==================================================================================

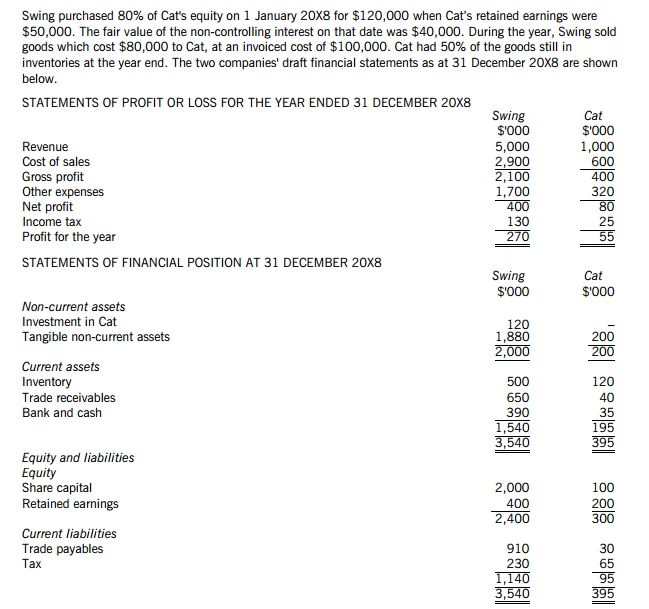

Introduction

For swing traders, setting up a solid take profit strategy is one of the most important steps in ensuring consistent profitability. While entry points often get the most attention, deciding when and how to take profits is what ultimately defines a successful trading strategy. A well-executed take profit setup can protect gains, lock in profits, and provide clarity in volatile markets.

In this comprehensive guide, we will explore the best take profit strategies for swing traders, delve into the psychology behind taking profits, and discuss the tools and techniques that can help traders fine-tune their exit points for optimal returns.

Understanding Take Profit in Swing Trading

Take profit (TP) refers to a set level at which a trader decides to close a trade and secure their profits. For swing traders, this is particularly crucial because the goal is to capitalize on short- to medium-term price movements while avoiding the risk of turning profitable trades into losses.

A well-defined take profit setup ensures:

- Protection of profits: Locking in gains before the market reverses.

- Avoiding over-trading: Prevents traders from staying in positions too long, risking profitable outcomes.

- Increased consistency: Helps develop a disciplined approach to trading.

Why Take Profit Matters for Swing Traders

The significance of take profit strategies extends beyond the simple act of taking gains. Here’s why it’s essential:

- Maintaining discipline: Pre-determining exit points reduces emotional trading and helps stick to the strategy.

- Risk-to-reward balance: Proper TP settings allow swing traders to maintain favorable risk-to-reward ratios, ensuring long-term profitability.

- Market volatility management: With volatile markets, taking profits at the right time ensures that you don’t give back all the profits you’ve made.

Methods for Setting Take Profit Levels

1. Fixed Take Profit Levels

One of the simplest and most popular methods among swing traders is setting a fixed take profit level. This approach involves setting a predetermined price at which the position will automatically be closed.

Pros:

- Simplicity: Easy to calculate and implement, especially for new traders.

- Predictable outcomes: Offers clear exit points, reducing uncertainty.

Cons:

- Missed opportunities: May leave potential profits on the table if the market continues to move in the trader’s favor.

- No adjustment for market conditions: Fixed TP doesn’t account for changes in market volatility or shifts in trend momentum.

Best for:

- Traders who prefer a straightforward approach and are not interested in constantly adjusting their exits.

Example:

If you enter a trade at \(100 with a target of 10% profit, your fixed TP would be set at \)110.

