==============================================

Introduction

One of the most critical aspects of successful trading is effective risk management, and nothing embodies this more than the correct use of stop loss mechanisms. In quantitative trading, where strategies are automated and backtested, setting a stop loss is not just about protecting capital—it’s about ensuring the long-term survival and scalability of the trading system.

This article provides a detailed guide on how to set a stop loss in quantitative trading, exploring multiple methods, their advantages and drawbacks, and practical applications. We will also discuss advanced stop loss techniques for professional quants, illustrate how stop loss interacts with backtesting and portfolio optimization, and provide actionable recommendations.

Why Stop Loss Matters in Quantitative Trading

Risk Control

Stop losses cap potential losses, preventing small mistakes or market anomalies from turning into catastrophic drawdowns.

Discipline Enforcement

Automated stop losses eliminate emotional decision-making, a key advantage in quantitative systems.

Capital Preservation

By reducing exposure during adverse conditions, stop losses enable quants to reallocate capital to strategies with higher expected returns.

Where to Place Stop Loss in Quantitative Strategy

When designing a quant strategy, the placement of stop loss levels is crucial. Traders often debate whether to use fixed percentage stops, volatility-based stops, or dynamic algorithmic stops. Each approach impacts risk-adjusted returns differently.

Key Methods for Setting Stop Loss

Method 1: Fixed Percentage Stop Loss

A straightforward approach where the stop is set at a predefined percentage below (or above, for short positions) the entry price.

- Example: 2% stop loss on equities, 0.5% on futures.

Pros:

- Easy to implement and backtest.

- Works well for high-liquidity instruments.

Cons:

- Ignores volatility and market conditions.

- Can result in premature exits during normal fluctuations.

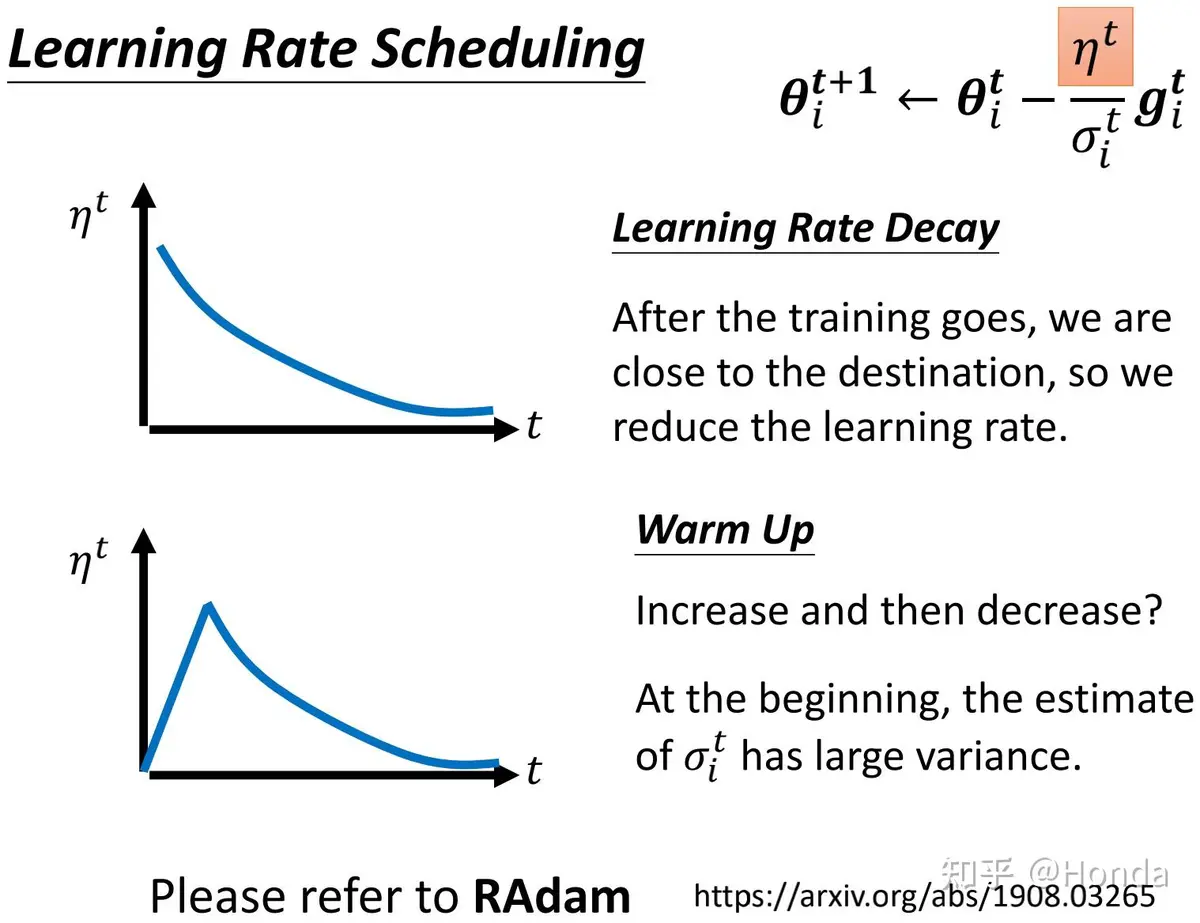

Method 2: Volatility-Based Stop Loss

This method adjusts stops based on asset volatility, often using ATR (Average True Range) or standard deviation.

