=======================================================================================

Market impact is one of the most critical factors in modern trading. When large institutional or algorithmic traders execute sizable orders, their trades often move prices against them. To address this, quantitative models to measure market impact have become essential tools in financial markets. These models not only estimate the expected cost of executing trades but also guide strategies that minimize slippage and optimize execution quality.

This article explores the main quantitative approaches to market impact measurement, compares their strengths and weaknesses, discusses real-world applications, and provides actionable insights for traders, risk managers, and researchers.

Understanding Market Impact

Market impact refers to the price movement caused by executing an order. For instance, when a trader buys a large block of shares, the increased demand can drive up the stock price, making the execution more expensive. Conversely, selling pressure often drives prices lower.

In practice, market impact is often divided into two main components:

- Temporary impact: The short-lived price change that reverts after the trade is completed.

- Permanent impact: The long-term shift in the equilibrium price, reflecting the information conveyed by the trade.

Quantitative models help separate these effects and estimate their magnitude, giving traders a framework to balance execution speed, cost, and risk.

Why Quantitative Models Matter

The financial markets have become increasingly electronic and competitive. Algorithmic traders, institutional investors, and market makers must understand market impact to remain profitable. Without accurate models, even sophisticated strategies risk losing edge due to excessive transaction costs.

In particular, understanding market impact is key to answering questions like:

- How does market impact affect quantitative trading? It erodes alpha and can distort signals if not properly accounted for.

- How to calculate market impact in trading? Models provide systematic methods to estimate the costs before placing trades, allowing for better decision-making.

Core Quantitative Models to Measure Market Impact

1. The Linear Models

Overview

One of the earliest frameworks assumes that market impact is linearly related to trade size. The simplest form is:

Impact=α+β⋅Q\text{Impact} = \alpha + \beta \cdot QImpact=α+β⋅Q

Where:

- QQQ = order size,

- β\betaβ = sensitivity factor,

- α\alphaα = baseline impact.

Advantages

- Easy to implement.

- Works well for small to medium-sized orders.

- Provides quick estimates for cost analysis.

Disadvantages

- Oversimplifies market microstructure.

- Tends to underestimate impact for very large trades.

- Cannot fully separate temporary vs. permanent effects.

2. The Square-Root Law of Market Impact

Overview

Widely used in academic research and industry, this model suggests that market impact grows with the square root of trade size relative to daily volume:

Impact∝σ⋅QV\text{Impact} \propto \sigma \cdot \sqrt{\frac{Q}{V}}Impact∝σ⋅VQ

Where:

- σ\sigmaσ = volatility of the asset,

- VVV = daily traded volume,

- QQQ = trade size.

Advantages

- Empirically validated across equities, futures, and FX.

- Scales better for large trades.

- Useful for institutional execution planning.

Disadvantages

- Parameters vary across asset classes.

- Assumes a smooth relationship that may not hold during stress periods.

- Less precise for high-frequency trading.

3. Stochastic and Order-Book Based Models

Overview

More advanced models incorporate limit order book dynamics, liquidity depth, and stochastic processes. These models simulate how orders interact with the existing book and predict both short-term and long-term effects.

Advantages

- High accuracy for algorithmic trading.

- Captures microstructure elements like bid-ask spread, order cancellation, and hidden liquidity.

- Useful for simulation models for market impact prediction.

Disadvantages

- Computationally intensive.

- Requires granular tick-level data.

- Complexity may limit interpretability for non-quant professionals.

Comparing Approaches

| Model Type | Best For | Strengths | Weaknesses |

|---|---|---|---|

| Linear Models | Retail & small traders | Simplicity | Poor for large orders |

| Square-Root Law | Institutional investors | Scalable, robust | Not accurate in stress markets |

| Stochastic & Order-Book Models | Algorithmic & HFT | High precision, microstructure-aware | Data-heavy, complex |

Each model has its place. For example, long-term asset managers might prefer the square-root model, while high-frequency traders rely on microstructure simulations.

Applications in Trading Strategies

Execution Algorithms

Broker algorithms such as VWAP (Volume-Weighted Average Price) and TWAP (Time-Weighted Average Price) use market impact models to determine optimal trade slicing.

Risk Management

Quant teams embed impact costs into portfolio optimization, ensuring that expected alpha is not fully consumed by trading costs.

Asset Class Differences

Market impact varies significantly across equities, FX, and commodities. For example:

- Equities: Strong liquidity dependence.

- FX: Market impact often muted due to large global volume.

- Commodities: Market depth can vary by contract.

This makes market impact considerations for options traders and other asset-specific strategies highly relevant.

