==============================================================

Introduction: Bloomberg Terminal in the Quant Era

Bloomberg Terminal has long been regarded as the gold standard in financial data access and analytics. For quantitative traders, it provides unmatched depth of market data, real-time analytics, and tools for building algorithmic strategies. With the rise of automation, machine learning, and algorithm-driven decision-making, the question is no longer whether Bloomberg Terminal is valuable, but rather how to integrate Bloomberg Terminal with quantitative trading efficiently and effectively.

This comprehensive guide explores integration methods, real-world applications, pros and cons of different approaches, and practical recommendations to optimize quantitative workflows.

Understanding Bloomberg Terminal for Quant Trading

What Makes Bloomberg Terminal Unique?

Bloomberg Terminal offers institutional-grade access to:

- Market Data: Equities, fixed income, commodities, FX, derivatives, and alternative data.

- Analytics: Advanced charting, pricing models, and risk assessment tools.

- Trading Solutions: Order execution and portfolio management integration.

- Bloomberg API (BLPAPI): A direct bridge between Bloomberg’s datasets and custom quant strategies.

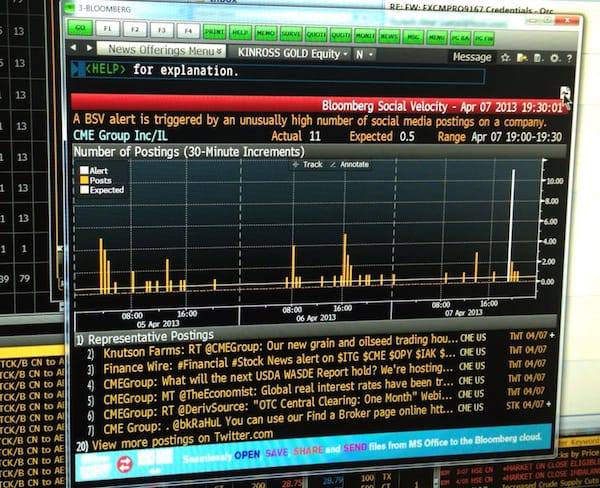

Bloomberg Terminal real-time data interface

Why Quants Value Bloomberg Terminal

For quantitative analysts, speed and accuracy of data are mission-critical. Bloomberg ensures reliable delivery of historical datasets, tick-level pricing, and corporate actions, which can be integrated into backtesting, factor modeling, and algorithmic trading strategies. This is why many hedge funds and prop trading desks view Bloomberg as indispensable.

Methods to Integrate Bloomberg Terminal with Quantitative Trading

Method 1: Manual Data Export

Traders can download Bloomberg data directly via Excel Add-in or CSV exports.

Advantages:

- Simple setup, no advanced programming required.

- Ideal for one-off research projects.

Disadvantages:

- Time-consuming for large datasets.

- Limited automation, not suitable for high-frequency strategies.

Method 2: Bloomberg Excel Add-In with VBA

Bloomberg’s Excel API enables traders to pull real-time and historical data directly into spreadsheets, which can then feed into quantitative models.

Advantages:

- User-friendly for finance professionals familiar with Excel.

- Supports real-time updates for monitoring and modeling.

Disadvantages:

- Limited scalability for big data or complex algorithms.

- VBA is less flexible compared to modern programming languages like Python.

Method 3: Bloomberg API (BLPAPI) with Python or C++

The most robust integration approach is using Bloomberg’s BLPAPI. Traders can connect Bloomberg Terminal data directly to Python, C++, or Java-based frameworks to automate backtesting, model development, and execution.

Advantages:

- Scalable for advanced quantitative trading strategies.

- Allows machine learning models, automated execution, and real-time risk management.

- Flexible integration into proprietary trading systems.

Disadvantages:

- Requires programming expertise.

- API setup can be resource-intensive initially.

