=============================================

Introduction

In the world of algorithmic and quantitative trading, strategies must constantly adapt to dynamic markets, nonlinear data patterns, and unexpected volatility. Traditional optimization techniques often struggle in these environments because they get trapped in local optima or require strict assumptions about distributions. This is where genetic algorithms (GAs) shine.

If you’ve ever wondered why genetic algorithm is effective in trading, the answer lies in its ability to evolve strategies much like natural selection evolves species. By iteratively testing, mutating, and combining strategies, GAs discover robust solutions in complex financial markets.

In this article, we’ll explore the mechanics of genetic algorithms, compare them with traditional optimization methods, and examine practical ways they improve trading strategies. We’ll also discuss real-world applications, provide a comparison of approaches, and close with actionable insights for both beginner traders and advanced quants.

What Is a Genetic Algorithm in Trading?

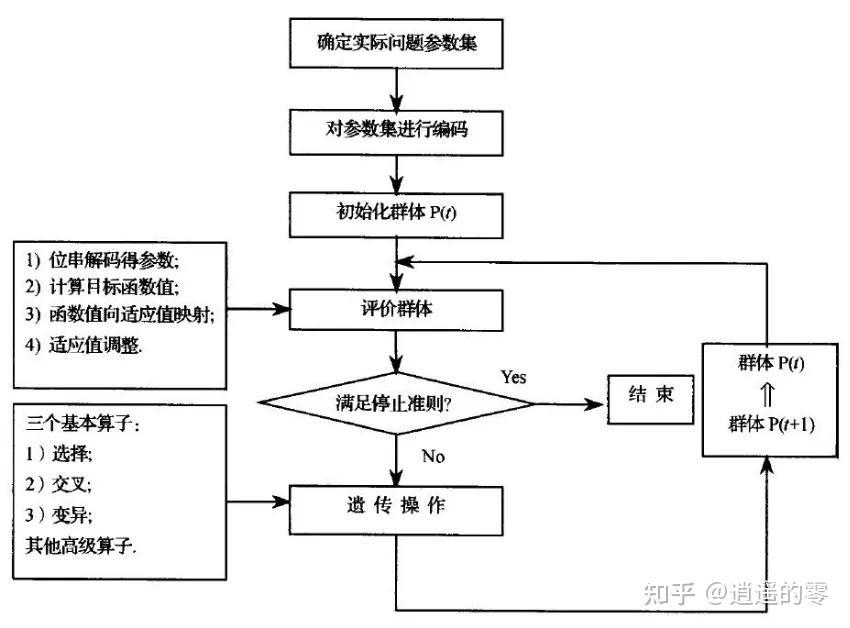

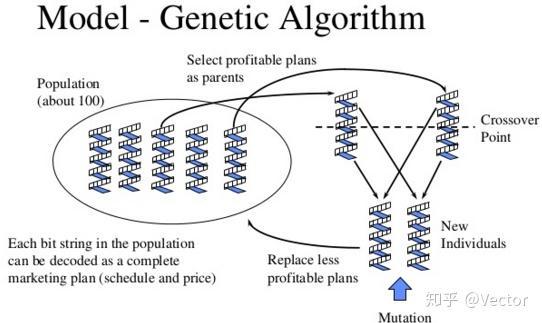

A genetic algorithm is an optimization technique inspired by Darwinian evolution. It operates by generating multiple “candidate solutions” (in trading, these might be parameter sets or strategies), evaluating their performance, and then selecting the most promising candidates to create the next generation. Over many iterations, the algorithm evolves strategies that are increasingly efficient and adaptive.

Key components include:

- Population: A set of potential trading strategies or parameter combinations.

- Fitness Function: The performance metric (e.g., Sharpe ratio, profit factor, drawdown) used to rank solutions.

- Crossover: Combining two strong solutions to generate a new hybrid.

- Mutation: Randomly adjusting parameters to introduce variability and avoid stagnation.

- Selection: Keeping the best-performing solutions while discarding weaker ones.

In practice, this allows traders to automatically optimize trading rules, improve predictive models, and adapt to changing markets.

Why Genetic Algorithm Is Effective in Trading

1. Adaptability to Market Changes

Financial markets are nonlinear, chaotic, and full of noise. Unlike static optimization methods, genetic algorithms adapt dynamically by evolving solutions over time, making them better suited for shifting market conditions.

2. Avoidance of Local Optima

Conventional optimization, like gradient descent, often gets trapped in local optima. GAs, with their random mutations and recombination, are excellent at exploring the global search space and finding more resilient strategies.

