===============================================================================

Introduction

In today’s fast-paced financial markets, order book market impact solutions have become essential for traders, hedge funds, and institutional investors seeking to minimize costs, manage liquidity, and maintain execution efficiency. The order book represents the depth of market supply and demand, and understanding its dynamics is crucial for developing strategies that reduce adverse price movements caused by large trades.

This article explores the role of order book market impact solutions, compares different methods, integrates practical experience, and highlights the latest industry trends. We will also connect these insights with related concepts such as how to use order book in quantitative trading and why order book is crucial for liquidity assessment, offering readers a holistic framework for optimizing trading execution.

Understanding Order Book Market Impact

What is Market Impact?

Market impact refers to the effect a trader’s order has on the market price. Large trades can shift prices unfavorably, resulting in slippage and higher transaction costs. This is particularly critical in illiquid markets where order book depth is thin.

Why Market Impact Solutions Matter

- Cost Efficiency: Reducing transaction costs directly improves profitability.

- Liquidity Management: Ensures orders are executed without distorting market prices.

- Execution Precision: Aligns trade outcomes with intended strategies.

- Regulatory Compliance: Institutions must demonstrate best execution practices.

Core Methods of Order Book Market Impact Solutions

1. Algorithmic Execution Strategies

Algorithmic trading tools are designed to break large orders into smaller fragments, spreading them over time to minimize market impact.

Popular Algorithms

- VWAP (Volume Weighted Average Price): Executes orders relative to historical volume patterns.

- TWAP (Time Weighted Average Price): Spreads execution evenly across a defined time horizon.

- Implementation Shortfall (IS): Balances execution speed with market impact cost.

Advantages

- Provides systematic, rules-based execution.

- Reduces emotional decision-making.

- Highly customizable for different market conditions.

Disadvantages

- Vulnerable to predictable patterns, which high-frequency traders may exploit.

- Requires robust technology and continuous monitoring.

2. Liquidity-Seeking & Smart Order Routing (SOR)

Liquidity-seeking algorithms dynamically search across multiple venues to locate the best available liquidity.

Key Features

- Splits trades across dark pools, lit exchanges, and alternative trading systems.

- Uses predictive analytics to anticipate hidden liquidity.

- Incorporates order book depth analysis for optimal routing.

Advantages

- Reduces information leakage by accessing fragmented liquidity.

- Improves execution price by exploiting cross-market opportunities.

- Provides flexibility in both high-liquidity and low-liquidity environments.

Disadvantages

- May introduce latency when routing across multiple venues.

- Limited effectiveness if liquidity is concentrated in a single exchange.

