TL;DR

Execution algorithms play a vital role in high-frequency trading (HFT), enabling traders to execute large orders quickly and efficiently.

Understanding the difference between VWAP (Volume Weighted Average Price) and TWAP (Time Weighted Average Price) can significantly impact your trading strategies.

Latency and market impact are key factors in optimizing execution algorithms for high-frequency trading.

Learn how to evaluate and optimize execution algorithms for maximum performance in competitive markets.

What Readers Will Get

In-depth understanding of execution algorithms in high-frequency trading, with a focus on best practices.

Detailed case studies showing how professional traders and institutions implement algorithms.

A clear comparison of two popular execution strategies: VWAP and TWAP, including their pros and cons.

Practical tips on optimizing execution algorithms, reducing latency, and improving trade performance.

Table of Contents

Introduction: What Are Execution Algorithms in High-Frequency Trading?

The Role of Execution Algorithms in High-Frequency Trading

Common Execution Algorithms for High-Frequency Traders

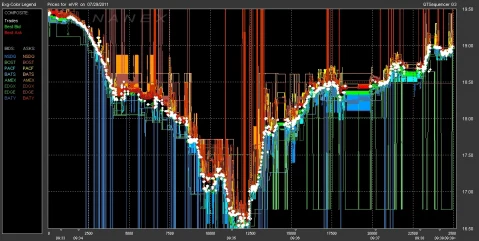

VWAP (Volume Weighted Average Price)

TWAP (Time Weighted Average Price)

Optimizing Execution Algorithms

Reducing Latency

Minimizing Market Impact

Risk Management and Evaluation

Case Studies: Execution Algorithms in Action

Conclusion and Best Practices

FAQ

Introduction: What Are Execution Algorithms in High-Frequency Trading?

Execution algorithms are specialized tools used in high-frequency trading (HFT) to automate the process of placing and managing orders in the financial markets. These algorithms aim to minimize the impact of large trades on market prices while achieving the best possible execution price. In high-frequency environments, where traders need to react to market movements in milliseconds, execution algorithms are critical to achieving optimal performance.

For high-frequency traders, the challenge lies in executing trades quickly, without causing significant market slippage or drawing attention to their positions. Execution algorithms address these issues by optimizing the speed and efficiency of order execution. This section will explore the importance of execution algorithms and provide a deeper understanding of how they function within the context of HFT.

The Role of Execution Algorithms in High-Frequency Trading

Execution algorithms play a key role in high-frequency trading by automating the execution of trades and enhancing liquidity. Their primary objective is to minimize costs associated with large trades and reduce market impact. HFT firms rely on these algorithms to efficiently manage multiple trades across various markets and instruments while ensuring that they can react to price changes almost instantly.

Moreover, execution algorithms help ensure that trades are executed at the best possible price within the available liquidity, which is especially crucial in volatile markets. Traders and algorithm developers often have to account for factors such as:

Slippage: The difference between the expected price and the actual execution price.

Latency: The time it takes for the algorithm to process and place orders.

Market Impact: The effect of large orders on the market price.

To address these challenges, HFT firms deploy different strategies to optimize the performance of their execution algorithms, which we’ll explore in more detail later in this article.

Common Execution Algorithms for High-Frequency Traders

VWAP (Volume Weighted Average Price)

VWAP is one of the most commonly used execution algorithms. It aims to execute a trade at the volume-weighted average price over a specified time period. VWAP is often used by traders who want to execute large orders without significantly affecting the market price.

How VWAP Works:

The algorithm divides the total order into smaller, time-segmented orders based on the historical volume of trades.

It executes trades at the average price of the market, weighted by volume, to minimize market impact.

Pros of VWAP:

Reduced market impact: By trading in line with the overall market volume, VWAP ensures that the trader’s orders do not significantly alter the market.

Easier to implement: VWAP is relatively simple to implement and understand, making it a good option for both professional traders and retail investors.

