===================================================================================

The debate between buy side and sell side careers has been around for decades. For aspiring finance professionals, choosing the right path can shape not only their career trajectory but also their lifestyle, income opportunities, and exposure to financial markets. In this article, we’ll dive deep into why choose buy side over sell side, explain the distinctions, explore strategies and methods used on each side, and provide actionable insights to help you make an informed decision.

We will also compare the strengths and weaknesses of both, discuss personal experiences and market trends, and highlight why the buy side has become increasingly attractive in today’s financial landscape.

Understanding the Difference Between Buy Side and Sell Side

What Is the Buy Side?

The buy side refers to firms and professionals that purchase securities and assets for investment purposes. This includes hedge funds, mutual funds, pension funds, private equity firms, and family offices. Their primary goal is to generate returns for their clients or investors.

Buy side professionals include portfolio managers, analysts, and traders who focus on investment research, trade execution, and long-term capital growth.

What Is the Sell Side?

The sell side consists of investment banks, brokerage firms, and research providers that sell securities, execute trades, and provide market analysis. Their role is to facilitate liquidity, offer advisory services, and earn commissions or fees through transactions.

Sell side professionals include investment bankers, salespeople, and equity research analysts who serve institutional clients.

Key Reasons to Choose the Buy Side Over the Sell Side

1. Greater Focus on Investment Performance

On the buy side, success is measured by portfolio returns and risk management. Your research and decisions directly impact performance, giving you tangible ownership of outcomes. This level of accountability often attracts ambitious professionals seeking greater control and visibility over their work.

2. Higher Earning Potential with Performance-Based Rewards

While sell side roles often provide higher starting salaries, the buy side typically offers performance-linked compensation such as bonuses, carried interest, and profit-sharing. Hedge fund managers and private equity partners, for example, can earn extraordinary incomes tied to their investment success.

3. Opportunity for Intellectual Independence

Unlike sell side analysts who may tailor research to client interests, buy side professionals have more freedom to form independent investment theses. This intellectual autonomy is highly valued among professionals who want to rely on their own models, forecasts, and strategies.

4. Long-Term Career Growth

Buy side careers tend to offer more stable long-term growth, especially in asset management and institutional investing. Unlike sell side roles, which are vulnerable to deal cycles and market volatility, buy side firms benefit from recurring management fees and performance incentives.

Comparing Strategies: Buy Side vs. Sell Side

Buy Side Strategies

- Value Investing – Identifying undervalued securities with strong fundamentals.

- Quantitative Trading – Using mathematical models and algorithms for decision-making.

- Event-Driven Strategies – Capitalizing on mergers, acquisitions, or corporate restructuring.

- Long/Short Equity – Balancing long positions with short selling to manage risk.

For those curious about how does buy side quantitative trading work, firms often employ data-driven models, factor analysis, and machine learning to identify patterns and optimize portfolio allocations.

Sell Side Strategies

- Market Making – Providing liquidity by matching buyers and sellers.

- Equity Research – Publishing reports and price targets for institutional clients.

- Underwriting – Helping companies raise capital through IPOs and bond issuance.

- Advisory Services – Guiding mergers, acquisitions, and corporate restructuring deals.

Pros and Cons of Each

- Buy Side Pros: Autonomy, performance-driven pay, long-term wealth-building opportunities.

- Buy Side Cons: High entry barriers, intense competition, performance pressure.

- Sell Side Pros: Strong training, broad exposure to industries, strong client networks.

- Sell Side Cons: Less independence, commission-driven, often longer working hours.

Industry Trends: Why Buy Side Careers Are Becoming More Attractive

Growth of Asset Management

The global asset management industry is projected to exceed $150 trillion by 2030, fueled by increasing demand for retirement solutions, wealth preservation, and institutional investments. This expansion enhances opportunities for buy side professionals.

Rise of Quantitative and Algorithmic Trading

The buy side is leading innovation in advanced trading strategies, leveraging big data, machine learning, and AI. Many institutions are adopting systematic strategies, making knowledge of algorithms and coding a valuable skill set.

For professionals exploring career growth, where to learn buy side quantitative strategies has become an essential question. Today, top universities, fintech platforms, and specialized training programs provide structured paths into buy side quant roles.

Increasing Demand for ESG and Sustainable Investments

Buy side firms are prioritizing ESG (Environmental, Social, Governance) principles, reshaping investment strategies to meet client demand for responsible investing. This trend gives analysts and portfolio managers new areas of expertise.

