==========================================

Risk management is one of the most crucial aspects of successful trading. It helps traders navigate the inherent uncertainties in financial markets while protecting their capital and maximizing their potential returns. In this guide, we’ll explore how to optimize risk management in trading through various strategies, tools, and techniques, with a focus on practical applications for traders at all experience levels.

Why Risk Management is Essential in Trading

Effective risk management prevents traders from losing their entire capital in one wrong move. It enables consistent profitability, provides a buffer against market volatility, and helps maintain a clear head during stressful market conditions. Without proper risk management, even the most skilled traders can face significant losses.

Key Benefits of Optimizing Risk Management

- Preserves Capital: Minimizes large losses and protects the trader’s capital.

- Promotes Consistency: Helps traders manage their trades effectively and reduce emotional decision-making.

- Enhances Decision-Making: Provides structure for evaluating risk and reward.

- Reduces Stress: Enables traders to focus on strategy and long-term goals without worrying about immediate large losses.

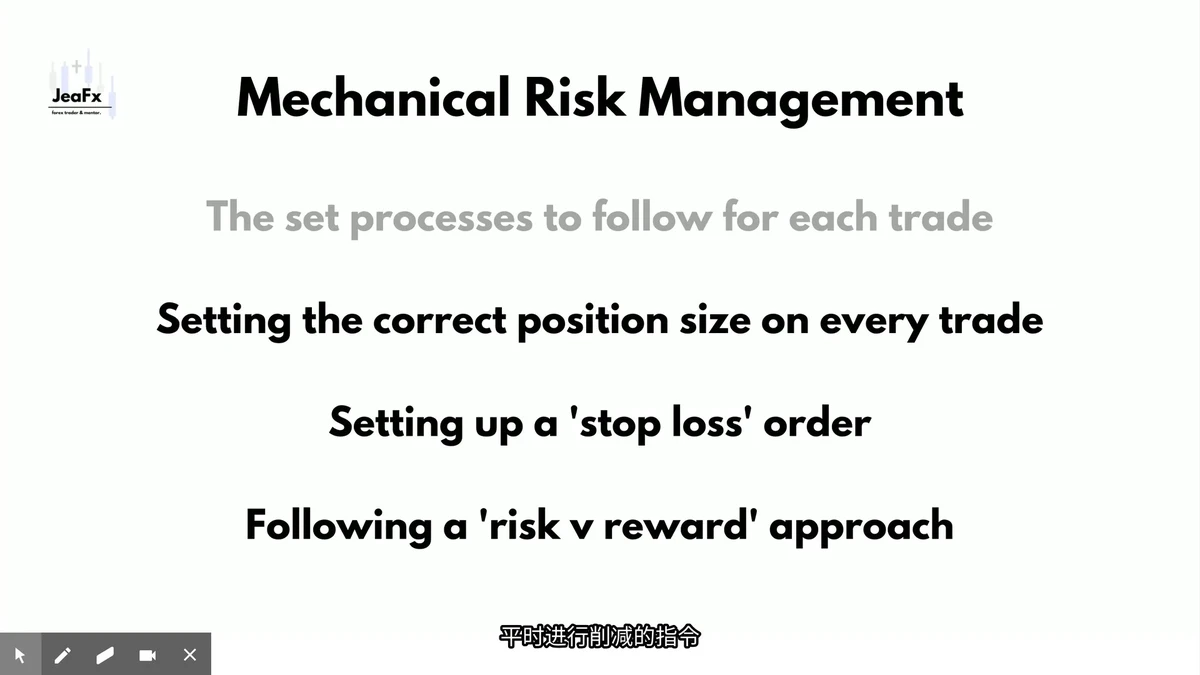

Methods for Optimizing Risk Management

There are multiple strategies and tools available for optimizing risk management in trading. Below, we discuss two primary approaches: Position Sizing and Risk-to-Reward Ratios. Both methods play an essential role in protecting capital and optimizing profitability.

1. Position Sizing: The Foundation of Risk Management

Position sizing refers to the amount of capital allocated to each trade. By carefully managing position sizes, traders can control the level of risk exposure and minimize the impact of any single trade on their overall portfolio.

How Position Sizing Works

Position sizing works by determining the appropriate amount of capital to risk on a trade based on the trader’s total portfolio size, risk tolerance, and the market conditions.

- Fixed Fractional Method: A popular approach where traders risk a fixed percentage of their capital on each trade (e.g., 1-2% of total capital). This approach limits risk while allowing for consistent growth.

- Volatility-Based Position Sizing: This method adjusts the position size based on the volatility of the asset being traded. Higher volatility assets have smaller position sizes, while lower volatility assets allow for larger positions.

Pros of Position Sizing

- Limits Risk: Prevents significant capital drawdowns in case of multiple losing trades.

- Adjustable: Position sizes can be dynamically adjusted based on the trader’s risk appetite and market conditions.

- Capital Preservation: By managing position size, traders can ensure that one bad trade doesn’t wipe out their capital.

Cons of Position Sizing

- Requires Active Monitoring: Traders need to adjust position sizes regularly, which can be time-consuming.

- Not a One-Size-Fits-All Approach: It’s important to adjust position sizing strategies depending on the trader’s strategy and market volatility.

2. Risk-to-Reward Ratio: Maximizing Potential Gains

The risk-to-reward ratio (RRR) is a crucial risk management metric used to evaluate potential trades. It compares the expected risk of a trade to the expected reward, helping traders decide whether the trade is worth pursuing.

