=====================================================

Introduction

The use of genetic algorithms (GAs) in trading has grown significantly in recent years, largely because of their ability to adapt, evolve, and optimize trading strategies in highly volatile markets. For traders eager to explore this frontier, one of the most pressing questions is: Where to find genetic algorithm tutorials for traders that are practical, reliable, and grounded in finance?

In this article, we will break down different sources of tutorials, evaluate their effectiveness, and compare strategies for applying GAs in trading systems. Drawing from both personal experience and recent industry developments, this comprehensive guide will help you identify the right learning paths and maximize the value of genetic algorithm tutorials.

Understanding Genetic Algorithms in Trading

Before diving into where to find tutorials, it’s crucial to understand what genetic algorithms are. Inspired by Darwin’s theory of natural selection, GAs are optimization methods that evolve solutions over generations. In trading, they are commonly used for:

- Strategy optimization (e.g., finding the best parameters for moving averages, stop-loss levels, or position sizing).

- Feature selection for predictive models.

- Adaptive trading systems that evolve based on market conditions.

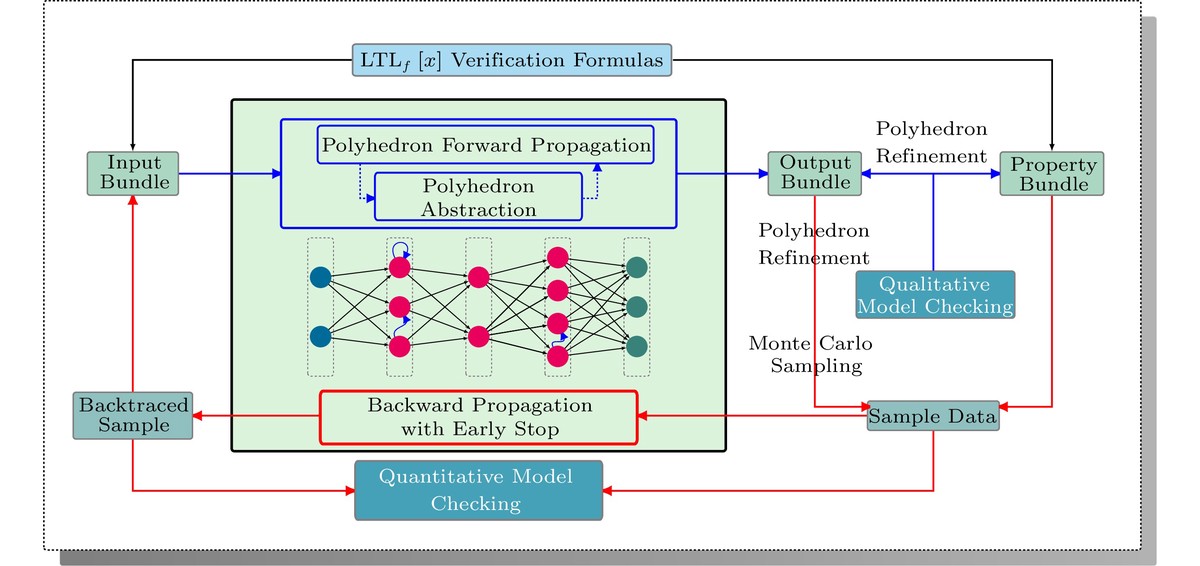

Illustration of genetic algorithm process in trading optimization

Where to Find Genetic Algorithm Tutorials for Traders

1. Online Learning Platforms

Platforms such as Coursera, Udemy, and edX often feature structured courses on machine learning and algorithmic trading that include modules on GAs.

- Advantages: Professionally designed, structured progression, hands-on exercises.

- Disadvantages: Sometimes generic, requiring traders to bridge the gap between theory and finance applications.

2. Academic Research and Whitepapers

Many quant finance research papers provide in-depth case studies on GA implementations. They can be found on SSRN, ResearchGate, and academic journals.

- Advantages: Rigorous methodologies, tested against real data.

- Disadvantages: Technical jargon and lack of step-by-step coding support.

3. Finance-Focused Blogs and YouTube Tutorials

Independent quant bloggers and YouTube creators frequently publish step-by-step genetic algorithm implementation guides tailored to traders.