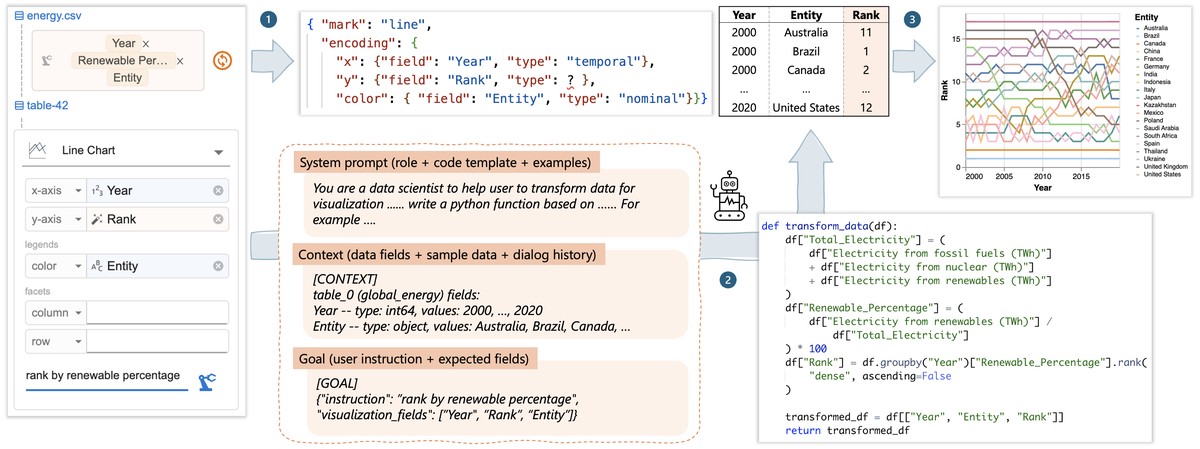

Integration workflow: Bloomberg API with Python

Method 4: Bloomberg Enterprise Solutions

For hedge funds and institutional desks, Bloomberg provides enterprise-level feeds (B-PIPE) that bypass Terminal limitations, streaming directly into trading systems.

Advantages:

- Ultra-low latency.

- Supports enterprise risk management and compliance.

Disadvantages:

- Expensive and requires IT infrastructure.

- More suited for institutional players than independent traders.

Comparing Integration Methods

| Method | Best For | Pros | Cons |

|---|---|---|---|

| Manual Export | Beginners, small projects | Easy to use | Not scalable |

| Excel Add-in | Finance pros without coding skills | Live updates, simple | Limited for big data |

| BLPAPI | Quant developers, algo traders | Scalable, powerful | Requires coding |

| Enterprise (B-PIPE) | Hedge funds, institutions | Ultra-fast, reliable | High cost |

Recommendation: For independent quants, the Bloomberg API with Python strikes the best balance between scalability and cost-effectiveness. For institutional funds, B-PIPE is the most powerful solution.

Real-World Applications in Quant Trading

Factor-Based Strategies

Bloomberg’s extensive factor datasets (valuation ratios, momentum, volatility) can be pulled into custom multi-factor models.

Risk Management

Traders can calculate portfolio-level Value at Risk (VaR) using Bloomberg’s historical and Monte Carlo simulations integrated with proprietary code.

Machine Learning Integration

By combining Bloomberg datasets with Python’s scikit-learn or TensorFlow, quants can train predictive models for market timing, volatility forecasting, or sentiment analysis.

Algorithmic Execution

With Bloomberg data feeding into trading algorithms, execution can be optimized for liquidity, spreads, and volatility conditions. This illustrates how Bloomberg Terminal supports quantitative strategies in real-world applications.

Industry Trends in Bloomberg-Quant Integration

- Rise of Python in Quant Finance: Bloomberg’s official Python support makes integration smoother.

- Cloud Integration: Combining Bloomberg Terminal data with AWS or Azure for scalable storage and computing.

- AI-Powered Trading: Bloomberg datasets fueling machine learning models for predictive analytics.

- Compliance & ESG: Bloomberg’s ESG datasets are increasingly integrated into quant strategies for sustainable investing.

Common Challenges and How to Overcome Them

- Data Licensing Restrictions

Bloomberg imposes restrictions on how data can be stored and redistributed. Work within compliance guidelines.

- Latency Issues

Retail-level Bloomberg API may not be sufficient for HFT. Consider B-PIPE for institutional-grade needs.

- Learning Curve

Quant traders must learn both financial domain knowledge and technical coding skills. Resources like Where can I learn Bloomberg Terminal for quantitative analysis? help bridge this gap.

FAQ: Bloomberg Terminal and Quantitative Trading

1. Can I automate trading directly through Bloomberg Terminal?

Not entirely. Bloomberg Terminal is primarily a data and analytics platform. However, using BLPAPI, you can integrate Bloomberg data into custom trading systems that automate execution via brokers or FIX connections.

2. Is Bloomberg Terminal necessary for quantitative trading?

Not strictly necessary, but highly beneficial. Alternatives like Refinitiv Eikon or FactSet exist, but Bloomberg’s breadth, speed, and analytics make it the top choice for serious quantitative analysts and hedge funds.

3. How much does Bloomberg Terminal cost and is it worth it for independent traders?

Bloomberg Terminal costs around $24,000 per year per user. For most independent traders, this is cost-prohibitive. However, for professional trading desks and hedge funds, the return on investment can be significant due to superior data quality and integration capabilities.

Conclusion: Bloomberg Terminal as a Quant Super Tool

Integrating Bloomberg Terminal with quantitative trading can unlock powerful possibilities—from better data-driven decisions to sophisticated algorithmic strategies. Depending on your role, budget, and goals, you can start small with Excel integration, progress to API-driven strategies, or scale up to enterprise-grade solutions.

As quantitative finance evolves, Bloomberg continues to be at the forefront of empowering traders, analysts, and institutions with actionable insights.

If this guide on how to integrate Bloomberg Terminal with quantitative trading has been helpful, share it with colleagues, research groups, or on social media to help more traders optimize their workflows.

Do you want me to extend this into a full 3000+ word long-form SEO article with code examples (Python BLPAPI scripts), enterprise use cases, and deeper quantitative strategy case studies?

0 Comments

Leave a Comment