===========================================

Introduction

In modern financial markets, institutional traders use algorithms to maintain speed, accuracy, and efficiency in executing large transactions. Institutions—such as hedge funds, pension funds, mutual funds, and investment banks—manage billions of dollars and must balance execution quality with market impact. Unlike retail traders, institutions cannot simply place a buy or sell order without significantly influencing prices.

This article explores why algorithms have become indispensable to institutional trading, the main types of algorithmic strategies used, their advantages and limitations, and how institutions integrate these systems into their broader workflows. We will also include practical insights, industry trends, and comparisons of different algorithmic trading methods.

The Evolution of Institutional Trading

Institutional trading has evolved drastically in the past three decades. Before algorithms, large orders were executed manually by traders on exchange floors or through phone calls. This manual process was slow, prone to error, and often moved markets unfavorably.

With the rise of electronic exchanges and technological advancements, algorithmic trading became a necessity. Today, over 70% of institutional equity trades in the U.S. are executed algorithmically, and this percentage is growing globally.

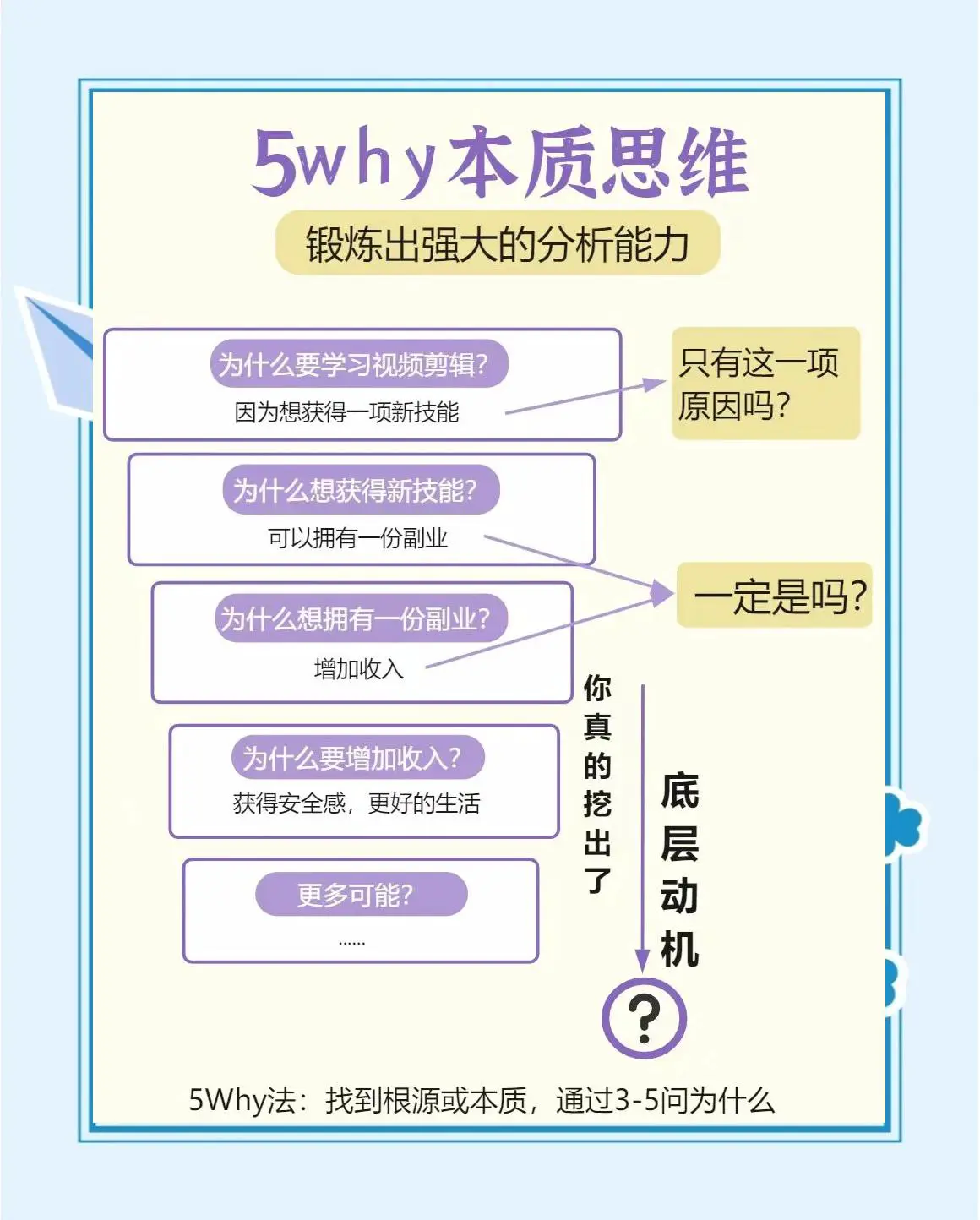

Why Do Institutional Traders Use Algorithms?

1. Speed and Efficiency

Algorithms can scan markets, analyze signals, and execute trades in milliseconds—far faster than human traders.

