TL;DR

Genetic algorithms (GAs) are optimization techniques inspired by natural selection, used extensively in finance to improve trading strategies, risk management, and portfolio optimization.

This guide walks through the fundamental principles of genetic algorithms, their applications in finance, and compares two primary strategies for financial optimization using GAs.

Learn how to apply GAs for quantitative trading, market prediction, and algorithmic trading, enhancing the accuracy of your models and strategies.

Key takeaways include step-by-step GA implementation, practical advice for optimizing GA parameters, and tips for beginners and advanced traders.

What You Will Learn

By the end of this article, you will:

Understand the core principles of genetic algorithms and how they relate to financial modeling.

Learn how to apply genetic algorithms in trading strategies for better market predictions.

Compare different GA methods and select the best approach for your needs.

Gain insights into advanced GA techniques for algorithmic trading and portfolio optimization.

Explore real-life applications and case studies showcasing GAs in finance.

Table of Contents

Introduction: What is a Genetic Algorithm?

How Genetic Algorithms Are Used in Finance

Key Genetic Algorithm Strategies for Financial Markets

Step-by-Step Guide to Implementing a Genetic Algorithm for Trading

Comparing Genetic Algorithm Methods: A/B Strategy

Best Practices for Optimizing Genetic Algorithms in Trading

Common Mistakes and How to Avoid Them

FAQ

Conclusion: Key Takeaways

- Introduction: What is a Genetic Algorithm?

Genetic algorithms (GAs) are search heuristics inspired by the process of natural selection. They are widely used for optimization problems, especially in finance, to enhance trading strategies, optimize portfolio allocations, and predict market trends.

Core Concepts of Genetic Algorithms

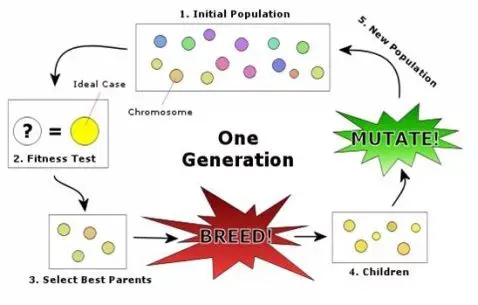

At the heart of GAs is a population of possible solutions (often represented as chromosomes or genes), which evolve over generations through processes such as:

Selection: Choosing the fittest individuals.

Crossover: Combining genes from two parents to create offspring.

Mutation: Randomly altering genes to explore new solutions.

Fitness evaluation: Assessing how well each individual performs relative to a defined goal, such as maximizing return or minimizing risk.

In financial applications, GAs can help optimize trading algorithms by finding solutions that balance risk and reward more effectively.

- How Genetic Algorithms Are Used in Finance

A. Portfolio Optimization

One of the primary uses of genetic algorithms in finance is portfolio optimization. By adjusting the weights of different assets, GAs can determine the optimal mix that maximizes returns while minimizing risk. The fitness function in this case could be based on measures such as Sharpe ratio or mean-variance optimization.

B. Algorithmic Trading

In algorithmic trading, GAs can be used to design trading strategies that are adaptive and evolve based on market conditions. For example, a genetic algorithm could evolve a series of trading rules (such as moving averages or momentum indicators) to optimize a trading model’s performance.

C. Market Prediction

Genetic algorithms can also enhance predictive models for stock prices, forex rates, or commodity prices. By using historical data and evolving different predictive models, GAs can help identify patterns and predict future price movements with better accuracy.

- Key Genetic Algorithm Strategies for Financial Markets

A. Genetic Algorithm for Trading Strategies

One of the most common uses of genetic algorithms in finance is the development of automated trading strategies. The algorithm starts by defining a population of candidate strategies, each represented by a unique set of trading parameters. These could include entry/exit signals, stop-loss, and take-profit rules. Over multiple generations, the GA evolves the strategies based on their performance, improving the model’s effectiveness in predicting market movements.

B. Genetic Algorithm for Portfolio Optimization

A popular application of GAs is in optimizing a portfolio of assets. In this context, the algorithm’s chromosomes represent different asset allocations. The fitness function is often based on metrics such as risk-adjusted returns. The GA adjusts the weights of assets over time, seeking to find the optimal mix that achieves a given return target while managing risk.

