===============================================================================

In the competitive world of trading, optimization plays a crucial role in enhancing profitability and reducing risk. Whether you’re a beginner or an experienced trader, understanding how to optimize your trading strategies, risk management, and portfolio can significantly boost your trading performance. This guide delves into various optimization techniques, tutorials, and practical advice to help traders optimize their systems and models.

Understanding Optimization in Trading

Optimization in trading refers to the process of adjusting different variables within a trading strategy to maximize profits, minimize risks, or achieve a specific objective. It’s essential for both quantitative and qualitative traders to utilize optimization strategies to improve the effectiveness of their trading models.

Why Optimization Is Important for Traders

Optimization is a key aspect of quantitative trading, as it allows traders to fine-tune their models, identify inefficiencies, and adapt strategies to changing market conditions. Whether you’re focused on backtesting, risk management, or portfolio optimization, optimizing various factors is crucial to maintaining a competitive edge in the market.

The Role of Backtesting in Optimization

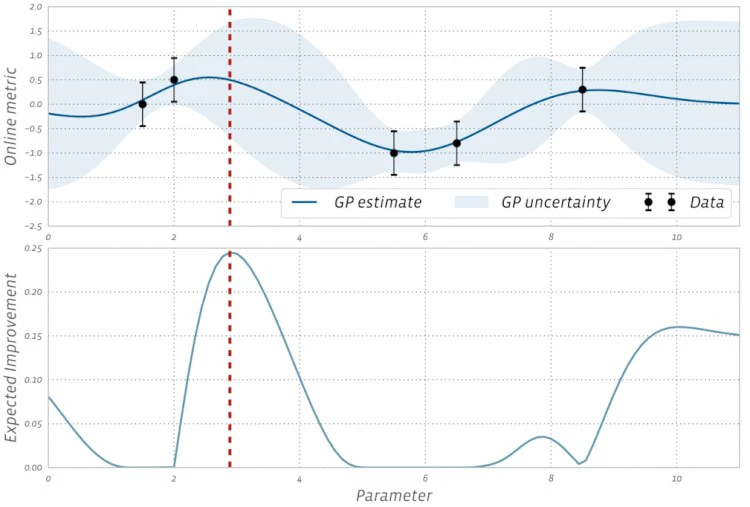

Backtesting involves testing a trading strategy using historical data to see how it would have performed. Optimization is a vital part of the backtesting process, as it allows traders to adjust their strategies based on past performance, ensuring better decision-making in real-world trading. By optimizing backtesting for trading strategies, traders can simulate various scenarios and fine-tune their models for maximum efficiency.

Different Optimization Methods and Strategies

1. Statistical Optimization

Statistical optimization focuses on using statistical methods and algorithms to improve trading strategies. Techniques such as Monte Carlo simulations, genetic algorithms, and machine learning are commonly used in this approach. These methods allow traders to run simulations and identify optimal parameter values for their models.

Advantages:

- Can analyze multiple parameters simultaneously.

- Provides insights into a variety of scenarios.

- Uses advanced mathematical techniques for precision.

Disadvantages:

- Requires a high level of expertise in statistics and programming.

- Can be computationally intensive.

2. Heuristic Optimization

Heuristic optimization involves applying rules of thumb and problem-solving techniques to optimize trading strategies. Unlike statistical optimization, heuristic optimization does not rely on complex algorithms or historical data. Instead, it focuses on finding solutions that are “good enough” through trial and error.

Advantages:

- Faster implementation compared to statistical methods.

- More accessible to beginner traders.

- Requires less computational power.

Disadvantages:

- May not always lead to the absolute optimal solution.

- Often relies on subjective judgment.

Best Optimization Practices for Traders

How to Optimize Quantitative Trading Strategies

Quantitative traders use mathematical models to execute trades. Optimization in this context involves adjusting parameters such as trading signals, stop-loss levels, and position sizes. By applying advanced optimization techniques, traders can enhance their strategy’s profitability.

Key Steps:

- Identify key parameters for optimization.

- Use historical data to test different parameter combinations.

- Apply optimization algorithms to fine-tune the parameters.

Optimizing Risk Management in Trading

Risk management is one of the most critical aspects of trading. Proper optimization can help minimize losses and protect capital. Traders use optimization techniques to fine-tune their risk-reward ratios, stop-loss levels, and position sizes to ensure they are taking on an acceptable level of risk.

Key Methods:

- Monte Carlo simulations for risk scenario analysis.

- Adjusting position sizes based on volatility.

- Dynamic stop-loss and take-profit levels.

Advanced Optimization Techniques

Machine Learning for Optimization

Machine learning (ML) is becoming an essential tool in modern trading. Traders can use ML algorithms to optimize their strategies by automatically adjusting parameters based on new data. These algorithms learn from historical data and improve their predictions over time.

Advantages:

- Can adapt to changing market conditions.

- Automatically adjusts strategy parameters for optimal performance.

- Offers predictive insights based on large datasets.