Cons of VWAP:

Less effective in illiquid markets: In low-volume markets, VWAP may fail to deliver optimal results because of the difficulty in matching order flow with market volume.

Not ideal for all trading strategies: VWAP is most effective for medium-term trades, but may not be the best for short-term strategies like arbitrage or high-frequency arbitrage.

TWAP (Time Weighted Average Price)

TWAP is another widely used execution algorithm, particularly suited for situations where the goal is to execute an order evenly over a specified time period. TWAP does not take into account the volume of trades in the market but focuses solely on time.

How TWAP Works:

The order is broken into equally sized portions, which are executed at regular intervals over the specified time period.

This strategy minimizes the risk of large orders moving the market price.

Pros of TWAP:

Suitable for stable markets: TWAP works well when the market is relatively stable, and there is no significant market-moving event.

Easy to control: Traders can set specific time intervals, offering precise control over how the order is executed.

Cons of TWAP:

Market impact: In fast-moving or illiquid markets, TWAP might lead to increased market impact because it doesn’t adjust for changing volume.

Inefficient in volatile environments: TWAP can be less effective in volatile markets where prices fluctuate rapidly.

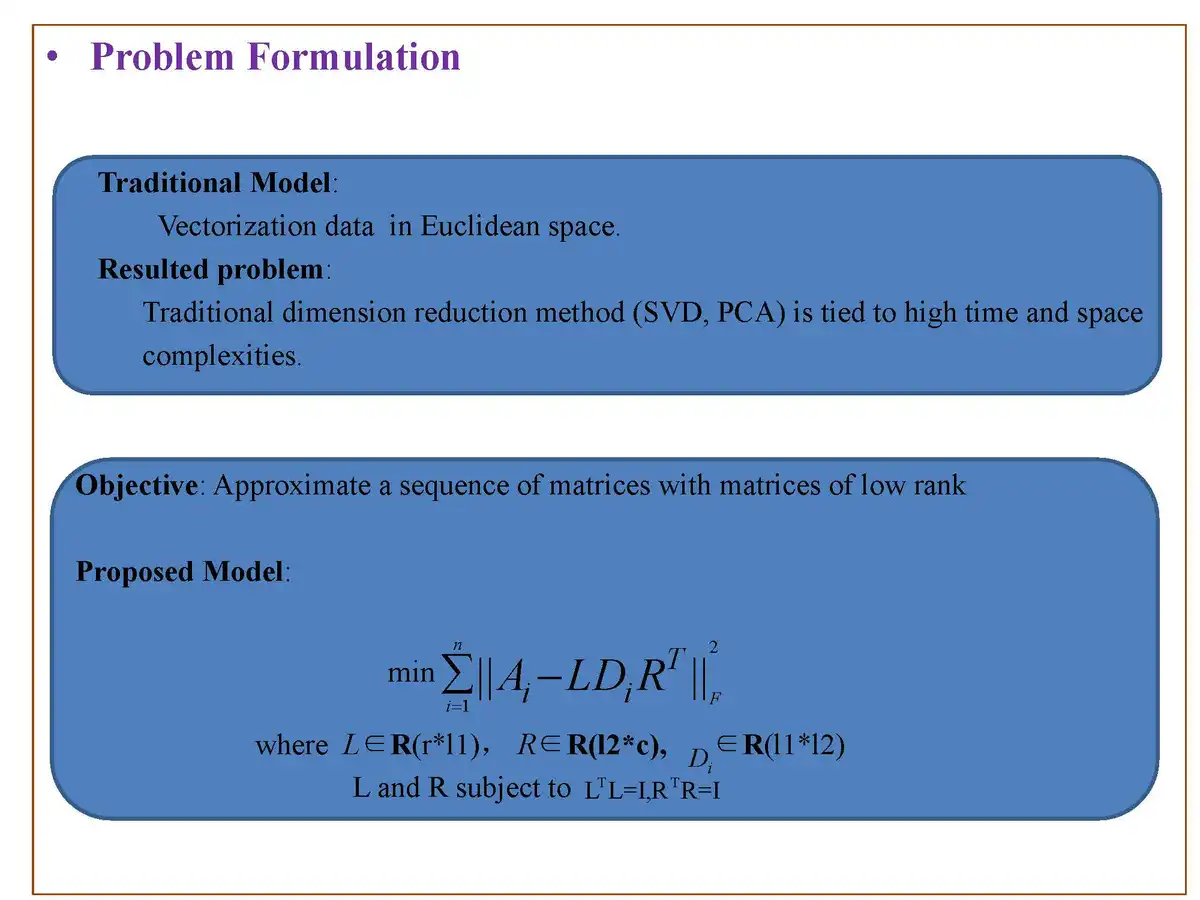

Optimizing Execution Algorithms

Reducing Latency

In high-frequency trading, latency is a critical factor that can significantly affect the performance of execution algorithms. Latency refers to the delay between when an event happens (e.g., a price change) and when the algorithm reacts to it.

To optimize latency:

Co-location: High-frequency traders often use co-location services, which place their servers physically close to the exchange’s servers to reduce transmission delays.

Hardware acceleration: Using FPGA (Field Programmable Gate Arrays) and other hardware solutions can reduce processing time and improve overall execution speed.

Optimized code: Efficiently written algorithms with minimal computational overhead help reduce latency.

Minimizing Market Impact

To minimize market impact, execution algorithms must be designed to break large orders into smaller ones, execute them over time, and adjust based on market conditions.

Adaptive Algorithms: Some advanced algorithms dynamically adjust the pace of order execution based on real-time market conditions, such as volatility and liquidity.

