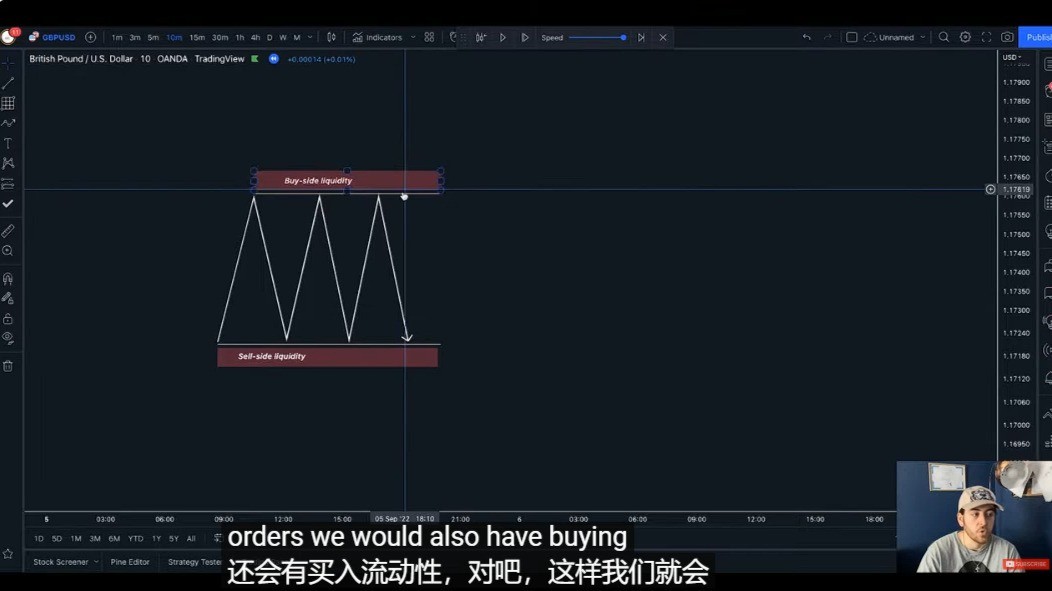

Visual Insights

The workflow combines data gathering, valuation modeling, risk analysis, and portfolio integration.

Fundamental methods provide depth, while quantitative approaches provide breadth and speed.

AI and machine learning enhance stock evaluation by analyzing vast alternative datasets.

FAQ

- What’s the difference between buy side and sell side analysts?

Sell-side analysts publish research for external clients, often with a marketing angle. Buy side analysts conduct confidential, in-house research to make direct investment decisions for funds. Their focus is execution and alpha generation, not broad distribution.

- Which evaluation method is most effective for buy side analysts?

Neither fundamental nor quantitative methods alone are universally superior. The most effective approach is a hybrid model: quantitative screens for opportunity discovery, followed by fundamental validation to assess long-term viability.

- How do buy side analysts use alternative data?

Buy side analysts increasingly integrate alternative data such as web traffic, credit card transactions, and satellite imagery to detect business trends before quarterly reports. These insights provide an informational edge but require careful validation to avoid false signals.

Conclusion

Buy side analysts play a critical role in shaping portfolio performance through rigorous stock evaluation. By blending fundamental research, quantitative analysis, and alternative data, they help firms achieve superior risk-adjusted returns.

For professionals and aspiring analysts, mastering both traditional and modern methods—and knowing when to apply them—is essential for success.

If you found this guide useful, share it with colleagues or leave a comment with your perspective. Do you think AI-driven quant models will eventually replace traditional fundamental research? Let’s discuss.

0 Comments

Leave a Comment