===================================================

In the fast-paced world of quantitative trading, having access to real-time data, cutting-edge analytics, and advanced research tools is critical for success. Bloomberg Terminal has long been a cornerstone for institutional investors, hedge funds, and financial analysts due to its comprehensive data feeds, analytics capabilities, and market insights. In this article, we’ll delve into why Bloomberg Terminal is indispensable for quantitative trading, its key features, and how it can significantly enhance your trading strategies.

What is Bloomberg Terminal?

Bloomberg Terminal is a professional service provided by Bloomberg L.P. that offers access to a vast array of financial data, news, analytics, and trading tools. It is widely regarded as one of the most powerful and reliable tools in the finance industry, providing real-time data on equities, commodities, currencies, and other asset classes.

Bloomberg Terminal’s comprehensive set of features includes:

- Real-time market data: Live feeds on financial instruments, including price quotes, historical data, and financial metrics.

- Advanced charting and analytics tools: For analyzing trends, volatility, and market behavior.

- Customizable workflows: To support different trading, analysis, and portfolio management strategies.

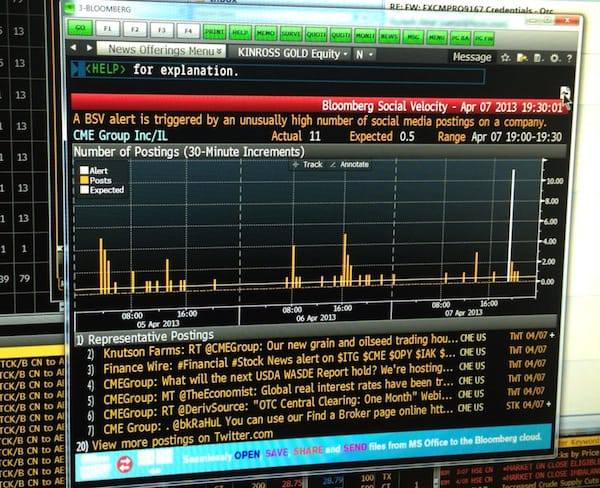

- News and alerts: Breaking news, financial reports, and personalized alerts that keep traders informed of market movements.

- Integration with financial models: Allows seamless integration with custom financial models for backtesting and predictive analytics.

How Bloomberg Terminal Supports Quantitative Trading

Quantitative trading relies heavily on data-driven strategies, with traders relying on mathematical models to generate signals, forecast market trends, and identify profitable opportunities. Bloomberg Terminal is a key enabler of these strategies due to its vast datasets, real-time updates, and powerful analytics. Below are some of the key ways Bloomberg Terminal enhances quantitative trading.

1. Access to Comprehensive Market Data

A major advantage of Bloomberg Terminal is its unparalleled access to a wide variety of financial data across asset classes. From historical price data to real-time market quotes, the terminal provides everything a quantitative trader needs to analyze the markets efficiently.

Data Offered by Bloomberg Terminal for Quantitative Trading:

- Equities: Real-time price feeds, earnings reports, and trading volume data.

- Fixed Income: Bond prices, yield curves, and corporate debt information.

- Commodities and FX: Data on oil, gold, agricultural products, and foreign exchange markets.

- Cryptocurrency: Real-time data on Bitcoin, Ethereum, and other cryptocurrencies.

- Economic Data: Macroeconomic reports, central bank announcements, and government statistics.

This data, combined with Bloomberg’s sophisticated filtering tools, enables traders to tailor their strategies based on market movements, sentiment analysis, and macroeconomic trends.

2. Advanced Analytics for Strategy Development

Bloomberg Terminal offers a rich suite of analytical tools that can help quantitative traders develop and optimize trading strategies. These tools support technical analysis, financial modeling, and risk assessment, making it an essential tool for backtesting and live trading.

Analytics Tools for Quantitative Traders:

- Bloomberg Excel Add-In: Allows users to pull live and historical data into spreadsheets, automate calculations, and apply quantitative models.

- Backtesting: The terminal’s ability to integrate real-time data with customized financial models makes it easy to backtest trading strategies before they are deployed in the live market.

- Risk Management: Bloomberg Terminal’s risk analytics tools enable traders to calculate and monitor portfolio risks using metrics like Value-at-Risk (VaR), stress testing, and scenario analysis.

