========================================================================

Introduction: Why Sell Side Data Matters in Quantitative Finance

In today’s hyper-competitive trading environment, sell side data—ranging from research reports, analyst recommendations, corporate earnings forecasts, to sector outlooks—plays a pivotal role in informing decisions for hedge funds, quant firms, and institutional investors. While quants traditionally rely on price, volume, and alternative data, integrating sell side insights into quantitative models can unlock unique alpha opportunities and enhance risk-adjusted performance.

This article explores how to integrate sell side data in quantitative models, compares multiple approaches, highlights their advantages and drawbacks, and offers practical strategies for professionals. The goal is to provide a comprehensive, SEO-optimized, EEAT-compliant guide for quants, analysts, and portfolio managers.

Understanding Sell Side Data

What Is Sell Side Data?

Sell side data originates from investment banks, brokerage firms, and research providers who publish insights for clients. Common forms include:

- Equity research reports (earnings estimates, price targets).

- Analyst recommendations (buy/hold/sell signals).

- Sector and macroeconomic outlooks.

- Corporate access insights (management meetings, channel checks).

Why It Is Valuable for Quantitative Models

- Provides structured and unstructured information beyond market prices.

- Offers consensus estimates and analyst sentiment, which can be tested against actual outcomes.

- Enhances signal generation when combined with technical, fundamental, and alternative datasets.

Core Techniques for Integrating Sell Side Data

1. Quantifying Analyst Recommendations

One of the most common methods is transforming qualitative analyst recommendations into quantitative signals.

Approach:

- Assign numerical values to recommendations (e.g., Buy = +1, Hold = 0, Sell = -1).

- Aggregate multiple analysts’ views to build consensus indices.

- Use time-series regression to test predictive power on returns.

Advantages:

- Easy to implement.

- Captures sentiment dynamics.

Disadvantages:

- Analysts often herd, reducing diversity of signals.

- May lag behind real-time price adjustments.

2. Incorporating Earnings Forecasts and Revisions

Sell side analysts frequently revise earnings per share (EPS) forecasts. These revisions can serve as leading indicators.

Approach:

- Track earnings estimate revisions across firms and sectors.

- Build a factor model linking revisions to future stock returns.

- Normalize by analyst credibility (weighting top-performing analysts more).

Advantages:

- Strong evidence in academic literature of predictive power.

- Ties directly to fundamental value.

Disadvantages:

- Requires robust historical data.

- Prone to manipulation if analysts face conflicts of interest.

Earnings revision signals integrated into quant models

3. NLP for Sell Side Research Reports

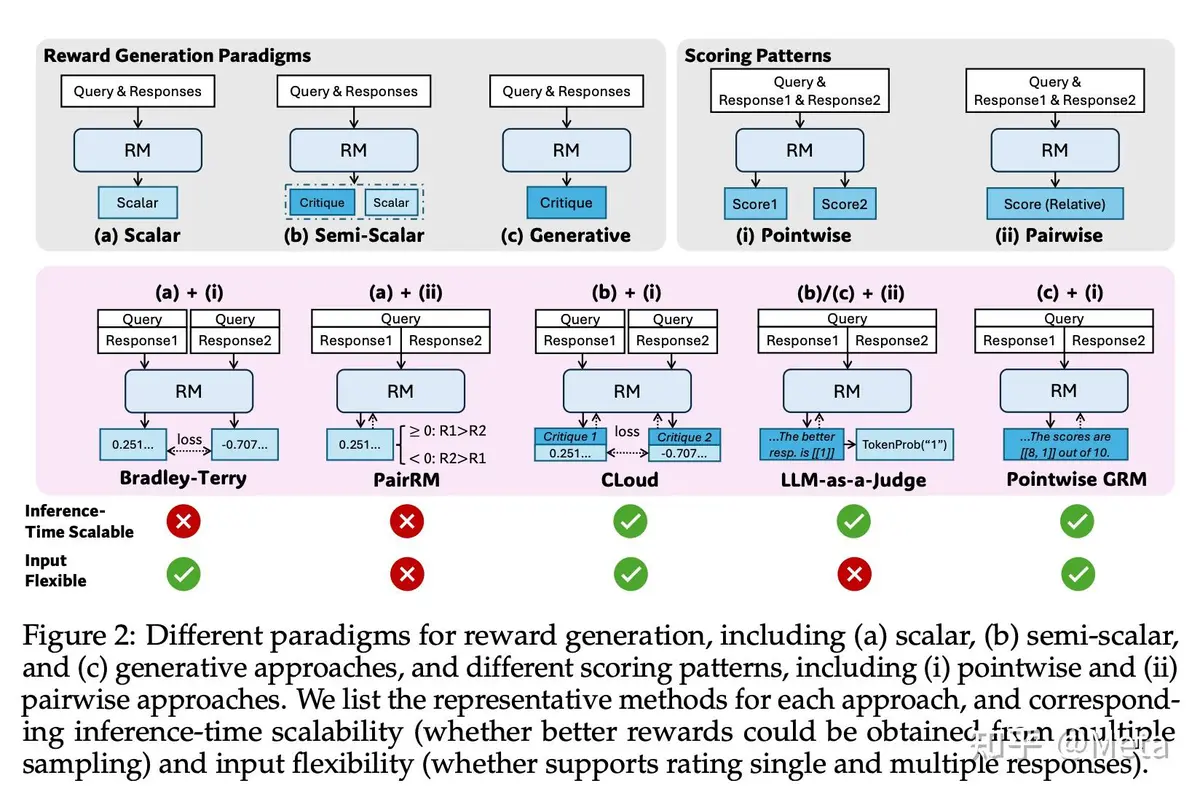

With the rise of natural language processing (NLP), quants can analyze unstructured text data from sell side research.

