================================================

Introduction

In today’s fast-paced financial markets, trade execution training for algorithmic traders has become a critical pillar of professional success. While building robust algorithms is essential, the way those algorithms interact with the market through execution strategies directly influences profitability, risk, and long-term sustainability. Poor execution can erode alpha, increase slippage, and create unintended exposure, even when the underlying strategy is sound.

This comprehensive guide explores modern methods of execution training, compares different approaches, and highlights best practices that traders, quants, and institutions should adopt to ensure efficient, consistent, and compliant execution. By integrating expertise, market experience, and the latest industry insights, we’ll uncover how algorithmic traders can refine their skills to stay ahead in competitive markets.

Why Trade Execution Training Matters

The Hidden Cost of Execution

Execution is often underestimated. Traders might spend months developing a model but overlook the execution layer, which can make or break performance. Slippage, latency, and market impact often account for significant losses, especially in strategies relying on tight spreads or high frequency.

Link to Alpha Preservation

Execution training helps traders preserve alpha by minimizing transaction costs, avoiding unnecessary risks, and adapting to real-time liquidity. Without this, even the most mathematically elegant strategies fail in live markets.

Industry Validation

Global financial institutions invest heavily in execution training because it bridges the gap between strategy design and real-world implementation. It ensures traders know not only “what to trade” but also “how to trade.”

Core Components of Trade Execution Training

1. Market Microstructure Understanding

Traders must master the mechanics of order books, tick sizes, spreads, and liquidity dynamics. This foundation helps them anticipate how trades affect the market.

2. Algorithmic Execution Strategies

Execution training typically includes the study of widely used algorithms such as:

- VWAP (Volume-Weighted Average Price): Designed to minimize impact by distributing orders over time.

- TWAP (Time-Weighted Average Price): Focused on consistent pacing, regardless of volume.

- Implementation Shortfall: Aims to minimize deviation from the decision price.

3. Latency and Infrastructure Awareness

Algorithmic traders require low-latency systems and smart order routing. Training often covers the role of co-location, API integration, and exchange connectivity.

4. Risk and Compliance

Execution is not just about speed. Regulatory requirements, best execution standards, and compliance frameworks shape how trades can be executed responsibly.

Two Leading Training Methods: Comparison and Insights

Method 1: Simulation-Based Execution Training

How It Works

Traders practice execution strategies in simulated environments that replicate market conditions, including order book depth, spreads, and volatility.

Advantages

- Risk-free learning without capital exposure.

- Enables testing across multiple market regimes.

- Supports iterative improvement with feedback loops.

Limitations

- Simulations rarely capture all real-world frictions, such as hidden liquidity or irregular volatility spikes.

- Traders may develop strategies that work in theory but fail in practice.

Method 2: Live Market Micro-Practice

How It Works

Traders execute small real trades in live markets to gain direct experience while minimizing financial risk.

Advantages

- Realistic exposure to slippage, latency, and liquidity issues.

- Immediate feedback on actual execution costs.

- Builds trader intuition that simulations cannot replicate.

Limitations

- Requires capital, even at micro-levels.

- Mistakes, though small, can result in real losses.

- Emotional bias may affect early learners.

Recommended Approach

A blended model is most effective:

- Start with simulations to build confidence and technical proficiency.

- Transition into live micro-practice to gain intuition and experience.

- Integrate ongoing monitoring tools and analytics to continuously refine execution quality.

Advanced Execution Training Techniques

Execution Benchmarking

Traders should learn to measure performance against benchmarks such as VWAP, arrival price, or implementation shortfall. This allows objective evaluation of execution quality.

Smart Order Routing (SOR) Training

Execution training increasingly includes multi-venue routing, teaching traders how to capture hidden liquidity and reduce costs by accessing fragmented markets.