Liquidity Seeking: Algorithms can be programmed to target liquidity pools and execute orders when the market is deeper, reducing the likelihood of causing large price movements.

Risk Management and Evaluation

Incorporating risk management into the development of execution algorithms is essential for minimizing unexpected losses. High-frequency traders need to ensure that their algorithms are equipped to handle extreme market conditions, such as sudden price jumps or system failures.

Risk management practices for execution algorithms may include:

Stop-loss triggers: Automatically halting trading when certain risk thresholds are met.

Diversification: Distributing orders across multiple venues to reduce exposure to any single exchange.

Real-time monitoring: Continuously tracking the performance of algorithms to detect anomalies early.

Case Studies: Execution Algorithms in Action

Case Study 1: Institutional Trading with VWAP

A large investment bank used VWAP to execute a $500 million equity trade without moving the market price. By breaking the order into smaller parts based on volume, the bank successfully minimized slippage and achieved a price within 0.2% of the VWAP benchmark.

Case Study 2: TWAP in High-Volume Markets

A hedge fund used TWAP to enter a high-frequency trading strategy, executing large orders over a short time period. Despite market volatility, the fund minimized its market impact and achieved its target execution price within minutes.

Conclusion and Best Practices

Execution algorithms are indispensable tools for high-frequency traders, allowing them to execute large trades efficiently and with minimal market impact. By understanding and implementing strategies like VWAP and TWAP, traders can significantly improve the performance of their trades. Additionally, optimizing for latency and minimizing market impact can further enhance trading results.

For professional traders, the key to success lies in selecting the right execution algorithm for each situation and continuously optimizing it based on real-time market data. Co-location, hardware acceleration, and adaptive algorithms will play an increasingly important role in maintaining competitive advantages in the fast-paced world of high-frequency trading.

FAQ

Q1: How do execution algorithms reduce slippage in high-frequency trading?

Execution algorithms like VWAP and TWAP help minimize slippage by breaking large orders into smaller, more manageable trades. These algorithms are designed to execute orders at the best available price without drawing too much attention to the trade, thus reducing the likelihood of slippage.

Q2: What are the main differences between VWAP and

0 Comments

Leave a Comment