Order book analysis is a powerful technique in trading that provides deep insights into market sentiment, price trends, and liquidity. Whether you’re a beginner or an experienced trader, understanding how to interpret the order book effectively can significantly enhance your decision-making process and trading strategy. This comprehensive guide explores the best effective order book analysis techniques, their practical applications, and how you can use them to gain an edge in the market.

TL;DR

Order book analysis provides critical insights into market depth, liquidity, and price movements by showing live buy and sell orders.

Key techniques include market depth analysis, liquidity analysis, and order flow monitoring.

Proactive and reactive strategies are often used to predict price movements based on the data in the order book.

Tools like TradingView, Bookmap, and specialized platforms enhance order book analysis.

Using order book data with algorithmic trading systems can further refine decision-making and backtesting.

Table of Contents

What Is an Order Book and Why It Matters

Key Techniques for Order Book Analysis

Market Depth Analysis

Liquidity Analysis

Order Flow Monitoring

How to Interpret Order Book Signals Effectively

Advanced Order Book Techniques for Seasoned Traders

How Order Book Analysis Enhances Trading Decisions

Best Tools for Order Book Analysis

Order Book Strategies for Quantitative Traders

FAQ

Conclusion and Best Practices

What Is an Order Book and Why It Matters

An order book is a real-time list of all buy and sell orders placed by market participants for a particular financial instrument, such as stocks or cryptocurrencies. It shows the price levels and the amount of each asset being bought or sold at that level. The data typically includes:

Bid Orders: Buyers willing to purchase the asset at a specific price.

Ask Orders: Sellers willing to sell at a certain price.

Order Book Depth: The amount of buy and sell orders at each price level.

Why Use Order Book Data?

Market Sentiment: The order book can provide insights into the psychology of traders. Large orders at certain price levels may indicate strong support or resistance.

Liquidity: The number of orders at various price levels reflects market liquidity, which impacts how easily trades can be executed without significant price slippage.

Price Action Prediction: By analyzing the dynamics of orders coming in and out of the book, traders can predict future price movements.

Key Techniques for Order Book Analysis

Market Depth Analysis

Market depth refers to the volume of orders at each price level in the order book. Analyzing market depth helps traders understand the liquidity of a market and how much pressure is needed to move the price.

How to Analyze Market Depth:

Look at the Spread: The spread between the highest bid and the lowest ask is a primary indicator of liquidity. A narrow spread often indicates a more liquid market.

Monitor Large Orders: Large buy or sell orders at certain price levels can act as support or resistance.

Depth Ratio: The ratio between the buy and sell orders at different price levels can show whether the market is skewed in favor of buyers or sellers.

Liquidity Analysis

Liquidity analysis involves examining the amount of trading volume at different price levels. High liquidity typically means less price slippage, while low liquidity can cause rapid price changes and erratic movements.

Key Liquidity Signals:

Absence of Orders: Gaps in the order book with no orders can lead to high volatility when price action approaches these gaps.

Order Imbalance: A market with many more buy orders than sell orders (or vice versa) may indicate a trend toward upward or downward price movement.

Order Book Balance: A balanced order book suggests neutral market sentiment, while an imbalance may hint at an impending price breakout or reversal.

Order Flow Monitoring

Order flow refers to the sequence of orders being placed, modified, and canceled in the order book. By monitoring this, traders can gain a sense of buying pressure or selling pressure and understand potential future price movements.

Techniques for Effective Order Flow Monitoring:

Monitor Order Cancellations: If large orders are canceled without being filled, it may indicate a lack of conviction in the current price levels.

Look for Accumulation: If large buy orders accumulate at a certain price, it suggests buying interest and could indicate a potential upward move.

How to Interpret Order Book Signals Effectively

Effective order book interpretation requires recognizing specific signals that predict market moves. Here are a few key signals to watch:

Support and Resistance Levels

Support: A large number of buy orders at a certain price level may act as support, meaning the price is unlikely to fall below this level.

Resistance: Conversely, large sell orders at a price level may act as resistance, preventing the price from moving higher.

Whale Moves

Whale Orders: Large, institutional orders can have a significant impact on market price. Monitoring these can give you an early indication of a market move.

Spoofing: Be wary of spoofing tactics where large orders are placed with the intent to manipulate market perception and then canceled before execution.

Imbalance in Orders

A high imbalance between buy and sell orders can signal a breakout. For instance, if there are far more buy orders than sell orders, it may indicate bullish sentiment and an impending price increase.

Advanced Order Book Techniques for Seasoned Traders

For advanced traders, effective order book analysis goes beyond just observing the bid/ask spread and order volumes. Here are some techniques used by professionals:

Volume-Weighted Average Price (VWAP)

VWAP is an average price that reflects the volume of trades executed throughout the day. By comparing the VWAP with the current price, traders can determine whether the asset is overbought or oversold.

Time and Sales Data

Time and sales data shows the actual executed trades, as opposed to just the orders on the book. This data can help traders gauge the strength of a move. A large number of trades executed above the ask price suggests strong buying pressure, while trades below the bid price indicate strong selling pressure.

