======================================================================================

In the fast-paced world of quantitative trading, detecting anomalies is crucial for maintaining consistent performance and managing risk. The use of integrated anomaly detection services for quant trading offers an efficient way to monitor and identify abnormal patterns in financial data. This article explores how anomaly detection enhances trading strategies, discusses the various methods and tools available, and provides insights into integrating these services into quantitative trading systems.

What is Anomaly Detection in Quantitative Trading?

Anomaly detection is the process of identifying data points, events, or observations that deviate significantly from the expected pattern. In quantitative trading, anomalies could indicate market inefficiencies, potential risks, or opportunities that need to be addressed. By using anomaly detection algorithms, traders can detect unusual price movements, spikes in volatility, or errors in trading systems.

Integrated anomaly detection services for quant trading focus on leveraging machine learning algorithms and statistical methods to automatically detect and flag outliers in real-time. These systems allow traders to react quickly to market shifts, manage risks more effectively, and optimize their trading strategies.

The Role of Anomaly Detection in Quantitative Trading

Risk Management and Early Warning Systems

Anomaly detection plays a vital role in risk management. By analyzing historical data and current market conditions, anomaly detection systems can identify deviations that might indicate emerging risks. These risks could range from sudden price drops or unexpected correlations in asset prices to errors in algorithmic trading strategies. For instance, if a trade diverges from expected behavior, it can be flagged as an anomaly, prompting the trader to take corrective action before further losses occur.

In the context of high-frequency and algorithmic trading, where trades happen in microseconds, detecting anomalies in real-time is essential for preventing significant losses and ensuring trading strategies remain effective.

Enhancing Trading Performance

Anomalies can also represent untapped opportunities. For example, when an asset experiences sudden price fluctuations outside of typical patterns, it may indicate the potential for a profitable trade. With integrated anomaly detection services, quantitative traders can identify such movements faster, improving their ability to act quickly and take advantage of opportunities before they vanish.

By utilizing anomaly detection, trading algorithms can dynamically adjust to evolving market conditions, learning and optimizing based on new data. This leads to better execution, more refined strategies, and ultimately, enhanced trading performance.

Different Methods for Anomaly Detection in Quantitative Trading

Statistical Methods

- Z-Score Analysis: One of the simplest forms of anomaly detection in quantitative trading is using the Z-score. This method measures how far a data point is from the mean, in terms of standard deviations. Data points that exceed a certain threshold are considered anomalies. Although effective for basic anomaly detection, Z-score analysis may fail to detect complex, non-linear patterns often found in financial data.

- Moving Average Models: Moving averages (e.g., exponential or simple) are commonly used in anomaly detection for trading. By calculating the average of prices over a specific period, traders can monitor short-term fluctuations. Any significant deviation from the moving average might signal an anomaly. This method works well for detecting trends but can struggle to capture sudden or irregular market shifts.

Machine Learning Approaches

- Isolation Forests: Isolation Forests are machine learning models designed specifically for anomaly detection. This technique isolates observations by randomly selecting features and then recursively partitioning the data. It is efficient for detecting anomalies in large datasets, making it ideal for real-time anomaly detection in high-frequency trading environments.

- Autoencoders: Autoencoders, a type of neural network, are effective for anomaly detection by learning to compress and reconstruct data. When the reconstruction error is high, it indicates an anomaly. These models are excellent for detecting complex and subtle anomalies in multidimensional financial datasets, making them particularly useful for detecting irregular patterns in quantitative trading.

- Support Vector Machines (SVMs): SVMs can be used for anomaly detection by finding a hyperplane that best separates normal and anomalous data points. SVMs are powerful for high-dimensional spaces and can detect anomalies that may not be evident with simpler statistical methods.

Comparing Statistical vs. Machine Learning Approaches

Statistical methods are quick to implement and effective for basic anomaly detection, especially in simpler market conditions or for small datasets. However, they are limited in their ability to adapt to complex market dynamics and may miss out on more sophisticated anomaly patterns.

On the other hand, machine learning methods are more advanced and can detect subtle and complex anomalies in large datasets. These methods are capable of learning from past data and improving over time, making them ideal for real-time trading environments. The drawback is that machine learning models require more computational resources and may need regular retraining to stay up-to-date with market changes.