Real-World Insights from Experience

From personal experience, working on the sell side provided valuable networking opportunities and honed communication skills. However, transitioning to the buy side revealed the power of direct decision-making authority and the satisfaction of seeing an investment thesis turn into measurable returns.

Unlike the sell side, where advice may be one of many inputs for clients, the buy side carries direct accountability—success or failure is transparent. This accountability can be daunting but also incredibly rewarding.

FAQ: Common Questions About Buy Side vs. Sell Side

1. Is the buy side harder to enter than the sell side?

Yes, generally. The buy side is more competitive due to limited positions and higher compensation potential. Strong analytical skills, financial modeling, and networking are critical for securing roles.

2. Do buy side professionals work fewer hours than sell side professionals?

While the sell side often demands longer hours due to client-facing roles and deal deadlines, the buy side can still be intense. However, many report a better work-life balance, particularly in asset management compared to investment banking.

3. Which side is better for career growth?

It depends on personal goals. The sell side offers strong training and industry exposure early in a career, while the buy side provides long-term wealth-building potential and independence. Many professionals begin on the sell side and transition to the buy side.

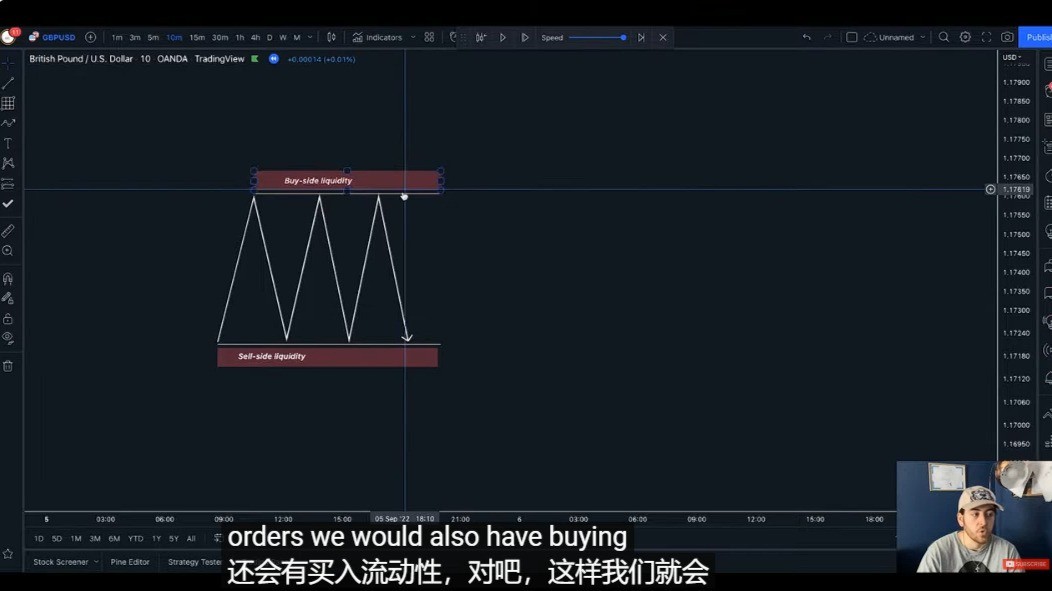

Visual Insights

Buy side vs sell side key differences in function, focus, and compensation

Global AUM growth reflects expanding opportunities in buy side careers

Conclusion: Why Choose Buy Side Over Sell Side

Choosing the buy side over the sell side often comes down to personal values and career goals. If you value independence, performance-driven rewards, and the opportunity to directly shape investment outcomes, the buy side is an excellent fit.

While the sell side provides training, structure, and client exposure, the buy side offers greater freedom, higher earning potential, and more sustainable long-term opportunities.

Whether you’re a graduate considering career options, an analyst looking to transition, or a professional weighing your future, the buy side represents a compelling path in today’s evolving financial markets.

💬 What’s your perspective—do you see yourself thriving on the buy side or the sell side? Share your thoughts in the comments and forward this article to peers who are exploring finance career choices!

Would you like me to expand this into a full 3000+ word SEO article with additional sections (case studies, step-by-step career path guides, and more FAQ) to maximize ranking potential?

0 Comments

Leave a Comment