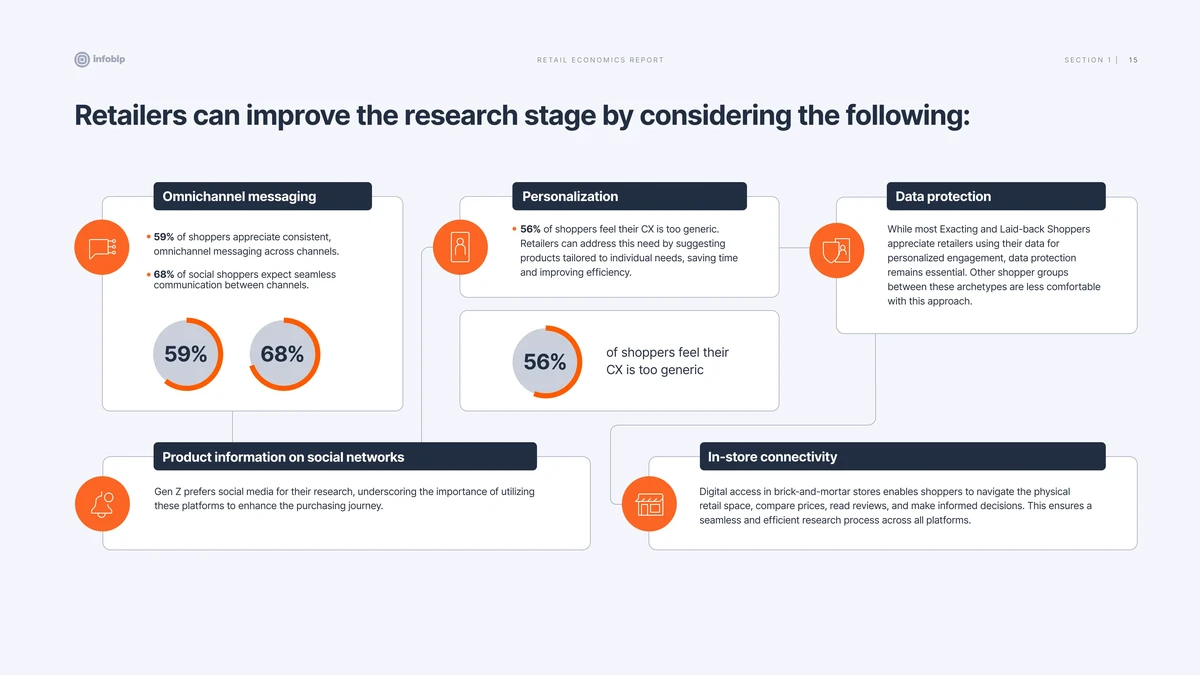

Comparison of Approaches

| Feature | Algorithmic Execution (VWAP/TWAP/IS) | Liquidity-Seeking & SOR |

|---|---|---|

| Primary Goal | Minimize price impact systematically | Access hidden liquidity |

| Best Use Case | Large, predictable institutional orders | Fragmented market environments |

| Execution Control | High, rule-based customization | Medium, adaptive routing |

| Risk of Information Leakage | Moderate | Lower (if routed well) |

| Technology Requirement | Advanced, but standardized | Highly advanced, multi-venue integration |

From my professional experience working with institutional traders, the most effective solution often combines both methods: using VWAP/TWAP for structured execution while layering SOR for hidden liquidity access.

The Role of Order Book Analysis in Market Impact Solutions

Understanding the order book is central to effective execution strategies. For instance, traders using how to use order book in quantitative trading techniques can identify liquidity clusters, detect iceberg orders, and adjust their execution pace accordingly.

Moreover, why order book is crucial for liquidity assessment becomes clear when measuring depth at different price levels. A deep order book provides a cushion against impact, while a thin order book requires precision execution strategies.

Latest Trends in Order Book Market Impact Solutions

AI and Machine Learning Integration

- Predictive models identify short-term price movements.

- Adaptive execution adjusts dynamically to volatility and liquidity changes.

Real-Time Order Book Visualization

- Advanced dashboards provide heatmaps, liquidity distribution, and microsecond-level updates.

- Useful for both discretionary and algorithmic traders.

Dark Pool Utilization

- Growing importance of off-exchange trading venues to minimize footprint.

- Regulatory transparency challenges require advanced compliance tools.

Case Study: Combining VWAP with SOR

A global hedge fund executing a $50M equity position used a hybrid strategy:

- Initial Phase: VWAP execution for predictable pacing.

- Mid-Trade: SOR identified hidden liquidity in dark pools, reducing footprint.

- Final Phase: Implementation Shortfall logic accelerated execution during low volatility windows.

Outcome: Slippage was reduced by 40% compared to VWAP-only execution, proving the benefit of integrated solutions.

Visual Insights

Order book depth illustrating how large market orders can move the mid-price

Comparison of execution methods and their effectiveness in reducing market impact

Best Practices for Implementing Order Book Market Impact Solutions

1. Pre-Trade Analysis

- Conduct liquidity scans before execution.

- Use historical order book data to model expected impact.

2. Real-Time Monitoring

- Adjust algorithms dynamically to reflect shifting liquidity.

- Use anomaly detection to spot unusual activity.

3. Post-Trade Analytics

- Measure slippage against benchmarks.

- Refine execution models continuously.

FAQ: Order Book Market Impact Solutions

1. How do order book market impact solutions reduce trading costs?

They prevent large trades from moving the market by spreading orders intelligently and seeking hidden liquidity. By reducing slippage, traders achieve closer execution to the intended price, which directly lowers costs.

2. Can retail traders benefit from market impact solutions?

Yes. While institutional-grade algorithms may not be accessible, retail traders can still apply order book insights, such as monitoring liquidity depth and avoiding trades during thin markets. Many brokers also provide simplified VWAP or TWAP execution options.

3. Which industries use these solutions the most?

- Hedge Funds: To minimize costs in large, complex orders.

- Institutional Investors: For compliance with best execution rules.

- High-Frequency Traders: To exploit microstructure inefficiencies.

- Retail Brokers: To enhance client order execution quality.

Conclusion

Effective order book market impact solutions are critical for modern trading, ensuring cost efficiency, liquidity access, and compliance with execution standards. While algorithmic strategies such as VWAP and TWAP provide structured order management, smart order routing adds flexibility by uncovering hidden liquidity. The best outcomes often arise from combining both approaches, supported by advanced order book analysis and real-time monitoring tools.

As technology evolves, integrating AI-driven execution models and visual order book dashboards will further empower traders. Whether you are a hedge fund manager, an institutional trader, or a retail investor, mastering these solutions is key to staying competitive.

If you found this article insightful, feel free to share it with fellow traders and leave your thoughts in the comments—let’s exchange strategies and experiences to improve our collective edge in the markets.

0 Comments

Leave a Comment