============================================================

In the world of quantitative trading, the integration of sell-side analysis plays a pivotal role in shaping strategies, optimizing performance, and enhancing risk management. Sell-side firms—such as investment banks, brokerages, and financial research firms—generate valuable insights and market research that can significantly influence quantitative strategies. In this article, we’ll explore where to find high-quality sell-side analysis for quantitative strategies, the benefits of leveraging this research, and how you can integrate it into your trading models for optimal performance.

What is Sell-Side Analysis?

Sell-side analysis refers to the research and insights provided by firms that sell investment products, such as stocks, bonds, and derivatives. Sell-side firms primarily focus on producing market reports, analyst recommendations, economic forecasts, and financial models to guide institutional investors, hedge funds, and retail traders in making informed decisions.

Sell-side research is typically provided by analysts who specialize in specific sectors, asset classes, or regions, providing crucial insights into market trends, company performance, and economic outlooks. For quantitative traders, these insights can be crucial for refining models, building strategies, and enhancing predictive algorithms.

Where to Find Sell-Side Analysis for Quantitative Strategies

Quantitative strategies rely heavily on data, and sell-side research can offer a wealth of valuable data that is often hard to come by elsewhere. Here are the top places where you can find sell-side analysis tailored for quantitative strategies:

1. Brokerage Firms and Investment Banks

Most major investment banks and brokerage firms provide in-depth sell-side research that includes market reports, economic analysis, and individual stock or bond evaluations. Some of the top firms that offer sell-side analysis include:

- Goldman Sachs

- J.P. Morgan

- Morgan Stanley

- Barclays

- Deutsche Bank

These firms often have dedicated research departments that cover various asset classes, including equities, fixed income, commodities, and derivatives. Their reports often include detailed quantitative models, risk analysis, and market trends that are crucial for developing data-driven strategies.

How to Access:

Most major firms offer access to their research reports through their proprietary platforms or through third-party services. Some may require a subscription or institutional access.

2. Financial Data Providers

Several financial data providers specialize in selling research and market data that includes both sell-side insights and quantitative metrics. Some popular providers include:

- Bloomberg

- Thomson Reuters

- FactSet

- Morningstar

These services aggregate sell-side analysis and provide it alongside financial metrics, price data, and economic forecasts. Many quantitative traders use platforms like Bloomberg Terminal to access real-time data, sell-side research, and advanced financial modeling tools.

How to Access:

These platforms are typically subscription-based, with fees varying based on the type of data and access level required.

3. Sell-Side Research Aggregators

Sell-side research aggregators collect and distribute analysis from a wide range of firms, making it easier for traders to access insights from multiple sources in one place. These platforms allow quantitative traders to filter research based on specific criteria, such as asset class, sector, or geographic region.

Some well-known aggregators include:

- Sentieo

- AlphaSense

- Eikon (by Reuters)

These tools aggregate reports, notes, and economic analysis from various sell-side firms and make it searchable for quantitative analysis. They often include advanced features like sentiment analysis, natural language processing (NLP) to mine insights from text, and analytics to identify patterns in research.

How to Access:

Aggregators usually offer paid subscriptions with various access tiers. Some platforms may also offer free trials for users to explore the service before committing.

4. Sell-Side Research Portals

Many sell-side firms and research companies host dedicated research portals for their institutional clients. These portals typically provide access to exclusive market insights, trading models, and analyst reports. Some of the most well-regarded sell-side research portals include:

- Citi Research

- HSBC Global Research

- UBS Research

These portals often feature reports on individual stocks, macroeconomic indicators, sector performance, and forecasts. For quantitative traders, these portals offer detailed data that can be used to enhance predictive models and backtest strategies.

How to Access:

Access to these portals often requires institutional or professional-level subscriptions. Some firms offer tiered access based on the client’s relationship with the bank.

5. Academic Research Institutions and Quantitative Finance Communities

For those in search of cutting-edge sell-side research with a quantitative focus, academic institutions and quantitative finance communities can be excellent resources. Many universities and research centers collaborate with sell-side firms to publish research that includes quantitative models, statistical analysis, and financial theories.

Prominent academic institutions such as MIT Sloan, Stanford, and Harvard Business School frequently host conferences, webinars, and publications that include insights from sell-side firms. These often focus on advanced techniques in quantitative finance and algorithmic trading.

How to Access:

Many of these resources are freely available online, though some may require conference registration or institutional access for full research reports.