3. Robustness to Noise

Trading data is often messy. GAs don’t require strong assumptions about data distribution, which makes them effective in environments with high variance and incomplete information.

4. Flexibility Across Models

Whether you’re working with rule-based systems, machine learning models, or parameter optimization, genetic algorithms can be integrated without strict mathematical constraints.

Genetic algorithm workflow for trading optimization

Two Major Methods of Applying Genetic Algorithms in Trading

Method 1: Parameter Optimization for Trading Strategies

One of the most common uses of genetic algorithms is optimizing parameters for technical indicators and strategies. For example, adjusting moving average lengths, stop-loss levels, or volatility filters.

Pros:

- Efficiently explores a large parameter space.

- Prevents overfitting by evolving robust solutions.

- Can be adapted to any time horizon (day trading, swing, or long-term).

Cons:

- Computationally expensive.

- Risk of curve-fitting if not properly validated.

Method 2: Evolving Predictive Models and Machine Learning Hybrids

Another powerful application is combining GAs with machine learning. For instance, evolving neural network architectures or feature selection for price prediction.

Pros:

- Enhances predictive accuracy by optimizing input features.

- Discovers nonlinear relationships often missed by traditional models.

- Provides adaptable frameworks for high-frequency trading environments.

Cons:

- Requires advanced technical expertise.

- High resource consumption for training and testing.

Comparing the Two Approaches

| Approach | Best Use Case | Strengths | Limitations |

|---|---|---|---|

| Parameter Optimization | Rule-based and technical systems | Simple to implement, prevents local optima | Can be computationally heavy |

| Model Evolution (ML + GAs) | Predictive modeling, HFT, AI | Increases accuracy, adapts to nonlinear data | Requires expertise and resources |

From personal experience, parameter optimization is the best starting point for most traders, while advanced quants can leverage GAs with machine learning for cutting-edge strategies.

Where to Apply Genetic Algorithms in Quant Strategies

When traders ask where to apply genetic algorithm in quant strategies, the answer is: almost anywhere that requires optimization. Examples include:

- Portfolio optimization – Balancing risk-adjusted returns.

- Risk management models – Optimizing stop-loss and hedging rules.

- Execution algorithms – Reducing slippage and transaction costs.

- Feature selection in predictive analytics – Selecting the most relevant market indicators.

This versatility explains why genetic algorithm is important in quantitative finance, especially when compared to rigid optimization methods.

Applications of genetic algorithms in quantitative finance

Practical Example: Optimizing a Moving Average Strategy

Suppose a trader wants to optimize a simple moving average crossover system (e.g., 20-day vs. 50-day). Using traditional methods, they might test every possible combination—an expensive process.

With a GA, the trader can:

- Generate random sets of short- and long-term moving averages.

- Backtest each pair for performance (fitness evaluation).

- Select the best performers.

- Apply crossover and mutation to create new sets.

- Iterate until robust, profitable solutions emerge.

This evolutionary process dramatically reduces computation time while producing more resilient strategies.

FAQs

1. Why should I use a genetic algorithm instead of traditional optimization?

Traditional optimization methods work well for simple problems but often fail in complex, noisy financial data. GAs excel in exploring large, nonlinear solution spaces and adapting strategies to dynamic markets.

2. Can beginners use genetic algorithms in trading?

Yes. While advanced applications require programming, many trading platforms and research tools now integrate GA modules. Beginners can start with parameter optimization before moving into hybrid models.

3. How do I avoid overfitting when using genetic algorithms?

- Use out-of-sample testing and walk-forward analysis.

- Optimize based on multiple fitness functions (e.g., Sharpe ratio + drawdown).

- Keep solutions simple and avoid unnecessary complexity.

Conclusion

So, why genetic algorithm is effective in trading? Because it mimics natural evolution to find robust, adaptable, and profitable strategies in the chaotic world of financial markets. Whether applied to parameter optimization or hybrid predictive models, GAs give traders a powerful edge.

For beginners, starting with parameter tuning is recommended, while advanced quants can integrate GAs with AI for next-level performance. As markets continue to grow in complexity, genetic algorithms will remain an essential tool for anyone aiming to stay ahead.

If you found this article insightful, share it with your trading network or drop a comment below. Your experience with genetic algorithms could help others discover better trading solutions.

Would you like me to expand this article into a step-by-step GA implementation tutorial for trading, complete with pseudocode and case studies?

0 Comments

Leave a Comment