Comprehensive Guide to Chart Pattern Trading: A Complete Tutorial for Traders

TL;DR (Key Takeaways)

Learn the fundamentals of chart pattern trading and how to recognize key patterns like Head and Shoulders, Triangles, and Double Tops/Bottoms.

Compare two common strategies used in chart pattern trading: traditional manual charting vs. automated chart pattern recognition software.

Understand the risks, benefits, and applications of each method, including a step-by-step guide to setting up your chart pattern trading system.

Access real-world examples, strategies, and visual aids to help you master chart patterns in trading.

Discover common pitfalls and strategies to avoid them in real-time trading environments.

What You Will Gain From This Guide

Master the Basics: Get a deep understanding of chart patterns, what they indicate, and how they form.

Identify Key Patterns: Learn how to recognize and act on popular chart patterns like Head and Shoulders, Flags, and Pennants.

Choose the Best Strategy: Gain clarity on whether manual charting or using automated tools (like chart pattern recognition software) is better for you.

Apply Strategies to Different Markets: Whether you’re a day trader, swing trader, or long-term investor, this guide will help you choose the right approach for your trading style.

Learn from Real Examples: See chart patterns in action with case studies that demonstrate successful trades and the potential mistakes to avoid.

Table of Contents

Introduction to Chart Patterns in Trading

Understanding Key Chart Patterns

Head and Shoulders

Double Top and Bottom

Triangles: Symmetrical, Ascending, and Descending

How to Use Chart Patterns in Trading

Manual Chart Pattern Analysis vs. Automated Chart Pattern Recognition

A: Manual Charting

B: Automated Tools & Software

Case Studies and Real-World Examples

Practical Tips for Chart Pattern Trading

Common Pitfalls to Avoid

Frequently Asked Questions (FAQ)

Conclusion

References

- Introduction to Chart Patterns in Trading

Chart patterns are graphical representations of price movements in financial markets, used by traders to predict future price directions. Whether you’re trading stocks, forex, or cryptocurrencies, recognizing and interpreting these patterns can provide valuable insights into market trends. In this guide, we will delve into the basics of chart pattern trading, focusing on how traders use these patterns for decision-making.

Chart patterns typically reflect shifts in market sentiment. They can indicate continuation or reversal of trends, offering traders actionable signals for entry and exit points. We’ll also explore why chart patterns are critical in quantitative trading strategies, helping traders to make data-driven decisions.

- Understanding Key Chart Patterns

Chart patterns can generally be divided into two types: continuation patterns and reversal patterns. Continuation patterns suggest the current trend will continue, while reversal patterns indicate that a trend might change direction. Here are the most commonly used patterns:

Head and Shoulders

The Head and Shoulders pattern is one of the most reliable reversal patterns, signaling a trend change. It consists of three peaks: a higher peak (head) between two smaller peaks (shoulders). A breakdown below the “neckline” confirms the reversal signal.

Double Top and Bottom

These are classic reversal patterns that form when price action reaches a high or low, retraces, and then revisits the previous high or low before reversing. The Double Top indicates a bearish reversal, while the Double Bottom signals a bullish reversal.

Triangles: Symmetrical, Ascending, and Descending

Triangles are continuation patterns formed by converging trendlines. These can be:

Symmetrical triangles, where the price consolidates into a point, indicating a breakout.

Ascending triangles, generally signaling an upward breakout.

Descending triangles, suggesting a downward breakout.

- How to Use Chart Patterns in Trading

Using chart patterns in your trading requires understanding when and how they form, as well as identifying the right moments to act. The typical process involves:

Identifying the Pattern: Look for well-formed patterns on price charts. Patience is key to spotting clear signals.

Confirming the Signal: Once the pattern completes, wait for confirmation of the breakout or breakdown (via volume or price action).

Setting Targets and Stops: Based on the pattern’s size, set realistic profit targets and stop-loss levels to manage risk.