How to Integrate Sell-Side Analysis into Quantitative Strategies

Incorporating sell-side research into quantitative strategies can significantly enhance the predictive power of your models. Here’s how to effectively integrate this data into your strategy development:

1. Data Aggregation and Cleaning

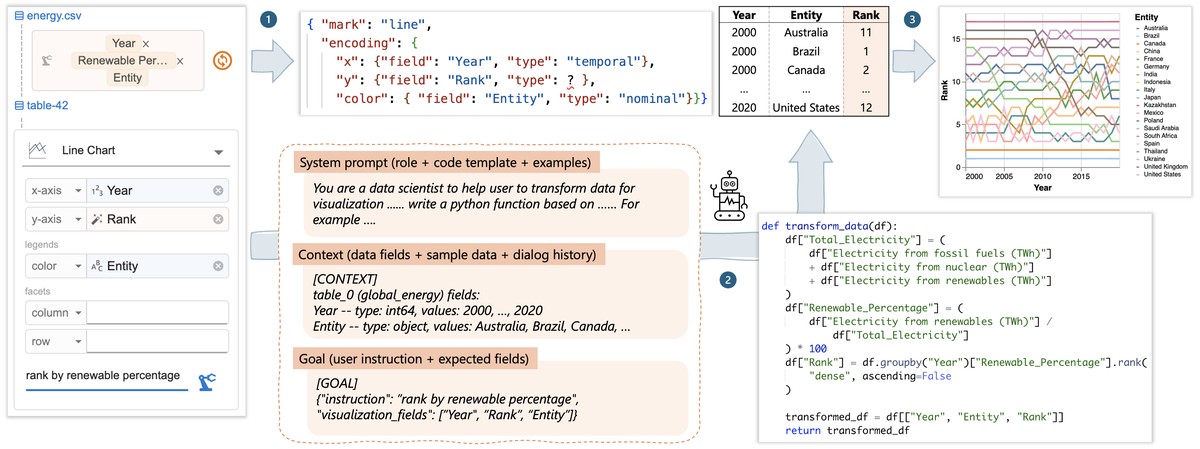

Sell-side reports contain a vast amount of data that can be valuable for quantitative strategies. However, this data needs to be aggregated and cleaned before it can be incorporated into your models. Many sell-side reports include proprietary data points such as earnings forecasts, analyst recommendations, and price targets. This data can be useful in building features for machine learning models or as inputs into statistical arbitrage strategies.

2. Sentiment Analysis

Sentiment analysis of sell-side reports can provide valuable insights into market psychology and investor sentiment. Many sell-side reports contain language that reflects the analysts’ views on market conditions, individual stocks, or sectors. Quantitative traders can use Natural Language Processing (NLP) techniques to process this unstructured data, converting qualitative information into quantitative features that can inform their models.

3. Market Forecasting and Risk Modeling

Quantitative traders can use sell-side economic forecasts and market predictions to inform their models. These forecasts are often based on detailed macroeconomic analysis, which can improve the accuracy of financial forecasting models. By integrating these insights with historical data, traders can build models that predict price movements, volatility, and other key market metrics.

FAQ: Common Questions About Sell-Side Analysis for Quantitative Strategies

1. Why should quantitative traders use sell-side research?

Sell-side research provides valuable insights that can help quantitative traders identify trends, evaluate risks, and enhance their predictive models. It offers in-depth market analysis, economic forecasts, and data points that are crucial for developing sophisticated trading strategies.

2. How do I know if the sell-side analysis is relevant for my quantitative strategy?

The relevance of sell-side research depends on your strategy’s focus. For example, if you are developing a statistical arbitrage model, analyst recommendations, earnings forecasts, and price targets could serve as important inputs. Similarly, if you are building a risk model, macroeconomic data and market sentiment may be crucial.

3. What are the best tools to integrate sell-side research into quantitative models?

The best tools for integrating sell-side research depend on your needs. Platforms like Bloomberg, AlphaSense, and Sentieo offer advanced data analytics capabilities. Additionally, machine learning libraries such as Python’s scikit-learn or TensorFlow can be used to analyze sell-side sentiment and integrate it into predictive models.

Conclusion

Sell-side analysis is an indispensable resource for quantitative traders seeking to develop more informed, data-driven strategies. By accessing sell-side research through brokerages, data aggregators, academic resources, and dedicated portals, traders can integrate valuable insights into their models, improving both the accuracy and performance of their strategies.

Whether you are an institutional investor or a retail trader, leveraging sell-side insights can give you a competitive edge, enabling you to make more informed decisions, manage risks effectively, and ultimately, achieve better trading outcomes. Keep these resources in mind as you explore how to integrate sell-side research into your quantitative strategies.

0 Comments

Leave a Comment