In the world of algorithmic trading, risk management is paramount. One of the most effective tools for mitigating risk is the stop loss. But how exactly does a stop loss work in algorithmic trading, and why is it so crucial for the success of automated trading strategies? In this article, we will explore the mechanics of stop loss, how it’s implemented in algorithmic systems, and how you can optimize it to ensure robust risk management in your quantitative trading strategies.

Table of Contents

What is a Stop Loss in Algorithmic Trading?

How Does Stop Loss Work in Algorithmic Trading?

2.1 Traditional Stop Loss

2.2 Trailing Stop Loss

Why is Stop Loss Important in Quantitative Trading?

Types of Stop Loss Strategies in Algorithmic Trading

4.1 Fixed Price Stop Loss

4.2 Volatility-Based Stop Loss

4.3 Time-Based Stop Loss

How to Set a Stop Loss in Quantitative Trading

5.1 Stop Loss in Backtesting

5.2 Optimal Stop Loss Levels

Challenges with Stop Loss in Algorithmic Trading

6.1 Slippage and Market Gaps

6.2 Stop Loss Triggering at Inopportune Times

FAQ: Common Questions About Stop Loss in Algorithmic Trading

Conclusion

What is a Stop Loss in Algorithmic Trading?

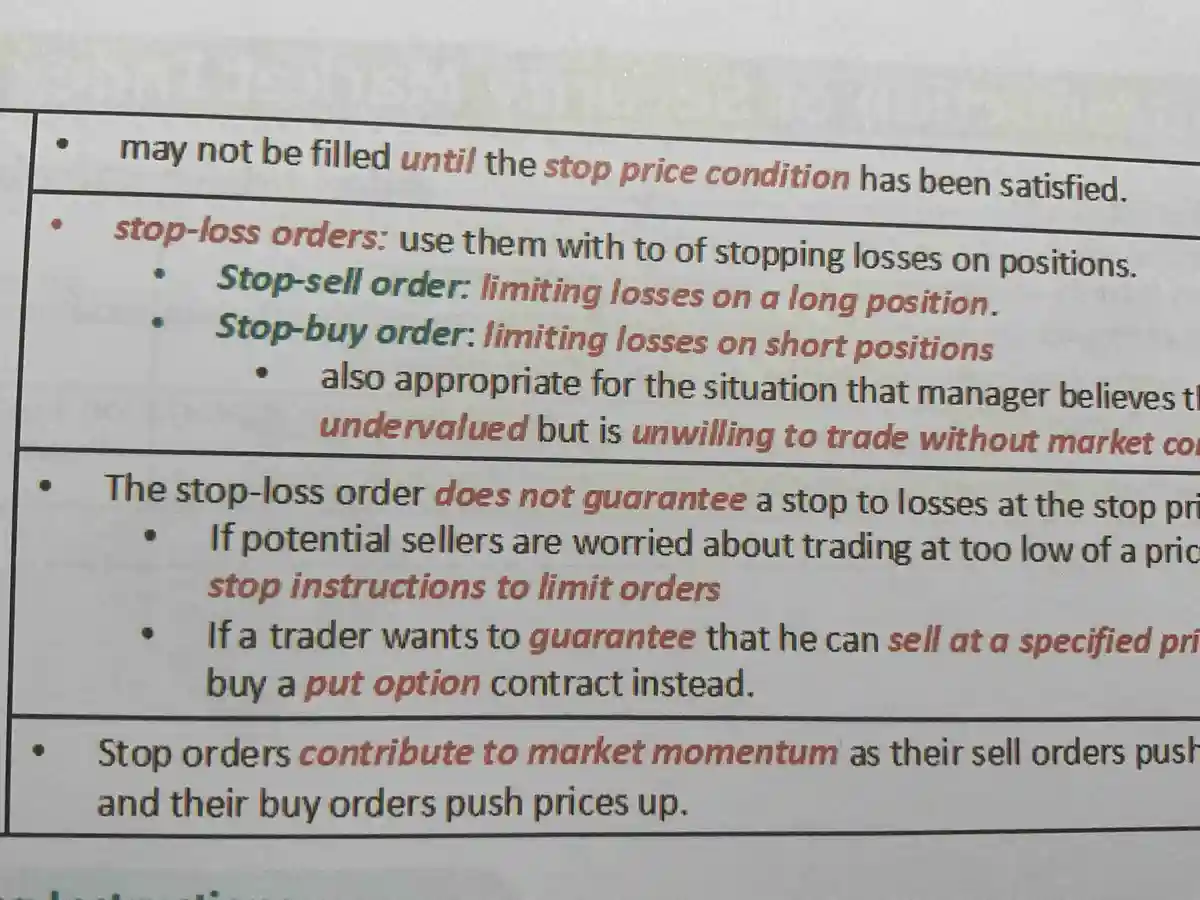

A stop loss is a risk management tool used to limit an investor’s loss on a position. In algorithmic trading, it refers to an automatic order that is placed by a trading algorithm to sell a security when it reaches a predetermined price. This ensures that an investor doesn’t lose more than they are willing to, thus protecting their capital from excessive drawdowns.

Stop loss orders are particularly useful in volatile markets, as they can help avoid large losses in the event of significant market fluctuations.

How Does Stop Loss Work in Algorithmic Trading?

In algorithmic trading, the concept of a stop loss is integrated into automated trading strategies. The algorithm executes a trade when the conditions specified in the strategy are met. When a stop loss is set, the algorithm is programmed to exit a position when the market price reaches a specified threshold, thereby cutting losses.