Integrating Anomaly Detection Services into Quant Trading Systems

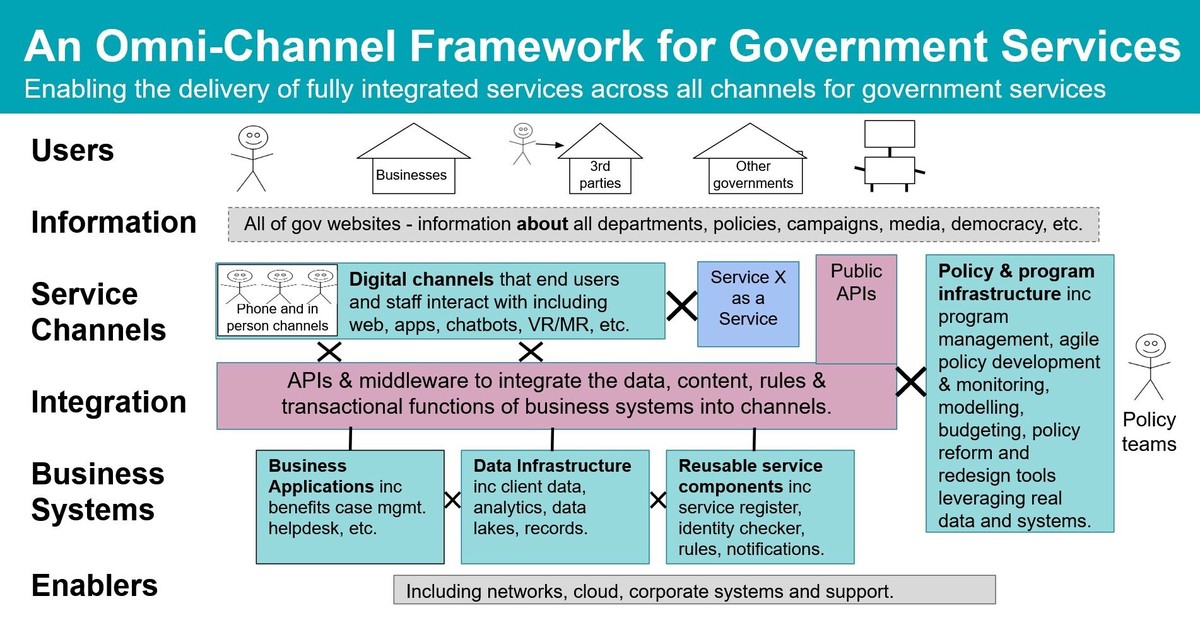

End-to-End Integration

Integrating anomaly detection into quantitative trading systems involves embedding these services into the broader trading infrastructure. This integration includes the use of APIs to connect anomaly detection tools with trading platforms and real-time data feeds. Once integrated, the system can automatically analyze incoming data, detect anomalies, and trigger alerts or automated responses as required.

One popular approach is using cloud-based anomaly detection systems. These systems offer scalability, flexibility, and real-time processing capabilities, making them suitable for firms with large-scale operations and global trading activities.

Real-Time Detection and Automated Response

Real-time anomaly detection allows trading systems to identify unusual market conditions as they happen. These systems can automatically trigger a range of responses, from simply alerting the trader to adjusting trade parameters or halting trades altogether. In automated trading systems, this can lead to smarter, faster decision-making, reducing human error and improving performance.

Customizable Solutions for Trading Firms

For many quant trading firms, an off-the-shelf anomaly detection solution may not be sufficient. In such cases, firms can opt for customizable anomaly detection services tailored to their specific trading strategies and risk profiles. These bespoke solutions integrate seamlessly with existing trading infrastructure, ensuring that the anomaly detection system meets the firm’s precise needs.

FAQ (Frequently Asked Questions)

1. Why is anomaly detection important in quantitative trading?

Anomaly detection is critical in quantitative trading because it allows traders to identify unusual patterns that could indicate risks, errors, or profitable opportunities. In high-frequency and algorithmic trading environments, detecting these anomalies in real-time can prevent large losses, improve risk management, and enhance overall performance.

2. How does machine learning improve anomaly detection in trading?

Machine learning enhances anomaly detection by enabling models to learn from historical data and adapt to evolving market conditions. Unlike traditional statistical methods, machine learning algorithms like autoencoders and isolation forests can detect complex, non-linear patterns that are often present in financial data, providing more accurate and nuanced results.

3. How do I integrate anomaly detection into my trading system?

To integrate anomaly detection into your trading system, you can choose from a variety of tools and platforms that offer real-time data analysis, machine learning integration, and automated alerting. Some services offer APIs to integrate anomaly detection features directly into your trading infrastructure. Additionally, cloud-based solutions provide scalability and flexibility for large-scale operations.

Conclusion

Integrated anomaly detection services are invaluable in the world of quantitative trading. By leveraging advanced machine learning techniques and statistical methods, traders can identify and respond to risks, errors, and opportunities more effectively. Whether using simple statistical models or cutting-edge machine learning approaches, the key is integrating anomaly detection systems into your trading strategy to enhance performance and minimize risks.

For traders looking to stay ahead of the curve, adopting real-time anomaly detection systems and continuously refining them will provide a competitive edge in the dynamic world of quantitative trading.

0 Comments

Leave a Comment