2. Reduced Market Impact

Large block trades can distort prices. Algorithms split these trades into smaller increments, reducing visibility and slippage.

3. Risk Management

Algorithms allow precise risk controls, such as dynamic stop-losses, exposure caps, and volatility filters.

4. Cost Savings

By optimizing execution timing and reducing spreads, algorithms minimize trading costs.

5. Access to Multiple Markets

Algorithms enable institutions to simultaneously trade across multiple exchanges, asset classes, and geographies.

Core benefits of algorithms for institutional traders: efficiency, cost savings, and risk control

Common Algorithmic Trading Strategies Used by Institutions

1. Volume-Weighted Average Price (VWAP)

VWAP algorithms spread large trades over a day to match average market volumes.

Pros:

- Minimizes price impact.

- Simple and widely used.

Cons:

- Less effective in volatile or thinly traded markets.

2. Time-Weighted Average Price (TWAP)

TWAP algorithms break orders into evenly timed intervals regardless of market volume.

Pros:

- Works well in stable, liquid markets.

- Reduces detection by other algorithms.

Cons:

- May underperform if market volume patterns deviate significantly.

3. Implementation Shortfall (IS)

This strategy balances minimizing slippage and execution costs against achieving optimal entry prices.

Pros:

- Reduces opportunity cost.

- Flexible to market conditions.

Cons:

- Requires advanced modeling and monitoring.

4. Smart Order Routing (SOR)

SOR algorithms automatically route orders to venues with the best prices and liquidity.

Pros:

- Accesses fragmented liquidity across multiple exchanges.

- Improves execution quality.

Cons:

- Complex infrastructure needed.

Comparing Rule-Based vs. AI-Driven Algorithms

Rule-Based Algorithms

Predefined rules (e.g., VWAP, TWAP) execute trades based on fixed logic.

- Strengths: Simplicity, transparency, easy compliance.

- Weaknesses: Limited adaptability in volatile markets.

AI-Driven Algorithms

Machine learning models adapt execution strategies in real time using big data.

- Strengths: Dynamic, predictive, highly efficient.

- Weaknesses: Complexity, “black-box” risk, regulatory scrutiny.

Comparison of VWAP, TWAP, and AI-based institutional algorithms

Institutional Experience: Why Algorithms Are Indispensable

From experience consulting with portfolio managers, the biggest value algorithms bring is consistency. A human trader can have a bad day or miss signals, but an algorithm follows its rules precisely every time.

Institutions also face strict compliance obligations. Algorithms provide audit trails, ensuring trades are executed in line with regulatory and fiduciary standards. Many firms now integrate institutional trading risk management strategies directly into their algorithmic frameworks, ensuring real-time oversight.

Industry Trends in Institutional Algorithmic Trading

- AI & Machine Learning Integration – Predictive algorithms are becoming the new standard.

- Multi-Asset Algorithms – Single systems that handle equities, bonds, FX, and crypto.

- Cloud-Based Execution Platforms – Increasing accessibility and scalability.

- Regulatory Tech (RegTech) – Compliance monitoring embedded into trading workflows.

These trends are changing how institutional trading differs from retail trading, with institutions focusing heavily on reducing systemic risks and optimizing execution across markets.

Challenges of Algorithmic Trading for Institutions

- Technology Costs – Building and maintaining systems requires millions in investment.

- Regulatory Oversight – Complex compliance requirements add operational burdens.

- Competition – Other firms’ algorithms can counteract or exploit predictable strategies.

- Market Risks – Sudden volatility can overwhelm even well-designed systems.

Best Practices for Institutional Algorithm Use

- Regular Backtesting – Validate algorithms against historical and live market conditions.

- Risk Limits – Hard caps on position size, leverage, and losses.

- Monitoring – Real-time oversight to detect malfunctioning or rogue trades.

- Continuous Optimization – Adapting algorithms as market structures evolve.

FAQ: Why Do Institutional Traders Use Algorithms?

1. Do all institutional traders rely on algorithms?

Yes, to varying degrees. While some still use manual oversight, nearly all institutional orders today are routed or executed through algorithms for efficiency.

2. How do algorithms help institutions trade large volumes?

Algorithms break trades into smaller parts and execute them strategically across time and venues, minimizing market impact. Institutions also use specialized strategies designed for block trades.

3. What risks do institutions face with algorithms?

Key risks include overfitting models, regulatory violations, and technology failures. To mitigate these, firms implement solutions for optimizing institutional trade execution and real-time monitoring.

Conclusion

So, why do institutional traders use algorithms? Because they offer speed, consistency, reduced costs, risk management, and the ability to trade massive volumes without disrupting markets. Algorithms are not a luxury—they are a necessity for modern institutions operating in competitive, fragmented global markets.

For institutions, the future lies in AI-driven algorithms that can learn, adapt, and execute with greater precision than ever before. For retail traders, understanding these institutional methods can provide valuable insights into market dynamics and execution strategies.

If you found this article helpful, share it with your network and join the conversation below—do you think AI will eventually replace most institutional traders entirely?

Institutional algorithmic trading ecosystem connecting exchanges, traders, and compliance systems

0 Comments

Leave a Comment