Practical Insights and Trends

- Machine Learning Integration: Increasingly, quants are combining traditional models with ML techniques for better predictive accuracy.

- Alternative Data: Liquidity and sentiment data are being integrated into models.

- Regulatory Focus: Transparency in execution costs has made accurate impact modeling essential for compliance.

Case Example

Imagine an institutional trader looking to buy 1 million shares of a stock with daily volume of 20 million. Using the square-root model:

- Estimated cost = proportional to 1,000,000/20,000,000=0.05≈0.22\sqrt{1,000,000 / 20,000,000} = \sqrt{0.05} \approx 0.221,000,000/20,000,000=0.05≈0.22.

- If volatility = 2%, expected market impact ≈ 0.44% of price.

Such an estimate helps decide whether to execute via VWAP slicing or via dark pools to reduce footprint.

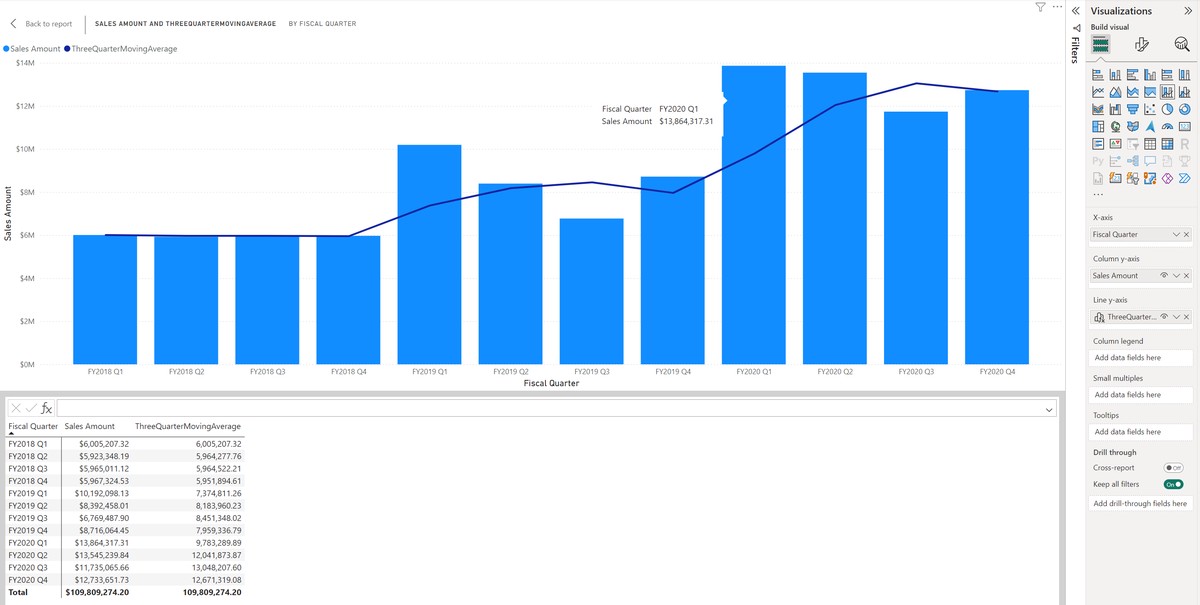

Visual Example

Market impact often follows a concave function, showing diminishing cost increases relative to trade size.

FAQ: Quantitative Models and Market Impact

1. What is the most accurate model for measuring market impact?

No single model fits all cases. For large institutional trades, the square-root law is widely accepted. For high-frequency trading, order-book based stochastic models are preferred. Traders often combine models depending on order size, urgency, and market conditions.

2. How can I minimize market impact in my trading algorithms?

Traders can reduce impact by slicing orders over time, using smart order routing, leveraging dark pools, or combining VWAP/TWAP strategies with predictive models. Hybrid execution strategies that blend passive and aggressive orders often perform best.

3. Where to find data on market impact for trading?

Accessing high-quality data is critical. Traders often rely on exchange-provided tick-level data, broker transaction cost analysis (TCA) reports, or specialized vendors offering liquidity analytics. Combining historical data with simulation models for market impact prediction can further improve accuracy.

Conclusion

Quantitative models to measure market impact are no longer optional—they are essential tools for traders and investors across asset classes. While simple models offer quick approximations, advanced approaches using order-book simulations and machine learning provide competitive edge in modern markets.

By carefully selecting the right model, integrating execution strategies, and leveraging data-driven insights, traders can protect alpha, improve efficiency, and comply with evolving regulatory demands.

If you found this article valuable, feel free to share it with your network, leave a comment, or discuss your experiences with market impact models. Collaboration and knowledge sharing are the best ways to refine these models and push financial innovation forward.

0 Comments

Leave a Comment