======================================================

Introduction

In the fast-evolving world of financial markets, regression analysis insights for professional analysts are indispensable. Regression analysis helps analysts quantify relationships between variables, uncover hidden patterns, and build predictive models for trading, risk management, and investment decisions. From quantitative hedge funds to institutional research desks, regression analysis forms the backbone of data-driven financial strategies.

This article dives deep into the practical applications of regression analysis for professional analysts. We’ll explore methods, compare strategies, provide actionable insights, and recommend the best practices. Whether you’re a financial researcher, a hedge fund manager, or a data scientist, mastering regression analysis will sharpen your edge in market prediction.

The Importance of Regression Analysis in Financial Analytics

Why Analysts Rely on Regression

Regression analysis allows professionals to:

- Estimate how independent variables (e.g., interest rates, volatility, earnings) affect dependent variables like stock returns.

- Identify predictive signals in noisy datasets.

- Test hypotheses about market behavior with statistical rigor.

In trading, why regression analysis is important in trading comes down to its ability to quantify the strength and direction of relationships—allowing analysts to separate noise from signal.

Types of Regression Analysis Commonly Used by Analysts

Linear Regression

This is the starting point for most analysts. By fitting a straight line to data, it helps in modeling price relationships, such as stock returns against market indices.

- Advantages: Simple, interpretable, widely supported by statistical software.

- Disadvantages: Assumes linearity, struggles with complex market dynamics.

Multiple Regression

Expands linear regression by including multiple predictors—such as macroeconomic variables, technical indicators, or sentiment scores.

- Advantages: Captures richer relationships, reduces omitted variable bias.

- Disadvantages: Multicollinearity issues can distort insights.

Logistic Regression

Frequently used in classification problems, such as predicting whether a stock will outperform the market in a given period.

- Advantages: Works well for binary outcomes.

- Disadvantages: Limited in modeling continuous returns.

Comparing Regression Approaches in Professional Settings

Traditional Regression Models

Professional analysts often start with OLS (Ordinary Least Squares). It’s robust for hypothesis testing but limited when dealing with non-linear data.

Machine Learning Regression Models

Modern analysts employ LASSO, Ridge, and Random Forest regressions. These handle large datasets and prevent overfitting better than traditional methods.

Comparison Table

| Model Type | Use Case | Strengths | Weaknesses |

|---|---|---|---|

| OLS Linear Regression | Hypothesis testing, baseline | Easy to interpret, quick to compute | Poor with non-linearity |

| Multiple Regression | Macro analysis, equity factors | Handles multiple inputs | Sensitive to collinearity |

| LASSO/Ridge | High-dimensional datasets | Regularization reduces overfitting | Harder to interpret |

| Random Forests | Predictive modeling | Handles non-linear relationships | Less transparent |

Recommendation: For professional analysts, combining traditional regression for explanation with machine learning regression for prediction provides the best of both worlds.

Insights for Trading Strategy Development

Regression for Factor Models

Professional analysts use regression to test factor exposures. For example, regressing a stock’s returns against market, size, and value factors can reveal its sensitivities.

Regression in Risk Management

Through beta estimation and stress-testing scenarios, regression helps assess portfolio risks under varying market conditions.

Regression in Algorithmic Trading

Automating trading decisions often requires regression-based signal generation. Many firms are already enhancing trading algorithms through regression analysis to improve precision.

