============================================================

In the world of quantitative trading, data is the cornerstone of strategy development, backtesting, and execution. The Bloomberg Terminal is one of the most powerful and widely used tools for financial professionals, providing comprehensive data and analytical capabilities. For quantitative traders, the terminal’s extensive datasets and analytical tools offer invaluable insights into market behavior, financial instruments, and trading patterns. In this article, we’ll explore the types of data provided by the Bloomberg Terminal and how they can be leveraged in quantitative trading strategies.

What is Bloomberg Terminal?

The Bloomberg Terminal is a sophisticated platform used by financial professionals worldwide to access real-time financial data, news, and analytics. It provides tools for trading, financial analysis, market research, and portfolio management. Known for its extensive data offerings, the Bloomberg Terminal helps traders, analysts, and investors make informed decisions in real-time.

Types of Data Provided by Bloomberg Terminal for Quantitative Trading

For quantitative traders, the Bloomberg Terminal offers a variety of data that is essential for building, testing, and executing trading algorithms. Below are the key types of data available:

1. Market Data and Price Feeds

Market data is critical for quantitative trading as it provides real-time and historical information about financial instruments. Bloomberg Terminal offers comprehensive price feeds for equities, commodities, fixed-income securities, derivatives, forex, and cryptocurrencies.

Key Data Points:

- Real-time price quotes

- Bid/ask spreads

- Volume data

- Open/close prices

- Historical price data (spanning from minutes to decades)

This data is crucial for backtesting strategies, analyzing volatility, and detecting market trends.

2. Fundamental Data

For traders focusing on fundamental analysis or incorporating fundamental factors into their quantitative models, Bloomberg Terminal offers a wealth of financial statement data, earnings reports, and company filings.

Key Data Points:

- Income statements

- Balance sheets

- Cash flow statements

- Earnings reports

- Ratios (PE ratio, debt/equity ratio, etc.)

This data is essential for constructing models that rely on fundamental analysis and for evaluating companies’ financial health.

3. Economic Indicators and Macroeconomic Data

Macroeconomic data plays a significant role in quantitative trading strategies, especially for those focused on global macro or event-driven strategies. Bloomberg Terminal provides access to a wide range of economic indicators, including GDP growth rates, inflation, unemployment figures, and interest rates.

Key Data Points:

- Interest rates (Fed, ECB, etc.)

- Inflation data

- GDP reports

- Employment statistics

- Consumer sentiment indicators

These indicators help in the development of macro-driven trading models and are often used to forecast market moves in response to changes in the global economy.

4. Alternative Data

Alternative data refers to unconventional data sources that provide unique insights into market behavior. Bloomberg Terminal has access to a wide range of alternative datasets that can be used to develop alpha-generating strategies.

Key Data Points:

- Social media sentiment analysis

- Satellite imagery (for monitoring commodities)

- Credit card transaction data

- Web scraping data

- News sentiment analysis

These datasets can help quantitative traders discover hidden trends or signal potential market-moving events that traditional data might overlook.

5. Derivatives and Fixed Income Data

For derivatives traders or those incorporating options, futures, and fixed-income securities into their strategies, Bloomberg Terminal provides detailed data on these financial instruments.

Key Data Points:

- Option prices and implied volatility

- Futures contracts and pricing

- Fixed-income securities data

- Swap rates and credit default swaps (CDS) data

These data are crucial for creating derivatives pricing models and for managing risks in portfolios that involve options and futures.

6. News and Sentiment Analysis

The Bloomberg Terminal integrates real-time news feeds and sentiment analysis tools that can influence market movements. News data is often used by quantitative traders to identify market events, such as corporate earnings announcements, mergers, acquisitions, and economic policy changes, which can be incorporated into predictive models.

Key Data Points:

- Real-time news feeds

- Corporate announcements

- Economic policy changes

- Sentiment analysis tools

These features can be integrated into algorithmic strategies that rely on event-driven trading.

