======================================================

In recent years, genetic algorithms (GAs) have gained prominence as an essential tool in various fields, especially in finance. They are used to optimize trading strategies, enhance forecasting models, and solve complex optimization problems. By mimicking the process of natural selection, genetic algorithms can help identify optimal solutions in complex, high-dimensional data sets where traditional methods might fail. This article explores where genetic algorithms can be implemented in finance, their advantages, limitations, and how they are transforming the financial industry.

What Are Genetic Algorithms?

1. Understanding Genetic Algorithms

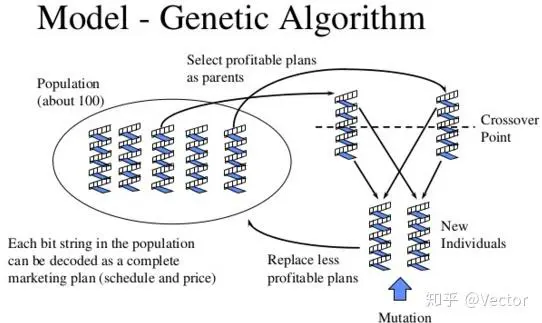

A genetic algorithm is a search heuristic that uses techniques inspired by natural evolution, such as selection, mutation, crossover (recombination), and inheritance. In essence, GAs are optimization techniques used to find approximate solutions to complex problems, especially when the solution space is vast and multidimensional.

2. How Genetic Algorithms Work

GAs start with a population of possible solutions (often referred to as chromosomes) and evolve them over several generations. Each solution is evaluated based on a fitness function, and the best solutions are used to create new offspring through crossover and mutation. Over time, the population of solutions improves as it evolves, ultimately converging toward the best possible solution.

3. Why Genetic Algorithms Are Effective in Finance

In the financial industry, the landscape is highly dynamic, with vast amounts of data and a need for adaptive, flexible models. Traditional methods, such as linear regression or time-series analysis, may struggle with complex, non-linear relationships in financial data. Genetic algorithms, on the other hand, excel in evolving solutions that can adapt to changing market conditions, offering flexibility and efficiency in optimization tasks.

Where Can Genetic Algorithms Be Applied in Finance?

1. Quantitative Trading Strategies

How Genetic Algorithms Enhance Trading Models

One of the most common applications of genetic algorithms in finance is in the development and optimization of quantitative trading strategies. GAs are used to optimize parameters for trading models, such as moving averages, stop-loss levels, or risk management rules. By evolving a population of potential trading strategies, genetic algorithms can search through countless combinations to find the most effective ones.

- Example: A GA can be used to optimize a trading algorithm’s entry and exit points, risk parameters, or position sizes. This method can be particularly useful for high-frequency trading (HFT) or algorithmic trading, where small changes can make a significant impact on profitability.

Advantages and Limitations

- Advantages: Genetic algorithms are capable of finding non-linear relationships that traditional optimization methods may miss. They are also adaptive, making them suitable for dynamic market conditions.

- Limitations: GAs can be computationally expensive, especially when optimizing complex models with a large number of variables. Additionally, they require careful parameter tuning to avoid overfitting.

2. Portfolio Optimization

Using Genetic Algorithms to Maximize Portfolio Returns

Portfolio optimization aims to select the best mix of assets that maximizes returns for a given level of risk. Genetic algorithms can be employed to optimize portfolios by evolving sets of asset weights to find the optimal risk-return trade-off. This is particularly useful when managing portfolios with a large number of assets, where traditional optimization techniques might struggle.

- Example: In modern portfolio theory (MPT), GAs can be used to find the optimal combination of stocks, bonds, and alternative investments that minimize risk while maximizing returns.

Advantages and Limitations

- Advantages: GAs provide a flexible approach that can incorporate complex constraints, such as liquidity, transaction costs, and diversification. They can also handle non-linear constraints, unlike traditional optimization methods.

- Limitations: Portfolio optimization using GAs requires significant computational power, especially when dealing with large portfolios or real-time data.