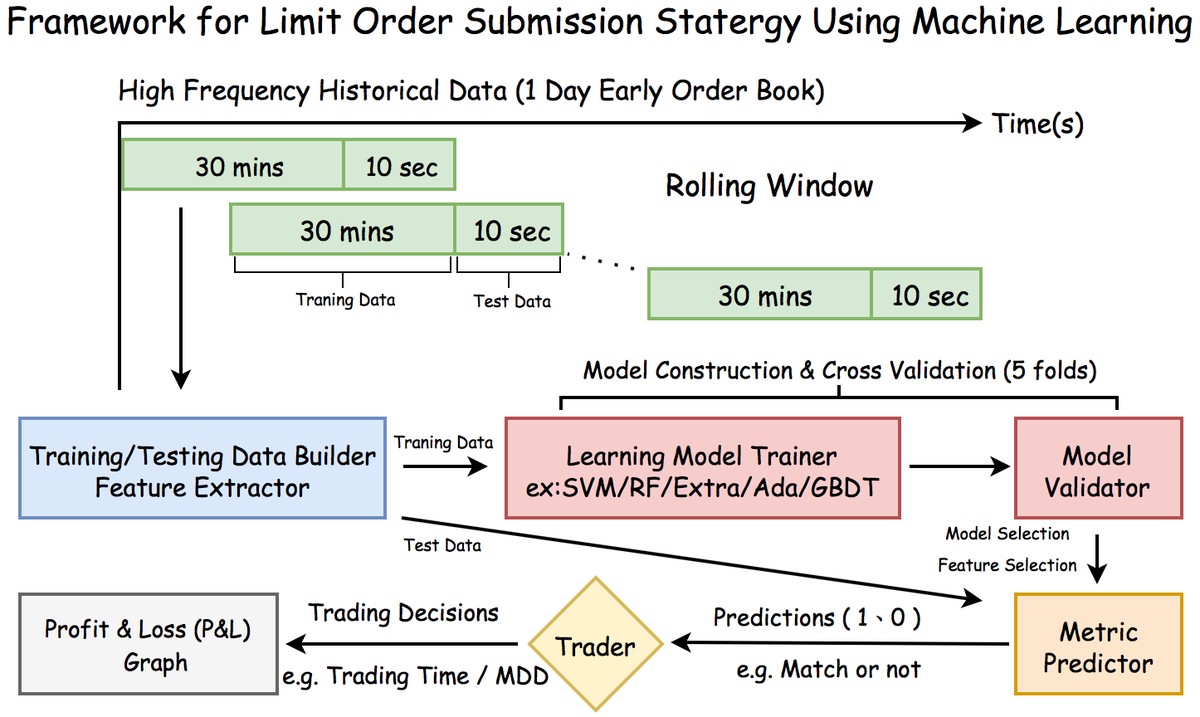

High-Frequency Order Book Analysis

High-frequency trading (HFT) relies heavily on ultra-fast order book data to make split-second decisions. While this type of analysis is often reserved for institutional traders, understanding the underlying principles can still provide insights for retail traders.

How Order Book Analysis Enhances Trading Decisions

Order book analysis can improve trading decisions by providing critical information about market sentiment, liquidity, and potential price moves. Here’s how it enhances your trading strategy:

Real-time Decision Making: It allows you to make informed decisions in real-time based on market depth and liquidity.

Predicting Short-Term Price Movements: By understanding how orders are flowing, you can predict short-term price movements before they happen.

Minimizing Slippage: By knowing where the liquidity is concentrated, you can place orders that are less likely to experience slippage.

Best Tools for Order Book Analysis

To implement effective order book analysis, you’ll need the right tools. Below are some of the best platforms and software to help you analyze the order book efficiently:

Bookmap: A professional tool for visualizing order flow and liquidity.

TradingView: While mainly used for charting, TradingView also offers order book integration through its various broker connections.

QuantConnect: This platform integrates order book data with algorithmic trading strategies.

3Commas: A trading bot and algorithmic trading platform that also utilizes order book data.

Sierra Chart: A comprehensive trading platform with real-time order book data integration.

How to Integrate Order Book Data with Trading Algorithms

Integrating order book data into algorithms can enhance trade execution. By using the data for market impact modeling or order routing, you can improve your strategy’s performance.

Order Book Strategies for Quantitative Traders

For quantitative traders, leveraging order book data for automated strategies is crucial. Here are some effective strategies:

Liquidity-Based Trading: Create algorithms that react to liquidity changes, such as sudden shifts in the bid/ask spread or a large imbalance between buy and sell orders.

Market Depth Forecasting: Predict price movements based on shifts in market depth. For instance, if a large buy order enters the book, your algorithm could prepare for an upward price movement.

Order Flow Algorithms: These algorithms can identify market manipulation (e.g., spoofing) and react accordingly to avoid being caught in false moves.

FAQ

How do I analyze order book data for cryptocurrency trading?

Analyzing order book data for cryptocurrency trading follows similar principles to traditional markets. Focus on key signals like bid/ask spread, market depth, and the presence of large orders at key price levels. Since crypto markets are more volatile, be sure to account for higher levels of risk and potential price swings.

What is the best strategy for using order book data in trading?

A

0 Comments

Leave a Comment