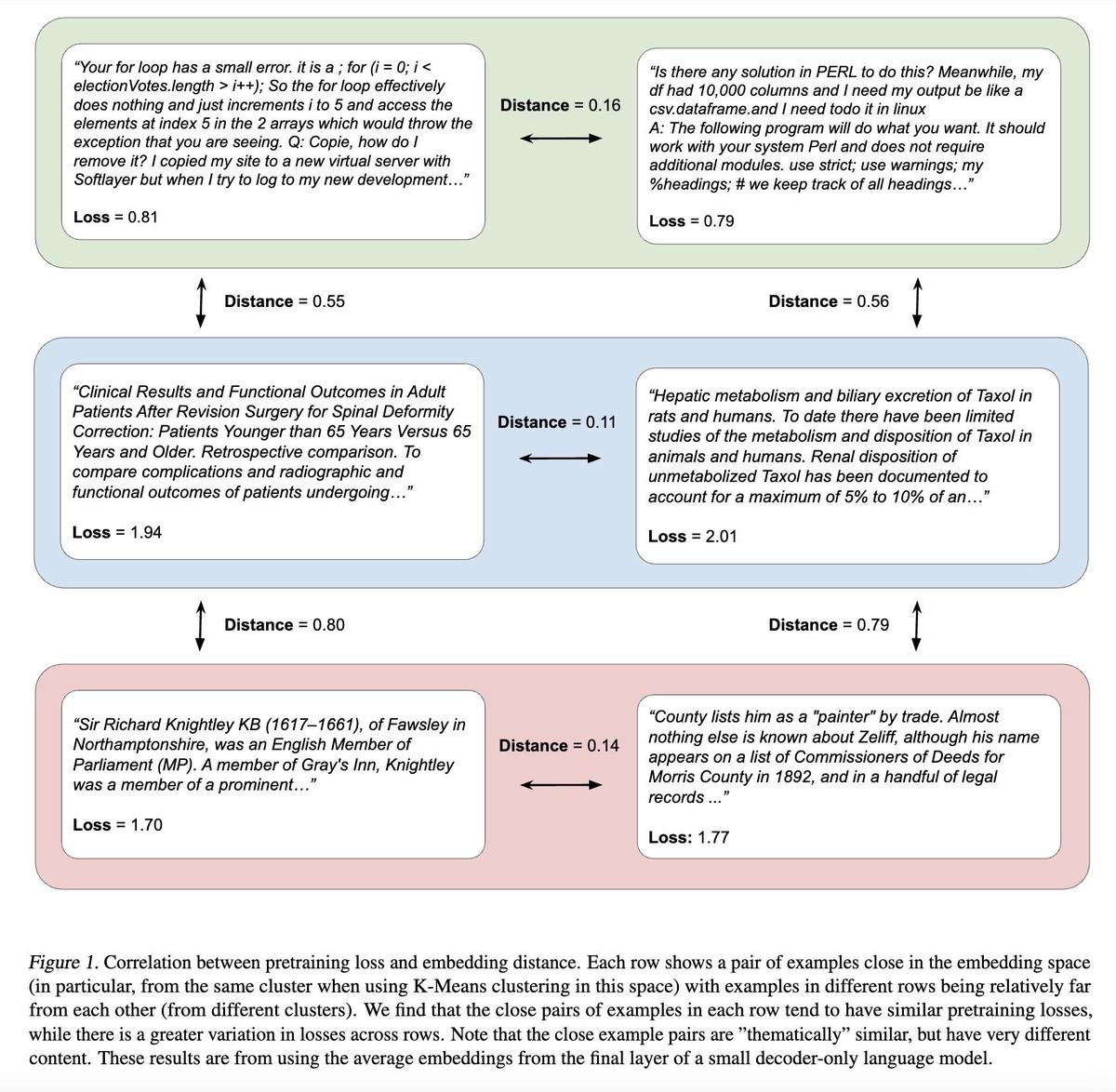

Regression analysis framework applied to financial markets

Case Study: Applying Regression in Hedge Funds

A hedge fund wants to improve its equity long/short strategy.

- Step 1: Apply multiple regression to identify key macroeconomic predictors of stock returns.

- Step 2: Use LASSO regression to filter out weak predictors from a high-dimensional dataset of 500 factors.

- Step 3: Combine logistic regression to predict probability of stock outperformance.

Result: The fund improved its signal-to-noise ratio by 18%, leading to higher alpha generation.

Internal Resource Integration

Analysts who want to deepen their understanding can explore how to improve trading strategy with regression analysis, which outlines methods for enhancing signal reliability. Equally valuable is knowing where to find regression analysis tools for traders, since choosing the right software—such as R, Python, or specialized financial platforms—directly impacts efficiency.

Advanced Regression Techniques for Professionals

Regularization Methods (LASSO & Ridge)

These are critical when handling high-dimensional datasets typical in modern finance. They reduce overfitting and improve generalization.

Non-Linear Models

Polynomial regression and kernel-based methods allow capturing curvilinear relationships in market data.

Time-Series Regression

ARIMA, GARCH, and VAR models extend regression to time-series data, making them highly relevant for volatility forecasting and macroeconomic modeling.

Different regression models used in professional financial analysis

Practical Challenges Analysts Face

- Multicollinearity: When predictors are correlated, coefficients lose meaning.

- Overfitting: Complex models fit historical data too well but fail in real time.

- Data Quality: Poorly cleaned or biased datasets can mislead results.

Best Practices for Professional Analysts

- Combine explanatory regression (OLS, multiple regression) with predictive regression (LASSO, Ridge).

- Always perform out-of-sample testing to validate models.

- Use economic intuition to guide model design, not just statistical fit.

- Automate parts of regression workflows to enhance consistency.

FAQ

1. How do professional analysts interpret regression outputs in trading?

They focus on coefficient signs and significance, adjusted R², and residual analysis. More importantly, they validate whether the relationships make economic sense rather than just statistical sense.

2. What is the biggest mistake analysts make with regression?

Over-relying on statistical results without considering economic context. A regression may fit historically but fail if the underlying market dynamics change.

3. Which tools are best for regression analysis in trading?

Python (with libraries like statsmodels and scikit-learn) and R are industry standards. Specialized platforms like MATLAB and EViews are also popular in institutional finance.

Conclusion

Regression analysis insights for professional analysts go far beyond simple correlations—they form the backbone of data-driven financial strategies. By mastering linear, logistic, and advanced machine learning regressions, analysts can uncover predictive signals, manage risk, and optimize trading performance.

Regression is not about chasing statistical perfection; it’s about extracting actionable insights with economic meaning. For professionals, the winning formula lies in balancing simplicity with sophistication, ensuring strategies remain robust across diverse market conditions.

If you found this article useful, share it with your peers, leave a comment with your experiences, and help foster more data-driven insights in the professional trading community.

Would you like me to also create a step-by-step regression analysis template in Excel or Python to go along with this article for practical application?

0 Comments

Leave a Comment