3. Risk Management and Hedging Strategies

How Genetic Algorithms Improve Risk Management

In risk management, GAs are often used to optimize hedging strategies. By simulating different portfolio configurations and hedging instruments (such as options or futures), genetic algorithms can help institutional investors design more effective risk mitigation strategies. GAs can evolve solutions to minimize the potential losses from adverse market movements, particularly in volatile environments.

- Example: A hedge fund may use GAs to evolve optimal hedging strategies, such as determining the best combination of options and futures contracts to protect a portfolio from market downturns.

Advantages and Limitations

- Advantages: GAs can adapt to changing market conditions and optimize hedging strategies dynamically. They also offer a way to handle complex, non-linear risk factors that may not be well-suited to traditional risk management models.

- Limitations: The effectiveness of GAs in risk management depends heavily on the quality of the fitness function used to evaluate different strategies. If the function is poorly defined, the GA may not converge to an optimal solution.

4. Credit Scoring and Default Prediction

Genetic Algorithms for Credit Risk Assessment

Genetic algorithms are also used in credit scoring and default prediction models, which are crucial for financial institutions and lenders. By evolving models that take into account a vast array of variables—such as credit history, income levels, and market conditions—GAs can identify patterns and predict the likelihood of a borrower defaulting on a loan.

- Example: A bank may use a genetic algorithm to optimize a credit scoring model by evolving different combinations of predictive features, allowing the institution to better assess the creditworthiness of loan applicants.

Advantages and Limitations

- Advantages: GAs can process large, high-dimensional datasets and identify complex relationships between various variables. This makes them well-suited for tasks like credit scoring, where traditional methods might struggle.

- Limitations: GAs in credit risk modeling may require large amounts of training data and computational resources to achieve optimal results. Overfitting is also a concern, particularly if the GA is not properly constrained.

Genetic Algorithm vs Traditional Methods in Finance

1. Comparison with Traditional Optimization

Traditional optimization methods, such as linear programming or gradient descent, are often limited to finding local optima and are best suited for problems with linear constraints. Genetic algorithms, on the other hand, are more flexible and can explore a larger, non-linear solution space. This makes GAs particularly effective in complex, dynamic environments like financial markets.

- Example: In portfolio optimization, traditional methods might only find optimal solutions for well-defined constraints, while GAs can explore a broader set of solutions by adapting the weights of assets over time.

2. Comparison with Other Machine Learning Techniques

While machine learning methods such as neural networks and random forests are powerful, genetic algorithms offer a unique advantage in optimizing and evolving solutions over time. Unlike machine learning, GAs don’t require vast amounts of labeled data and are better suited for problems where finding an exact model is difficult or computationally expensive.

FAQ: Genetic Algorithms in Finance

1. What are the key benefits of using genetic algorithms in finance?

Genetic algorithms allow financial professionals to solve complex optimization problems, such as portfolio construction, trading strategy optimization, and risk management. They can handle large, high-dimensional data sets, find non-linear solutions, and adapt to changing market conditions.

2. How does a genetic algorithm improve predictive analytics in finance?

GAs improve predictive analytics by evolving and optimizing models to better predict market trends, asset prices, and other financial variables. By simulating many possible solutions and evolving the best ones, GAs can enhance model accuracy and adaptability.

3. What are some challenges when using genetic algorithms in finance?

The main challenges include computational complexity, overfitting, and the need for large amounts of data to train the algorithms. Additionally, tuning the parameters of the GA (such as mutation rate and crossover probability) can be time-consuming and require expertise.

Conclusion

Genetic algorithms are a powerful tool in finance, offering innovative solutions for complex problems such as trading strategy optimization, portfolio management, and risk mitigation. Their ability to handle large datasets, adapt to changing conditions, and explore non-linear relationships makes them an invaluable asset for institutional investors, quantitative traders, and financial engineers. As financial markets continue to grow more complex, the role of genetic algorithms in finance will undoubtedly expand, offering new ways to improve performance and minimize risk.

0 Comments

Leave a Comment