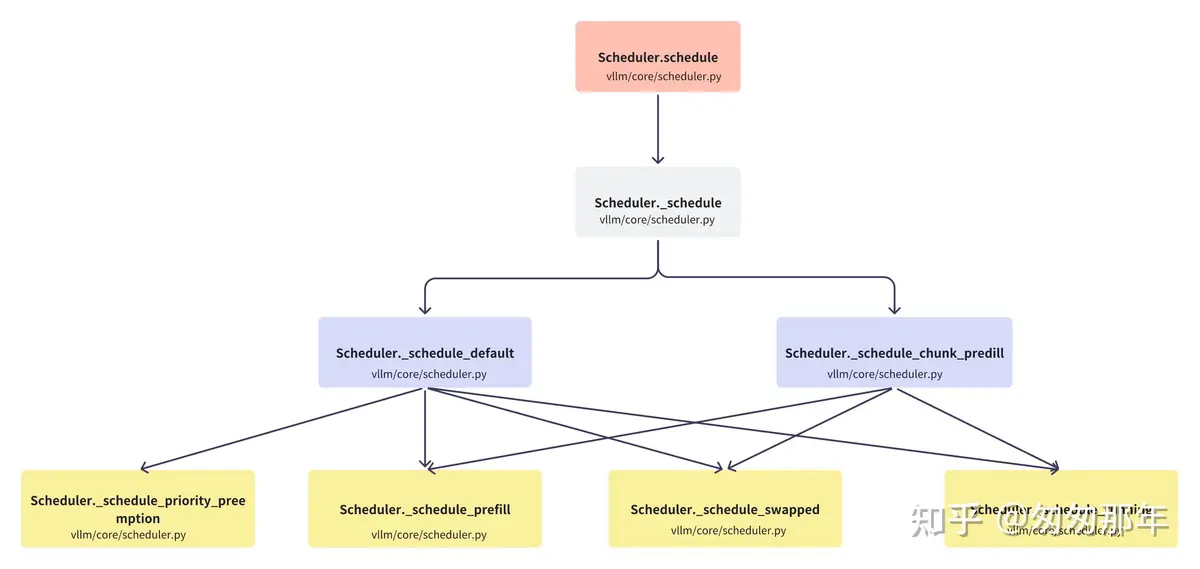

How to Use Chart Patterns in Quantitative Trading

Quantitative traders often employ algorithmic models that incorporate chart pattern recognition. By programming certain rules, these traders can identify and act on patterns without needing manual intervention.

- Manual Chart Pattern Analysis vs. Automated Chart Pattern Recognition

A: Manual Charting

Manual charting involves the traditional method of visually inspecting charts to identify patterns. This method requires:

Experience to recognize patterns in different timeframes.

Patience to wait for the perfect setup.

Subjectivity in interpreting patterns, which can lead to occasional misinterpretation.

Pros:

Flexibility to adapt to different market conditions.

No reliance on software or automated tools.

Cons:

Time-consuming.

Subject to human error and emotion.