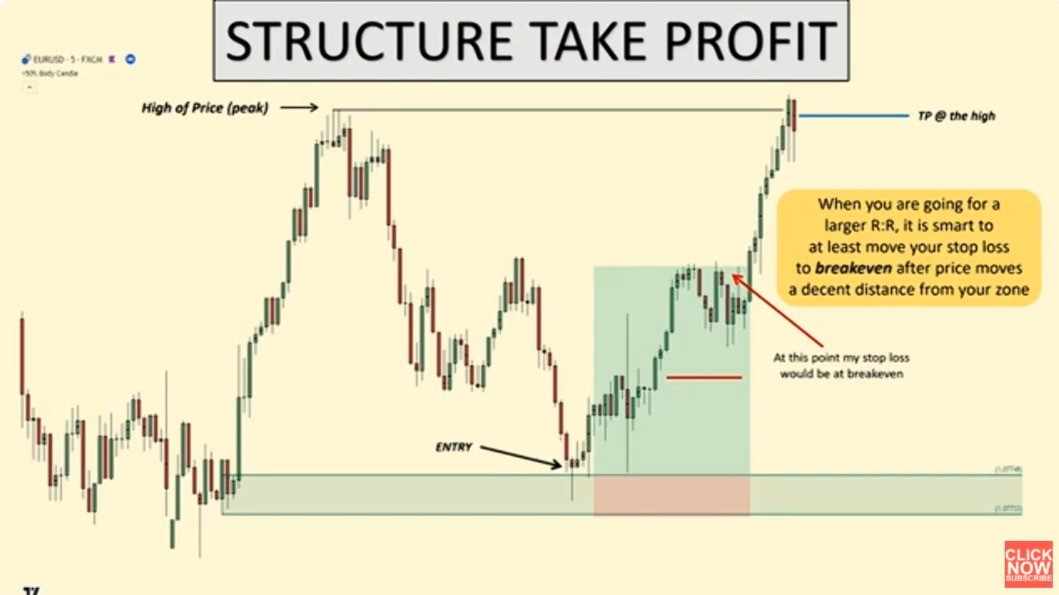

2. Dynamic Take Profit Using Trailing Stop

A trailing stop is a more advanced take profit strategy where the exit point moves in tandem with the price, locking in profits as the market moves in the trader’s favor.

Pros:

- Maximizing profits: Allows for participation in bigger moves while still locking in profits as the market reverses.

- Flexibility: Adjusts to market conditions, helping swing traders capture larger trends.

Cons:

- Increased complexity: Requires constant monitoring and is not suitable for traders who cannot actively manage their trades.

- Premature exits: The trailing stop could be hit too early if the market experiences short-term retracements.

Best for:

- Traders looking to capture bigger trends without the risk of giving back too much profit.

Example:

If the price moves from \(100 to \)110, and you set a 5% trailing stop, your stop will trail at \(104.50 (5% below \)110). If the price falls back to $104.50, the position will be closed.

How to Choose the Right Take Profit Method for Swing Trading

The right TP strategy depends on your trading goals, style, and risk tolerance. Here are some important considerations:

1. Market Conditions

In trending markets, a dynamic TP strategy like a trailing stop might be more effective, allowing you to capture larger moves. In choppy or sideways markets, fixed levels might be more appropriate to lock in profits quickly.

2. Risk-to-Reward Ratio

The optimal TP level should align with your risk-to-reward ratio. A commonly used guideline is a minimum 2:1 ratio, meaning that your potential reward should be at least twice as large as the amount you’re risking.

Example:

If your stop loss is set at \(5 below your entry, a TP of \)10 above your entry maintains a 2:1 risk-to-reward ratio.

3. Timeframe

The timeframe of the swing trade influences the TP strategy. Short-term swing trades may benefit from quicker, fixed TPs, while longer-term swing trades can be better suited to dynamic TPs or trailing stops.

Advanced Take Profit Strategies for Professional Swing Traders

1. Fibonacci Retracement Levels

Many professional traders use Fibonacci retracement levels to set take profit levels. These levels often align with areas of support and resistance where price reversals are likely to occur.

How It Works:

Fibonacci levels (23.6%, 38.2%, 50%, 61.8%) can help identify potential profit-taking zones. For example, if a price moves up from \(100 to \)150, you might set your TP at the 61.8% retracement level, which corresponds to $138.20.

Pros:

- Precision: Fibonacci levels are widely used and can help identify highly probable exit points.

- Market-tested: These levels have been successful in various market conditions over time.

Cons:

- Subjectivity: Drawing Fibonacci levels can be subjective, and slight variations can lead to different conclusions.

2. Support and Resistance Levels

Support and resistance levels are natural take profit points, as prices often reverse or stall at these areas.

How It Works:

If you’re trading an uptrend, your TP may be set near the next resistance level. In a downtrend, set the TP near support levels.

Pros:

- Clear market psychology: Support and resistance levels reflect key price points where traders are likely to enter or exit positions.

- Universally applicable: This strategy works across all timeframes and asset classes.

Cons:

- No guarantee: Prices do not always reverse at these levels, and breakouts or breakdowns can lead to missed profit opportunities.

FAQs on Take Profit Strategies

1. How do I set the optimal take profit level?

The optimal TP level should align with your trading strategy, risk tolerance, and market conditions. For swing traders, using tools like Fibonacci retracements, support/resistance levels, or trailing stops can help in determining the most effective TP.

2. Why does take profit matter for swing traders?

Take profit setups are vital because they allow traders to lock in gains and manage risk effectively. Without a solid exit strategy, traders may hold onto positions too long, risking profits turning into losses.

3. How can I improve my take profit strategy over time?

Constantly backtest your strategies, monitor market conditions, and adjust your take profit setups based on past performance. Implementing tools like automated trading systems or trade alerts can also improve consistency.

Conclusion

Setting the right take profit levels is one of the most important skills for swing traders. Whether you opt for fixed take profits, trailing stops, or advanced strategies like Fibonacci levels and support/resistance points, it’s crucial to incorporate these tools into your trading plan. With the right take profit strategy in place, swing traders can ensure they maximize returns while minimizing risks.

Share your experiences and thoughts in the comments! And don’t forget to share this article with fellow traders looking for solid take profit strategies.

Let me know if you’d like to proceed with adding images or further details in any section!

0 Comments

Leave a Comment