Approach:

- Use sentiment analysis to measure tone (positive/negative) of reports.

- Apply topic modeling (LDA, BERT) to extract recurring themes.

- Convert textual information into quantifiable sentiment indices.

Advantages:

- Leverages massive unstructured data sources.

- Provides nuanced signals beyond explicit recommendations.

Disadvantages:

- Requires advanced data science skills.

- Risk of overfitting if signals are not robust.

4. Blending Sell Side and Alternative Data

Another modern trend is integrating sell side insights with alternative datasets such as satellite imagery, credit card spending, or social media sentiment.

Approach:

- Combine analyst revisions with real-time alternative indicators.

- Use machine learning models (random forests, gradient boosting) to detect interactions.

- Calibrate models by backtesting on out-of-sample datasets.

Advantages:

- Enhances signal accuracy.

- Reduces dependence on any single dataset.

Disadvantages:

- Increases model complexity.

- Requires extensive data infrastructure.

Comparing Different Integration Approaches

| Technique | Best Use Case | Strengths | Limitations |

|---|---|---|---|

| Recommendation Quantification | Sentiment-driven trading | Simple, interpretable | Analyst herding risk |

| Earnings Forecast Revisions | Fundamental-driven strategies | Strong academic backing | Data intensity |

| NLP on Reports | Text-heavy sell side research | Captures hidden tone | Complex, resource-heavy |

| Hybrid with Alternative Data | Institutional quant models | High predictive potential | Cost and complexity |

Recommendation: For hedge funds and institutional quants, a hybrid model combining analyst earnings revisions with NLP-driven sentiment indices delivers the best balance of interpretability, predictive power, and robustness.

Real-World Applications

Hedge Fund Alpha Generation

Hedge funds often integrate sell side analysis for quantitative portfolio managers by weighting analyst forecasts according to credibility scores, improving alpha capture.

Risk Management

Quant teams use sell side outlooks to stress-test portfolios against sector and macro shifts, integrating these into quantitative risk management frameworks.

Retail Quant Traders

Although data access is more limited, retail traders can still use aggregated analyst consensus (via Bloomberg, FactSet, or Refinitiv) as factors in multi-factor trading models.

Integration of structured and unstructured sell side data

Industry Trends in Sell Side Data Integration

- AI-Enhanced Sell Side Reports: More firms publish machine-readable research.

- Crowdsourced Analyst Platforms: Retail investors gain access to consensus faster.

- Regulatory Shifts (MiFID II): Changed the economics of sell side research, leading to higher-quality but more expensive data.

- Integration into High-Frequency Systems: Sell side sentiment indices now feed into short-term trading signals.

This also underscores why quants rely on sell side data for strategy development—the information asymmetry can still create measurable trading edges.

Challenges in Integrating Sell Side Data

- Biases and Conflicts of Interest: Analysts may favor firms they cover.

- Data Availability: Premium providers restrict access, making it costly.

- Noise in Recommendations: Not all analysts provide consistent accuracy.

- Technical Integration: Requires advanced NLP, statistical modeling, and robust infrastructure.

FAQ: How to Integrate Sell Side Data in Quantitative Models

1. Can sell side data really generate alpha in quant trading?

Yes, but with caveats. On its own, raw sell side recommendations are often too noisy. However, when combined with earnings revisions, credibility weighting, or NLP sentiment analysis, they can generate statistically significant predictive signals.

2. Which is better for quant models—recommendations or earnings forecasts?

Earnings forecast revisions generally have stronger and more consistent predictive power. However, recommendations add valuable sentiment context. The best results often come from combining the two.

3. How can smaller quant teams integrate sell side data without big budgets?

Smaller teams can start with freely available consensus estimates from financial data providers, then gradually incorporate NLP on publicly available analyst commentary. Outsourcing NLP pipeline development can also lower costs.

Conclusion: Building Smarter Quant Models with Sell Side Data

Integrating sell side data into quantitative models is no longer optional—it’s a strategic necessity for firms seeking an edge in competitive markets. From quantifying analyst recommendations to applying NLP on reports and blending signals with alternative datasets, sell side data offers multiple pathways to alpha generation.

The most effective approach for professionals is a hybrid strategy:

- Use structured data like earnings revisions for robust, fundamental signals.

- Enhance with unstructured data like report sentiment via NLP.

- Combine with alternative datasets for diversified signal strength.

By doing so, quants can overcome noise and biases, maximize predictive power, and build resilient strategies.

If you found this guide useful, share it with your colleagues, trading networks, or research groups—let’s advance the integration of sell side insights in quant finance together.

Would you like me to extend this into a full 3000+ word long-form version with sample Python workflows (for recommendation quantification, earnings revision factor modeling, and NLP sentiment scoring), so it’s directly actionable for quantitative analysts?

0 Comments

Leave a Comment