Traditional Stop Loss

A traditional stop loss is a fixed price level at which a position will be sold automatically if the market price falls below this threshold. The algorithm continuously monitors the market price, and once the stop loss price is triggered, the position is liquidated.

For example, if you enter a long position at \(100, and you set a stop loss at \)90, the algorithm will automatically sell your position if the price falls to $90 or lower.

Trailing Stop Loss

A trailing stop loss is a more dynamic form of risk management. Instead of being fixed, the stop loss level adjusts in relation to the market price. This allows traders to lock in profits as the price moves in their favor while still protecting themselves from large losses if the price reverses.

For instance, if the price rises to \(110 and a 10% trailing stop is set, the stop loss would move up to \)99 (10% below \(110). If the price then drops to \)99, the position will be sold. This allows traders to capture gains while minimizing risk.

Why is Stop Loss Important in Quantitative Trading?

In quantitative trading, where algorithms are used to trade based on mathematical models and market data, stop loss is crucial for the following reasons:

Risk Management: Without a stop loss, algorithms could run into substantial losses in a market downturn. Stop loss ensures the algorithm limits its exposure to adverse market movements.

Consistency in Performance: Stop loss helps maintain consistent performance by ensuring that one bad trade doesn’t significantly harm the overall strategy.

Automation of Risk Mitigation: Since algorithmic trading strategies are fully automated, setting stop losses means the system can protect your investments without manual intervention, even during volatile market conditions.

Types of Stop Loss Strategies in Algorithmic Trading

There are several ways to implement stop loss in algorithmic trading. The strategy you choose depends on your trading style, risk tolerance, and market conditions.

Fixed Price Stop Loss

The fixed price stop loss is the simplest form of stop loss, where a predetermined price is set, and the position is sold once the market price hits that level.

Pros: Easy to implement and understand.

Cons: Does not account for market volatility, potentially triggering the stop loss prematurely during temporary fluctuations.

Volatility-Based Stop Loss

A volatility-based stop loss adjusts the stop loss based on the volatility of the asset. The logic behind this is that in highly volatile markets, the stop loss should be wider to avoid getting triggered by short-term price swings.

Pros: More adaptive to market conditions, reducing the chances of being stopped out prematurely.

Cons: Can expose the position to larger drawdowns if the volatility is high and the market continues to move against you.

Time-Based Stop Loss

A time-based stop loss triggers an exit after a specified time has passed, regardless of the price level. This is particularly useful in short-term quantitative trading strategies where positions are held for short durations, and time is a key factor in decision-making.

Pros: Useful for strategies that focus on short-term trends.

Cons: May not account for market conditions adequately and can result in exiting a position too early or too late.

How to Set a Stop Loss in Quantitative Trading

Setting a stop loss in quantitative trading is a highly data-driven process. Here are the steps to effectively implement stop losses in your algorithmic strategy.

Stop Loss in Backtesting

Before implementing a stop loss in live trading, it’s crucial to test it using backtesting. This involves simulating past trades to evaluate how different stop loss strategies would have performed. The goal is to identify the optimal stop loss placement that minimizes risk without sacrificing too many profits.

Optimal Stop Loss Levels

The optimal stop loss level varies depending on several factors, such as volatility, asset class, and the overall strategy. For instance, if you’re trading in a volatile market, a wider stop loss may be necessary. Conversely, if you’re trading a stable asset, a tighter stop loss may be more effective. Using technical indicators like Average True Range (ATR) can help calculate an optimal stop loss level based on the asset’s volatility.

Challenges with Stop Loss in Algorithmic Trading

While stop loss is an essential tool for managing risk, it’s not without its challenges in algorithmic trading.

Slippage and Market Gaps

In highly volatile markets or during events like earnings reports or economic announcements, prices can gap, meaning they jump from one level to another without trading at intermediate prices. This can result in slippage, where the stop loss is triggered at a worse price than expected.

Stop Loss Triggering at Inopportune Times

Another challenge with stop loss is that it can sometimes trigger at inopportune times, especially in choppy or sideways markets. For instance, if the market briefly dips and then quickly recovers, a stop loss could be executed unnecessarily, causing the algorithm to miss out on a potential rebound.

FAQ: Common Questions About Stop Loss in Algorithmic Trading

- How do I calculate the optimal stop loss level?

The optimal stop loss level can be calculated using indicators like Average True Range (ATR), support/resistance levels, or by applying a percentage-based approach. The key is to balance risk and reward while considering the asset’s volatility.

- What happens if I don’t use a stop loss in algorithmic trading?

Without a stop loss, your algorithm could expose you to significant losses if the market moves against your position. It may also lead to more emotional decision-making and higher volatility in your trading outcomes.

- Can a stop loss fail in algorithmic trading?

Yes, stop losses can fail in extreme market conditions, such as gaps or flash crashes. This is why it’s essential to monitor the effectiveness of your stop loss strategy regularly and adapt to changing market conditions.

Conclusion

The use of stop loss in algorithmic trading is critical for managing risk and ensuring consistent performance. Whether you use a traditional stop loss, a trailing stop loss, or a volatility-based stop loss, understanding how these tools work and implementing them properly can significantly enhance the effectiveness of your quantitative trading strategies. By backtesting different stop loss methods and adapting to market conditions,

0 Comments

Leave a Comment