These features enable quantitative traders to experiment with different strategies, analyze their potential risks, and optimize for better performance.

3. Enhanced Trading Algorithms

In quantitative trading, the development of algorithms is key to executing high-frequency and systematic trading strategies. Bloomberg Terminal provides several tools that support the creation, testing, and execution of these algorithms, enabling traders to refine their strategies for maximum profit potential.

Key Algorithmic Features on Bloomberg Terminal:

- Bloomberg API: Allows integration of Bloomberg data into custom algorithmic trading platforms, enabling direct communication between the terminal and automated trading systems.

- Algorithmic Execution: Bloomberg’s algorithmic trading platform offers a variety of execution strategies, including smart order routing and execution algorithms designed to minimize market impact and trading costs.

- Real-Time Alerts: Traders can set up custom alerts based on price movements, technical indicators, or news events, allowing for quick responses to market changes.

These features make Bloomberg Terminal a one-stop shop for quantitative traders looking to develop and deploy sophisticated trading algorithms.

How to Integrate Bloomberg Terminal into Quantitative Trading?

Integrating Bloomberg Terminal into a quantitative trading strategy requires a clear understanding of the tools and how they can complement existing trading systems. Below are the key steps to effectively integrate Bloomberg Terminal into your trading workflow:

4.1 Data Integration and API Usage

Bloomberg Terminal provides several ways to integrate its data feeds with external systems, including its API and Excel Add-In. Quantitative traders can leverage this integration to pull large amounts of data for modeling, backtesting, and live trading.

- API Integration: The Bloomberg API allows traders to retrieve real-time and historical data from Bloomberg’s vast database. This data can be fed directly into trading models or automated systems for decision-making.

- Excel Add-In: The Bloomberg Excel Add-In allows traders to download market data directly into their spreadsheets for analysis. This tool is useful for building custom models and conducting detailed analysis without needing to switch between platforms.

By integrating Bloomberg data into existing models and systems, traders can enhance their quantitative analysis and create more accurate predictive models.

4.2 Backtesting and Strategy Optimization

Backtesting is a critical step in quantitative trading, and Bloomberg Terminal offers several tools to help traders test their strategies using historical market data. Traders can create custom backtests by integrating Bloomberg data into their models and analyzing performance metrics like Sharpe ratio, maximum drawdown, and alpha.

- Backtest Strategies: Use Bloomberg’s historical data to test different trading strategies and refine them for better future performance.

- Optimization: Bloomberg’s powerful analytics and modeling tools allow traders to optimize their strategies by adjusting parameters like risk tolerance and trading size to maximize profitability.

By backtesting and optimizing strategies with Bloomberg Terminal, traders can ensure they are deploying the most effective algorithms in real-market conditions.

FAQ: Common Questions About Using Bloomberg Terminal in Quantitative Trading

1. How does Bloomberg Terminal support algorithmic trading?

Bloomberg Terminal supports algorithmic trading through its advanced execution platforms and APIs. Traders can design, test, and deploy algorithms that use real-time data from Bloomberg’s feeds. The terminal’s smart order routing and execution algorithms allow traders to minimize slippage and market impact, making it an essential tool for high-frequency and systematic trading strategies.

2. What kind of data can I access on Bloomberg Terminal for quantitative analysis?

Bloomberg Terminal provides a vast array of data for quantitative traders, including real-time prices, historical price data, economic indicators, corporate financials, and alternative datasets such as sentiment analysis and news feeds. This data is essential for backtesting, model development, and live trading.

3. Can I integrate Bloomberg Terminal with my own quantitative models?

Yes, Bloomberg Terminal can be integrated with custom quantitative models through its API and Excel Add-In. This allows traders to automate data retrieval, create models using Bloomberg data, and perform real-time analysis and backtesting.

Conclusion

Bloomberg Terminal is an invaluable tool for quantitative traders, offering comprehensive data, advanced analytics, and seamless integration with trading algorithms. Whether you’re a seasoned quantitative trader or just starting out, the Terminal provides the tools necessary to develop, test, and execute sophisticated trading strategies. Its rich feature set, combined with real-time data and risk management tools, makes it an indispensable resource for anyone involved in quantitative finance.

For traders looking to enhance their strategies and improve their risk-adjusted returns, incorporating Bloomberg Terminal into their workflow can lead to more informed decision-making and more effective trading outcomes.

0 Comments

Leave a Comment