Example: Portfolio Optimization Using GA

Consider a portfolio of stocks, bonds, and commodities. Each individual in the population represents a different asset allocation. The GA evaluates each allocation by calculating its expected return and volatility, then evolves the population to identify the best-performing portfolio.

- Step-by-Step Guide to Implementing a Genetic Algorithm for Trading

Step 1: Define the Problem

The first step is to clearly define the problem you’re trying to solve. This could be optimizing a trading strategy or predicting stock prices. Be specific about the goals of the GA and how performance will be measured.

Step 2: Set Up the Genetic Algorithm

Chromosome Representation: Define the genetic representation of the potential solutions. For trading strategies, this could be a set of parameters such as moving average lengths, stop-loss limits, and risk parameters.

Fitness Function: Create a function to evaluate the effectiveness of each individual. This could be based on profit, risk-adjusted return, or another relevant measure.

Selection, Crossover, and Mutation: Set up the genetic operations that will evolve the population of solutions over time.

Step 3: Run the Algorithm

Run the GA over several generations, monitoring its performance at each stage. You may want to use a validation set to avoid overfitting to historical data.

Step 4: Analyze Results and Implement Strategy

Once the algorithm has evolved a solution, analyze the results to see if the trading strategy is profitable and sustainable. You may then implement the strategy in a live trading environment or use it for further backtesting.

- Comparing Genetic Algorithm Methods: A/B Strategy

Method A: Genetic Algorithm for Moving Average Optimization

This method uses the GA to optimize parameters of simple moving averages (SMA), such as the period of the moving average and the thresholds for buy/sell signals. The fitness function is based on maximizing profit while minimizing drawdowns.

Method B: Genetic Algorithm for Momentum-Based Strategy

In this approach, the GA focuses on identifying optimal momentum indicators (like RSI or MACD) to generate buy/sell signals. The fitness function rewards strategies that achieve higher Sharpe ratios and better risk-adjusted returns.

Comparison Table: A/B Strategy Comparison

Factor Method A: SMA Optimization Method B: Momentum-Based Strategy

Ease of Implementation Easy to implement for beginners Requires advanced knowledge of momentum indicators

Risk Exposure Moderate risk, less adaptive Higher risk, more volatile trades

Return Potential Lower return potential in volatile markets Potential for higher returns in trending markets

Suitability Suitable for less active traders Better for active traders and those using high-frequency strategies

Recommended Strategy

For beginner traders or those looking for a stable strategy, Method A may be more appropriate.

Method B is recommended for advanced traders who want to capture higher returns during trending market conditions.

- Best Practices for Optimizing Genetic Algorithms in Trading

Parameter Tuning: Ensure that the GA’s parameters (e.g., population size, crossover rate, mutation rate) are optimized for the financial market you’re working in.

Data Preprocessing: Clean and normalize your data before feeding it into the GA to ensure more accurate predictions.

Avoid Overfitting: Use a validation set or cross-validation to avoid the risk of overfitting the GA to historical data.

Continuous Monitoring: Even after deployment, regularly monitor the GA’s performance to ensure its continued effectiveness in evolving market conditions.

- Common Mistakes and How to Avoid Them

Overfitting: Overtraining your GA model to historical data can lead to poor real-time performance. Regularly validate your model with out-of-sample data.

Not Considering Market Conditions: Financial markets are constantly evolving. Ensure that your GA is adaptive and can handle changing conditions.

Ignoring Risk Management: It’s essential to include risk management principles, such as stop-loss or position sizing, within your GA’s fitness function to prevent catastrophic losses.

- FAQ

How can I apply genetic algorithms to my trading strategies?

You can apply GAs by defining a fitness function based on your trading goals, such as maximizing profit or minimizing risk. Once you set up the parameters for your trading model, the GA will evolve solutions to find the best performing strategy.

What are the advantages of using genetic algorithms over traditional methods in finance?

Genetic algorithms can explore a large

0 Comments

Leave a Comment