- Advantages: Practical, trader-focused examples with code snippets.

- Disadvantages: Quality varies, and some tutorials may oversimplify concepts.

4. Quantitative Trading Communities

Communities like Quantopian (archived resources), QuantConnect, and Kaggle discussions often include GA-related tutorials.

- Advantages: Peer-reviewed, interactive discussions, real-world problem-solving.

- Disadvantages: Unstructured, requiring self-discipline to extract insights.

5. Books and Specialized Finance Texts

Books such as “Genetic Algorithms in Trading and Finance” offer comprehensive guides. While less interactive than video tutorials, they provide strong theoretical foundations.

Comparing Two Learning Strategies

Strategy A: Self-Study via Free Resources

- Approach: Using blogs, YouTube tutorials, and open-source code repositories.

- Pros: Cost-effective, immediate access, wide range of examples.

- Cons: Can be inconsistent, requires significant self-discipline.

Strategy B: Structured Courses with Guided Mentorship

- Approach: Enrolling in a structured course from a reputable platform or university.

- Pros: Reliable content, mentorship, and certification.

- Cons: Costly, less flexibility, and may lack real-world finance examples.

Recommendation: A hybrid approach works best. Start with free resources to build foundational knowledge, then invest in structured courses for advanced insights. This way, traders can learn how to use genetic algorithm in quantitative trading while simultaneously gaining exposure to academic rigor.

Practical Applications in Trading

Optimizing Strategy Parameters

Genetic algorithms can automatically tune parameters of strategies like moving average crossovers or volatility filters, saving traders hours of manual backtesting.

Feature Selection for Predictive Models

Traders can use GAs to determine which market indicators (RSI, MACD, order flow metrics) should be included in predictive models, enhancing accuracy.

Adaptive Models

Markets evolve, and static models often fail. GAs help design adaptive trading models, allowing strategies to evolve as market conditions change. This ties directly into where to apply genetic algorithm in quant strategies, as adaptability is a major advantage in volatile markets.

Backtesting dashboard showing optimization with genetic algorithm

My Personal Experience

When I first explored GAs, I relied heavily on free tutorials from quant blogs. While these gave me quick wins (e.g., coding a GA to optimize RSI thresholds), I quickly hit limitations—mainly in scalability and robustness. Later, I enrolled in a university-backed course that integrated finance-specific case studies, and the difference was striking. The structured mentorship allowed me to refine my models, incorporate risk-adjusted returns, and build systems that performed better out-of-sample.

The lesson: free tutorials get you started, but structured guidance builds mastery.

Industry Trends in GA Tutorials for Traders

- Python Dominance: Most tutorials now use Python libraries like DEAP and PyGAD.

- Hybrid Models: Combining GAs with reinforcement learning for smarter trading systems.

- Cloud-Based Backtesting: Tutorials increasingly focus on scalable GA implementations in cloud environments.

- Visualization Tools: More tutorials are adding data visualization for GA progress tracking.

FAQ: Genetic Algorithm Tutorials for Traders

1. What’s the best way for a beginner to learn genetic algorithms for trading?

Start with free YouTube tutorials or blogs to understand the basics. Once comfortable with Python, move on to structured courses that focus specifically on trading applications.

2. Are genetic algorithms better than traditional optimization methods in trading?

Yes, in many cases. Unlike grid search or brute-force methods, GAs adaptively explore the parameter space and avoid overfitting. They are especially effective in high-dimensional optimization problems.

3. How much coding knowledge is required to follow genetic algorithm tutorials?

A basic understanding of Python is sufficient for most tutorials. Many resources include code templates, so traders can focus on modifying strategies rather than coding from scratch.

Conclusion

Finding the right genetic algorithm tutorials for traders depends on your level of expertise and learning style. Beginners may benefit from free resources, while advanced traders should invest in structured courses and academic references. Combining both ensures balanced learning—fast experimentation with depth and rigor.

As genetic algorithms continue to shape quantitative finance, traders who master them will be better equipped to design adaptive, profitable strategies.

If this article gave you valuable insights, feel free to share it with your trading network, comment with your favorite GA tutorials, and let’s keep building a stronger trading community together.

0 Comments

Leave a Comment