- Example: Stop loss = Entry price – 2 × ATR(14).

Pros:

- Adapts to different market environments.

- Prevents being stopped out during high-volatility phases.

Cons:

- Can lead to wider stops, increasing potential drawdown.

- Requires continuous recalibration.

Method 3: Dynamic Algorithmic Stop Loss

Advanced quantitative models integrate stop losses into machine learning or optimization algorithms, where stop levels adjust dynamically based on backtested performance.

Pros:

- Tailored to each strategy’s statistical profile.

- Enhances portfolio-wide risk management.

Cons:

- Requires complex infrastructure and robust testing.

- Risk of overfitting if not properly validated.

Stop loss levels illustrated on a sample trading chart

Comparing Methods: Fixed vs Volatility-Based

| Method | Advantages | Drawbacks | Best Use Case |

|---|---|---|---|

| Fixed % Stop Loss | Simple, easy to execute | Ignores volatility, may trigger too often | Beginner strategies, liquid assets |

| Volatility-Based Stop | Adapts to market conditions | Larger potential losses | Swing trading, high-volatility assets |

| Algorithmic Stop | Dynamic, strategy-optimized | Requires advanced infrastructure | Hedge funds, institutional quant desks |

Recommendation: For professional quants, volatility-adjusted or algorithmic stops typically outperform fixed stops. Beginners may benefit from simple fixed percentage stops as a learning tool before transitioning to more adaptive systems.

How to Calculate Stop Loss Points in Quant Models

Using ATR (Average True Range)

- Calculate ATR(14) from historical price data.

- Multiply ATR by factor (e.g., 2).

- Subtract from entry price (for long positions).

Using Standard Deviation

- Measure rolling price standard deviation.

- Set stop loss at entry – (k × σ), where k is a sensitivity parameter.

Using Machine Learning Models

- Train model on historical trades.

- Optimize stop placement to maximize Sharpe ratio or minimize drawdowns.

- Recalibrate periodically.

Stop Loss and Backtesting in Quant Trading

A stop loss strategy must always be backtested under historical conditions. Failing to incorporate stop losses during backtesting leads to unrealistic expectations.

Common Mistakes:

- Ignoring transaction costs when stop losses trigger frequently.

- Over-optimizing stop levels, leading to poor live performance.

- Assuming constant slippage and liquidity across all conditions.

Best Practice: Run Monte Carlo simulations and walk-forward testing to validate stop loss effectiveness.

Backtesting results with and without stop loss integration

Advanced Stop Loss Techniques for Quantitative Experts

1. Portfolio-Level Stop Loss

Instead of placing stops on individual trades, quants use max drawdown limits at the portfolio level.

2. Time-Based Stop Loss

Positions are exited after a fixed time period if profit targets are not achieved.

3. Trailing Stop Loss

Adjusts upward as a trade becomes profitable, locking in gains.

4. Regime-Sensitive Stop Loss

Dynamic stops that adapt depending on market regime (bullish, bearish, sideways).

How Stop Loss Interacts with Risk Management

Stop losses are not standalone tools—they work best as part of an integrated risk management framework:

- Position sizing models (Kelly criterion, volatility parity).

- Portfolio diversification.

- Correlation analysis to prevent clustering of risks.

This directly aligns with stop loss and risk management in quant trading, where capital allocation decisions and stop placements reinforce each other.

Common Stop Loss Mistakes in Quantitative Investing

- Setting stops too tight, causing unnecessary whipsaws.

- Ignoring slippage in low-liquidity markets.

- Over-optimizing in backtests, leading to curve-fitting.

- Using the same stop setting for all assets without adjusting for volatility.

FAQ: How to Set a Stop Loss in Quantitative Trading

1. What is the best ratio for stop loss in quant strategies?

There is no universal ratio. For equities, many quants use 1:2 or 1:3 risk-to-reward ratios. For futures and crypto, ATR-based stops are more effective because they adapt to changing volatility. Always backtest to determine the optimal ratio.

2. What happens without stop loss in quantitative trading?

Without stop losses, strategies face unlimited downside risk. Even if a system is profitable on average, a single extreme market move can wipe out months or years of gains. Historical crises like 2008 and 2020 show the importance of pre-defined exits.

3. Why do stop losses fail in some quantitative strategies?

Stop losses may fail when they are:

- Set too tight, causing frequent stop-outs.

- Ignored in high-slippage markets.

- Not aligned with the statistical distribution of returns of the strategy.

The solution is to use robust testing, adaptive models, and position sizing alongside stop losses.

Conclusion

Knowing how to set a stop loss in quantitative trading is a vital skill for risk management and strategy longevity. Fixed percentage stops provide simplicity, volatility-based stops adapt to changing markets, and algorithmic approaches offer precision for professionals.

The best practice is to combine volatility-based stops with dynamic optimization, ensuring that your strategy is resilient to unexpected market shocks.

If you found this guide useful, share it with fellow quants or comment below with your experiences—let’s exchange insights on building more robust quantitative trading systems.

0 Comments

Leave a Comment