B: Automated Chart Pattern Recognition

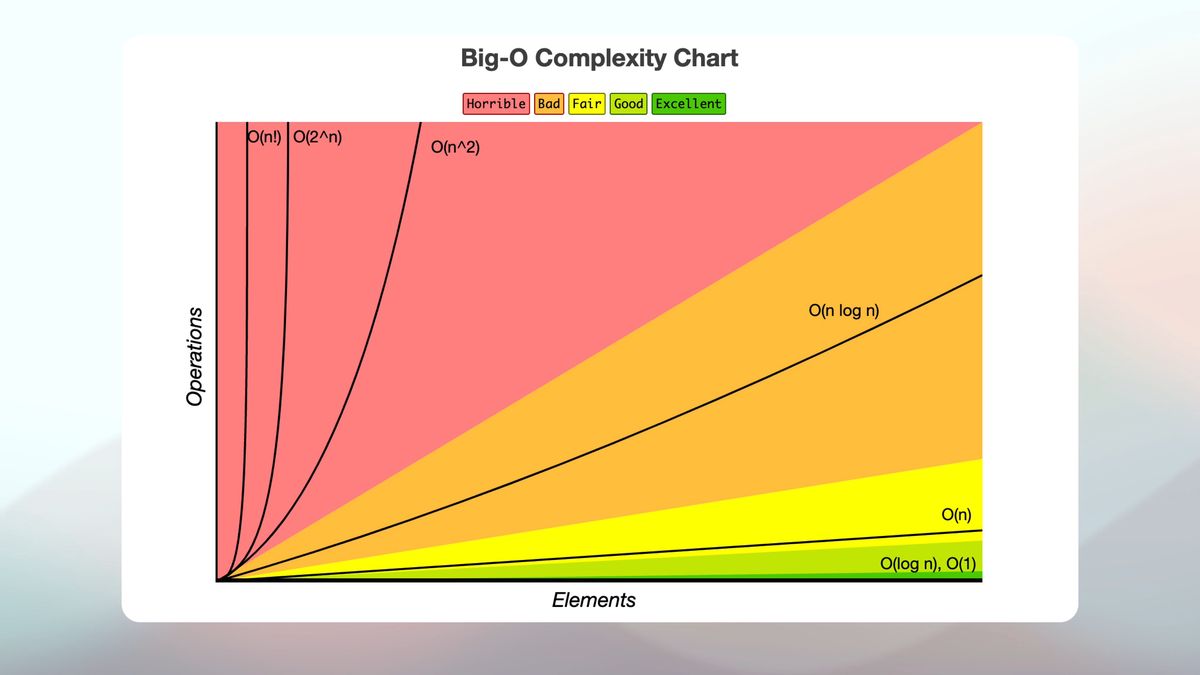

Automated tools use machine learning and algorithmic models to scan large volumes of data and identify chart patterns in real-time.

Pros:

Speed and efficiency in detecting patterns.

Reduction of emotional trading and human error.

Cons:

Potential overfitting in volatile markets.

Requires a learning curve to set up and understand.

Comparison Table:

Feature Manual Charting Automated Recognition Tools

Speed Slow Fast

Complexity Low High

Risk of Error High Low

Initial Setup Easy Complex

Long-Term Viability High, with experience Can be adjusted, but may require maintenance

Conclusion & Recommendations:

For novice traders or those with limited time, automated recognition tools may provide better results. However, for those who enjoy the art of trading and have developed experience, manual charting might feel more intuitive and rewarding.

- Case Studies and Real-World Examples

Example 1: Head and Shoulders in Stock Trading

A popular case where a Head and Shoulders pattern signaled the reversal of an uptrend in a major stock index. The chart showed a clear formation with a breakdown at the neckline, leading to a profitable short trade.

Example 2: Double Bottom in Forex

A Double Bottom in the EUR/USD forex pair, indicating a potential bullish reversal after a significant downtrend. The price broke above the neckline, confirming a long position.

Images and charts can illustrate these patterns effectively.

- Practical Tips for Chart Pattern Trading

Be patient: Wait for the pattern to complete before making any moves.

Confirm with volume: A breakout with high volume is more likely to succeed.

Use multiple timeframes: Patterns on higher timeframes tend to be more reliable.

Risk Management: Always use stop-loss orders to minimize potential losses.

- Common Pitfalls to Avoid

Ignoring the Neckline: In patterns like Head and Shoulders, the neckline is critical for confirming the trend reversal.

Overtrading: Not all chart patterns lead to profitable trades. Avoid forcing trades based on imperfect patterns.

Failing to Set Targets: Without clear profit targets and stop-losses, trades may become emotionally driven.

- Frequently Asked Questions (FAQ)

Q1: Why are chart patterns important in trading?

Chart patterns offer traders insight into market psychology, highlighting potential future movements based on past price action.

Q2: Can chart patterns predict market trends accurately?

While chart patterns are a useful tool, they cannot guarantee outcomes. They should be used in conjunction with other technical indicators for better accuracy.

Q3: How do I learn chart pattern analysis?

There are numerous online resources, including video tutorials, courses, and trading platforms that offer charting tools to help you practice identifying patterns.

- Conclusion

Chart pattern trading is a vital technique for traders seeking to predict market movements. Whether you choose to go manual or use automated tools, understanding these patterns and how to apply them effectively can significantly improve your trading success.

- References

Investopedia · “Chart Patterns in Technical Analysis” · https://www.investopedia.com/terms/c/chart-pattern.asp

· Published: 2023-01-05 · Accessed: 2023-09-17

StockCharts · “Understanding Chart Patterns” · https://www.stockcharts.com

· Published: 2023-02-20 · Accessed:

0 Comments

Leave a Comment