How Risk-to-Reward Ratio Works

The RRR is calculated by dividing the potential loss (the risk) by the potential gain (the reward). For example, if a trader is risking \(100 on a trade and expects to make \)300 in profit, the risk-to-reward ratio is 1:3.

- Common Ratios: A common benchmark is a 1:2 or 1:3 risk-to-reward ratio, meaning that traders aim to make at least two or three times as much as they are willing to lose.

- Setting Stop-Loss and Take-Profit: The risk-to-reward ratio helps traders set their stop-loss and take-profit levels effectively. A well-set ratio ensures that even if a trader has more losing trades than winning trades, they can still remain profitable over time.

Pros of Risk-to-Reward Ratio

- Clear Profit Targets: Traders have defined expectations for each trade, making it easier to set realistic goals.

- Helps with Trade Evaluation: A solid RRR allows traders to assess whether a trade is worth the risk.

- Consistency: A favorable risk-to-reward ratio helps smooth out the impact of losing trades, ensuring overall profitability.

Cons of Risk-to-Reward Ratio

- Potential for Missed Opportunities: By focusing strictly on RRR, traders may overlook potentially profitable trades with low ratios.

- Requires Accurate Projections: The effectiveness of RRR depends on how accurately a trader can predict potential gains and losses, which can be challenging in volatile markets.

Using Technology to Optimize Risk Management

In today’s digital age, traders have access to a variety of tools and platforms to automate and optimize their risk management strategies. Below are some common technologies that can help optimize risk management in trading.

1. Risk Management Software

Software solutions that help traders monitor and control their risk exposure can be a game-changer. These platforms typically offer features such as:

- Real-Time Risk Monitoring: Allows traders to track their positions in real time, ensuring that they stay within their risk tolerance limits.

- Automated Alerts: Traders can set up notifications to warn them when their positions are approaching their risk limits.

- Portfolio Analytics: Provides insights into portfolio diversification and risk exposure, helping traders make data-driven decisions.

Popular risk management platforms include MetaTrader, Riskalyze, and TradingView.

2. Algorithmic Trading for Risk Management

Algorithmic trading involves using automated trading systems to execute trades based on predefined criteria, which can be optimized for risk management. These systems can help:

- Optimize Position Sizing: Algorithms can automatically adjust position sizes based on current market conditions and portfolio risk.

- Dynamic Stop-Loss Adjustments: Algorithms can modify stop-loss levels during market fluctuations, reducing the risk of large losses.

Using algorithmic trading platforms like QuantConnect or AlgoTrader can greatly enhance the efficiency of risk management.

Risk Management in Different Trading Styles

Risk management techniques can vary based on the trading style and strategy employed. Let’s explore how risk management strategies differ for day traders, swing traders, and long-term investors.

1. Day Traders

Day traders typically engage in short-term trades and need to manage risk quickly and efficiently. The primary focus for day traders is to avoid significant losses within a single trading day.

- Position Sizing: Day traders often use a fixed fractional approach to minimize risk exposure on each trade.

- Stop-Loss and Take-Profit: Quick and tight stop-loss orders (often based on a percentage or specific price level) are used to prevent major losses.

- Real-Time Risk Monitoring: Day traders rely heavily on real-time risk management tools to adjust positions in real-time.

2. Swing Traders

Swing traders hold positions for several days or weeks and need a broader view of market trends.

- Risk-to-Reward Ratio: Swing traders typically target higher RRRs (1:3 or 1:4) to allow for larger potential gains.

- Stop-Loss Placement: Stop-losses for swing traders are usually placed further from the entry price, given the longer holding period.

- Diversification: Swing traders often diversify their trades across multiple assets to manage risk effectively.

3. Long-Term Investors

Long-term investors, such as those involved in stock trading or portfolio management, focus on optimizing risk over a more extended period.

- Portfolio Risk Optimization: Long-term investors aim to balance risk through asset allocation, ensuring that their portfolios are well-diversified.

- Drawdown Protection: Long-term risk management strategies include using techniques such as dollar-cost averaging to reduce risk over time.

- Rebalancing: Regular portfolio rebalancing helps manage risk by adjusting exposure to different asset classes based on market conditions.

FAQs: Optimizing Risk Management in Trading

1. What is the best method to optimize risk management in trading?

The best method depends on the trader’s goals and trading style. For most traders, a combination of position sizing, risk-to-reward ratio, and real-time risk monitoring will be the most effective. It’s important to experiment and find the strategy that works best for your personal risk tolerance.

2. How does volatility affect risk management in trading?

Volatility increases the risk of significant price movements, which can lead to larger losses. To optimize risk management during high volatility periods, traders should reduce position sizes, use wider stop-loss levels, and implement dynamic risk adjustments based on current market conditions.

3. Can risk management strategies be automated?

Yes, many traders use algorithmic trading and risk management software to automate their strategies. This reduces human error, increases efficiency, and ensures consistent risk management according to predefined rules.

Conclusion

Optimizing risk management in trading is not a one-size-fits-all approach. By combining multiple strategies such as position sizing, risk-to-reward ratios, and technological tools, traders can minimize risk and enhance the potential for long-term profitability. Whether you’re a day trader, swing trader, or long-term investor, optimizing your risk management strategy is essential to achieving success in the markets.

Related Articles:

Image Suggestions:

- A chart showing different risk management techniques in trading.

- A visual comparison of risk-to-reward ratios and their impact on trading outcomes.

0 Comments

Leave a Comment