Adaptive Execution Algorithms

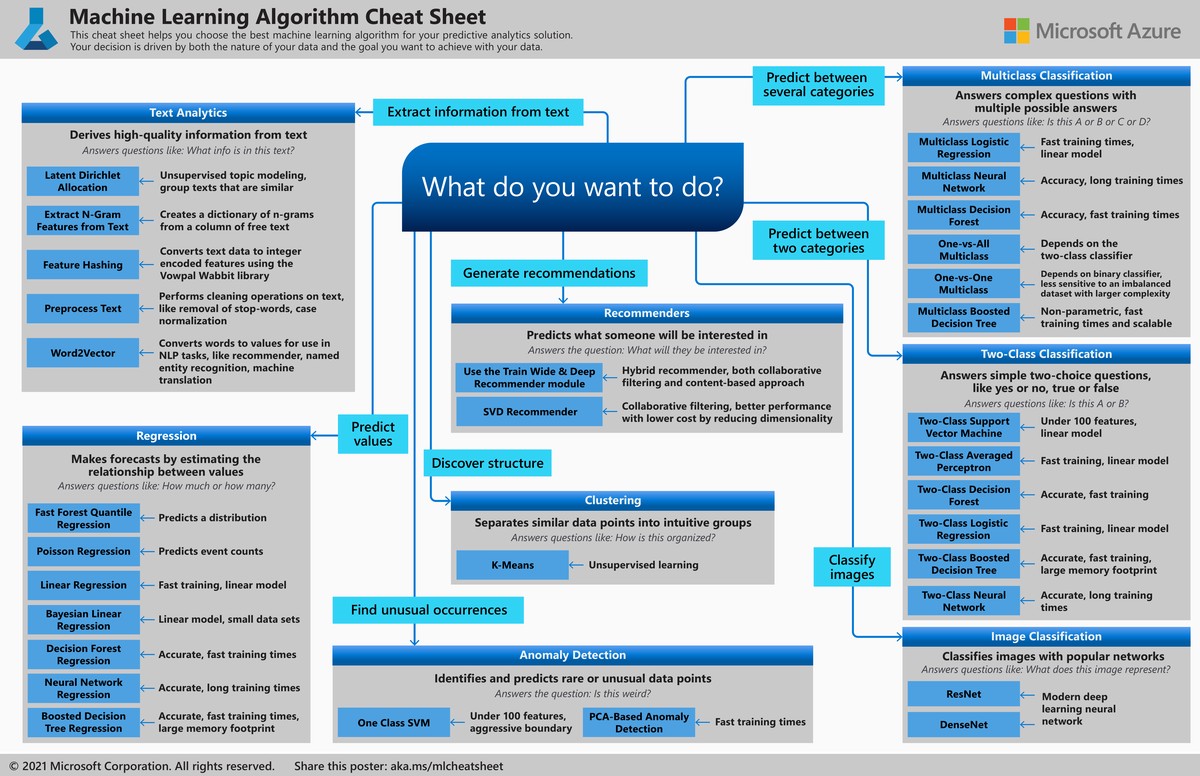

Modern training emphasizes machine learning-enhanced execution models, which adjust order slicing, pacing, and venue selection in real-time based on evolving conditions.

Practical Applications for Algorithmic Traders

Execution training is not an abstract exercise; it directly ties into trading strategies. For example:

- High-frequency trading (HFT): Traders must master ultra-low latency and order book dynamics.

- Quantitative stock trading: Execution impacts fill ratios, slippage, and effective spread capture. (See also: how trade execution impacts quantitative stock trading.)

- Retail algorithmic trading: Proper execution reduces unnecessary costs, even with small accounts. (Related: where to improve trade execution for retail traders.)

Visual Example: Execution Quality Comparison

Below is a simplified illustration of how poor vs. optimized execution affects strategy performance:

Comparison of trade execution efficiency in different liquidity conditions

Key Industry Trends in Trade Execution Training

AI and Machine Learning

Execution training now includes tools powered by AI that adapt to liquidity patterns, detect anomalies, and minimize impact in real-time.

Regulatory Shifts

New regulations on best execution (MiFID II in Europe, SEC standards in the US) demand higher transparency and training in compliance frameworks.

Globalization of Liquidity

Traders increasingly need cross-asset and multi-region execution skills, spanning equities, futures, crypto, and forex.

FAQs: Trade Execution Training for Algorithmic Traders

1. How long does it take to become proficient in trade execution?

Most traders require 6–12 months of structured practice combining simulations, live trading, and post-trade analysis. Proficiency depends on market complexity (e.g., equities vs. HFT) and access to mentorship.

2. What tools are essential for effective execution training?

Core tools include:

- Simulators and backtesting platforms for pre-trade preparation.

- Real-time execution analytics to measure slippage and fill ratios.

- Smart order routers for multi-venue access.

- Latency monitoring dashboards to detect delays.

3. Is execution training equally important for retail traders?

Yes. While institutions face larger order sizes, retail traders also benefit. Even small slippage accumulates over thousands of trades. Retail-focused execution training helps reduce spreads, improve entry/exit timing, and protect capital.

Conclusion

Mastering trade execution training for algorithmic traders is not optional—it is essential. From simulations to live micro-practice, from benchmarking to adaptive AI-driven tools, execution training shapes the real-world success of trading strategies. By blending technical skills with regulatory awareness and intuitive experience, traders can consistently reduce costs, preserve alpha, and compete at institutional levels.

If you found this article insightful, share it with your peers, comment with your own execution challenges, and join the conversation. Collective knowledge is the key to evolving smarter, faster, and more effective execution practices.

Would you like me to also prepare a table of execution training benchmarks (VWAP, TWAP, IS, Arrival Price, etc.) as a visual infographic to make the article even more engaging?

0 Comments

Leave a Comment