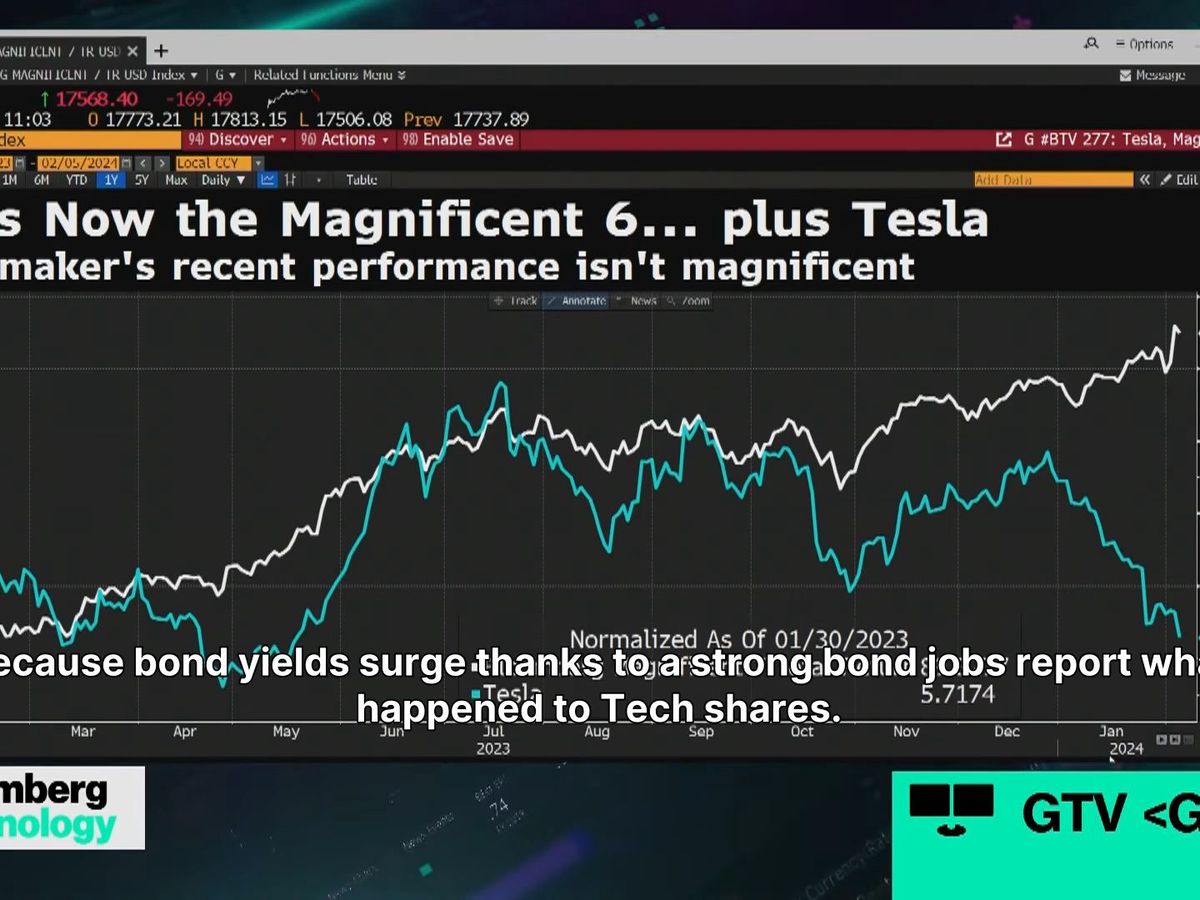

7. Market Analytics and Technical Indicators

For technical traders or quants who rely on technical analysis, the Bloomberg Terminal offers a wide range of market analytics and technical indicators that help with trend identification, pattern recognition, and momentum analysis.

Key Data Points:

- Moving averages

- RSI (Relative Strength Index)

- MACD (Moving Average Convergence Divergence)

- Bollinger Bands

- Charting tools and overlays

These technical indicators are used for developing algorithmic trading strategies that focus on price action, volatility, and trend-following techniques.

How Can Quantitative Traders Use Bloomberg Terminal Data?

1. Backtesting Strategies

Quantitative traders can use historical price and fundamental data from Bloomberg Terminal to backtest their strategies. By simulating trades based on historical data, traders can evaluate the performance of their strategies under various market conditions.

Pros:

- Reliable data for accurate backtesting.

- Access to vast datasets for thorough strategy validation.

Cons:

- Historical data limitations in certain timeframes.

2. Building Predictive Models

With Bloomberg Terminal’s access to macroeconomic indicators, alternative data, and sentiment analysis, traders can create predictive models that anticipate price movements or identify trading opportunities before they materialize.

Pros:

- Advanced analytics to improve model predictions.

- Access to alternative data for unique trading insights.

Cons:

- Requires expert knowledge in quantitative modeling and data science.

3. Real-Time Data for Algorithmic Trading

Bloomberg Terminal’s real-time data feeds can be integrated into algorithmic trading systems to execute trades automatically based on predefined criteria. This ensures that traders can act on market opportunities instantly, without manual intervention.

Pros:

- Instantaneous market data for fast execution.

- Reduced human error in trading decisions.

Cons:

- Dependency on stable internet connection and hardware.

FAQ: Common Questions on Bloomberg Terminal for Quantitative Trading

1. Why use Bloomberg Terminal in quantitative trading?

Bloomberg Terminal offers comprehensive data, analytics, and news feeds, making it a valuable tool for quantitative traders. Its real-time market data and advanced analytics provide traders with the insights needed to develop and test complex trading algorithms.

2. How does Bloomberg Terminal enhance trading algorithms?

Bloomberg Terminal enhances trading algorithms by providing rich datasets, including historical prices, economic indicators, and alternative data. Traders can use this data to refine their algorithms, backtest strategies, and optimize execution.

3. Can Bloomberg Terminal be used for automated trading?

Yes, Bloomberg Terminal can integrate with automated trading systems through its API, allowing quantitative traders to implement real-time trading strategies based on the data and analysis available on the platform.

Conclusion

The Bloomberg Terminal is an indispensable tool for quantitative traders who rely on accurate, timely data to make informed decisions. With its vast range of market data, fundamental analysis, macroeconomic indicators, and advanced analytics, the terminal empowers traders to develop robust trading algorithms, backtest strategies, and execute trades effectively. By leveraging the Bloomberg Terminal’s data in their trading strategies, quants can gain a significant edge in the competitive world of quantitative trading.

For more information on integrating Bloomberg Terminal with quantitative trading or exploring advanced data analysis tools, check out the following resources: How to integrate Bloomberg Terminal with quantitative trading and Bloomberg Terminal for quantitative analysis.

0 Comments

Leave a Comment