Disadvantages:

- Requires advanced knowledge of machine learning and programming.

- Can be resource-intensive.

Real-Time Optimization for Algorithmic Traders

Algorithmic traders rely on real-time optimization to execute trades based on current market conditions. This method involves continuously adjusting the parameters of a trading algorithm to adapt to new data as it comes in. Real-time optimization allows traders to stay ahead of the curve and respond quickly to market changes.

Key Benefits:

- Instant adaptation to new market conditions.

- Enhances decision-making speed and accuracy.

- Provides more precise entry and exit points.

FAQs on Optimization for Traders

1. What are the most common optimization tools for trading?

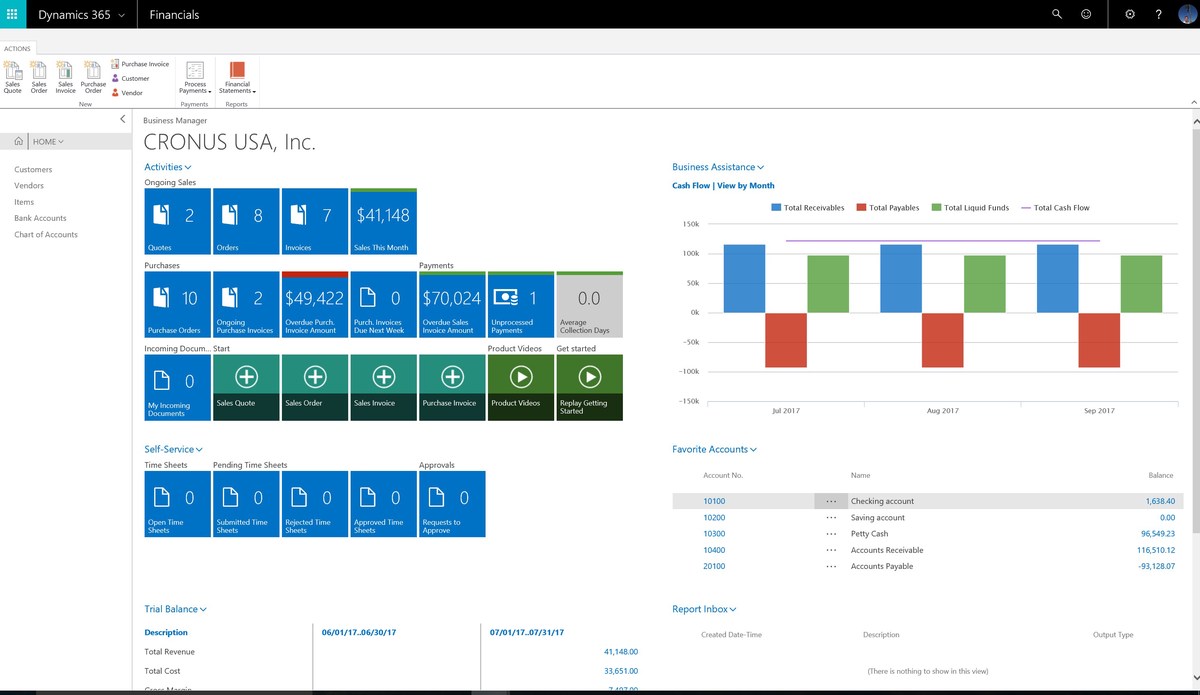

Some of the most common tools include backtesting software, optimization libraries for programming languages like Python, and specialized trading platforms with built-in optimization features. Examples include MetaTrader, NinjaTrader, and QuantConnect.

2. How can beginners start optimizing their trading strategies?

Beginner traders can start by focusing on basic optimization methods, such as adjusting stop-loss and take-profit levels or experimenting with different technical indicators. Using backtesting software is a great starting point to refine strategies and get feedback on performance.

3. Why is optimization critical for long-term trading success?

Optimization helps traders continuously refine their strategies and models, adapt to changing market conditions, and identify the best parameters to achieve sustainable profitability. Without optimization, traders risk using outdated or inefficient models that can lead to significant losses.

Conclusion

Optimization is a fundamental aspect of successful trading. Whether you’re fine-tuning your risk management, improving backtesting procedures, or employing machine learning for real-time adjustments, optimization strategies can provide you with the edge needed to excel in the markets. As we’ve explored various optimization techniques, from statistical methods to real-time trading algorithms, it’s clear that the key to effective optimization lies in choosing the right methods that align with your trading style and goals.

If you’re serious about optimizing your trading, start experimenting with the strategies discussed in this article. Over time, you’ll gain a deeper understanding of which techniques work best for your specific trading style. Don’t forget to share your experiences in the comments and share this guide with fellow traders who might find it useful.

Feel free to check out these related articles:

- How to Optimize Quantitative Trading Strategies

- Why Optimization Is Important in Quantitative Trading

By continuously refining your strategies with proper optimization, you’ll be able to achieve better results, lower risks, and become a more successful trader in the long run.

0 Comments

Leave a Comment